UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

|

|

☐ |

|

Soliciting Material Under Rule 14a-12 |

GULF ISLAND FABRICATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

|

No fee required. |

|||

|

☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

|

|

(1 |

) |

|

Title of each class of securities to which transaction applies: |

|

|

|

(2 |

) |

|

Aggregate number of securities to which transaction applies: |

|

|

|

(3 |

) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

(4 |

) |

|

Proposed maximum aggregate value of transaction: |

|

|

|

(5 |

) |

|

Total fee paid: |

|

☐ |

|

Fee paid previously with preliminary materials. |

|||

|

☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

|||

|

|

|

(1 |

) |

|

Amount previously paid: |

|

|

|

(2 |

) |

|

Form, Schedule or Registration Statement No: |

|

|

|

(3 |

) |

|

Filing Party: |

|

|

|

(4 |

) |

|

Date Filed: |

{B1339286.20}

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 300

HOUSTON, TEXAS 77084

________________________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 20, 2021

TO THE SHAREHOLDERS OF GULF ISLAND FABRICATION, INC.:

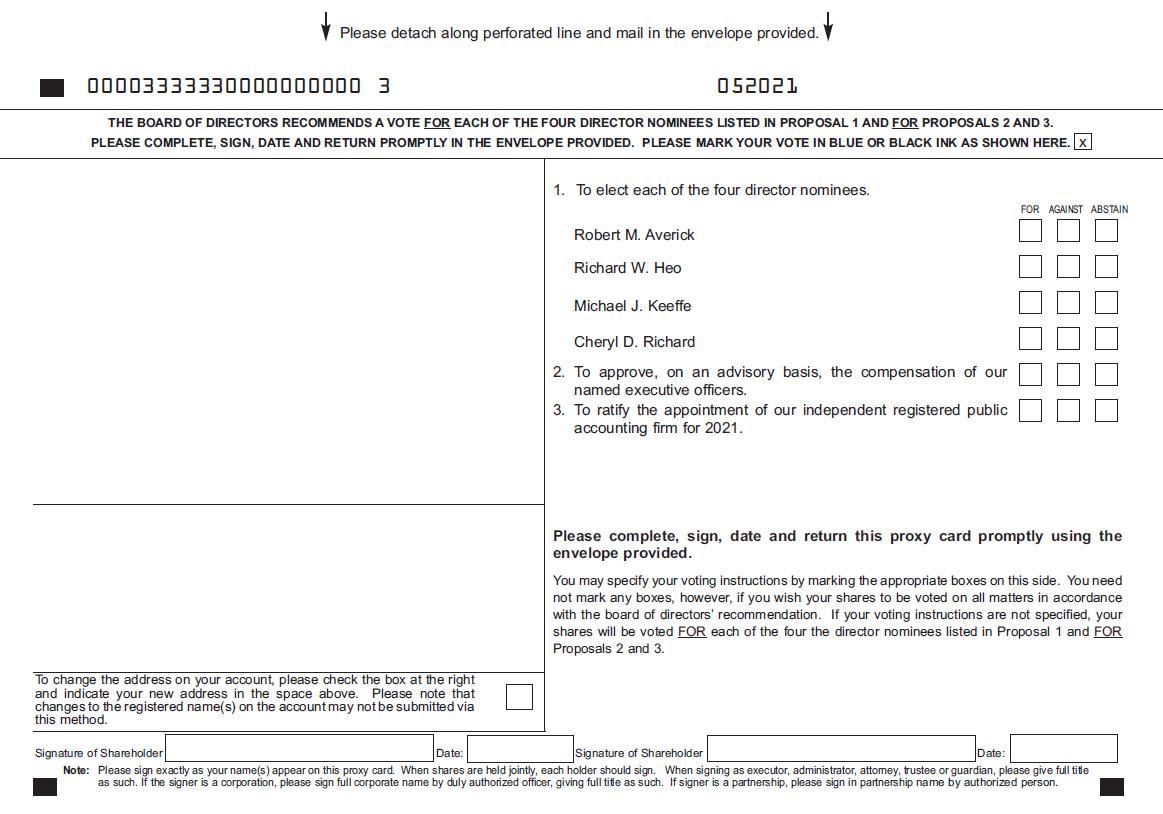

The 2021 annual meeting of shareholders (the “2021 annual meeting”) of Gulf Island Fabrication, Inc. (the “Company” or “Gulf Island”) will be held at 9:00 a.m., Central Time, on Thursday, May 20, 2021, conducted exclusively via live audio webcast, accessible at https://web.lumiagm.com/266826102 for the following purposes, as more fully described in the enclosed proxy statement:

|

|

1. |

To elect each of the four director nominees named in this proxy statement; |

|

|

2. |

To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

|

|

3. |

To ratify the appointment of the Company’s independent registered public accounting firm for 2021; and |

|

|

4. |

To transact any other business that may properly come before the 2021 annual meeting. |

The board of directors of Gulf Island (the “Board”) has fixed the close of business on March 31, 2021, as the record date for the determination of shareholders entitled to notice of and to vote at the 2021 annual meeting and all adjournments thereof.

In light of the continuing public health impact of the COVID-19 pandemic and in order to prioritize the health and well-being of meeting participants, the 2021 annual meeting will be a virtual meeting of shareholders conducted exclusively via a live audio webcast, accessible at https://web.lumiagm.com/266826102. Please see “Questions and Answers about the 2021 Annual Meeting and Voting” beginning on page 38 for information about how to join and participate in the virtual annual meeting.

Your vote is important. Regardless of whether you plan to login to the meeting website as a shareholder to participate in the 2021 annual meeting, please complete, date and sign the enclosed proxy card and return it promptly in the enclosed stamped envelope or submit your proxy and voting instructions online at www.voteproxy.com. Returning the enclosed proxy card or submitting your proxy and voting instructions online will not prevent you from voting at the 2021 annual meeting if you login to the meeting website as a shareholder should you wish to do so. To obtain additional instructions for joining as a guest or participating and voting as a shareholder at the 2021 annual meeting, please contact Bryan Anderson at American Stock Transfer & Trust Company, LLC (“AST”) at (718) 921-8300 ext. 6457.

|

|

By Order of the Board of Directors |

|

|

|

|

|

/s/ Westley S. Stockton |

|

|

Westley S. Stockton |

|

|

Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

Houston, Texas

April 15, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF THE PROXY MATERIALS FOR THE SHAREHOLDERS

MEETING TO BE HELD ON MAY 20, 2021.

This proxy statement and the 2020 annual report are available at https://ir.gulfisland.com/corporate-governance/proxy-materials.

{B1339286.20}

|

|

Page |

|

1 |

|

|

1 |

|

|

2 |

|

|

2 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

Corporate Governance; Our Board of Directors and Its Committees |

5 |

|

5 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

9 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

12 |

|

|

13 |

|

|

13 |

|

|

15 |

|

|

15 |

|

|

15 |

|

|

15 |

|

|

16 |

|

|

Information about the Director Nominees, Continuing Directors and Executive Officers |

17 |

|

22 |

|

|

22 |

|

|

29 |

|

|

PROPOSAL 2: ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

33 |

|

34 |

|

|

35 |

|

|

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2021 |

36 |

|

36 |

|

|

37 |

|

|

38 |

|

|

Questions and Answers about the 2021 Annual Meeting and Voting |

38 |

|

Shareholder Proposals and Nominations for the 2022 Annual Meeting |

46 |

We include website addresses throughout this proxy statement for reference only. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC. Printed versions of these materials are available, free of charge, to any shareholder who requests them from our Secretary.

