UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

GULF ISLAND FABRICATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 300

HOUSTON, TEXAS 77084

________________________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 19, 2022

TO THE SHAREHOLDERS OF GULF ISLAND FABRICATION, INC.:

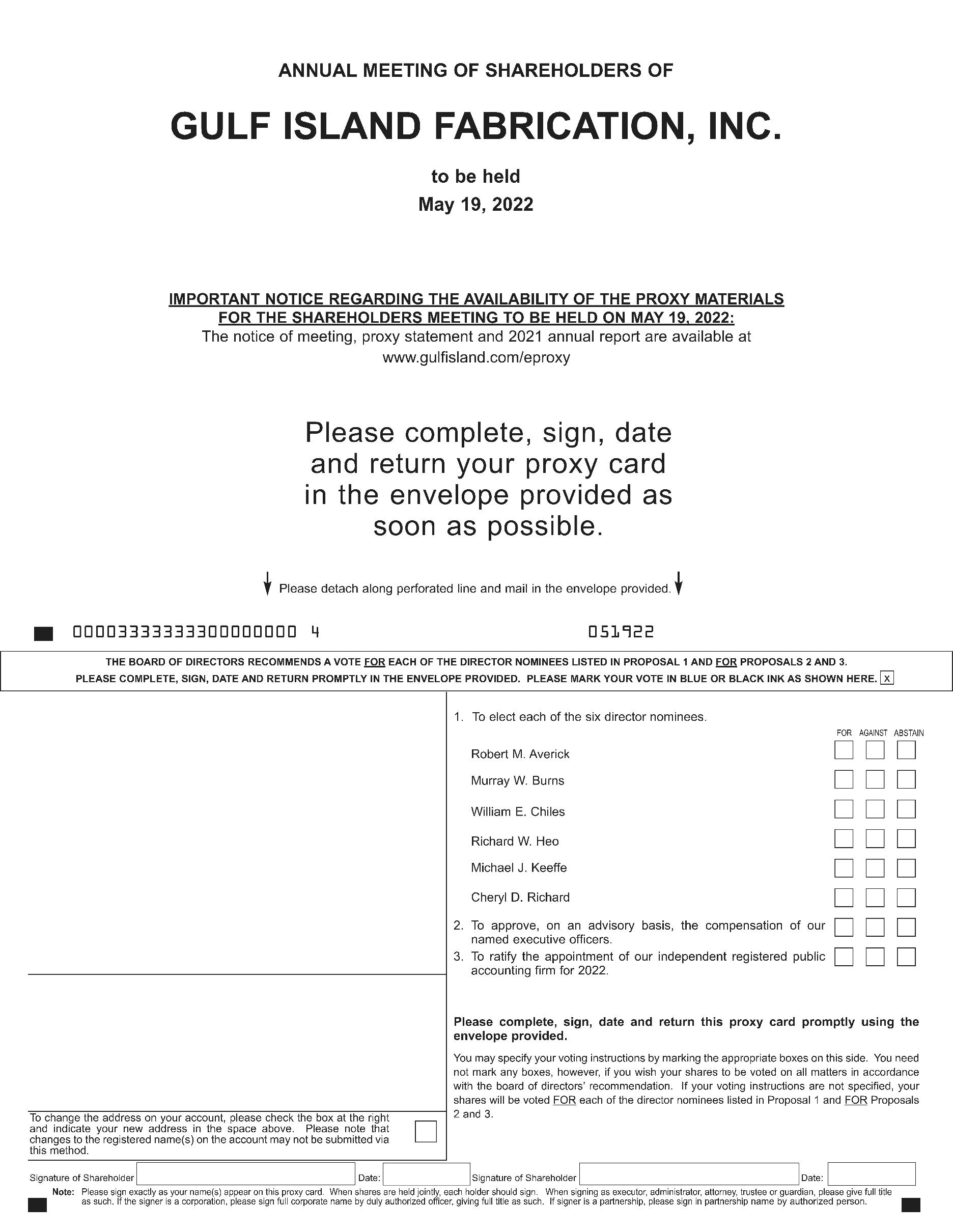

The 2022 annual meeting of shareholders (the “2022 annual meeting”) of Gulf Island Fabrication, Inc. (the “Company” or “Gulf Island”) will be held at 9:00 a.m., Central Time, on Thursday, May 19, 2022, in the same building in which the corporate office of Gulf Island is located at 16225 Park Ten Place, Suite 260, Houston, Texas 77084* for the following purposes, as more fully described in the enclosed proxy statement:

|

|

1. |

To elect each of the six director nominees named in this proxy statement; |

|

|

2. |

To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

|

|

3. |

To ratify the appointment of the Company’s independent registered public accounting firm for 2022; and |

|

|

4. |

To transact any other business that may properly come before the 2022 annual meeting. |

The board of directors of Gulf Island (the “Board”) has fixed the close of business on March 30, 2022, as the record date for the determination of shareholders entitled to notice of and to vote at the 2022 annual meeting and all adjournments thereof.

Your vote is important. Regardless of whether you plan to attend the 2022 annual meeting, please complete, date and sign the enclosed proxy card and return it promptly in the enclosed stamped envelope or submit your proxy and voting instructions online at www.voteproxy.com. Returning the enclosed proxy card or submitting your proxy and voting instructions online will not prevent you from voting at the 2022 annual meeting in person. To obtain directions to attend the 2022 annual meeting, please contact Westley S. Stockton at (713) 714-6100.

By Order of the Board of Directors

/s/ Westley S. Stockton

Westley S. Stockton

Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Houston, Texas

April 13, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF THE PROXY MATERIALS FOR THE SHAREHOLDERS

MEETING TO BE HELD ON MAY 19, 2022.

This proxy statement and the 2021 annual report are available at www.gulfisland.com/eproxy.

* Although we are currently planning to hold the 2022 Annual Meeting in person, we are monitoring the public health and travel concerns relating to COVID-19 and the related recommendations and protocols issued by federal, state and local governments. In the event that it is not possible or advisable to hold our 2022 Annual Meeting in person as originally planned, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. We will announce any such changes, including details on how to participate, in advance in a press release, a copy of which will be filed with the Securities and Exchange Commission (“SEC”) as additional proxy solicitation materials and posted on the “Investors” page of our website at https://ir.gulfisland.com. Accordingly, if you are planning to attend our 2022 Annual Meeting, please monitor our website prior to the meeting date. See “Questions and Answers about the 2022 Annual Meeting and Voting” for details on safety protocols in place for the 2022 Annual Meeting.

|

|

Page |

|

1 |

|

|

1 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

5 |

|

|

Corporate Governance; Our Board of Directors and Its Committees |

6 |

|

6 |

|

|

6 |

|

|

6 |

|

|

7 |

|

|

9 |

|

|

10 |

|

|

11 |

|

|

11 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

13 |

|

|

14 |

|

|

14 |

|

|

14 |

|

|

14 |

|

|

16 |

|

|

16 |

|

|

16 |

|

|

16 |

|

|

17 |

|

|

Information about the Director Nominees and Executive Officers |

18 |

|

22 |

|

|

22 |

|

|

28 |

|

|

PROPOSAL 2: Advisory Vote on The Compensation of Our Named Executive Officers |

31 |

|

32 |

|

|

33 |

|

|

33 |

|

|

34 |

|

|

34 |

|

|

35 |

|

|

Questions and Answers about the 2022 Annual Meeting and Voting |

36 |

|

Shareholder Proposals and Nominations for the 2023 Annual Meeting |

41 |

Cautionary Statement Regarding Forward-Looking Statements

This proxy statement contains forward-looking statements, which are all statements other than statements of historical facts. We caution readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause our actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to, those described in more detail under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2021 (2021 Form 10-K), filed with the U.S. Securities and Exchange Commission. We undertake no obligation to update any forward-looking statements. Further, we include website addresses throughout this proxy statement for reference only. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC.

