| OMB APPROVAL

|

| OMB Number: 3235-0059 Expires: February 28, 2008 Estimated average burden hours per response . . . . . . 12.75

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

GULF ISLAND FABRICATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

SEC 1913 (01-05)

GULF ISLAND FABRICATION, INC.

583 THOMPSON ROAD

HOUMA, LOUISIANA 70363

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 27, 2005

TO THE SHAREHOLDERS OF GULF ISLAND FABRICATION, INC.:

The annual meeting of shareholders of Gulf Island Fabrication, Inc. (the “Company”) will be held at 10:00 a.m., local time, on Wednesday, April 27, 2005, at the office of the Company, 583 Thompson Road, Houma, Louisiana, for the following purposes, more fully described in the accompanying proxy statement:

| 1. | To elect two Class II directors. |

| 2. | To ratify the appointment of Ernst & Young LLP as the independent auditors to audit the financial statements of the Company and its subsidiaries for the year 2005. |

| 3. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

The Board of Directors has fixed the close of business on February 28, 2005 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and all adjournments thereof.

Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the annual meeting, please mark, date and sign the enclosed proxy card and return it promptly in the enclosed stamped envelope. Furnishing the enclosed proxy will not prevent you from voting in person at the annual meeting should you wish to do so.

By Order of the Board of Directors

ROBIN A. SEIBERT

Secretary

Houma, Louisiana

March 14, 2005

GULF ISLAND FABRICATION, INC.

583 THOMPSON ROAD

HOUMA, LOUISIANA 70363

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 27, 2005

This Proxy Statement is furnished to shareholders of Gulf Island Fabrication, Inc. (the “Company”) in connection with the solicitation of proxies on behalf of the Company’s Board of Directors for use at its annual meeting of shareholders to be held at the date, time and place set forth in the accompanying notice and at any adjournment thereof (the “Meeting”). This Proxy Statement is being mailed to shareholders on or about March 14, 2005.

On February 28, 2005, the record date for determining shareholders entitled to notice of and to vote at the Meeting, the Company had outstanding 12,222,441 shares of common stock (“Common Stock”), each of which is entitled to one vote on all matters to be considered at the Meeting.

Shares represented by all properly executed proxies on the enclosed form received in time for the Meeting will be voted at the Meeting. A proxy may be revoked at any time before it is exercised by filing with the Secretary of the Company an instrument revoking it or a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. Unless revoked, the proxy will be voted as specified and, if no specifications are made, will be voted in favor of the proposed nominees and for the ratification of the appointment of auditors as described herein.

The cost of soliciting proxies will be borne by the Company. Banks, brokerage houses and other institutions, nominees and fiduciaries will be requested to forward solicitation materials to the beneficial owners of the shares of Common Stock of the Company; upon request, the Company will reimburse such persons for reasonable out-of-pocket expenses incurred in connection therewith. We may have our employees or other representatives (who will receive no additional compensation for their services) solicit proxies by telephone, telecopy, or other means.

SHAREHOLDER PROPOSALS AND NOMINATIONS FOR 2006 ANNUAL MEETING

Any shareholder who wishes to bring a matter, other than shareholder nominations of directors, before the 2006 annual meeting must notify the Secretary of the Company, in writing at the address shown on the first page of this Proxy Statement, no later than January 28, 2006. However, if the date of the 2006 annual meeting is changed by more than 30 calendar days from the date of the 2005 annual meeting, the notice must be received by the Secretary of the Company at least 45 days prior to the date the Company intends to distribute its proxy materials with respect to the 2006 annual meeting.

If a shareholder does not provide such notice timely, the chairman of the 2006 annual meeting may exclude the matter and, if the chairman so elects, the matter will not be acted upon at the meeting. If the chairman does

1

not exclude the matter, proxies solicited on behalf of the Board of Directors for the 2006 annual meeting will confer discretionary authority to vote with respect to any such matter, as permitted by the proxy rules of the Securities and Exchange Commission (“SEC”).

Shareholders intending to nominate a director at the 2006 annual meeting of shareholders may do so if they comply with the Company’s Amended and Restated Articles of Incorporation by furnishing timely written notice containing specified information concerning, among other things, information about the nominee and the shareholder making the nomination. See “Corporate Governance—Consideration of Director Nominees” for more information.

Any shareholder who desires to present a proposal for inclusion in the Company’s proxy materials for the 2006 annual meeting must forward the proposal in writing to the Secretary of the Company at the address shown on the first page of this Proxy Statement in time to arrive at the Company no later than November 15, 2005, and the proposal must comply with applicable federal proxy rules.

CORPORATE GOVERNANCE

Ethics and Business Conduct Policies

The Company has adopted a Code of Ethics for the Chief Executive Officer and Senior Financial Officers (the “Code of Ethics”) and a Code of Business Conduct and Ethics, which applies to all employees and directors, including the Chief Executive Officer and senior financial officers of the Company. These codes are posted on the Company’s website at www.gulfisland.com. Any substantive amendments to the Code of Ethics or any waivers granted under the Code of Ethics will be disclosed as required by applicable SEC rules and the listing standards of the Nasdaq National Market (“Nasdaq”).

Board Structure and Committee Composition

As of the date of this Proxy Statement, the Company’s Board of Directors consists of 8 members. The Board of Directors held five regularly-scheduled meetings during 2004. The Board has established two standing committees: an Audit Committee and a Compensation Committee. Each committee operates under a written charter adopted by the Board, which are available on our website at www.gulfisland.com. The composition of Board committees is reviewed and re-determined each year at the initial meeting of the Board after the annual meeting of shareholders. During 2004, each of the Company’s directors attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which he served during the periods of his Board membership and committee service, except Mr. Fairley, who attended one of the five Board meetings and two of the six Audit Committee meetings.

Trico Marine Services, Inc., of which Mr. Fairley is the President and Chief Executive Officer, filed voluntarily a petition under the federal bankruptcy laws on December 21, 2004. According to information released by Trico Marine Services, Inc., its plan of reorganization was confirmed by the federal bankruptcy court and it expects to emerge from bankruptcy protection in March 2005.