{B1339286.20}

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 300

HOUSTON, TEXAS 77084

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 20, 2021

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before returning your proxy card. For more information regarding our 2020 financial and operational performance, please review our 2020 annual report to shareholders, including financial statements (our “2020 annual report”). The 2020 annual report is first being mailed to shareholders together with this proxy statement, the notice of annual meeting and form of proxy card (collectively, the “proxy materials”) on or about April 15, 2021.

2021 Annual Meeting of Shareholders

|

|

Time and Date: |

9:00 a.m., Central Time, Thursday, May 20, 2021 |

|

|

|

|

|

|

Location: |

https://web.lumiagm.com/266826102 |

|

|

|

|

|

|

Record Date: |

March 31, 2021 |

|

|

|

|

|

|

Voting: |

Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each of the director nominees and one vote for each of the other proposals to be voted on at the 2021 annual meeting. |

1

{B1339286.20}

Agenda and Voting Recommendations

The Board is asking shareholders to vote on these matters:

|

Item |

|

Proposal |

|

Board Vote Recommendation |

|

Page |

|

1 |

|

Election of each of the four director nominees named in this proxy statement |

|

FOR |

|

16 |

|

2 |

|

Advisory vote to approve the compensation of our named executive officers |

|

FOR |

|

33 |

|

3 |

|

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2021 |

|

FOR |

|

36 |

We have included summary information about each of the director nominees and each other director of the Company whose term will continue after the 2021 annual meeting in the table below. See “Information about the Director Nominees, Continuing Directors and Executive Officers” for additional information regarding our director nominees and continuing directors.

|

Name |

|

Class/ Term |

|

Age |

|

Director Since |

|

Principal Occupation |

|

Independent |

|

Board Committees |

|

Robert M. Averick |

|

None |

|

55 |

|

2018 |

|

Portfolio Manager, Kokino LLC |

|

Yes |

|

•Compensation •Corporate Governance & Nominating |

|

Murray W. Burns |

|

I |

|

75 |

|

2014 |

|

Consultant, MBurns Consulting |

|

Yes |

|

•Audit •Corporate Governance & Nominating* |

|

William E. Chiles |

|

I |

|

72 |

|

2014 |

|

Managing Partner, Pelican Energy Partners |

|

Yes |

|

•Audit •Compensation* |

|

Michael A. Flick** |

|

I |

|

72 |

|

2007 |

|

Retired Banking Executive |

|

Yes |

|

•Audit •Corporate Governance & Nominating |

|

Richard W. Heo |

|

III |

|

50 |

|

2019 |

|

Chief Executive Officer of Gulf Island |

|

No |

|

|

|

Michael J. Keeffe*** |

|

III |

|

69 |

|

2014 |

|

Retired Senior Audit Partner, Deloitte & Touche LLP |

|

Yes |

|

•Audit* •Compensation |

|

Cheryl D. Richard |

|

III |

|

65 |

|

2018 |

|

Retired Executive, Transocean Ltd. |

|

Yes |

|

•Compensation •Corporate Governance & Nominating |

____________________________

|

* |

Committee Chairman |

|

** |

Chairman of the Board |

*** Audit Committee Financial Expert

2

{B1339286.20}

Compensation Highlights (pages 15 and 22)

|

|

• |

Annual Cash Incentive Program Payout Based on Performance. Annual cash incentive awards for 2020 for our named executive officers (“NEOs”) were based on specific targets related to earnings before interest, taxes, depreciation and amortization (“EBITDA”), Free Cash Flow (“FCF”), safety, and individual performance objectives. Based on our 2020 performance, our NEOs earned annual cash payouts representing approximately 36% to 45% of their target annual cash incentive awards. |

|

|

• |

Salary Reductions in 2020. Given the economic environment of the oil and gas and marine industries and challenges faced by the Company, including the uncertainty created by the effects of the COVID-19 pandemic and the significant decline and volatility in oil prices, our executive officers voluntarily reduced their base salaries effective May 1, 2020, with our chief executive officer reducing his base salary by 25%. Our Compensation Committee has not increased base salaries for our NEOs since 2014, except for increases for certain NEOs in 2020 to account for the elimination of the automobile allowance for each NEO. |

|

|

• |

2019 Long-Term Incentive Program (“LTIP”) Focused on Performance. The LTIP design for 2019 eliminated the time-based restricted stock unit (“RSU”) component of the LTIP, thereby reducing the aggregate LTIP target award received by our executive officers, including our NEOs, except for Mr. Stockton, who also received time-based awards in the form of RSUs due to his recent affiliation with the Company. In addition, the Board replaced the relative total shareholder return metric used in previous years with an annual income metric for the performance period, supporting the Company’s focus on improving financial results. One-third of the 2019 long-term performance award will be earned each year in the performance period, provided the applicable income target for the year is achieved, or will be forfeited if the applicable target is not achieved. The first and second tranches of the 2019 award were forfeited as the Company did not achieve the applicable income targets. Our executives did not receive any new long-term performance awards in 2020. |

|

|

• |

2020 Incentives Focused on Retention. The LTIP design for 2020 continued to maintain a reduction in the aggregate LTIP target award received by our executive officers, including our NEOs. However, in light of the current industry outlook and the Company’s financial condition, retention concerns for our NEOs given their recent affiliations with the Company in the case of Messrs. Heo and Stockton and recent appointment to his position in the case of Mr. Vaccari, and to align the executive team’s interests with those of our shareholders, each NEO’s 2020 LTIP award was delivered solely in RSUs. Further, given the previously mentioned retention concerns, the Compensation Committee also approved a cash retention program for our executive officers, including our NEOs, in order to incentivize them to remain with the Company during 2020. |

|

|

• |

Recent Director Fee Reductions. Effective May 1, 2018, the Board approved a 10% reduction in the annual fees paid to our directors, and beginning in 2019, the Board eliminated the annual equity grant to non-employee directors, resulting in a further reduction in the annual compensation paid to our directors. |

|

|

• |

“Double Trigger” Equity and Performance-Based Cash Awards. Vesting of equity awards will only accelerate in connection with a change of control event if, within one year upon such change of control event, a participant’s employment is terminated without cause or terminated by the participant for good reason. Similarly, in connection with a change of control event, the long-term performance-based cash awards granted to our executive officers will only accelerate and be payable at the target level if, in connection with such change of control event, a participant’s employment is terminated without cause or by the participant for good reason. |

3

{B1339286.20}

Corporate Governance Highlights (page 11)

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens the accountability of our Board and management and engenders public trust in the Company. In furtherance of our commitment to strong corporate governance, our Board reviews on an ongoing basis evolving governance practices and investor preferences, including feedback from our shareholders.