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 300

HOUSTON, TEXAS 77084

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 19, 2022

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before returning your proxy card. For more information regarding our 2021 financial and operational performance, please review our 2021 annual report to shareholders, including financial statements (our “2021 annual report”). The 2021 annual report is first being mailed to shareholders together with this proxy statement, the notice of annual meeting and form of proxy card (collectively, the “proxy materials”) on or about April 13, 2022.

2022 Annual Meeting of Shareholders

Time and Date: 9:00 a.m., Central Time, Thursday, May 19, 2022

Location*: 16225 Park Ten Place, Suite 260

Houston, Texas 77084

Record Date:March 30, 2022

|

|

Voting: |

Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each of the director nominees and one vote for each of the other proposals to be voted on at the 2022 annual meeting. |

* Although we are currently planning to hold the 2022 Annual Meeting in person, we are monitoring the public health and travel concerns relating to COVID-19 and the related recommendations and protocols issued by federal, state and local governments. In the event that it is not possible or advisable to hold our 2022 Annual Meeting in person as originally planned, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. We will announce any such changes, including details on how to participate, in advance in a press release, a copy of which will be filed with the Securities and Exchange Commission (“SEC”) as additional proxy solicitation materials and posted on the “Investors” page of our website at https://ir.gulfisland.com. Accordingly, if you are planning to attend our 2022 Annual Meeting, please monitor our website prior to the meeting date. See “Questions and Answers about the 2022 Annual Meeting and Voting” for details on safety protocols in place for the 2022 Annual Meeting.

1

Agenda and Voting Recommendations

The Board is asking shareholders to vote on these matters:

|

Item |

|

Proposal |

|

Board Vote Recommendation |

|

Page |

|

1 |

|

Election of each of the six director nominees named in this proxy statement |

|

FOR |

|

17 |

|

2 |

|

Advisory vote to approve the compensation of our named executive officers |

|

FOR |

|

31 |

|

3 |

|

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2022 |

|

FOR |

|

33 |

Director Nominee Highlights (page 18)

We have included summary information about each of the director nominees in the table below. See “Information about the Director Nominees and Executive Officers” for additional information regarding our director nominees.

|

Name |

|

Age |

|

Director Since |

|

Principal Occupation |

|

Independent |

|

Board Committees |

|

Robert M. Averick |

|

56 |

|

2018 |

|

Portfolio Manager, Kokino LLC |

|

Yes |

|

•Compensation* •Corporate Governance & Nominating |

|

Murray W. Burns |

|

76 |

|

2014 |

|

Consultant, MBurns Consulting |

|

Yes |

|

•Audit •Corporate Governance & Nominating* |

|

William E. Chiles** |

|

73 |

|

2014 |

|

Managing Partner, Pelican Energy Partners |

|

Yes |

|

•Audit •Compensation |

|

Richard W. Heo |

|

51 |

|

2019 |

|

Chief Executive Officer of Gulf Island |

|

No |

|

|

|

Michael J. Keeffe*** |

|

70 |

|

2014 |

|

Retired Senior Audit Partner, Deloitte & Touche LLP |

|

Yes |

|

•Audit* •Compensation |

|

Cheryl D. Richard |

|

66 |

|

2018 |

|

Retired Executive, Transocean Ltd. |

|

Yes |

|

•Compensation •Corporate Governance & Nominating |

____________________________

|

* |

Committee Chairman as of May 19, 2022, with Mr. Averick becoming the Chairman of the Compensation Committee following Mr. Chiles becoming Chairman of the Board |

|

** |

Chairman of the Board as of May 19, 2022 in connection with the retirement of Michael A. Flick. |

|

*** |

Audit Committee Financial Expert |

2

Compensation Highlights (pages 16 and 22)

|

|

• |

Annual Cash Incentive Program Payout Based on Performance. Annual cash incentive awards for 2021 for our named executive officers (“NEOs”) were based on specific targets related to adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted cash, safety, and individual performance objectives. Based on our 2021 performance, our NEOs earned above target annual cash payouts. However, following management’s recommendation, the Compensation Committee approved annual cash payouts at the target level for each of our NEOs. In addition, in connection with our sale of the assets and certain vessel construction contracts of our Shipyard Division in April 2021 for approximately $28.6 million (“Shipyard Transaction”), during 2021, certain of our executive officers and other key employees received transaction-related incentives. |

|

|

• |

Reduced Salaries. Given the economic environment of the oil and gas and marine industries and challenges faced by the Company, including the uncertainty created by the effects of the COVID-19 pandemic and the significant decline and volatility in oil prices, our executive officers voluntarily reduced their base salaries effective May 1, 2020, with our chief executive officer reducing his base salary by 25%. Although the base salaries of our executive officers were increased effective June 1, 2021, our executive officers voluntarily maintained their base salaries below their original levels, with our chief executive officer’s salary continuing to be 15% less than his 2019 salary. |

|

|

• |

2021 Long-Term Incentive Program (“LTIP”) Incorporates Performance. Unlike the 2020 LTIP, which was solely time-based to address retention concerns, the 2021 LTIP included both time-based restricted stock units (“RSUs”) and performance-based RSUs, with the performance award accounting for 25% of the program. The performance-based RSUs provide for payout of between 0% and 200% of the target award based on the level of 2021 adjusted EBITDA achieved, with the resulting amount vesting in equal installments over the three-year period following the grant date. Following the end of 2021, the Board determined that the performance condition for the 2021 performance-based RSUs had been achieved at the maximum level. |

In addition, the performance period for the final tranche of the 2019 performance award ended in 2021. The Company did not achieve the applicable performance target associated with this award, and accordingly, the award was not earned and was forfeited.

|

|

• |

“Double Trigger” Equity Awards. Vesting of equity awards will only accelerate in connection with a change of control event if, within one year upon such change of control event, a participant’s employment is terminated without cause or terminated by the participant for good reason. |

Ongoing Board Refreshment (page 7)

Since 2018, the Board has appointed three new directors, including one female director and one racially diverse director while at the same time reducing its overall size from ten to seven directors. The Board will further reduce its size to six directors immediately following the 2022 annual meeting in connection with the expiration of the term of Mr. Flick. Mr. Flick will be our fourth long-standing directors to retire since 2018, the combination of such retirements and appointments has decreased our average tenure and age of our directors. In addition, following the 2022 annual meeting, the Board will be fully declassified and each of our directors will be elected annually.

Corporate Governance Highlights (page 12)

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens the accountability of our Board and management and engenders public trust in the Company. In furtherance of our commitment to strong corporate governance, our Board reviews on an ongoing basis evolving governance practices and investor preferences, including feedback from our shareholders.

The table below summarizes certain highlights of our corporate governance practices and policies. For detail regarding our ongoing corporate governance practices, see “Corporate Governance; Our Board of Directors and its Committees—Commitment to Corporate Governance.”