Audit Committee

The Audit Committee consists of the following four directors: Gregory J. Cotter (Chairman), Thomas E. Fairley, Hugh J. Kelly and Ken C. Tamblyn. Each of these directors is “independent” as such term is defined in Nasdaq’s listing standards, and also satisfies the additional requirements applicable to an audit committee member under the Nasdaq listing standards. The Board has determined that Mr. Ken C. Tamblyn is an “audit committee financial expert” as such term is defined in the applicable rules of the SEC.

The Audit Committee met six times during 2004. The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by monitoring (i) the Company’s continuing development and

2

performance of its system of financial reporting, auditing, disclosure controls and procedures and internal control over financial reporting, (ii) the operation and integrity of its financial reporting system, (iii) the performance and qualifications of the Company’s independent (external) and internal auditors, and (iv) the independence of the Company’s independent auditors.

Compensation Committee

The Compensation Committee consists of the following four directors: Huey J. Wilson (Chairman), Gregory J. Cotter, Alden J. (“Doc”) Laborde, and John P. (“Jack”) Laborde. Each of these directors is “independent” as such term is defined in Nasdaq’s listing standards. The Compensation Committee, which met once in 2004, (i) periodically reviews, approves and recommends to the Board the Company’s goals and objectives relating to the compensation of the Company’s officers and the compensation of the President of each of the Company’s subsidiaries (including the specific relationship of corporate performance to such officers’ compensation), (ii) evaluates the performance of the Company’s officers and the performance of the President of each of the Company’s subsidiaries in light of these goals and objectives, (iii) recommends to the Board the compensation of the Company’s officers and the compensation of the President of each of the Company’s subsidiaries based on such evaluations, (iv) approves award grants under the Company’s incentive compensation plans and programs, (v) otherwise administers the Company’s incentive compensation plans and programs, and (vi) performs such other functions as may be prescribed by the Board.

Board Independence

The Board has determined that seven of the directors are “independent” as such term is defined in Nasdaq’s listing standards. Mr. Kerry J. Chauvin, the Chairman of the Board, President and Chief Executive Officer of the Company, is the only director who is not independent as defined by Nasdaq.

Consideration of Director Nominees

The Board of Directors has elected not to have a separate nominating committee. The Board made this determination after considering its nomination process and concluding that as many directors as possible should participate in that process. As stated above, the Board has determined that all of its current directors are independent under Nasdaq’s listing standards other than Mr. Chauvin, who is not considered independent because he is an officer of the Company. Accordingly, the Board has decided that nominations of directors and related matters will be considered and voted upon by all of the independent directors while meeting in executive session. In this manner, all but one of the directors will be involved in the nominations process.

In evaluating the suitability of nominees for membership on the Board, the independent directors consider many factors, including personal and professional integrity, general understanding of the industry, finance and other elements relevant to the success of a publicly-traded company in today’s business environment, educational and professional background, and independence. The independent directors evaluate each individual in the context of the Board as a whole, with the objective of nominating persons for election to the Board who can best perpetuate the success of the Company’s business, be an effective director in conjunction with the full Board, and represent shareholder interests through the exercise of sound judgment using their diversity of experience in these various areas.

The independent directors will regularly assess the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that any vacancies are anticipated, or otherwise arise, the independent directors will consider various potential candidates for director who may come to the attention of the Board through current board members, professional search firms, shareholders or other persons. Each candidate brought to the attention of the Board is considered on the basis of the criteria set forth above.

3

The Board is open to suggestions from our shareholders on candidates for election to the Board. Any shareholder may suggest a nominee by sending the following information to the Board: (i) the proposing shareholder’s name, address and telephone number, (ii) the number of shares of Common Stock beneficially owned by the proposing shareholder and the suggested nominee, (iii) the suggested nominee’s name, age, business and residential addresses and telephone number, (iii) a statement whether the suggested nominee knows that his or her name is being suggested by the proposing shareholder, and whether he or she has consented to being suggested and is willing to serve, (iv) the suggested nominee’s résumé or other description of his or her background and experience, and (v) the proposing shareholder’s reasons for suggesting that the individual be considered. The information should be sent to the Board addressed as follows: Secretary of Gulf Island Fabrication, Inc., 583 Thompson Road, Houma, Louisiana 70363, and the Secretary will forward the information to the independent directors.

The Company’s Amended and Restated Articles of Incorporation also permit shareholders to directly nominate directors for consideration at an annual shareholder meeting. In general, to be timely, a shareholder’s notice must be in writing, must include certain specified information about the nominee and the shareholder making the nomination, and must be received by the Secretary of the Company at our principal executive offices no less than 45 days or more than 90 days prior to the shareholder meeting.

Executive Sessions; Communications with the Board; Meeting Attendance

The Board has adopted a policy providing that the independent directors will meet in executive session at each regularly-scheduled Board meeting, or more frequently if necessary. Under this policy, the chair of each executive session meeting will be chosen by the independent directors, by majority vote, immediately prior to the convening of each such meeting.

Any shareholder may communicate with our Board (or with any individual director) by sending a letter by mail addressed to the Chairman of the Board of Gulf Island Fabrication, Inc., 583 Thompson Road, Houma, Louisiana 70363. The Chairman of the Board will forward the shareholder’s communication directly to the appropriate director or directors.

The Board has adopted a policy that recommends that all directors personally attend each annual and special meeting of the Company’s shareholders. At the last annual meeting of shareholders held on April 28, 2004, all of the directors then in office were in attendance.

Director Compensation

In 2004, each non-employee director received an annual fee of $16,500 for his services as a director and an attendance fee of $1,200 for each Board or committee meeting attended (excluding meetings held via telephone conference call). All directors are reimbursed for reasonable out-of-pocket expenses incurred in attending Board and committee meetings. For 2005, the annual fee will be $16,500 for each non-employee director, except the chairman of the Audit Committee, who will receive an annual fee of $18,500, and the attendance fee will be $1,500 for each meeting attended in person and $1,000 for each meeting attended via telephone conference call.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers, controller, and beneficial owners of more than 10% of the Common Stock to file certain beneficial ownership reports with the SEC. Murphy A. Bourke, Vice President of Marketing, failed to file timely one statement on Form 4 in 2004 reporting two transactions: the exercise of employee stock options for 18,700 shares and the sale of those shares on the open market. The Form 4 reporting these transactions was subsequently reported three days after the required due date. All other reports due in 2004 were timely filed.