The table below summarizes certain highlights of our corporate governance practices and policies. For detail regarding our ongoing corporate governance practices, see “Corporate Governance; Our Board of Directors and its Committees—Commitment to Corporate Governance.”

|

|

|||||

|

✓ |

Phase-In Declassification of the Board to be Complete after the 2022 annual meeting |

||||

|

✓ |

6 of 7 Directors Independent |

✓ |

100% Independent Committees |

✓ |

Regular Executive Sessions |

|

✓ |

Annual Board Evaluations and Skills Assessment |

✓ |

Majority Voting Standard for Uncontested Elections |

✓ |

Demonstrated Board Refreshment |

|

✓ |

Focus on Board Diversity (Board Diversity Policy) |

✓ |

Separate Chairman and CEO |

✓ |

Stock Ownership Guidelines for Directors and Officers |

|

✓ |

No Shareholder Rights Plan |

✓ |

Right to Call a Special Meeting |

✓ |

No Supermajority Voting |

|

✓ |

Clawback Policy |

✓ |

Anti-Hedging and Anti- Pledging Policy |

✓ |

Robust Corporate Governance Guidelines |

Communications with our Board and Shareholder Engagement (page 12)

We believe it is important for our shareholders and interested parties to provide input on our business, our corporate governance and executive compensation practices, or any other matter of shareholder interest. Shareholders and interested parties may contact our Chief Executive Officer, who will coordinate distribution of the correspondence to our full Board, as provided below:

|

By Letter |

|

By Telephone |

|

By Email |

|

Virtually |

|

Gulf Island Fabrication, Inc. 16225 Park Ten Place Suite 300 Houston, TX 77084 |

|

Richard Heo (713) 714-6100 |

|

Richard Heo rheo@gulfisland.com |

|

Annual Meeting https://web.lumiagm.com/266826102 |

During 2020, we engaged in regular dialogue with our shareholders and their representatives, with discussions centering on the following topics: (1) strategy; (2) executive compensation; (3) project execution; and (4) improvements in personnel, processes and procedures.

Informed by these discussions with our shareholders, the Board has previously implemented certain changes to our governance, board and management structures, as further detailed in these proxy materials.

4

{B1339286.20}

Corporate Governance; Our Board of Directors and Its Committees

Our Board currently consists of seven members. Our Board formally met ten times during 2020. Our Board has established three standing committees: the Corporate Governance and Nominating Committee, the Audit Committee and the Compensation Committee.

Each committee operates under a written charter adopted by our Board, and such charters, together with our Corporate Governance Guidelines, are available on our corporate governance page at www.gulfisland.com under “Investors—Governance—Governance Documents.” The composition of each committee is reviewed annually by our Board. During 2020, each of our incumbent directors attended 100% (except one who attended 93%) of the aggregate of the total number of meetings of our Board and the total number of meetings held by all committees of our Board on which he or she served during the periods of his or her Board membership and committee service.

Our Corporate Governance Guidelines require the Chairman of the Board and Chief Executive Officer positions to be separate. Our Board determined that the separation of these roles would maximize management’s efficiency by allowing the Chief Executive Officer to focus on our day-to-day business and the Chairman of our Board to lead the Board in its fundamental role of providing guidance to, and oversight of, management. Our Board periodically reviews the Company’s leadership structure and may make changes in the future as it deems appropriate. Our President and Chief Executive Officer is Richard W. Heo. Our Chairman of the Board is Michael A. Flick, who the Board unanimously elected as Chairman of the Board to succeed John P. Laborde following the 2020 annual meeting.

Our Board believes that our independent directors, with the leadership of our Chairman of the Board, provide effective oversight of management. Moreover, in addition to director feedback provided during the course of meetings of our full Board, the non-management directors are given the opportunity to meet in executive session at each regular meeting of our Board or more frequently, as needed. During 2020, the Chairman of the Board, which was Mr. Laborde until his retirement and thereafter Mr. Flick, chaired all executive sessions of the independent directors and acted as the liaison between the independent directors and the management team. Our three standing committees are composed entirely of independent directors and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board or management.

On the basis of information solicited from each director, and upon the advice and recommendation of the Corporate Governance and Nominating Committee, our Board annually determines the independence of each of our then-current directors in connection with the nomination process. Further, in connection with the appointment of any new director to the Board during the year, our Board makes the same determination. Our Board has determined that each of our current directors (specifically Ms. Richard and Messrs. Averick, Burns, Chiles, Flick and Keeffe), except for Mr. Heo (our Chief Executive Officer), has no material relationship with the Company and is independent as defined in the director independence standards of the listing standards of The NASDAQ Stock Market LLC (“NASDAQ”), as currently in effect. In making this determination, our Corporate Governance and Nominating Committee, with assistance from the Company’s legal counsel, evaluated responses to a questionnaire completed annually by each director regarding relationships and possible conflicts of interest between each director, the Company and management, and made a recommendation to our Board. In its review of director independence, our Board considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and family relationships any director may have with the Company or management.

5

{B1339286.20}

Board Skills Matrix

The following table notes the breadth and variety of business experience that each of our current directors brings to the Company and which enable the Board to provide insightful leadership to the Company so that it may better advance its strategies and deliver returns to shareholders. The Corporate Governance and Nominating Committee annually reviews this skills matrix for possible additions and any developments in the experience, qualifications, attributes and skills of the directors.

|

Director Experience and Skills Matrix |

||||

|

CEO or other Senior Executive Experience |

|

Experience in senior leadership positions provides our Board with practical insights in developing and implementing business strategies, maintaining effective operations and driving growth, so that we may achieve our strategic goals. |

|

6 of 7 directors |

|

Industry Experience |

|

Industry expertise and experience in energy or energy service, marine and industrial construction and fabrication allows the Board to develop a deeper understanding of our key business, its operations and key performance indicators in a competitive environment. In addition, industry expertise and experience provides the Board with awareness and know-how to help the Company cultivate and sustain growth in its industries and helps to maintain compliance with industry-related regulations. |

|

6 of 7 directors |

|

Accounting & Financial Experience |

|

Experience as an accountant, auditor, financial expert or other relevant experience is critical to allowing the Board to oversee the preparation and audit of our financial statements and comply with various regulatory requirements and standards. |

|

5 of 7 directors |

|

Other Public Company Board Experience |

|

Directors who serve or have served on the boards of other public companies understand the responsibilities of a public company and board and can provide insight on issues commonly faced by public companies gained from this experience. |

|

5 of 7 directors |

|

Capital Markets & Banking Experience |

|

Experience overseeing investments and capital market transactions provides the Board with critical background, knowledge and skills that enhance the Company’s ability to raise capital to fund its operations and evaluate and implement capital allocation strategies. |

|

4 of 7 directors |

|

Legal & Regulatory Compliance Experience |

|

Experience in the legal field or in regulated industries provides the Board with knowledge and insights in complying with government regulations and legal obligations, as well as identifying and mitigating legal and compliance risks. |

|

4 of 7 directors |

|

Cybersecurity |

|

Cybersecurity risks are increasing for all industries, including the Company’s, and our Board members’ experience and expertise in this rapidly developing area are essential to mitigating cybersecurity risks and to the Company’s risk management as a whole. |

|

1 of 7 directors |

|

Human Capital Management |

|

Experience in human capital management, including employee development, diversity and equal employment opportunity initiatives, workplace health and safety, labor relations, workforce engagement and administration, and executive compensation, helps the Board and the Company recruit, retain and develop key talent, grow diversity of personnel at all levels throughout the Company and build strong relationships with our employees. |