3

|

|

|||||

|

✓ |

Declassification of the Board Complete after the 2022 annual meeting |

||||

|

✓ |

6 of 7 Directors Independent |

✓ |

100% Independent Committees |

✓ |

Regular Executive Sessions |

|

✓ |

Annual Board Evaluations and Skills Assessment |

✓ |

Majority Voting Standard for Uncontested Elections |

✓ |

Demonstrated Board Refreshment |

|

✓ |

Focus on Board Diversity (Board Diversity Policy) |

✓ |

Separate Chairman and CEO |

✓ |

Stock Ownership Guidelines for Directors and Officers |

|

✓ |

No Shareholder Rights Plan |

✓ |

Right to Call a Special Meeting |

✓ |

No Supermajority Voting |

|

✓ |

Clawback Policy |

✓ |

Anti-Hedging and Anti- Pledging Policy |

✓ |

Robust Corporate Governance Guidelines |

Communications with our Board and Shareholder Engagement (page 13)

We believe it is important for our shareholders and interested parties to provide input on our business, our corporate governance and executive compensation practices, or any other matter of shareholder interest. Shareholders and interested parties may contact our Chief Executive Officer, who will coordinate distribution of the correspondence to our full Board, as provided below:

|

By Letter |

|

By Telephone |

|

By Email |

|

In Person |

|

Gulf Island Fabrication, Inc. 16225 Park Ten Place Suite 300 Houston, TX 77084 |

|

Richard Heo (713) 714-6100 |

|

Richard Heo rheo@gulfisland.com |

|

Annual Meeting 16225 Park Ten Place Suite 260 Houston, TX 77084 |

During 2021, we engaged in regular dialogue with our shareholders and their representatives, with discussions centering on the following topics: (1) strategy; (2) recent transactions (including the Shipyard Transaction and planned wind down of our Shipyard division operations and the acquisition of a services and industrial staffing business on December 1, 2021 (“Services Acquisition”); (3) market outlook; (4) labor market and related challenges; and (5) liquidity and capital resources.

Informed by discussions with our shareholders, the Board has previously implemented certain changes to our governance, board and management structures.

2021 Corporate Strategy Accomplishments

During 2020, we outlined a strategy to address our operational, market and economic challenges and position the Company to pursue stable, profitable growth. Our strategy focused on the following initiatives: (1) mitigating the impacts of COVID-19 on our operations, employees and contractors; (2) reducing our risk profile; (3) preserving and improving our liquidity; (4) improving our resource utilization and centralizing key project resources; (5) improving our competitiveness and project execution; and (6) reducing our reliance on the offshore oil and gas construction sector and pursuing new growth end markets, including onshore refining, petrochemical, LNG and industrial facilities, and offshore wind developments.

During 2021, we continued to advance these initiatives, which have provided a foundation for our future success, and commenced the next phase of our strategic transformation, which is focused on generating stable, profitable growth. Underpinning this strategy is a focus on the following initiatives (1) expanding our skilled workforce and (2) pursuing additional growth end markets and increasing our time and materials versus fixed price revenue mix, including (i) diversifying our offshore customer base; (ii) increasing our offshore services offerings; (iii) expanding our services business to include onshore facilities along the Gulf Coast; and (iv) fabricating structures in support of our customers as they make energy transitions away from fossil fuels.

4

Our 2021 strategic accomplishment highlights included:

|

|

• |

Mitigating the impacts of COVID-19 on our operations while ensuring the safety and well-being of our employees and contractors; |

|

|

• |

Completing the Shipyard Transaction in April 2021, which improved our risk profile and reduced our bonding, letters of credit and working capital requirements; |

|

|

• |

Reducing costs, selling under-utilized assets and maintaining a focus on project cash flow management; |

|

|

• |

Ending 2021 with a strong balance sheet, which is required to execute our backlog and compete for new project awards; |

|

|

• |

Continuing to enhance our proposal, estimating and operations resources, processes and procedures, and realizing strong project performance for our Fabrication & Services division backlog; |

|

|

• |

Completing the Services Acquisition in December 2021, which increased our time and materials versus fixed price revenue mix and nearly doubled our skilled workforce, expanded our geographic footprint for skilled labor, and will contribute to the retention and recruitment of personnel, all of which furthered our continued focus on ways to improve retention and enhance and add to our skilled, craft personnel; and |

|

|

• |

Focusing our business development efforts on the fabrication of modules, piping systems and other structures for onshore refining, petrochemical, LNG and industrial facilities, including increasing our volume of bidding activity, and experiencing success with several smaller project opportunities. |

Hurricane Ida Recovery

On August 29, 2021, Hurricane Ida made landfall near our Houma, Louisiana facilities as a powerful Category 4 hurricane, with high winds, heavy rains and storm surge causing significant damage and power outages throughout the region. The high winds and heavy rain damaged multiple buildings and equipment and resulted in significant debris throughout our facilities. As a result of the power outages, damage to buildings and debris, the operations at our facilities were temporarily suspended and we immediately commenced cleanup and restoration efforts. In an effort to return the Company to normal operations as quickly and as safely as possible, cleanup and restoration efforts commenced immediately following the passage of the storm, and as a result of the dedication and efforts of our employees, we recommenced operations before the end of the third quarter 2021.

Our employees were also severely impacted by the storm, with many experiencing significant damage to, or complete loss of, their homes and most going without power and water for over a month. To support our employees through this time of catastrophic loss, the Company provided necessary essentials, served onsite meals and established the Gulf Island Emergency Relief Fund to provide financial relief to those employees most impacted by the storm. Cleanup and restoration from the storm are still ongoing and we continue to support our employees and the community with these efforts.

5

Corporate Governance; Our Board of Directors and Its Committees

Our Board currently consists of seven members and has established three standing committees: the Corporate Governance and Nominating Committee, the Audit Committee and the Compensation Committee. Our Board formally met eight times during 2021.

Each committee operates under a written charter adopted by our Board, and such charters, together with our Corporate Governance Guidelines, are available at www.gulfisland.com under “Investors—Governance—Governance Documents.” The composition of each committee is reviewed annually by our Board. During 2021, each of our incumbent directors (except one) attended 100% of the aggregate of the total number of meetings of our Board and the total number of meetings held by all committees of our Board on which he or she served during the periods of his or her Board membership and committee service; one of our incumbent directors was absent from our August 2021 board and committee meetings and, therefore, attended 88% of all such meetings.

Our Corporate Governance Guidelines require the Chairman of the Board and Chief Executive Officer positions to be separate. Our Board determined that the separation of these roles would maximize management’s efficiency by allowing the Chief Executive Officer to focus on our day-to-day business and the Chairman of our Board to lead the Board in its fundamental role of providing guidance to, and oversight of, management. Our Board periodically reviews the Company’s leadership structure and may make changes in the future as it deems appropriate. Our President and Chief Executive Officer is Richard W. Heo. Our Chairman of the Board is currently Michael A. Flick. The Board has unanimously elected William W. Chiles as Chairman of the Board to succeed Mr. Flick following his retirement at the 2022 annual meeting.

Our Board believes that our independent directors, with the leadership of our Chairman of the Board, provide effective oversight of management. Moreover, in addition to director feedback provided during the course of meetings of our full Board, the non-management directors are given the opportunity to meet in executive session at each regular meeting of our Board or more frequently, as needed. During 2021, Mr. Flick chaired all executive sessions of the independent directors and acted as the liaison between the independent directors and the management team. Our three standing committees are composed entirely of independent directors and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board or management.