4

ELECTION OF DIRECTORS

The Company’s Amended and Restated Articles of Incorporation provide for a Board of Directors consisting of three classes, with the number of directors to be set forth in the Company’s By-laws. The Company’s By-laws provide for a Board of Directors of eight persons. The term of office of the Class II directors will expire at the Meeting, and the persons listed as the Class II nominees in the table below will be nominated for election to the Board of Directors for a term expiring in 2008. The term of office of the Class III directors will expire at the 2006 annual meeting. The term of office of the Class I directors will expire at the 2007 annual meeting.

The independent directors of the Board of Directors have nominated two candidates for election at the Meeting and recommend that shareholders vote FOR the election of the nominees. Proxies cannot be voted for more than two candidates. In the absence of contrary instructions, the proxy holders will vote for the election of the two nominees listed below. In the unanticipated event that any nominee is unavailable as a candidate for director, the persons named in the accompanying proxy will vote for a substitute candidate nominated by the Board of Directors.

The following table sets forth, as of February 1, 2005, for each nominee, each other director of the Company whose term will continue after the Meeting and each of the executive officers of the Company, the age, positions with the Company, and principal occupations and employment during the past five years of each such person, any family relationships among such persons, and, if a nominee or a director, each person’s directorships in other public corporations and the year that he was first elected a director of the Company or its predecessor. All executive officers serve at the pleasure of the Board of Directors of the Company.

| Name and Age |

Positions with the Company, Principal Occupations, Directorships in Other Public Corporations, and Family Relationships |

Director Since | ||

| Nominees for Election as Class II Directors (term expires in 2008) |

||||

| Gregory J. Cotter, 56 |

Director of the Company. Director, President and Chief Operating and Financial Officer of Huey Wilson Interests, Inc., a financial and business management company. Chief Financial Officer of Wilson Jewelers, Inc., a jewelry merchandiser, until 2001. | 1985 | ||

| John P. (“Jack”) Laborde, 55 |

Director of the Company. President of Overboard Holdings, L.L.C. (“Overboard”), a management company engaged in oil and gas exploration and development since January 2002. Chief Executive Officer of All Aboard Development Corporation (“All Aboard”), an independent oil and gas exploration and production company, since 1996. President of All Aboard since 1997. All Aboard is currently being managed by Overboard. Son of Alden J. Laborde. | 1997 | ||

| Continuing Class III Directors (term expires in 2006) |

||||

| Kerry J. Chauvin, 57 |

Chairman of the Board of the Company since April 2001. President and Chief Executive Officer of the Company. | 1985 | ||

| Alden J. (“Doc”) Laborde, 89 |

Director of the Company. Chairman of the Board of the Company from 1985 to April 2001. Father of John P. Laborde. | 1985 | ||

| Huey J. Wilson, 77 |

Director of the Company. Chairman of the Board and Chief Executive Officer of Huey Wilson Interests, Inc. Chairman of the Board and Chief Executive Officer of Wilson Jewelers, Inc. until 2001. | 1997 | ||

5

| Name and Age |

Positions with the Company, Principal Occupations, Directorships in Other Public Corporations, and Family Relationships |

Director Since | ||

| Continuing as Class I Directors (term expires in 2007) |

||||

| Thomas E. Fairley, 56 |

Director of the Company. Director, President and Chief Executive Officer of Trico Marine Services, Inc., a marine vessel operator. | 1997 | ||

| Hugh J. Kelly, 79 |

Director of the Company. Consultant to the oil and gas industry. | 1997 | ||

| Ken C. Tamblyn, 61 |

Director of the Company. Private Investor. Executive Vice President and Chief Financial Officer of Tidewater, Inc. from March 1986 through August 2000. Member of the Board of Directors of Offshore Logistics. | 2003 | ||

| Executive Officers not Serving as Directors |

||||

| Kirk J. Meche, 42 |

Executive Vice President—Operations of the Company. President of Gulf Island, L.L.C., a wholly-owned fabrication subsidiary of the Company, since February 2001. President of Southport, Inc., a former wholly-owned subsidiary of the Company, from December 1999 to February 2001. Vice President of Operations for Southport, Inc. from February 1999 to December 1999. From 1996 to December 1999, a project manager for the Company. | N/A | ||

| Murphy A. Bourke, 60 |

Executive Vice President—Marketing of the Company. Vice President—Marketing of the Company until December 1999. | N/A | ||

| Joseph P. Gallagher, III, 54 |

Vice President—Finance, Chief Financial Officer and Treasurer of the Company. | N/A | ||

STOCK OWNERSHIP

The following table sets forth, as of February 1, 2005, certain information regarding beneficial ownership of Common Stock by (i) each director of the Company, (ii) each executive officer of the Company, (iii) all directors and executive officers of the Company as a group, and (iv) each other shareholder known by the Company to be the beneficial owner of more than 5% of the outstanding Common Stock. Unless otherwise indicated, the Company believes that the shareholders listed below have sole investment and voting power with respect to their shares based on information furnished to the Company by such shareholders.

| Name of Beneficial Owner |

Number of Shares Beneficially Owned(1) |

Percent of Outstanding Common Stock(2) |

||||

| Murphy A. Bourke |

40,200 | * | ||||

| Kerry J. Chauvin |

166,700 | 1.4 | % | |||

| Gregory J. Cotter |

3,000 | * | ||||

| Thomas E. Fairley |

10,000 | * | ||||

| Joseph P. Gallagher, III |

54,300 | * | ||||

| Hugh J. Kelly |

4,000 | * | ||||

| Alden J. Laborde (3) |

1,554,000 | (4) | 12.8 | % | ||

| John P. Laborde |

20,100 | * | ||||

| Kirk J. Meche |

35,802 | * | ||||

| Ken C. Tamblyn |

500 | * | ||||

| Huey J. Wilson (5) |

1,056,500 | 8.7 | % | |||

| All directors and executive officers as a group (11 persons) |

2,945,102 | 23.8 | % | |||

| St. Denis J. Villere & Company, L.L.C. (6) |

736,837 | (7) | 6.1 | % | ||

| Royce & Associates, LLC (8) |

715,407 | (9) | 5.9 | % | ||

| FMR Corp. and related entities (10) |

1,204,145 | (11) | 9.9 | % | ||

| Barclays Global Investor, N.A. and related entities (12) |

846,463 | (13) | 7.0 | % |

6

| * | Less than one percent. |

| (1) | Includes shares that could be acquired within sixty days after February 1, 2005 upon the exercise of options granted pursuant to the Company’s stock incentive plans, as follows: Mr. Bourke, 18,000 shares; Mr. Chauvin, 99,700 shares; Mr. Gallagher, 53,300 shares; Mr. Meche, 32,800 shares; and all directors and executive officers as a group, 203,800 shares. |