|

7 of 7 directors |

|

Risk Management & Oversight |

|

Experience overseeing complex risk management allows the Board to pre-emptively identify, assess and mitigate key risks and to design and implement risk management practices to protect shareholder return. |

|

7 of 7 directors |

|

Corporate Strategy & Business Development |

|

Corporate strategy and business development experience enhances the Board’s ability to develop innovative solutions, including our business and strategic plans, and to drive growth in our competitive industry. |

|

7 of 7 directors |

|

Corporate Governance & Ethics |

|

Directors with experience implementing governance structures and policies provide an understanding of best practices and key issues, enhancing our ability to maintain good governance and to execute new key governance initiatives. |

|

7 of 7 directors |

|

Independence |

|

Directors who are “independent” under the rules of the Securities and Exchange Commission (the “SEC”), listing exchanges and other entities allow the Board to provide unbiased oversight over the Company and to implement governance practices with integrity and transparency. |

|

6 of 7 directors |

6

{B1339286.20}

Board Diversity, Tenure and Refreshment

We are committed to Board diversity and Board refreshment and we believe the Company’s policies and practices help to ensure a diversity of skills, experience, and tenure on the Board.

Diversity Policy

We have a formal Board Diversity Policy, which is available on our corporate governance page at www.gulfisland.com under “Investors—Governance—Governance Documents.” Pursuant to such policy, the Corporate Governance and Nominating Committee strives for inclusion of diverse groups, knowledge and viewpoints within the Board, considering various matters of diversity, including, but not limited to, gender, race, religion, sexual orientation and disability. The Corporate Governance and Nominating Committee seeks out highly qualified diverse candidates and evaluates each director nominee in the context of our Board composition as a whole, with the objective of nominating director candidates who can best perpetuate the success of our business, be effective directors in conjunction with our full Board and represent shareholder interests through the exercise of sound judgment. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, has committed to interviewing at least one candidate who would increase the gender, racial and/or ethnic diversity of the Board. To accomplish this, the Corporate Governance and Nominating Committee has sole authority to retain and terminate qualified independent external advisors, if it deems necessary, to conduct searches for candidates that help achieve the Board’s diversity objectives, and to approve such advisors’ fees and other retention terms.

Tenure and Refreshment

In 2019, the Board appointed Mr. Heo as a member in connection with his appointment as our Chief Executive Officer. The Board was reduced to seven directors upon the retirement of Gregory J. Cotter, Christopher M. Harding and John P. Laborde (three of our long-standing directors) immediately following the 2020 annual meeting. In addition, at the recommendation of our Board, our shareholders voted to approve a proposal to amend and restate our articles of incorporation to declassify the Board on a phase-in basis beginning with our director (Mr. Averick) elected at our 2020 annual meeting. The Board will be fully declassified, with each director elected annually, following our 2022 annual meeting.

The appointment of Mr. Heo in 2019 and the retirement of Messrs. Cotter, Harding and Laborde following the 2020 annual meeting, in addition to the appointments of Ms. Richard and Mr. Averick to the Board in 2018, have increased diversity on our Board and decreased the average tenure and age of our directors. In addition to increasing diversity on our Board, Mr. Heo’s appointment as Chief Executive Officer has increased the diversity of our executive management team.

Director Resignation Policy

The Board has adopted a Director Resignation Policy. The policy requires that directors provide a written offer of resignation, which the Corporate Governance and Nominating Committee will consider and recommend to the Board whether to accept or reject, in the event that (1) an incumbent director nominee receives less than a majority of affirmative votes in an uncontested election; or (2) a director has a material change in his or her principal occupation, employment or business association or job responsibilities, including retirement, or plans to join another company board for which our Chairman of the Board has determined that a potential conflict of interest may arise.

In addition, subject to our amended and restated articles of incorporation (our “articles of incorporation”), our amended and restated by-laws (our “by-laws”) and our Corporate Governance Guidelines, employee directors will resign from the Board when they retire or otherwise cease to be employed by the Company.

Finally, the Board believes that a director should offer his or her resignation if there is a substantial conflict of interest between the director and the Company or the Board and such conflict cannot be resolved to the satisfaction of the Board, which is stated in our Corporate Governance Guidelines.

7

{B1339286.20}

Board’s Role in Risk Oversight

The Board, as a whole, is responsible for risk oversight, with review of certain areas being conducted by the relevant Board committees that report to the full Board. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. There are several ways our Board performs this function, including: (1) receiving quarterly management updates on our business operations and financial results and discussing risks related to the business at each regular Board meeting, (2) receiving reports on all significant committee activities at each regular Board meeting, (3) evaluating the risks inherent in significant transactions as applicable and (4) receiving annual reports from our information technology personnel regarding potential cybersecurity threats and the status of our defenses. Throughout the year, the Board received briefings and assessments of the Company’s risks through regular interactions with our management and, from time-to-time, input from independent advisors, including, among other items, the following key risks related to:

|

•Business environment and market |

•Cybersecurity |

|

•Compliance |

•Tax |

|

•Human resources |

•Health, safety and environmental |

|

•Treasury |

•Security |

|

•Mergers and acquisitions |

•Legal |

|

•Financial reporting |

•Strategy |

Our Board believes that full and open communication between management and our Board is essential to effective risk oversight. Management is available to address any questions or concerns raised by our Board on risk management or any other matters, and any member of management may be requested to attend any meeting of the Board or a committee of the Board, upon request of any non-management director. Our Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company’s business opportunities and challenges and monitors the development and management of risks that impact our strategic goals.

The Board conducts certain risk oversight activities through its committees, which oversee specific areas and provide reports to the full Board regarding such committee’s considerations and actions. The Audit Committee reviews and considers financial, accounting, internal controls and regulatory compliance risks, including those that could arise from our accounting and financial reporting processes. The Audit Committee also reviews and monitors risks through various reports presented by our outsourced internal auditors and our independent registered public accounting firm. The Compensation Committee reviews and considers risks related to our compensation policies, including incentive plans, to determine whether those plans subject the Company to material risks. The Corporate Governance and Nominating Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with our Board leadership structure and corporate governance matters, including the oversight of our risk-management processes with respect to environmental, social and corporate governance.

In carrying out its risk oversight responsibilities, the Board is active in overseeing management’s actions to refocus our business strategy and enhance our financial position. To ensure informed and effective oversight, especially during a period of weak market conditions, the Board organizes periodic strategic planning retreats to discuss our strategic initiatives and to participate in the development of our strategic direction. Outside of these retreats, the Board continues to receive regular updates regarding management’s execution of the Company’s strategic initiatives. The Board also continues to monitor the Company’s performance against its annual business plan, including reviewing actual and forecast operating results on a regular basis to evaluate the status and success of management in the execution of the Company’s annual business plan.

Board Evaluation Process

The Corporate Governance and Nominating Committee is responsible for overseeing the annual performance evaluation of the Board, which is a multi-step process designed to evaluate the performance of the Board and each of its committees.