On the basis of information solicited from each director, and upon the advice and recommendation of the Corporate Governance and Nominating Committee, our Board annually determines the independence of each of our then-current directors in connection with the nomination process. Further, in connection with the appointment of any new director to the Board during the year, our Board makes the same determination. Our Board has determined that each of our current directors (specifically Ms. Richard and Messrs. Averick, Burns, Chiles, Flick and Keeffe), except for Mr. Heo (our Chief Executive Officer), has no material relationship with the Company and is independent as defined in the director independence standards of the listing standards of The NASDAQ Stock Market LLC (“NASDAQ”), as currently in effect. In making this determination, our Corporate Governance and Nominating Committee, with assistance from the Company’s legal counsel, evaluated responses to a questionnaire completed annually by each director regarding relationships and possible conflicts of interest between each director, the Company, management and the independent registered public accounting firm and made a recommendation to our Board. In its review of director independence, our Board considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and family relationships any director may have with the Company, management and the independent registered public accounting firm.

The following table notes the breadth and variety of business experience that each of our directors nominees brings to the Company and which enable the Board to provide insightful leadership to the Company so that it may better advance its strategies and deliver returns to shareholders. The Corporate Governance and Nominating Committee annually reviews this skills matrix for possible additions and any developments in the experience, qualifications, attributes and skills of the directors.

6

|

Director Nominee Experience and Skills Matrix |

||||

|

CEO or other Senior Executive Experience |

|

Experience in senior leadership positions provides our Board with practical insights in developing and implementing business strategies, maintaining effective operations and driving growth, so that we may achieve our strategic goals. |

|

5 of 6 directors |

|

Industry Experience |

|

Industry expertise and experience in energy or energy service, industrial construction and fabrication allows the Board to develop a deeper understanding of our key business, its operations and key performance indicators in a competitive environment. In addition, industry expertise and experience provides the Board with awareness and know-how to help the Company cultivate and sustain growth in its industries and helps to maintain compliance with industry-related regulations. |

|

5 of 6 directors |

|

Accounting & Financial Experience |

|

Experience as an accountant, auditor, financial expert or other relevant experience is critical to allowing the Board to oversee the preparation and audit of our financial statements and comply with various regulatory requirements and standards. |

|

4 of 6 directors |

|

Other Public Company Board Experience |

|

Directors who serve or have served on the boards of other public companies understand the responsibilities of a public company and board and can provide insight on issues commonly faced by public companies gained from this experience. |

|

4 of 6 directors |

|

Capital Markets & Banking Experience |

|

Experience overseeing investments and capital market transactions provides the Board with critical background, knowledge and skills that enhance the Company’s ability to raise capital to fund its operations and evaluate and implement capital allocation strategies. |

|

3 of 6 directors |

|

Legal & Regulatory Compliance Experience |

|

Experience in the legal field or in regulated industries provides the Board with knowledge and insights in complying with government regulations and legal obligations, as well as identifying and mitigating legal and compliance risks. |

|

3 of 6 directors |

|

Cybersecurity |

|

Cybersecurity risks are increasing for all industries, including the Company’s, and our Board members’ experience and expertise in this rapidly developing area are essential to mitigating cybersecurity risks and to the Company’s risk management as a whole. |

|

1 of 6 directors |

|

Human Capital Management |

|

Experience in human capital management, including employee development, diversity and equal employment opportunity initiatives, workplace health and safety, labor relations, workforce engagement and administration, and executive compensation, helps the Board and the Company recruit, retain and develop key talent, grow diversity of personnel at all levels throughout the Company and build strong relationships with our employees. |

|

6 of 6 directors |

|

Risk Management & Oversight |

|

Experience overseeing complex risk management allows the Board to pre-emptively identify, assess and mitigate key risks and to design and implement risk management practices to protect shareholder return. |

|

6 of 6 directors |

|

Corporate Strategy & Business Development |

|

Corporate strategy and business development experience enhances the Board’s ability to develop innovative solutions, including our business and strategic plans, and to drive growth in our competitive industry. |

|

6 of 6 directors |

|

Corporate Governance & Ethics |

|

Directors with experience implementing governance structures and policies provide an understanding of best practices and key issues, enhancing our ability to maintain good governance and to execute new key governance initiatives. |

|

6 of 6 directors |

|

Independence |

|

Directors who are “independent” under the rules of the Securities and Exchange Commission (the “SEC”), listing exchanges and other entities allow the Board to provide unbiased oversight over the Company and to implement governance practices with integrity and transparency. |

|

5 of 6 directors |

Board Diversity, Tenure and Ongoing Refreshment

We are committed to Board diversity and Board refreshment and we believe the Company’s policies and practices help to ensure a diversity of skills, experience, and tenure on the Board.

Diversity Policy

We have a formal Board Diversity Policy, which is available at www.gulfisland.com under “Investors—Governance—Governance Documents.” Pursuant to such policy, the Corporate Governance and Nominating Committee strives for inclusion of diverse groups, knowledge and viewpoints within the Board, considering various matters of diversity, including, but not limited to, gender, race, religion, sexual orientation and disability. The Corporate Governance and Nominating Committee seeks out highly qualified diverse candidates and evaluates each director nominee in the context of our Board composition as a whole, with the objective of nominating director candidates who can best perpetuate the success of our business, be effective directors in conjunction with our full Board and represent shareholder interests through the exercise of sound judgment. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, commits to interviewing at least one candidate who would increase the diversity of the Board with respect to gender, race, sexual orientation or disability. To accomplish this, the Corporate Governance and Nominating Committee has

7

sole authority to retain and terminate qualified independent external advisors, if it deems necessary, to conduct searches for candidates that help achieve the Board’s diversity objectives, and to approve such advisors’ fees and other retention terms.

Board Diversity Matrix

The table below provides certain highlights of the composition of our director nominees. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

|

Board Diversity Matrix (as of March 30, 2022) |

|||||||

|

Total Number of Directors |

6 directors |

||||||

|

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|||

|

Part I: Gender Identity |

|||||||

|

Directors |

1 |

5 |

- |

- |

|||

|

Part II: Demographic Background |

|||||||

|

African American or Black |

- |

- |

- |

- |

|||

|

Alaskan Native or Native American |

- |

- |

- |

- |

|||

|

Asian |

- |

1 |

- |

- |

|||

|

Hispanic or Latinx |

- |

- |

- |

- |

|||

|

Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

|||

|

White |

1 |

4 |

- |

- |

|||

|

Two or More Races or Ethnicities |

- |

- |

- |

- |

|||

|

LGBTQ+ |

- |

- |

- |

- |

|||

|

Did Not Disclose Demographic Background |

- |

- |

- |

- |

|||

In addition to increasing diversity on our Board, Mr. Heo’s appointment as Chief Executive Officer has increased the diversity of our executive management team.

Tenure and Ongoing Refreshment

Since 2018, the Board has appointed three new directors, including one female director and one racially diverse director while at the same time reducing its overall size from ten to seven directors. The Board will further reduce its size to six directors immediately following the 2022 annual meeting in connection with the expiration of the term of Mr. Flick. Mr. Flick will be our fourth long-standing directors to retire since 2018, the combination of such retirements and appointments has decreased our average tenure and age of our directors. In addition, following the 2022 annual meeting, the Board will be fully declassified and each of our directors will be elected annually.