| (2) | Based on 12,170,541 shares of Common Stock outstanding as of February 1, 2005. |

| (3) | The address of Mr. Laborde is 400 Poydras Street, Suite 1560, New Orleans, Louisiana 70130. |

| (4) | Mr. Laborde has sole voting and dispositive power with respect to 9,300 shares and shares voting and dispositive power with respect to 1,544,700 shares, of which 1,524,700 are held by Starboard Enterprises, L.L.C. (“Starboard”) and 20,000 are held by All Aboard. Mr. Laborde holds a majority equity interest in each of Starboard and All Aboard. The address of each of Starboard and All Aboard is 400 Poydras Street, Suite 1560, New Orleans, LA 70130. |

| (5) | The address of Mr. Wilson is 3636 South Sherwood Forest Boulevard, Suite 650, Baton Rouge, Louisiana 70816. |

| (6) | The address of St. Denis J. Villere & Company, L.L.C. is 210 Baronne Street, Suite 808, New Orleans, LA 70112-1727. |

| (7) | Based on information supplied by St. Denis J. Villere & Company, they have sole power to vote and sole power to dispose or direct the disposition of 37,000 shares, and shared power to vote and shared powers to dispose or direct the disposition of 699,137 shares. |

| (8) | The address of Royce & Associates, LLC is 1414 Avenue of the Americas, New York, New York 10019. |

| (9) | Based on such holder’s Schedule 13G filed with the SEC on January 28, 2005, Royce & Associates, LLC has sole power to vote and sole power to dispose or direct the disposition of 715,407 shares. |

| (10) | The address of FMR Corp. is 82 Devonshire Street, Boston, MA 02109. |

| (11) | Based on information contained in the Schedule 13G filed with the SEC on February 14, 2005, jointly by FMR Corp., Fidelity Management & Research Company (“Fidelity”), Fidelity Low Priced Stock Fund, Edward C. Johnson 3d, and Abigail P. Johnson. FMR Corp. is the parent company of Fidelity and members of the Johnson family and trusts for their benefit are the predominant owners of the voting stock of FMR Corp. According to the Schedule 13G, Fidelity is the beneficial owner of 1,181,045 shares, or approximately 9.721% of our common stock, as a result of acting as investment advisor to various investment companies registered under the Investment Company Act of 1940. Further, the interests of one of those investment companies, Fidelity Low Priced Stock Fund, amounted to 962,245 shares, or approximately 7.92% of our common stock. According to the Schedule13G, Edward C. Johnson 3d and FMR Corp., (i) through their control of Fidelity, each have sole power to dispose of the 1,181,045 shares owned by the investment funds, but do not have or share voting power with respect to the shares; and (ii) through their control of another subsidiary of FMR Corp., each have sole power to vote or direct the vote and sole power to dispose of 23,100 shares. |

| (12) | The address of Barclays Global Investors, N.A. is 45 Fremont Street, 17th Floor, San Francisco, CA 94105. |

| (13) | Based on information contained in the Schedule 13G filed with the SEC on February 14, 2005, jointly by Barclays Global Investors, NA, and a number of its domestic and foreign affiliates. According to the Schedule 13G, Barclay Global Investors, NA, has sole power vote with respect to 716,557 shares and sole power to dispose of 759,040 shares, and Barclays Global Fund Advisors has sole power vote with respect to 86,623 shares and sole power to dispose of 87,423 shares. According to the Schedule 13G, the reported shares are held in trust accounts for the economic benefit of the beneficiaries of those accounts. |

7

EXECUTIVE COMPENSATION

The following table summarizes the compensation paid in 2004, 2003, and 2002 by the Company to its Chief Executive Officer and each of its other executive officers (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| Long-Term Compensation Awards |

|||||||||||||

| Name and Principal Position |

Year |

Annual Compensation |

Securities Underlying Options (#) |

All Other Compensation(2) | |||||||||

| Salary |

Bonus(1) |

||||||||||||

| Kerry J. Chauvin |

2004 | $ | 355,527 | $ | 192,638 | 20,000 | $ | 12,431 | |||||

| Chairman of the Board, |

2003 | 337,580 | 251,212 | 20,000 | 11,147 | ||||||||

| President and Chief Executive Officer |

2002 | 318,208 | 165,736 | 20,000 | 9,094 | ||||||||

| Kirk J. Meche |

2004 | $ | 174,550 | $ | 94,431 | 10,000 | $ | 10,164 | |||||

| Executive Vice President—Operations, |

2003 | 159,813 | 123,143 | 10,000 | 10,147 | ||||||||

| President of Gulf Island, L.L.C. |

2002 | 149,084 | 81,243 | 10,000 | 8,368 | ||||||||

| (fabrication subsidiary) |

|||||||||||||

| Murphy A. Bourke |

2004 | $ | 185,008 | $ | 81,210 | 7,500 | $ | 12,431 | |||||

| Executive Vice President— |

2003 | 175,298 | 105,903 | 7,500 | 11,147 | ||||||||

| Marketing |

2002 | 167,005 | 69,869 | 7,500 | 9,093 | ||||||||

| Joseph P. Gallagher, III |

2004 | $ | 166,905 | $ | 77,433 | 7,500 | $ | 12,431 | |||||

| Vice President—Finance, Chief |

2003 | 158,280 | 100,978 | 7,500 | 10,879 | ||||||||

| Financial Officer and Treasurer |

2002 | 151,006 | 66,619 | 7,500 | 9,026 | ||||||||

| (1) | For 2004, the Company’s executive officers were paid bonuses equal to a specified percentage of the Company’s income before taxes and before deduction of the executive bonuses. The percentages for Messrs. Chauvin, Meche, Bourke and Gallagher were 1.02%, .50%, .43% and .41%, respectively. |

| (2) | Includes (i) matching and profit-sharing contributions of $12,091, $9,824, $12,091, and $12,091 in 2004, $10,807, $9,807, $10,807 and $10,539 in 2003, and $8,705, $7,979, $8,704, and $8,637 in 2002 to the Company’s 401(k) plan on behalf of Messrs. Chauvin, Meche, Bourke and Gallagher, respectively, and (ii) premium payments of $340, $340, $340 and $340 in 2004, $340, $340, $340 and $340 in 2003, and $389, $389, $389, and $389 in 2002 for Messrs. Chauvin, Meche, Bourke and Gallagher, respectively, under a long-term disability insurance plan, which premium payments are attributable to benefits in excess of those benefits provided generally for other employees. |

8

Stock Option Grants

The following table sets forth information with respect to all stock options granted in 2004 by the Company to each of the Named Executive Officers.