8

{B1339286.20}

|

STEP 1: Confidential Evaluations |

|

Annually, each director completes an evaluation of the full Board which is intended to provide each director with an opportunity to evaluate performance for the purpose of improving Board and committee processes and effectiveness. The detailed evaluation questionnaire seeks quantitative ratings and subjective comments in key areas of Board practice, and asks each director to evaluate how well the Board and its committees operate and to make suggestions for improvements. These key areas include assessment of Board composition, meeting procedures, allocation and delegation of responsibilities among the Board and its committees and adequacy and availability of resources. |

|

STEP 2: Board Summary |

|

The Corporate Governance and Nominating Committee reviews the results and its assessment of Board performance, including of the committees, is presented to the full Board. As needed, the Corporate Governance and Nominating Committee recommends any areas of improvement for the Board to consider implementing. |

|

STEP 3: Recommendations Implemented |

|

Based on the results, assessment and recommendations presented by the Corporate Governance and Nominating Committee, Board and Company practices and policies are updated, as appropriate. |

In response to feedback received from evaluations in recent years, the Board has established a periodic retreat of the Board with key management focused on strategic planning and has improved Board and committee meeting practices by allocating more time to topics relating to risk oversight and strategy. Additionally, in response to feedback received during the Board evaluation process relating to Board refreshment, diversity and succession planning, since 2020, the Chairman of the Corporate Governance and Nominating Committee has a more formal process to discuss with each director such director’s plans for continued service on the Board and any projected retirement date.

The following table notes our current committee structure and membership, which became effective in May 2020 (M - Member; C - Chairperson; FE - Financial Expert):

|

Director (1) |

|

Corporate Governance and Nominating Committee |

|

Audit Committee |

|

Compensation Committee |

|

Robert M. Averick |

|

M |

|

|

|

M |

|

Murray W. Burns |

|

C |

|

M |

|

|

|

William E. Chiles |

|

|

|

M |

|

C |

|

Michael A. Flick |

|

M |

|

M |

|

|

|

Michael J. Keeffe |

|

|

|

C, FE |

|

M |

|

Cheryl D. Richard |

|

M |

|

|

|

M |

_______________

|

|

(1) |

As a non-independent director, Mr. Heo does not serve as a member of any committee of the Board, all of which are composed entirely of independent directors. |

Our Board annually reviews and approves committee assignments with any changes made thereto effective immediately following the annual shareholders meeting.

The Audit Committee currently consists of the following four directors: Michael J. Keeffe (Chairman and Financial Expert), Murray W. Burns, William E. Chiles and Michael A. Flick. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards

9

{B1339286.20}

specifically governing audit committee members, and satisfies the additional requirements applicable to an audit committee member under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NASDAQ listing standards. Our Board has determined that Mr. Keeffe is an “Audit Committee Financial Expert” as such term is defined within the applicable rules of the SEC. Following the 2020 annual meeting, Mr. Keeffe became Chairman of the Audit Committee. The Audit Committee met four times during 2020.

The Audit Committee’s primary function is to assist our Board in fulfilling its oversight responsibilities relating to: (1) the quality and integrity of the accounting, auditing, disclosure controls and procedures, internal control over financial reporting and financial reporting practices of the Company, (2) the independent auditor’s qualifications and independence, (3) the performance of the Company’s independent auditors and (4) review and approval or ratification of any transaction that may require disclosure under Item 404 of Regulation S-K of the rules and regulations of the SEC.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of the following four directors: Murray W. Burns (Chairman), Robert M. Averick, Michael A. Flick and Cheryl D. Richard. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards. The Corporate Governance and Nominating Committee met three times during 2020.

The Corporate Governance and Nominating Committee assists the Board in fulfilling its oversight responsibilities by: (1) identifying, considering and recommending to the Board candidates to be nominated for election or reelection to the Board or as necessary to fill vacancies and newly-created directorships, (2) monitoring the composition of the Board and its committees and making recommendations to the Board on membership of the committees, (3) maintaining the Company’s Corporate Governance Guidelines and recommending to the Board any advisable changes, (4) evaluating the effectiveness of the Board and its committees, (5) addressing any related matters required by the federal securities laws or NASDAQ and (6) overseeing the succession plan process for each of the Company’s executive officers and the Chairman of the Board.

Compensation Committee; Compensation Committee Procedures

The Compensation Committee currently consists of the following four directors: William E. Chiles (Chairman), Robert M. Averick, Michael J. Keeffe and Cheryl D. Richard. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards specifically governing compensation committee members, and satisfies the additional requirements applicable for a compensation committee member under Rule 10C-1(b)(1) under the Exchange Act. Our Board has determined that each of the directors is a “non-employee director” as defined under Rule 16b-3 under the Exchange Act. The Compensation Committee met three times during 2020.

The Compensation Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibilities by: (1) discharging the responsibilities of the Board relating to the compensation of the Company’s officers and directors and (2) administering the Company’s cash-based and equity-based incentive compensation plans. The Compensation Committee has overall responsibility for approving, evaluating and recommending to the Board all compensation plans of the Company and to administer and interpret such plans.

The Compensation Committee seeks the input of our Chief Executive Officer in connection with performance evaluations and compensation decisions for our other executive officers; however, our Chief Executive Officer is not present when the Compensation Committee meets to evaluate his performance nor when our Board determines his compensation.

The terms of our stock incentive plans permit the Compensation Committee to delegate to appropriate personnel its authority to make awards to employees other than those subject to Section 16 of the Exchange Act. While the Compensation Committee has not historically delegated this authority, in early 2020, it delegated to Mr. Heo, our Chief Executive Officer, the authority to grant up to 80,001 shares to certain new hires in connection with the Company’s ongoing efforts to recruit additional talent.

10

{B1339286.20}

Commitment to Corporate Governance

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens accountability of our Board and management and engenders public trust in the Company. As discussed in “Corporate Governance Highlights,” in furtherance of our commitment to strong governance and in response to feedback from our shareholders, we have taken steps to improve our corporate governance practices, including those highlighted in the table below. We will continue this commitment to act in the best interest of our shareholders by regularly reviewing and updating our corporate governance practices over time. Our dedication to good corporate governance is evidenced by the following:

|

Corporate Governance Highlights |

||

|

Board Declassification |

|

In 2020, at the recommendation of our Board, our shareholders voted to approve a proposal to amend and restate our articles of incorporation to declassify the Board on a phase-in basis. The Board will be fully declassified, with each director elected annually, following our 2022 annual meeting. |

|

Majority Vote for Directors |

|

We have a majority voting standard for election of directors in an uncontested election. |

|

Majority Independent Board |

|

In 2020, six of our seven directors were independent. Three of our four director nominees are independent; only our CEO is not independent. |

|

100% Independent Committees |

|

Each of our Audit, Compensation and Corporate Governance and Nominating Committees is composed of entirely independent directors. |

|

Separate Chairman and CEO |

|

Our Corporate Governance Guidelines require the Chairman of the Board and Chief Executive Officer positions to be separate. |

|

Annual Board Evaluations |

|

Each year our directors complete an evaluation of the full Board and its committees for the purpose of improving Board and committee processes and effectiveness. |

|

Annual Board Skills Assessment |

|

The Corporate Governance and Nominating Committee conducts an annual assessment of director experience, qualifications, attributes and skills needed for the Board to effectively oversee the interests of the Company. |

|

Demonstrated Board Refreshment |

|

The Board has appointed three new directors since 2018, including one female director and one racially diverse director, and reduced the size of our Board from ten to seven directors immediately following the 2020 annual meeting upon retirement of three of our long-standing directors. |