Director Resignation Policy

The Board has adopted a Director Resignation Policy. The policy requires that directors provide a written offer of resignation, which the Corporate Governance and Nominating Committee will consider and recommend to the Board whether to accept or reject or whether other action should be taken, in the event that (1) an incumbent director nominee receives less than a majority of affirmative votes in an uncontested election; or (2) a director has a material change in his or her principal occupation, employment or business association or job responsibilities, including retirement, or plans to join another company board for which our Chairman of the Board has determined that a potential conflict of interest may arise.

In addition, in accordance with our Corporate Governance Guidelines, subject to our amended and restated articles of incorporation (our “articles of incorporation”), and our amended and restated by-laws (our “by-laws”), employee directors will resign from the Board when they retire or otherwise cease to be employed by the Company.

Finally, as stated in our Corporate Governance Guidelines, the Board believes that a director should offer his or her resignation if there is a substantial conflict of interest between the director and the Company or the Board and such conflict cannot be resolved to the satisfaction of the Board.

8

Board’s Role in Risk Oversight

The Board, as a whole, is responsible for risk oversight, with review of certain areas being conducted by the relevant Board committees that report to the full Board. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. There are several ways our Board performs this function, including: (1) receiving quarterly management updates on our business operations and financial results and discussing risks related to the business at each regular Board meeting, (2) receiving reports on all significant committee activities at each regular Board meeting, (3) evaluating the risks inherent in significant transactions, as applicable, and (4) receiving annual reports from our information technology personnel regarding potential cybersecurity threats and the status of our defenses. Throughout the year, the Board received briefings and assessments of the Company’s risks through regular interactions with our management and, from time-to-time, input from independent advisors, including, among other items, key risks related to:

|

•Business environment and market |

•Cybersecurity |

|

•Compliance |

•Tax |

|

•Human resources |

•Health, safety and environmental |

|

•Treasury |

•Security |

|

•Mergers and acquisitions |

•Legal |

|

•Financial reporting |

•Strategy |

Our Board believes that full and open communication between management and our Board is essential to effective risk oversight. Management is available to address any questions or concerns raised by our Board on risk management or any other matters, and any member of management may be requested to attend any meeting of the Board or a committee of the Board, upon request of any non-management director.

The Board conducts certain risk oversight activities through its committees, which oversee specific areas and provide reports to the full Board regarding such committee’s considerations and actions. The Audit Committee reviews and considers financial, accounting, internal controls and regulatory compliance risks, including those that could arise from our accounting and financial reporting processes. The Audit Committee also reviews and monitors risks through various reports presented by our outsourced internal auditors and our independent registered public accounting firm. The Compensation Committee reviews and considers risks related to our compensation policies, including incentive plans, to determine whether those plans subject the Company to material risks. The Corporate Governance and Nominating Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with our Board leadership structure and corporate governance matters, including the oversight of our risk-management processes with respect to environmental, social and corporate governance.

Strategy

Our Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company’s business opportunities and challenges and monitors the development and management of risks that impact our strategic goals.

In carrying out its risk oversight responsibilities, the Board is active in overseeing management’s actions to refocus our business strategy and enhance our financial position. To ensure informed and effective oversight, especially during a period of weak market conditions, the Board organizes periodic strategic planning retreats to discuss our strategic initiatives and to participate in the development of our strategic direction. Outside of these retreats, the Board continues to receive regular updates regarding management’s execution of the Company’s strategic initiatives. The Board also continues to monitor the Company’s performance against its annual business plan, including reviewing actual and forecast operating results on a regular basis to evaluate the status and success of management in the execution of the Company’s annual business plan.

9

Cybersecurity

As part of its risk oversight program, the Board is responsible for overseeing cyber risk, information security, and technology risk, including management’s actions to identify, assess, mitigate, and remediate material cyber issues and risks. The Board receives annual reports from our information technology personnel regarding potential cybersecurity threats and the status of our defenses against such threats. The annual report includes an overall cyber risk assessment, potential risk mitigation tactics and action items to decrease cyber risks. The Company also maintains a cyber insurance policy to mitigate the costs associated with potential cyber-attacks.

In 2021, the Board continued its focus on cybersecurity risks with cybersecurity being included on the board meeting agenda for three of its four meetings. The Board continues to review cyber security recommendations from our information technology personnel with input from our director with cybersecurity expertise in an effort to mitigate the associated risks and protect the Company from attacks.

The Corporate Governance and Nominating Committee is responsible for overseeing the annual performance evaluation of the Board, which is a multi-step process designed to evaluate the performance of the Board and each of its committees.

|

STEP 1: Confidential Evaluations |

|

Annually, each director completes an evaluation of the full Board which is intended to provide each director with an opportunity to evaluate performance for the purpose of improving Board and committee processes and effectiveness. The detailed evaluation questionnaire seeks quantitative ratings and subjective comments in key areas of Board practice, and asks each director to evaluate how well the Board and its committees operate and to make suggestions for improvements. These key areas include assessment of Board composition, meeting procedures, allocation and delegation of responsibilities among the Board and its committees and adequacy and availability of resources. |

|

STEP 2: Board Summary |

|

The Corporate Governance and Nominating Committee reviews the results and its assessment of Board performance, including of the committees, is presented to the full Board. As needed, the Corporate Governance and Nominating Committee recommends any areas of improvement for the Board to consider implementing. |

|

STEP 3: Recommendations Implemented |

|

Based on the results, assessment and recommendations presented by the Corporate Governance and Nominating Committee, the Board and Company practices and policies are updated, as appropriate. |

In response to feedback received from evaluations as well as the periodic updates on cybersecurity, the Board approved the use of a board portal for director communications. Other changes made in recent years in response to feedback from evaluations include the establishment of a periodic retreat of the Board with key management focused on strategic planning, and improvements to the Board and committee meeting practices by allocating more time to topics relating to risk oversight and strategy. Additionally, in response to feedback relating to Board refreshment, diversity and succession planning, since 2020, the Chairman of the Corporate Governance and Nominating Committee has a more formal process to discuss with each director such director’s plans for continued service on the Board and any projected retirement date.

10

Board Committees

The following table notes our current committee structure and membership (M - Member; C - Chairperson; FE - Financial Expert):

|

Director (1) |

|

Corporate Governance and Nominating Committee |

|

Audit Committee |

|

Compensation Committee |

|

Robert M. Averick |

|

M |

|

|

|

M |

|

Murray W. Burns |

|

C |

|

M |

|

|

|

William E. Chiles |

|

|

|

M |

|

C |

|

Michael A. Flick |

|

M |

|

M |

|

|

|

Michael J. Keeffe |

|

|

|

C, FE |

|

M |

|

Cheryl D. Richard |

|

M |

|

|

|

M |

_______________

|

|

(1) |

As a non-independent director, Mr. Heo does not serve as a member of any committee of the Board, all of which are composed entirely of independent directors. |

Our Board annually reviews and approves committee assignments with any changes made thereto effective immediately following the annual shareholders meeting. Following the 2022 annual meeting, Mr. Averick will become Chairman of the Compensation Committee in connection with Mr. Chiles’ appointment as Chairman of the Board.