Option Grants in 2004

| Individual Grants |

Grant Date Value | ||||||||||

| Name |

Number of Securities Underlying Options Granted(1) |

% of Total Options Granted To Employees in 2004 |

Exercise or Base Price ($/Sh) |

Expiration Date |

Grant Date Present Value ($)(2) | ||||||

| Kerry J. Chauvin |

20,000 | 20.4 | % | 21.85 | 12/10/14 | 169,200 | |||||

| Kirk J. Meche |

10,000 | 10.2 | % | 21.85 | 12/10/14 | 84,600 | |||||

| Murphy A. Bourke |

7,500 | 7.7 | % | 21.85 | 12/10/14 | 63,450 | |||||

| Joseph P. Gallagher, III |

7,500 | 7.7 | % | 21.85 | 12/10/14 | 63,450 | |||||

| (1) | Each of the stock options granted in 2004 by the Company to the Named Executive Officers will become exercisable in one-fifth increments over a five-year period. The stock options will become immediately exercisable in their entirety upon (i) a reorganization, merger or consolidation of the Company in which the Company is not the surviving entity, (ii) the sale of all or substantially all of the assets of the Company, (iii) a liquidation or dissolution of the Company, (iv) a person or group of persons, other than Alden J. Laborde or Huey J. Wilson or any employee benefit plan of the Company, becoming the beneficial owner of 30% or more of the Company’s voting stock or (v) the replacement of a majority of the Board of Directors in a contested election (each, a “Significant Transaction”). The Compensation Committee has the authority to take several actions regarding outstanding stock options upon the occurrence of a Significant Transaction, including requiring that outstanding stock options remain exercisable only for a limited time, providing for mandatory conversion of outstanding stock options in exchange for either a cash payment or Common Stock, making equitable adjustments to stock options or providing that outstanding stock options will become stock options relating to securities to which a participant would have been entitled in connection with the Significant Transaction if the stock options had been exercised. |

| (2) | The Black-Scholes option-pricing model was used to determine the grant date present value of the stock options granted in December 2004 by the Company to the Named Executive Officers. Under the Black-Scholes option-pricing model, the grant date present value of each stock option referred to in the table was calculated to be $8.46. The following facts and assumptions were used in making such calculation: (i) an exercise price of $21.85 for each such stock option; (ii) a fair market value of $21.85 for one share of Common Stock on the date of grant; (iii) a dividend yield of .92% on Common Stock; (iv) a stock option term of 10 years; (v) a stock volatility of 29.9%, based on an analysis of monthly closing stock prices of shares of Common Stock during a 24-month period; and (vi) an assumed risk-free interest rate of 4.25%, which is equivalent to the yield on a ten-year treasury note on the date of grant. No other discounts or restrictions related to vesting or the likelihood of vesting of stock options were applied. The resulting grant date present value of $8.46 for each stock option was multiplied by the total number of stock options granted to each of the Named Executive Officers to determine the total grant date present value of such stock options granted to each Named Executive Officer, respectively. |

9

Stock Option Exercises and Outstanding Stock Options

The following table sets forth information with respect to all Company stock option exercises in 2004 by each of the Named Executive Officers and all outstanding Company stock options held by each of the Named Executive Officers as of December 31, 2004.

Aggregated Option Exercises in 2004 and Option Values as of December 31, 2004

| Shares Acquired |

Value Realized ($) |

Number of Securities Underlying Unexercised Options at 12/31/04 |

Value of Unexercised In-the-Money Options at | |||||||||

| Exercisable |

Unexercisable |

Exercisable |

Unexercisable | |||||||||

| Kerry J. Chauvin |

80,300 | 1,178,907 | 94,700 | 66,000 | 864,016 | 334,840 | ||||||

| Kirk J. Meche |

0 | 0 | 31,600 | 31,500 | 259,648 | 150,025 | ||||||

| Murphy A. Bourke |

30,300 | 270,243 | 16,200 | 26,600 | 113,956 | 141,108 | ||||||

| Joseph P. Gallagher, III |

15,000 | 191,550 | 51,500 | 26,600 | 515,890 | 141,108 | ||||||

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, none of Messrs. Wilson (Chairman), Cotter, Alden J. Laborde, or John P. Laborde, who comprise the Compensation Committee, were officers or employees of the Company or any of its subsidiaries. Alden J. Laborde was Chief Executive Officer of the Company from 1986 to 1990. No other member of the Compensation Committee is a former officer of the Company.

In connection with the initial public offering of its Common Stock, the Company entered into registration rights agreements (the “Registration Rights Agreements”) with Alden J. Laborde and Huey J. Wilson, pursuant to which each of them has one remaining right to require the Company to register shares of Common Stock owned by him under the Securities Act of 1933. If either one of them makes such a demand, the other one is entitled to include his shares in such registration. If the Company proposes to register any Common Stock under the Securities Act in connection with a public offering, each of Messrs. Laborde and Wilson may require the Company to include all or a portion of the shares of Common Stock held by such shareholder. The Company has agreed under the Registration Rights Agreements to pay all the expenses of registration, other than underwriting discounts and commissions.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors of the Company is composed of four directors and operates under a written charter adopted by the Board of Directors. The members of the Compensation Committee are independent as such term is defined under Nasdaq’s listing standards. The members of the Compensation Committee are Huey J. Wilson (Chairman), Gregory J. Cotter, Alden J. Laborde and John P. Laborde. The Compensation Committee has the authority, among other things, to review, analyze and recommend compensation programs to the Board of Directors and to administer and approve award grants under the Company’s incentive compensation plans and programs.