|

Continued Focus on Board Diversity |

|

We adhere to a formal Board Diversity Policy, pursuant to which we strive to select director nominees with diverse backgrounds, experiences, skills and perspectives. In 2019, in connection with his appointment as our Chief Executive Officer, the Board appointed Mr. Heo as a director, increasing the racial diversity of our Board. Our Board currently has one racially diverse director out of seven directors (or 14% of our Board). |

|

Shareholder Right to Call a Special Meeting |

|

Our shareholders holding 20% of our outstanding shares of common stock may call a special meeting of shareholders in accordance with our articles of incorporation. |

|

No Supermajority Requirements |

|

We do not have supermajority voting provisions in our articles of incorporation or by-laws. |

|

Stock Ownership Guidelines |

|

Our directors and executives are required to hold certain numbers of shares of our common stock and are prohibited from hedging or pledging the Company’s stock, subject to a limited exception for pledging. |

|

No Shareholder Rights Plan |

|

We have not implemented a shareholder rights plan, or “poison pill.” |

|

Regular Executive Sessions |

|

Our independent directors regularly meet in executive session without management present. |

|

Governance Policies |

|

We have adopted robust corporate governance guidelines and code of business conduct and ethics. |

11

{B1339286.20}

Communications with our Board and Shareholder Engagement

Our Board values communicating and engaging with our shareholders to understand their views on important business, corporate governance and executive compensation matters.

Any shareholder may communicate with our Board (or with any individual director) by sending a letter by mail addressed to the Chairman of the Board of Directors of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084 or by email to rheo@gulfisland.com. The Chairman of our Board or Chief Executive Officer, as applicable, will coordinate distribution of the correspondence to our full Board or relevant committee or Board members.

We engage in regular dialogue with our shareholders and their representatives. During 2020, our discussions collectively centered on the following topics: (1) strategy; (2) executive compensation; (3) project execution; and (4) improvements in personnel, processes and procedures.

Informed by discussions with certain of our shareholders, the Board has previously implemented certain changes to our governance, board and management structures, including adopting a majority voting standard for uncontested elections, removing the supermajority voting requirements in our articles of incorporation and by-laws, revising the threshold to call a special meeting to 20% of the outstanding shares of our common stock, adopting a Board Diversity Policy, increasing stock ownership guidelines for our directors, appointing a new Chief Executive Officer, electing a new Chairman of the Board, decreasing the size of the Board to seven directors, and amending and restating our articles of incorporation to declassify the Board on a phase-in basis.

Our Board has adopted a policy that recommends that all directors attend all meetings of our shareholders. At the last annual meeting of shareholders held on May 22, 2020, all then current members of our Board joined the virtual shareholders meeting.

Ethics and Business Conduct Related Policies

The Company maintains a Code of Ethics for our Chief Executive Officer and senior financial officers (our “Code of Ethics”) and a Code of Business Conduct and Ethics, which applies to all employees and directors, including our Chief Executive Officer and senior financial officers. These codes are posted on our corporate governance page at www.gulfisland.com under “Investors—Governance—Governance Documents.” Any substantive amendments to the Code of Ethics will be disclosed within four business days of such event on our website and will remain on our website for at least 12 months.

Director and Executive Officer Stock Ownership Guidelines

Our Corporate Governance Guidelines contain director and executive officer stock ownership guidelines that generally require: (1) directors to hold at least 15,000 shares of the Company’s stock, including any unvested restricted stock or restricted stock units, for the duration of their remaining tenure as a director of the Company, by the later of April 24, 2021 or five years from becoming a director and (2) executive officers to hold Company stock, including any unvested restricted stock or restricted stock units, in an amount equal to 2.0 times base salary in the case of the Chief Executive Officer and 1.25 times base salary in the case of all other executive officers by the later of April 30, 2021 or five years from becoming subject to such guidelines. With respect to the director ownership guidelines, the five-year compliance window will be increased by one year for every year the Board does not grant equity-based compensation to its non-employee directors.

As of March 31, 2021, all of our current directors, except Ms. Richard, exceeded their target ownership levels. Ms. Richard, who was appointed to the Board in October 2018, originally had until October 18, 2023 to reach her target ownership level. However, as disclosed under “Director Compensation,” we have not granted equity-based compensation to our non-employee directors since 2018. Accordingly, Ms. Richard’s compliance date has been extended by at least two years.

12

{B1339286.20}

Our executive officers have five years from the date of their respective appointments to attain their required ownership levels. All of our executive officers have been in their respective positions with the Company for less than five years. For more information regarding the stock ownership guidelines applicable to our executive officers, see “Executive Compensation—Narrative Description of Executive Compensation Program.”

Anti-Hedging and Pledging Policies

Our Corporate Governance Guidelines prohibit our directors and executive officers from entering into any hedging arrangements with respect to our securities. Specifically, the guidelines contain the following prohibition: “Directors and executive officers are prohibited from holding any Company stock in a margin account or engaging in any transaction that would have the effect of hedging the economic risk of ownership of their Company stock.”

Furthermore, directors and executive officers may not borrow against any account in which Company stock is held or pledge Company stock as collateral for a loan or for any other purpose, except that such insiders may pledge Company stock as collateral for a loan (not including margin debt) if:

|

|

• |

such shares are not pledged as collateral for a margin loan; |

|

|

• |

such executive or director establishes that he or she has the financial capacity to repay the loan without resorting to the pledged securities; |

|

|

• |

such executive or director notifies our Secretary prior to the execution of documents evidencing the proposed pledge; and |

|

|

• |

such shares pledged will not be considered as owned for purposes of the stock ownership guidelines applicable to the executive or the director. |

Finally, any pledging of or trading in Company stock by directors and executive officers must comply with any additional restrictions set forth in our Insider Trading Policy.

Consideration of Director Nominees

The Corporate Governance and Nominating Committee will regularly assess the appropriate size of our Board, as well as whether any vacancies on our Board are expected due to retirement or otherwise and whether such vacancies should be filled. The Corporate Governance and Nominating Committee will consider various potential candidates for director who may come to the attention of our Board through current members of our Board, professional search firms or shareholders during its annual review process. In the event of a vacancy, the Corporate Governance and Nominating Committee may recommend alternatively that the Board reduce its size. Each candidate brought to the attention of the Corporate Governance and Nominating Committee, regardless of who recommended such candidate, is evaluated in the same manner.

The identification and evaluation of qualified directors is a complex and subjective process that requires consideration of many intangible factors and will be significantly influenced by the particular needs of the Board and the Company from time to time. The Corporate Governance and Nominating Committee believes that each potential director nominee should be evaluated based on his or her individual merits, taking into account the Company’s needs and the composition of the Board at the time. As a result, the Corporate Governance and Nominating Committee has not set specific, minimum qualifications that a director must meet in order for the Corporate Governance and Nominating Committee to recommend him or her to the Board, other than being under the age of 78 at the time of his or her election.

In evaluating nominees for membership on our Board, the Corporate Governance and Nominating Committee considers the Board membership criteria set forth in our Board Diversity Policy and in our Corporate Governance Guidelines. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, has committed to interviewing at least one candidate who would increase the gender, racial and/or ethnic diversity of the Board.