The Audit Committee currently consists of the following four directors: Michael J. Keeffe (Chairman and Financial Expert), Murray W. Burns, William E. Chiles and Michael A. Flick. Our Board determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards specifically governing audit committee members, and satisfies the additional requirements applicable to an audit committee member under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NASDAQ listing standards. Our Board determined that Mr. Keeffe is an “Audit Committee Financial Expert” as such term is defined within the applicable rules of the SEC. The Audit Committee met five times during 2021.

The Audit Committee’s primary function is to assist our Board in fulfilling its oversight responsibilities relating to: (1) the quality and integrity of the accounting, auditing, disclosure controls and procedures, internal control over financial reporting and financial reporting practices of the Company, (2) the independent registered public accounting firm’s qualifications and independence, (3) the performance of the Company’s independent registered public accounting firm and internal audit firm and (4) review and approval or ratification of any transaction that may require disclosure under Item 404 of Regulation S-K of the rules and regulations of the SEC.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of the following four directors: Murray W. Burns (Chairman), Robert M. Averick, Michael A. Flick and Cheryl D. Richard. Our Board determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards. The Corporate Governance and Nominating Committee met two times during 2021.

The Corporate Governance and Nominating Committee assists the Board in fulfilling its oversight responsibilities by: (1) identifying, considering and recommending to the Board candidates to be nominated for election or reelection to the Board or as necessary to fill vacancies and newly-created directorships; (2) monitoring the composition of the Board and its committees and making recommendations to the Board on membership of the committees; (3) overseeing the Company’s environmental, social and governance (“ESG”) practices and procedures, including reviewing the Company’s ESG strategy, initiatives and practices; (4) maintaining the Company’s Corporate Governance Guidelines and recommending to the Board any desirable changes; (5) evaluating the effectiveness of the Board and its committees; (6) addressing any related matters required by the federal securities laws or NASDAQ; and (7) overseeing the succession plan process for each of the Company’s executive officers and the Chairman of the Board.

11

Compensation Committee; Compensation Committee Procedures

The Compensation Committee currently consists of the following four directors: William E. Chiles (Chairman), Robert M. Averick, Michael J. Keeffe and Cheryl D. Richard. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards specifically governing compensation committee members, and satisfies the additional requirements applicable for a compensation committee member under Rule 10C-1(b)(1) under the Exchange Act. Our Board has determined that each of the directors is a “non-employee director” as defined under Rule 16b-3 under the Exchange Act. The Compensation Committee met four times during 2021.

The Compensation Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibilities by: (1) discharging the responsibilities of the Board relating to the compensation of the Company’s officers and directors and (2) administering the Company’s cash-based and equity-based incentive compensation plans. The Compensation Committee has overall responsibility for approving, evaluating and recommending to the Board all compensation plans of the Company and to administer and interpret such plans.

The Compensation Committee seeks the input of our Chief Executive Officer in connection with performance evaluations and compensation decisions for our other executive officers; however, our Chief Executive Officer is not present when the Compensation Committee meets to evaluate his performance nor when our Board determines his compensation.

The terms of our stock incentive plans permit the Compensation Committee to delegate to appropriate personnel its authority to make awards to employees other than those subject to Section 16 of the Exchange Act. The Compensation Committee has only delegated this authority in limited circumstances.

Commitment to Corporate Governance

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens accountability of our Board and management and engenders public trust in the Company. As discussed in “Corporate Governance Highlights,” in furtherance of our commitment to strong governance and in response to feedback from our shareholders, we have taken steps to improve our corporate governance practices, including those highlighted in the table below. We will continue this commitment to act in the best interest of our shareholders by regularly reviewing and updating our corporate governance practices over time. Our dedication to good corporate governance is evidenced by the following:

|

Corporate Governance Highlights |

||

|

Board Declassification |

|

In 2020, at the recommendation of our Board, our shareholders voted to approve a proposal to amend and restate our articles of incorporation to declassify the Board on a phase-in basis. The Board will be fully declassified, with each director elected annually, following our 2022 annual meeting. |

|

Majority Vote for Directors |

|

We have a majority voting standard for election of directors in an uncontested election. |

|

Majority Independent Board |

|

In 2021, six of our seven directors were independent and five of our six director nominees are independent; only our CEO is not independent. |

|

100% Independent Committees |

|

Each of our Audit, Compensation and Corporate Governance and Nominating Committees is composed of entirely independent directors. |

|

Separate Chairman and CEO |

|

Our Corporate Governance Guidelines require the Chairman of the Board and Chief Executive Officer positions to be separate. |

|

Annual Board Evaluations |

|

Each year our directors complete an evaluation of the full Board and its committees for the purpose of improving Board and committee processes and effectiveness. |

|

Annual Board Skills Assessment |

|

The Corporate Governance and Nominating Committee conducts an annual assessment of director experience, qualifications, attributes and skills needed for the Board to effectively oversee the interests of the Company. |

|

Demonstrated Board Refreshment |

|

The Board has appointed three new directors since 2018, including one female director and one racially diverse director, and will have reduced the size of our Board from ten to six directors immediately following the 2022 annual meeting in connection with the retirement of Mr. Flick, who is another one of our long-standing directors. |

|

Continued Focus on Board Diversity |

|

We adhere to a formal Board Diversity Policy, pursuant to which we strive to select director nominees with diverse backgrounds, experiences, skills and perspectives. Following the 2022 annual meeting, our Board is expected to have two diverse directors, one female and one racially diverse, out of six directors (or approximately one-third of our Board). |

12

|

Shareholder Right to Call a Special Meeting |

|

Our shareholders holding 20% of our outstanding shares of common stock may call a special meeting of shareholders in accordance with our articles of incorporation. |

|

Limited Supermajority Requirements |

|

We have limited supermajority voting provisions in our articles of incorporation relating to the removal of directors and amending the article governing director liability and indemnification. |

|

Stock Ownership Guidelines |

|

Our directors and executives are required to hold certain numbers of shares of our common stock and are prohibited from hedging or pledging the Company’s stock, subject to a limited exception for pledging. |

|

No Shareholder Rights Plan |

|

We have not implemented a shareholder rights plan or “poison pill.” |

|

Regular Executive Sessions |

|

Our independent directors regularly meet in executive session without management present and at the request of such directors, may include certain outside service providers, such as our independent registered public accounting firm. |

|

Governance Policies |

|

We have adopted robust corporate governance guidelines and code of business conduct and ethics. |

Communications with our Board and Shareholder Engagement

Our Board values communicating and engaging with our shareholders to understand their views on important business, corporate governance and executive compensation matters.

Any shareholder may communicate with our Board (or with any individual director) by sending a letter by mail addressed to the Chairman of the Board of Directors of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084 or by email to rheo@gulfisland.com. The Chairman of our Board or Chief Executive Officer, as applicable, will coordinate distribution of the correspondence to our full Board or relevant committee or Board members.

We engage in regular dialogue with our shareholders and their representatives. During 2021, our discussions collectively centered on the following topics: (1) strategy; (2) recent transactions (including the Shipyard Transaction and planned wind down of our Shipyard division operations and Services Acquisition); (3) market outlook; (4) labor market and related challenges; and (5) liquidity and capital resources.

Informed by discussions with certain of our shareholders, the Board has previously implemented certain changes to our governance, board and management structures, including adopting a majority voting standard for uncontested elections, removing certain supermajority voting requirements in our articles of incorporation and by-laws, revising the threshold to call a special meeting to 20% of the outstanding shares of our common stock, adopting a Board Diversity Policy, increasing stock ownership guidelines for our directors, appointing a new Chief Executive Officer, electing a new Chairman of the Board, decreasing the size of the Board, and amending and restating our articles of incorporation to declassify the Board.