The Company’s executive compensation is comprised primarily of (i) salaries, (ii) annual cash incentive bonuses and (iii) long-term incentive compensation in the form of stock options granted under the Company’s Long-Term Incentive Plan and 2002 Long-Term Incentive Plan of the Company. The salaries of Kerry J. Chauvin, the Chairman of the Board, President and Chief Executive Officer, and the other executive officers of the Company are based on their individual levels of responsibility and the Compensation Committee’s subjective assessment of their performances.

The Company has no formal bonus plan, but it has adopted an executive compensation policy that ties a portion of executive compensation to the short-term performance of the Company. This policy is described in footnote 1 to the “Summary Compensation Table.”

10

The Company also provides long-term incentives to executive officers in the form of stock options granted under the Company’s Long-Term Incentive Plan and 2002 Long-Term Incentive Plan. The stock option awards are intended to reinforce the relationship between compensation and increases in the market price of the Common Stock and to align the executive officers’ financial interests with that of the Company’s shareholders. The size of awards is based upon the position of each participating officer and the Compensation Committee’s subjective assessment of each participant’s individual performance. The table entitled “Option Grants in 2004” under the heading “Executive Compensation” sets forth the stock options granted in 2004 to the Named Executive Officers, including Mr. Chauvin, the Chief Executive Officer, based upon position and subjective assessment.

The Compensation Committee has reviewed all components of Mr. Chauvin and the other executive officers’ compensation; and based on this review, finds such officers’ total compensation in the aggregate to be reasonable and not excessive.

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1 million for compensation paid to certain highly compensated executive officers. Qualified performance-based compensation is excluded from this deduction limitation if certain requirements are met. The Compensation Committee expects the stock options granted to executive officers, as discussed above, to qualify for the exclusion from the deduction limitation under Section 162(m). The Compensation Committee intends to continue to establish executive officer compensation programs that will maximize the Company’s income tax deduction, assuming the Compensation Committee determines that such actions are consistent with its philosophy and in the best interest of the Company and its shareholders.

The Compensation Committee

| Huey J. Wilson, Chairman | Gregory J. Cotter | Alden J. Laborde | John P. Laborde |

11

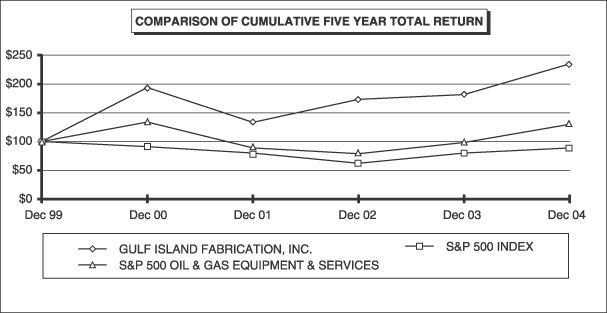

Performance Graph

The following graph compares the cumulative total shareholder return on the Common Stock from December 31, 1999 to December 31, 2004, with the cumulative total return of the Standard & Poor 500 Index and the Standard & Poor 500 Oil & Gas Equipment & Services Index for the same period. The returns are based on an assumed investment of $100 on December 31, 1999 in the Common Stock and in each of the indexes and on the assumption that dividends were reinvested. In prior years, we measured our performance against the Standard & Poor 500 Oil & Gas (Drilling & Equipment) Index, which no longer exists. During 2002, Standard & Poor divided this index into two indexes, one focusing on equipment and services in the oil and gas industry, and the other on drilling activities. The Company was placed in the Standard & Poor 500 Oil & Gas Equipment & Services Index, which we believe more closely reflects the industry in which we operate and is comprised of companies whose business and operations better match those of the Company.

Comparison of Cumulative Total Return

Gulf Island Fabrication, Inc., S&P 500 Index &

S&P 500 Oil & Gas Equipment & Services Index

| INDEXED RETURNS | ||||||||||||

| Years Ending | ||||||||||||

| Company / Index |

Base Period Dec 99 |

Dec 00 |

Dec 01 |

Dec 02 |

Dec 03 |

Dec 04 | ||||||

| GULF ISLAND FABRICATION, INC. |

100 | 194.00 | 133.44 | 173.33 | 181.65 | 235.18 | ||||||

| S&P 500 INDEX |

100 | 90.90 | 80.09 | 62.39 | 80.29 | 89.03 | ||||||

| S&P 500 OIL & GAS EQUIPMENT & SERVICES |

100 | 134.01 | 89.20 | 78.96 | 98.49 | 129.88 | ||||||

ASSUMES $100 INVESTED ON DECEMBER 31, 1999 IN GULF ISLAND FABRICATION, INC. COMMON STOCK, S&P 500 INDEX AND S&P 500 OIL & GAS EQUIPMENT & SERVICES INDEX.

12

Audit Committee Report

The Audit Committee of the Board of Directors of the Company is composed of four directors and operates under a written charter adopted by the Board of Directors, which is attached as Appendix A to this proxy statement. The members of the Audit Committee are independent as such term is defined under Nasdaq’s listing standards. The members of the Audit Committee are Gregory J. Cotter (Chairman), Thomas E. Fairley, Hugh J. Kelly and Ken C. Tamblyn. The Audit Committee selects on behalf of the Board of Directors, subject to shareholder ratification, the independent auditors of the Company.

Management is responsible for the internal controls and the financial reporting process of the Company. The independent auditors are responsible for performing an independent audit of the consolidated financial statements of the Company and its subsidiaries in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to monitor and to oversee these processes.

In this context, the Audit Committee met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the consolidated financial statements of the Company for 2004 were prepared in accordance with generally accepted accounting principles, and the Audit Committee reviewed and discussed the audited consolidated financial statements for 2004 with management and the independent auditors. The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgements as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The independent auditors of the Company also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s review and discussions described above and the Audit Committee’s review of the report of the independent auditors to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements for 2004 in the Annual Report on Form 10-K of the Company for the year ended December 31, 2004, filed with the Securities and Exchange Commission.

The Audit Committee

| Gregory J. Cotter, Chairman | Thomas E. Fairley | Hugh J. Kelly | Ken C. Tamblyn |

Independent Auditors

Fees and Related Disclosures for Accounting Services

The following table discloses fees for services provided by the Company’s independent auditors, Ernst & Young LLP, for each of the last two fiscal years:

| 2004 |

2003 | |||||

| Audit Fees (1) |

$ | 181,000 | $ | 88,000 | ||

| Audit-Related Fees (2) |

20,300 | 27,000 | ||||

| Tax Fees (3) |

59,000 | 42,000 | ||||

| All Other Fees |

0 | 0 | ||||

| (1) | As currently estimated. |

| (2) | Includes services rendered for 401(k) plan audit, new auditing standards and pronouncements review. |

| (3) | Relates to services rendered for tax planning, consultation and compliance services. |

13

The Audit Committee has considered and determined that the provision of the above services is compatible with maintaining the independence of the independent auditors.