13

{B1339286.20}

Consistent with these policies, the Corporate Governance and Nominating Committee consistently seeks directors with integrity and proven business judgment, management ability and a diverse mix of backgrounds and experiences to build a capable, responsive, balanced and effective Board. In reviewing the qualifications of potential director nominees, the Corporate Governance and Nominating Committee considers many factors, including accounting and financial expertise, capital markets and banking experience, energy and energy service industry experience and expertise, environmental compliance and corporate responsibility expertise, human capital management experience, cybersecurity and technology expertise, senior corporate executive experience, industrial construction and fabrication management experience, legal and regulatory compliance expertise, marine industry experience, shipbuilding industry experience and other public company board experience.

Upon the recommendations of the Corporate Governance and Nominating Committee, nominations of directors and related matters are voted upon by the Board. Since Mr. Heo is a member of management and a non-independent director, he is not involved in the nominations process.

As set forth in our Corporate Governance Guidelines, our Corporate Governance and Nominating Committee will consider director candidates recommended by our shareholders for nomination for election to our Board. Any shareholder may suggest a nominee by sending the following information to our Board: (1) the proposing shareholder’s name, address and telephone number, (2) the number of shares of our common stock beneficially owned by the proposing shareholder and the suggested nominee, (3) the suggested nominee’s name, age, business and residential addresses and telephone number, (4) a statement that the suggested nominee knows that his or her name is being suggested by the proposing shareholder, and that he or she has consented to being suggested and is willing to serve, (5) the suggested nominee’s resume or other description of his or her background and experience and (6) the proposing shareholder’s reasons for suggesting that the individual be considered. The information should be sent to the Corporate Governance and Nominating Committee of our Board addressed as follows: Chairman - Corporate Governance and Nominating Committee of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084.

In addition, we have advance notice procedures that permit a shareholder to present shareholder nominees at our annual shareholder meetings. For additional information regarding our advance notice procedures, see “Shareholder Proposals and Nominations for the 2022 Annual Meeting.”

14

{B1339286.20}

In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required by the Company to be an effective member of our Board. For 2020, the form and amount of director compensation was reviewed by the Compensation Committee and approved by our full Board.

Cash Compensation

In early 2017, following a review of director compensation by Aon Hewitt, the Compensation Committee’s independent consultant, the Board unanimously approved a non-employee director compensation program, which remained in effect until May 2018. However, considering the economic environment of the oil and gas and marine industries and in support of the Company’s efforts to reduce costs, effective May 1, 2018, the Board approved certain reductions to the fees paid to our non-employee directors, which remain in effect. Currently, our non-employee director compensation programs consists of the following cash components: (i) an annual fee paid to our Chairman of the Board of $126,000, (ii) an annual fee paid to each other non-employee director of $59,400, (iii) an additional annual fee of $12,000 paid to each of the chairs of the Audit Committee, the Corporate Governance and Nominating Committee, and the Compensation Committee, and (iv) an additional annual fee of $12,000 paid to the Audit Committee Financial Expert. Directors do not receive additional fees for attending meetings of our Board and its committees; however, all directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of our Board and its committees. The table below summarizes total compensation paid to our directors.

Equity-Based Compensation

In previous years, our non-employee directors received equity-based compensation under our stock incentive plans. However, considering the ongoing challenges faced by the Company, the Board has not approved equity-based awards for our non-employee directors since 2018.

2020 Director Compensation

The table below summarizes compensation earned for 2020 for each non-employee director serving as a director during 2020. Mr. Heo (our chief executive officer during 2020) did not receive any compensation for his service as a director, and his compensation as an executive of the Company is reflected in the 2020 Summary Compensation Table on page 29.

|

Name |

|

Fees Earned or Paid in Cash (1) |

|

Stock Awards (2) |

|

Total |

|||

|

Robert M. Averick |

|

$ |

54,450 |

|

$ |

— |

|

$ |

54,450 |

|

Murray W. Burns |

|

65,450 |

|

— |

|

65,450 |

|||

|

William E. Chiles |

|

65,450 |

|

— |

|

65,450 |

|||

|

Gregory J. Cotter (3) |

|

23,800 |

|

— |

|

23,800 |

|||

|

Michael A. Flick |

|

95,090 |

|

— |

|

95,090 |

|||

|

Christopher M. Harding (3) |

|

19,800 |

|

— |

|

19,800 |

|||

|

Michael J. Keeffe |

|

72,773 |

|

— |

|

72,773 |

|||

|

John P. Laborde (3) |

|

42,000 |

|

— |

|

42,000 |

|||

|

Cheryl D. Richard |

|

54,450 |

|

— |

|

54,450 |

|||

______________________________

|

|

(1) |

Reflects fees earned by our non-employee directors during 2020 for their service on our Board and its committees, as applicable. |

|

|

(2) |

Our non-employee directors did not receive equity-based awards during 2020. As of December 31, 2020, none of our non-employee directors had any unvested equity-based awards. |

|

|

(3) |

Messrs. Cotter, Harding and Laborde ceased serving on our Board on May 22, 2020, the date of the 2020 annual meeting of shareholders. |

15

{B1339286.20}

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

Our articles of incorporation provide that the number of directors will be set forth in our by-laws. Our by-laws allow for the number of directors constituting the entire Board to be a range of not less than three nor more than twelve, with the exact number of directors to be fixed by a duly adopted resolution of the Board. The size of our Board is currently set at seven directors. In addition, our articles of incorporation previously provided for a Board consisting of three classes, and directors elected prior to the 2020 annual meeting of shareholders were elected to hold office for staggered terms of three years. At the 2020 annual meeting of shareholders, our shareholders approved an amendment to our articles of incorporation to declassify the Board and make our directors subject to annual election as each the term of each class of the Board expires. As a result, Mr. Averick, formerly a Class II director, was elected at the 2020 annual meeting of shareholders to serve until the next annual meeting. Furthermore, following our 2020 annual meeting, if there is a vacancy on the Board because the number of directors is increased or otherwise, any director elected or appointed to fill such vacancy will hold office for a term expiring at the next annual meeting. In all cases, each director will hold office until his or her successor is elected and qualified, or until his or her earlier resignation or removal. Beginning with our 2022 annual meeting of shareholders, the Board will be completely declassified and all directors, regardless of their original term of office, will be elected on an annual basis to serve terms expiring at the next annual meeting.

The terms of office of Messrs. Heo and Keeffe and Ms. Richard, each a Class III director, expire at the 2021 annual meeting. In addition, the term of office of Mr. Averick expires at the 2021 annual meeting. Our Board has nominated Messrs. Averick, Heo and Keeffe and Ms. Richard for election to our Board for terms expiring at the next annual meeting in 2022 and until his or her successor is elected and qualified, or until his or her earlier resignation or removal. Messrs. Averick, Heo and Keeffe and Ms. Richard have consented to being named as nominees in this proxy statement and to serve as directors if elected.

In the unanticipated event that any nominee is unable to serve or for good cause will not serve as a candidate for director, the persons named in the enclosed proxy card will vote your shares of our common stock for a substitute candidate nominated by our Board, unless otherwise directed.

Directors are elected by the affirmative vote of a majority of the votes cast with respect to each director (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee), except in the event of a contested election, in which case directors are elected by the affirmative vote of a plurality of the votes cast (meaning the director nominees who receive the highest number of votes “for” their election are elected). A contested election occurs when the number of nominees for director exceeds the number of directors to be elected.