Our Board has adopted a policy that recommends that all directors attend all meetings of our shareholders. At the last annual meeting of shareholders held on May 20, 2021, all then current members of our Board joined the virtual shareholders meeting.

13

Ethics and Business Conduct Related Policies

The Company maintains a Code of Ethics for our Chief Executive Officer and senior financial officers (our “Code of Ethics”) and a Code of Business Conduct and Ethics, which applies to all employees and directors, including our Chief Executive Officer and senior financial officers. These codes are posted at www.gulfisland.com under “Investors—Governance—Governance Documents.” Any substantive amendments to the Code of Ethics will be disclosed within four business days of such event on our website and will remain on our website for at least 12 months.

Director and Executive Officer Stock Ownership Guidelines

Our Corporate Governance Guidelines contain director and executive officer stock ownership guidelines that generally require: (1) directors to hold at least 15,000 shares of the Company’s stock, including any unvested restricted stock units, for the duration of their remaining tenure as a director of the Company, by the later of April 24, 2021 or five years from becoming a director and (2) executive officers to hold Company stock, including any unvested restricted stock units, in an amount equal to 2.0 times base salary in the case of the Chief Executive Officer and 1.25 times base salary in the case of all other executive officers by the later of April 30, 2021 or five years from becoming subject to such guidelines. With respect to the director ownership guidelines, the five-year compliance window will be increased by one year for every year the Board does not grant equity-based compensation to its non-employee directors.

As of December 31, 2021, all of our named executive officers and all of our current directors, except Ms. Richard, exceeded their target ownership levels. Ms. Richard, who was appointed to the Board in October 2018, originally had until October 18, 2023 to reach her target ownership level. However, as disclosed under “Director Compensation,” we have not granted equity-based compensation to our non-employee directors since 2018. Accordingly, Ms. Richard’s compliance date has been extended by three years and is subject to potential future extension.

Anti-Hedging and Pledging Policies

Our Corporate Governance Guidelines prohibit our directors and executive officers from entering into any hedging arrangements with respect to our securities. Specifically, the guidelines contain the following prohibition: “Directors and executive officers are prohibited from holding any Company stock in a margin account or engaging in any transaction that would have the effect of hedging the economic risk of ownership of their Company stock.”

Furthermore, directors and executive officers may not borrow against any account in which Company stock is held or pledge Company stock as collateral for a loan or for any other purpose, except that such insiders may pledge Company stock as collateral for a loan (not including margin debt) if:

|

|

• |

such shares are not pledged as collateral for a margin loan; |

|

|

• |

such executive or director establishes that he or she has the financial capacity to repay the loan without resorting to the pledged securities; |

|

|

• |

such executive or director notifies our Secretary prior to the execution of documents evidencing the proposed pledge; and |

|

|

• |

such shares pledged will not be considered as owned for purposes of the stock ownership guidelines applicable to the executive or the director. |

Finally, any pledging of or trading in Company stock by directors and executive officers must comply with any additional restrictions set forth in our Insider Trading Policy.

Consideration of Director Nominees

The Corporate Governance and Nominating Committee will regularly assess the appropriate size of our Board, as well as whether any vacancies on our Board are expected due to retirement or otherwise and whether such vacancies should be filled. The Corporate Governance and Nominating Committee will consider various potential candidates for director who may come to the attention of our Board through current members of our Board, professional search firms or shareholders during its annual review process. In the event of a vacancy, the Corporate Governance and Nominating Committee may recommend alternatively that the Board reduce its size. Each candidate brought to the attention of the Corporate Governance and Nominating Committee, regardless of who recommended such candidate, is evaluated in the same manner.

14

The identification and evaluation of qualified directors is a complex and subjective process that requires consideration of many intangible factors and will be significantly influenced by the particular needs of the Board and the Company from time to time. The Corporate Governance and Nominating Committee believes that each potential director nominee should be evaluated based on his or her individual merits, taking into account the Company’s needs and the composition of the Board at the time. As a result, the Corporate Governance and Nominating Committee has not set specific, minimum qualifications that a director must meet in order for the Corporate Governance and Nominating Committee to recommend him or her to the Board, other than being under the age of 78 at the time of his or her election.

In evaluating nominees for membership on our Board, the Corporate Governance and Nominating Committee considers the Board membership criteria set forth in our Board Diversity Policy and in our Corporate Governance Guidelines. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, commits to interviewing at least one candidate who would increase the diversity of the Board with respect to gender, race, sexual orientation or disability.

Consistent with these policies, the Corporate Governance and Nominating Committee consistently seeks directors with integrity and proven business judgment, management ability and a diverse mix of backgrounds and experiences to build a capable, responsive, balanced and effective Board. In reviewing the qualifications of potential director nominees, the Corporate Governance and Nominating Committee considers many factors, including accounting and financial expertise, capital markets and banking experience, energy and energy service industry experience, environmental compliance and corporate responsibility expertise, human capital management experience, cybersecurity and technology expertise, senior corporate executive experience, industrial construction and fabrication management experience, legal and regulatory compliance expertise, renewable energy experience and other public company board experience.

Upon the recommendations of the Corporate Governance and Nominating Committee, nominations of directors and related matters are voted upon by the Board. Since Mr. Heo is a member of management and a non-independent director, he is not involved in the nominations process.

As set forth in our Corporate Governance Guidelines, our Corporate Governance and Nominating Committee will consider director candidates recommended by our shareholders for nomination for election to our Board. Any shareholder may suggest a nominee by sending the following information to our Board: (1) the proposing shareholder’s name, address and telephone number, (2) the number of shares of our common stock beneficially owned by the proposing shareholder and the suggested nominee, (3) the suggested nominee’s name, age, business and residential addresses and telephone number, (4) a statement that the suggested nominee knows that his or her name is being suggested by the proposing shareholder, and that he or she has consented to being suggested and is willing to serve, (5) the suggested nominee’s resume or other description of his or her background and experience and (6) the proposing shareholder’s reasons for suggesting that the individual be considered. The information should be sent to the Corporate Governance and Nominating Committee of our Board addressed as follows: Chairman - Corporate Governance and Nominating Committee of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084.

In addition, we have advance notice procedures that permit a shareholder to present shareholder nominees at our annual shareholder meetings. For additional information regarding our advance notice procedures, see “Shareholder Proposals and Nominations for the 2023 Annual Meeting.”

15

In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required by the Company to be an effective member of our Board. For 2021, the form and amount of director compensation was reviewed by the Compensation Committee and approved by our full Board.

Cash Compensation

In early 2017, following a review of director compensation by Aon Hewitt, the Compensation Committee’s independent consultant, the Board unanimously approved a non-employee director compensation program, which remained in effect until May 2018. However, considering the economic environment of the oil and gas and marine industries and in support of the Company’s efforts to reduce costs, effective May 1, 2018, the Board approved certain reductions to the fees paid to our non-employee directors, which remain in effect. Currently, our non-employee director compensation programs consists of the following cash components: (i) an annual fee paid to our Chairman of the Board of $126,000, (ii) an annual fee paid to each other non-employee director of $59,400, (iii) an additional annual fee of $12,000 paid to each of the chairs of the Audit Committee, the Corporate Governance and Nominating Committee, and the Compensation Committee, and (iv) an additional annual fee of $12,000 paid to the Audit Committee Financial Expert. Directors do not receive additional fees for attending meetings of our Board and its committees; however, all directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of our Board and its committees. The table below summarizes total compensation paid to our directors.