Pre-Approval Policies and Procedures. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. The Audit Committee will generally pre-approve a list of specific services and categories of services, including audit, audit-related and tax services, for the upcoming or current fiscal year, subject to a specified cost level. Any service that is not included in the approved list of services must be separately pre-approved by the Audit Committee in increments of $10,000. In addition, if fees for any service exceed the amount that has been pre-approved, then payment of additional fees for such service must be specifically pre-approved by the Audit Committee.

At each regularly-scheduled Audit Committee meeting, management updates the Audit Committee on the scope and anticipated cost of any service pre-approved by the Audit Committee since the last meeting of the Audit Committee, as well as the projected fees for each service or group of services being provided by the independent auditors.

Since the May 6, 2003 effective date of the SEC rules stating that an auditor is not independent of an audit client if the services it provides to the client are not appropriately approved, each service provided by the independent auditors was approved in advance by the Audit Committee, and none of those services required use of the de minimis exception to the pre-approval requirement contained in the SEC’s rules.

Ratification of the Independent Auditors

Ernst & Young LLP has served as the Company’s independent auditors since 1998. The Audit Committee has appointed Ernst & Young as our independent auditors for 2005. The Audit Committee and Board of Directors seek shareholder ratification of the Audit Committee’s appointment of Ernst & Young to act as the independent auditors of the Company and its subsidiaries’ financial statements for the year 2005. Neither the Audit Committee nor the Board of Directors has determined what action would be taken should the appointment of Ernst & Young not be ratified. Representatives of Ernst & Young will be available at the Meeting to respond to appropriate questions, and those representatives will also have an opportunity to make a statement if they desire to do so.

OTHER MATTERS

Quorum and Voting

The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock of the Company is necessary to constitute a quorum. Shareholders voting, or abstaining from voting, by proxy on any issue will be counted as present for purposes of constituting a quorum. If a quorum is present, (i) the election of the two directors to be elected at the Meeting will be determined by plurality vote (that is, the two nominees receiving the largest number of votes will be elected) and (ii) a majority of votes actually cast will decide any other matter properly brought before the Meeting for a vote of shareholders. Shareholders for which proxy authority to vote for any nominee for election as a director is withheld by the shareholder and shares that have not been voted by brokers who may hold shares on behalf of the beneficial owners (“broker non-votes”) will not be counted as voted for the affected nominee. With respect to all other matters, shares not voted as a result of abstentions will have the same effect as votes against those matters, but broker non-votes will not be considered as voted for purposes of determining whether or not a majority of votes were cast for such matters.

14

Other Business

Management has not received any notice that a shareholder desires to present any matter for action by shareholders at the Meeting and is unaware of any matter for action by shareholders at the Meeting other than the matters described in the accompanying notice. The enclosed proxy will, however, confer discretionary authority with respect to any other matter that may properly come before the Meeting or any adjournment thereof. It is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment on any such matter.

By Order of the Board of Directors

ROBIN A. SEIBERT

Secretary

Houma, Louisiana

March 14, 2005

15

APPENDIX A

GULF ISLAND FABRICATION, INC.

AUDIT COMMITTEE CHARTER

This Audit Committee Charter has been adopted by the Board of Directors of Gulf Island Fabrication, Inc. (the “Company”). The Audit Committee (the “Committee”) shall review and reassess this charter annually and recommend any proposed changes to the Board for approval.

Composition and Independence

The Committee shall be appointed by the Board and shall consist of a minimum of three directors. All Committee members shall be independent under the rules of the Securities and Exchange Commission and the Nasdaq Stock Market. The members shall also meet Nasdaq’s financial literacy requirement and at least one member will be financially sophisticated as defined by Nasdaq. The Board’s goal is that the Committee has at least one “audit committee financial expert,” as defined by the Securities and Exchange Commission. No member of the Committee shall have participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the three years prior to becoming a member of the Committee.

One member of the Committee shall be appointed by the Board as chair. The chair shall be responsible for leadership of the Committee, including scheduling and presiding over meetings, preparing agendas, and making regular reports to the Board. The Committee may not designate subcommittees except with the prior approval of the Board.

If a member ceases to be independent under the SEC or Nasdaq rules for reasons outside the member’s reasonable control, the member may remain as a member of the Committee until the earlier of the Company’s next annual stockholders’ meeting or one year from the occurrence of the event that caused the member to be no longer independent. If the Company relies on this paragraph, the Company shall give notice to Nasdaq immediately upon learning of the circumstances giving rise to such reliance.

Responsibilities

The Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, disclosure controls and procedures, internal control over financial reporting and financial reporting practices of the Company. Management is responsible for the preparation of the Company’s financial statements and the independent auditor is responsible for auditing those financial statements. The Committee and the Board recognize that management and the independent auditor have more resources and time, and more detailed knowledge and information regarding the Company’s accounting, auditing, disclosure controls and procedures, internal control over financial reporting and financial reporting practices than the Committee does. Accordingly the Committee’s role does not provide any guarantees as to the financial statements and other financial information provided by the Company to its shareholders and others.