In the event an incumbent director nominee does not receive a majority of the votes cast in an uncontested election, such director must tender his or her resignation to the Corporate Governance and Nominating Committee, which will consider the director’s offer of resignation and recommend to the Board whether to accept or reject the resignation, or whether other action should be taken. For additional information regarding the vote required and treatment of abstentions and broker non-votes, see “Questions and Answers about the 2021 Annual Meeting and Voting.”

Our Board unanimously recommends that you vote “FOR” the election of each of the four director nominees named in this proxy statement.

16

{B1339286.20}

Information about the Director Nominees, Continuing Directors and Executive Officers

The following table sets forth, as of March 31, 2021, for each director nominee, each other director of the Company whose term will continue after the 2021 annual meeting, and each of our executive officers, the age, any positions with the Company, principal occupations and employment during the past five years, and, if a director nominee or a continuing director, each such person’s directorships in other public corporations during the past five years and the year that such person was first elected a director of the Company. We have also included information about each continuing director and director nominee’s specific experience, qualifications, attributes, or skills that led our Board to recommend that our shareholders elect, such person to serve as one of our directors, in light of our business and Board structure at the time of such nomination. All executive officers serve at the pleasure of our Board. The director nominees have consented to being named as nominees in this proxy statement and to serve as directors if elected.

|

Name and Age |

|

Positions with the Company, Principal Occupations, and Directorships in Other Public Companies |

|

Director Since |

|

|

||||

|

Nominees for Election as Directors (to be annually elected with terms expiring in 2022 ) |

||||

|

|

||||

|

Robert M. Averick, 55 |

Mr. Averick has worked as a Portfolio Manager since 2012 at Kokino LLC, a private investment firm that provides investment management services to Piton Capital Partners LLC. Since 2016, Mr. Averick has served as a member of the board of directors of Amtech Systems, Inc., a publicly traded manufacturer of capital equipment. Mr. Averick has also served as a member of the board of directors of PhoneX Holdings, Inc. since 2020. Mr. Averick formerly served as a member of the board of directors of Key Technology, Inc., a manufacturer of process automation systems for food processing and other industries, from 2016 until the company’s sale in 2018.

Mr. Averick has more than 20 years of experience as a small-capitalization, value-driven public equity portfolio manager. His experience in finance, strategic planning and consulting, as well as his public company board experience, provide him with valuable skills and expertise and make him highly qualified to serve as a member of our Board, the Compensation Committee and the Corporate Governance & Nominating Committee.

Mr. Averick was originally appointed to the Board pursuant to a Cooperation Agreement by and among the Company, Piton Capital Partners LLC and Kokino LLC dated November 2, 2018, as amended on February 24, 2020, which will terminate following the 2021 annual meeting. Pursuant to the terms of the agreement, the Board appointed Mr. Averick to the Compensation Committee, effective November 3, 2018. Piton currently owns approximately 11.7% of the outstanding shares of the Company. |

2018 |

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

17

{B1339286.20}

|

Name and Age |

|

Positions with the Company, Principal Occupations, and Directorships in Other Public Companies |

|

Director Since |

|

|

|

|

||

|

Richard W. Heo, 50 |

Mr. Heo became President and Chief Executive Officer of the Company in November 2019. Prior to joining the Company, he served as Senior Vice President of North, Central and South America from 2018 to 2019 for McDermott International, Inc. (“McDermott”), a publicly traded multinational engineering, procurement, construction (“EPC”) and installation company, which merged with Chicago Bridge & Iron N.V. (“CB&I”), a publicly traded EPC company, in 2018. Mr. Heo served as Executive Vice President of Fabrication Services for CB&I from 2017 to 2018, and President of CB&I’s Engineered Products business unit from 2014 to 2017. Prior to joining CB&I, he served in various senior leadership positions at KBR, Inc., a publicly traded EPC company, from 2009 to 2014.

Mr. Heo’s experience in the engineering, fabrication and construction industry, as well as his business development and project execution experience and knowledge of publicly traded companies, and his role as Chief Executive Officer of the Company makes him highly qualified to serve as a member of our Board. |

2019 |

||

|

|

|

|

||

|

Michael J. Keeffe, 69 |

Prior to his retirement in 2011, Mr. Keeffe was a Senior Audit Partner with Deloitte & Touche LLP (“Deloitte”). He had 35 years of public accounting experience with Deloitte, directing financial statement audits of public companies, principally in the oil field services, engineering and construction and offshore industries. He also served as a risk management and quality assurance partner in Deloitte’s consultation network. Mr. Keeffe previously served on the board and as chairman of the audit committee of Ultra Petroleum Corp., a publicly traded exploration and production company from 2012 to 2020.

Mr. Keeffe’s extensive accounting and financial expertise, particularly in our industry and related industries, makes him highly qualified to serve as a member of our Board and the Compensation Committee and as Chairman of the Audit Committee as well as our Audit Committee Financial Expert. |

2014 |

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

18

{B1339286.20}

|

Name and Age |

|

Positions with the Company, Principal Occupations, and Directorships in Other Public Companies |

|

Director Since |

|

|

|

|

||

|

Cheryl D. Richard, 65 |

Ms. Richard is a retired oil and gas executive, with more than 30 years of experience in the energy industry, including service with upstream, offshore drilling and related companies. From 2003 to 2010, Ms. Richard served as Senior Vice President of Human Resources & Information Technology for Transocean Ltd., a publicly traded offshore drilling contractor. From 2000 to 2003, she served as Vice President of Human Resources for Chevron Phillips Chemical Company. From 1980 to 2000, Ms. Richard served in various leadership roles for Phillips Petroleum Co. Ms. Richard holds certificates in cybersecurity from the CERT Division of Carnegie Mellon University and Harvard Extension School. Ms. Richard currently serves on the Supervisory Board of SBM Offshore N.V., a publicly traded offshore oil and gas production and services company.

Ms. Richard’s broad experience in our industry, including her experience in human resources, information technology and cybersecurity, makes her highly qualified to serve as a member of our Board, the Corporate Governance and Nominating Committee and the Compensation Committee.

|

2018 |

||

|

Continuing Class I Directors (terms expire in 2022) |

||||

|

|

|

|

||

|

Murray W. Burns, 75 |

Mr. Burns has worked as a project management, engineering and business development consultant through MBurns Consulting since 2013, and has 51 years of experience in the offshore oil and gas, engineering and construction industries. From 1980 to 2013, Mr. Burns was employed in various executive capacities by Technip USA, Inc. and its affiliates (“Technip”), which provide subsea, onshore/offshore and surface project management, construction and engineering. His roles with Technip included: Vice President—Offshore, Vice President—Topsides and Fixed Platforms, Vice President—Engineering Operations, and Vice President—Engineering, President and COO (Technip Upstream Houston Inc.). From 1976 to 1980, Mr. Burns served in various management positions at Petro-Marine Engineering, Inc., an engineering consulting firm specializing in services to the offshore petroleum and marine industries. Prior to 1976, Mr. Burns worked in various engineering capacities at Shell Oil Company, an oil and gas producer, marketer and manufacturer.

Mr. Burns’ experience and knowledge in engineering, fabrication, project execution and business development in the energy and offshore industries make him highly qualified to serve as a member of our Board and the Audit Committee and as Chairman of the Corporate Governance and Nominating Committee. |

2014 |

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|