Equity-Based Compensation

In previous years, our non-employee directors received equity-based compensation under our stock incentive plans. However, considering the ongoing challenges faced by the Company, the Board has not approved equity-based awards for our non-employee directors since 2018.

2021 Director Compensation

The table below summarizes compensation earned for 2021 for each non-employee director serving as a director during 2021. Mr. Heo (our chief executive officer during 2021) did not receive any compensation for his service as a director, and his compensation as an executive of the Company is reflected in the 2021 Summary Compensation Table on page 28.

|

Name |

|

Fees Earned or Paid in Cash (1) |

|

Stock Awards (2) |

|

Total |

|||

|

Robert M. Averick |

|

$ |

59,400 |

|

$ |

— |

|

$ |

59,400 |

|

Murray W. Burns |

|

71,400 |

|

— |

|

71,400 |

|||

|

William E. Chiles |

|

71,400 |

|

— |

|

71,400 |

|||

|

Michael A. Flick |

|

126,000 |

|

— |

|

126,000 |

|||

|

Michael J. Keeffe |

|

83,400 |

|

— |

|

83,400 |

|||

|

Cheryl D. Richard |

|

59,400 |

|

— |

|

59,400 |

|||

___________________________

|

|

(1) |

Reflects fees earned by our non-employee directors during 2021 for their service on our Board and its committees, as applicable. |

|

|

(2) |

Our non-employee directors did not receive equity-based awards during 2021. As of December 31, 2021, none of our non-employee directors had any unvested equity-based awards. |

16

PROPOSAL 1: Election of Directors

Our articles of incorporation provide that the number of directors will be set forth in our by-laws. Our by-laws allow for the number of directors constituting the entire Board to be a range of not less than three nor more than twelve, with the exact number of directors to be fixed by a duly adopted resolution of the Board. The size of our Board is currently set at seven directors; however, immediately following the 2022 annual meeting, the Board will reduce its size to six directors, with Mr. Flick’s term expiring in connection with his retirement. We thank Mr. Flick for his service on behalf of the Company.

In addition, our articles of incorporation previously provided for a Board consisting of three classes, and directors elected prior to the 2020 annual meeting of shareholders were elected to hold office for staggered terms of three years. At the 2020 annual meeting of shareholders, our shareholders approved an amendment to our articles of incorporation to declassify the Board and make our directors subject to annual election as the term of each class of the Board expires. Beginning with our 2022 annual meeting of shareholders, the Board will be completely declassified and all directors, regardless of their original term of office, will be elected on an annual basis to serve terms expiring at the next annual meeting.

Our Board has nominated Messrs. Averick, Burns, Chiles, Heo and Keeffe and Ms. Richard for election to our Board for terms expiring at the next annual meeting in 2023 and until his or her successor is elected and qualified, or until his or her earlier resignation or removal. Messrs. Averick, Burns, Chiles, Heo and Keeffe and Ms. Richard have consented to being named as nominees in this proxy statement and to serve as directors if elected.

In the unanticipated event that any nominee is unable to serve or for good cause will not serve as a candidate for director, the persons named as proxies on the enclosed proxy card will vote your shares of our common stock for a substitute candidate nominated by our Board, unless otherwise directed.

Directors are elected by the affirmative vote of a majority of the votes cast with respect to each director (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee), except in the event of a contested election, in which case directors are elected by the affirmative vote of a plurality of the votes cast (meaning the director nominees who receive the highest number of votes “for” their election are elected). A contested election occurs when the number of nominees for director exceeds the number of directors to be elected.

In the event an incumbent director nominee does not receive a majority of the votes cast in an uncontested election, such director must tender his or her resignation to the Corporate Governance and Nominating Committee, which will consider the director’s offer of resignation and recommend to the Board whether to accept or reject the resignation, or whether other action should be taken. For additional information regarding the vote required and treatment of abstentions and broker non-votes, see “Questions and Answers about the 2022 Annual Meeting and Voting.”

Our Board unanimously recommends that you vote “FOR” the election of each of the six director nominees named in this proxy statement.

17

Information about the Director Nominees and Executive Officers

The following table sets forth, as of March 30, 2022, for each director nominee and each of our executive officers, the age, any positions with the Company, principal occupations and employment during the past five years, and, if a director nominee, each such person’s directorships in other public corporations during the past five years and the year that such person was first elected a director of the Company. We have also included information about each director nominee’s specific experience, qualifications, attributes, or skills that led our Board to recommend that our shareholders elect such person to serve as one of our directors, in light of our business and Board structure at the time of such nomination. All executive officers serve at the pleasure of our Board. The director nominees have consented to being named as nominees in this proxy statement and to serve as directors if elected.

|

Name and Age |

|

Positions with the Company, Principal Occupations, and Directorships in Other Public Companies |

|

Director Since |

|

|

|

|

|

|

|

|

|

Robert M. Averick, 56 |

|

Mr. Averick has worked as a Portfolio Manager since 2012 at Kokino LLC, a private investment firm that provides investment management services to Piton Capital Partners LLC. Since 2016, Mr. Averick has served as a member of the board of directors of Amtech Systems, Inc., a publicly traded manufacturer of capital equipment. Mr. Averick has also served as a member of the board of directors of PhoneX Holdings, Inc. since 2020. Mr. Averick formerly served as a member of the board of directors of Key Technology, Inc., a manufacturer of process automation systems for food processing and other industries, from 2016 until the company’s sale in 2018. Mr. Averick has more than 20 years of experience as a small-capitalization, value-driven public equity portfolio manager. His experience in finance, strategic planning and consulting, as well as his public company board experience, provide him with valuable skills and expertise and make him highly qualified to serve as a member of our Board and the Corporate Governance & Nominating Committee and as our new Chairman of the Compensation Committee. |

|

2018 |

|

|

|

|

|

|

|

|

|

Murray W. Burns, 76 |

|

Mr. Burns has worked as a project management, engineering and business development consultant through MBurns Consulting since 2013, and has 51 years of experience in the offshore oil and gas, engineering and construction industries. From 1980 to 2013, Mr. Burns was employed in various executive capacities by Technip USA, Inc. and its affiliates (“Technip”), which provide subsea, onshore/offshore and surface project management, construction and engineering. His roles with Technip included: Vice President—Offshore, Vice President—Topsides and Fixed Platforms, Vice President—Engineering Operations, and Vice President—Engineering, President and COO (Technip Upstream Houston Inc.). From 1976 to 1980, Mr. Burns served in various management positions at Petro-Marine Engineering, Inc., an engineering consulting firm specializing in services to the offshore petroleum and marine industries. Prior to 1976, Mr. Burns worked in various engineering capacities at Shell Oil Company, an oil and gas producer, marketer and manufacturer. Mr. Burns’ experience and knowledge in engineering, fabrication, project execution and business development in the energy and offshore industries make him highly qualified to serve as a member of our Board and the Audit Committee and as Chairman of the Corporate Governance and Nominating Committee. |

|

2014 |

|

18

|

Name and Age |

|

Positions with the Company, Principal Occupations, and Directorships in Other Public Companies |

|

Director Since |

|

|

|

|

|

|

|

|

|

William E. Chiles, 73 |

|