The Committee shall have the authority and responsibilities set forth below. The Committee shall report its actions to the Board of Directors at its next meeting. Except as otherwise expressly provided, the Committee shall have the sole authority with respect to the responsibilities delegated below, and further action by the Company’s Board of Directors shall not be required in order for the act of the Committee to constitute the act of the Company.

| • | The Committee shall be directly responsible for oversight of the Company’s internal auditors, which the audit function can be performed by either employees or outsourced. |

A-1

APPENDIX A

| • | The Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company (including resolution of disagreements between management and the auditor regarding financial reporting), and each such registered public accounting firm shall report directly to the Committee. |

| • | The Committee shall pre-approve all audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by the independent auditor, pursuant to policies and procedures adopted by the Committee in accordance with applicable legal requirements. The Committee may delegate such responsibility (other than with respect to the audit of the Company’s annual financial statements) to one or more members, provided that decisions made pursuant to such delegated authority shall be presented to the Committee at its next meeting. |

| • | The Committee shall obtain at least annually from the independent auditor a formal written statement describing all relationships between the auditor and the Company, consistent with Independence Standards Board Standard Number 1 or any successor standard. The Committee shall actively engage in a dialogue with the independent auditor with respect to any relationships that may impact the objectivity and independence of the auditor and shall take appropriate actions to oversee and satisfy itself as to the auditor’s independence. |

| • | The Committee shall confirm annually with the independent auditor that it is registered with the Public Company Accounting Oversight Board and that its registration is in good standing. |

| • | The Committee shall review the Company’s audited financial statements and discuss them with management and the independent auditor. These discussions shall include the matters required to be discussed under Statement of Auditing Standards No. 61 (or any successor standard) and consideration of the quality of the Company’s accounting principles as applied in its financial reporting, including a review of particularly sensitive accounting estimates, reserves and accruals, judgmental areas, audit adjustments (whether or not recorded), and other such inquiries as the Committee or the independent auditor shall deem appropriate. Based on such review, the Committee shall make its recommendation to the Board as to the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K (or the Annual Report to Shareholders, if distributed prior to the filing of the Form 10-K). |

| • | The Committee shall issue annually a report to be included in the Company’s proxy statement as required by the rules of the Securities and Exchange Commission. |

| • | The Committee shall discuss with a representative of management and the independent auditor: (1) the interim financial information contained in the Company’s Quarterly Report on Form 10-Q prior to its filing, (2) the earnings announcement prior to its release, and (3) the results of the review of such information by the independent auditor. (These discussions may be held with less than the full Committee, provided at least a quorum of the Committee or the Chairman of the Audit Committee is present in person or by telephone.) |

| • | The Committee shall discuss with management and the independent auditor the quality and adequacy of and compliance with the Company’s disclosure controls and procedures and internal control over financial reporting. |

| • | The Committee shall discuss with management and/or the Company’s counsel any legal matters (including the status of pending litigation) that may have a material impact on the Company’s financial statements, and any material reports or inquiries from regulatory or governmental agencies. |

| • | The Committee shall establish and oversee the implementation of procedures for (1) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and (2) the confidential anonymous submission by the Company’s employees and others of concerns regarding questionable accounting or auditing matters. |

A-2

APPENDIX A

| • | The Committee shall perform such responsibilities as may be delegated to it pursuant to the Company’s Code of Ethics for CEO and Senior Financial Officers and Code of Business Conduct and Ethics. The Committee shall have the sole authority to grant waivers of such Codes to a director or executive officer. |

| • | The Committee shall conduct an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis and all such transactions must be approved by the Committee. For this purpose, “related party transaction” shall refer to those transactions required to be disclosed pursuant to SEC Regulation S-K, Item 404. |

| • | The Committee shall maintain free and open communication with the independent auditor and Company management. |

| • | In discharging its oversight role, the Committee is empowered to investigate any matter relating to the Company’s accounting, auditing, disclosure controls and procedures, internal control over financial reporting or financial reporting practices brought to its attention, with full access to all Company books, records, facilities and personnel. |

| • | The Committee shall perform such other duties as may be assigned to it from time to time by the Board, the President or the Chairman of the Board. |

Advisors and Funding

The Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal counsel, accountants or other advisors.

The Company shall provide for appropriate funding, as determined by the Committee, for payment of (1) compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company, (2) compensation to any independent counsel and other advisers employed by the Committee as it determines necessary to carry out its duties, and (3) ordinary administrative expense of the Committee that are necessary or appropriate in carrying out its duties.

Meetings

The Committee shall meet at least four times annually or more frequently as circumstances dictate. At least once each year the Committee shall have separate private meetings with the independent auditor and management.

Meetings may be called by the chair of the Committee, or at the request of a majority of the members of the Committee, the President or Chairman of the Board.

A-3

ANNUAL MEETING OF SHAREHOLDERS OF

GULF ISLAND FABRICATION, INC.

April 27, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

- --------------------------------------------------------------------------------

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEES LISTED BELOW AND FOR PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE [x]

FOR AGAINST ABSTAIN

1. Election of the nominees for directors. 2. Ratification of appointment of Ernst & Young LLP [ ] [ ] [ ]

as independent auditors.

NOMINEES: 3. In their discretion to vote upon such other business

as may properly come before the Annual Meeting

[ ] FOR ALL NOMINEES O Gregory J. Cotter or any adjournment thereof.

O John P. "Jack" Laborde

Please mark, sign, date and return this proxy promptly using the enclosed

[ ] WITHHOLD AUTHORITY envelope.

FOR ALL NOMINEES

[ ] FOR ALL EXCEPT

(See instructions below)

INSTRUCTION: To withhold authority to vote for any

individual nominee(s), mark

"FOR ALL EXCEPT" and fill in the

circle next to each nominee you

wish to withhold, as shown here: O

- -----------------------------------------------------

- -------------------------------------------------------------------------------------

To change the address on your account, please check the box at right and [ ]

indicate your new address in the address space above. Please note that changes

to the registered name(s) on the account may not be submitted via this method.

- -------------------------------------------------------------------------------------

Signature of Shareholder _________________________ Date:___________ Signature of Shareholder _____________________ Date:_________

Note:Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When

signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a

corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership,

please sign in partnership name by authorized person.

This Proxy is Solicited on Behalf of the Board of Directors of

GULF ISLAND FABRICATION, INC.

The undersigned hereby constitutes and appoints Kerry J. Chauvin and Joseph

P. Gallagher, III, or either of them, proxy for the undersigned, with full power

of substitution, to represent the undersigned and to vote, as designated on the

reverse side, all of the shares of Common Stock of Gulf Island Fabrication, Inc.

(the "Company") that the undersigned is entitled to vote held of record by the

undersigned on February 28, 2005, at the annual meeting of shareholders of the

Company to be held on April 27, 2005 (the "Annual Meeting"), and at all

adjournments thereof.

This proxy, when properly executed, will be voted in the manner directed

herein by the undersigned shareholder. If no direction is made, this proxy will

be voted FOR the nominees and FOR the proposals listed on the reverse side. The

individuals designated above will vote in their discretion on any other matter

that may properly come before the meeting.

(Please See Reverse Side)