UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a party other than the Registrant ¨

Check the appropriate box:

|

| | |

| | |

ý

| | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

¨

| | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Under Rule 14a-12 |

GULF ISLAND FABRICATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

ý | | No fee required. |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | | Title of each class of securities to which transaction applies: |

| | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | (5 | ) | | Total fee paid: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | (1 | ) | | Amount previously paid: |

| | (2 | ) | | Form, Schedule or Registration Statement No: |

| | (3 | ) | | Filing Party: |

| | (4 | ) | | Date Filed: |

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 300

HOUSTON, TEXAS 77084

________________________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2019

TO THE SHAREHOLDERS OF GULF ISLAND FABRICATION, INC.:

The 2019 Annual Meeting of Shareholders of Gulf Island Fabrication, Inc. (the “Company” or “Gulf Island”) will be held at 10:00 a.m., Central time, on Thursday, May 9, 2019, at the corporate office of Gulf Island located at 16225 Park Ten Place, Suite 260, Houston, Texas, 77084, for the following purposes, as more fully described in the accompanying proxy statement:

| |

1. | To elect three Class I director nominees; |

| |

2. | To approve, on an advisory basis, the compensation of our named executive officers; |

| |

3. | To ratify the appointment of the Company’s independent registered public accounting firm; |

| |

4. | To approve an amendment to our articles of incorporation to increase the number of authorized shares of our common stock to 30,000,000; |

| |

5. | To approve an amendment to our articles of incorporation to revise the special meeting threshold; |

| |

6. | To approve certain other amendments to our articles of incorporation to conform to new Louisiana corporate law and current corporate governance practices; and |

| |

7. | To transact any other business that may properly come before the annual meeting. |

The Board of Directors has fixed the close of business on March 21, 2019, as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and all adjournments thereof.

Your vote is important regardless of the number of shares of the Company’s common stock you own. Whether or not you plan to attend the annual meeting, please complete, date and sign the enclosed proxy card and return it promptly in the enclosed stamped envelope or submit your proxy and voting instructions via the Internet at www.voteproxy.com. Returning the enclosed proxy card will not prevent you from voting in person at the annual meeting should you wish to do so. To obtain directions to attend the annual meeting and vote in person, please contact Westley S. Stockton at (713) 714-6100.

By Order of the Board of Directors

Westley S. Stockton

Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Houston, Texas

March 29, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITYOF THE PROXY MATERIALS

FOR THE SHAREHOLDERSMEETING TO BE HELD ON MAY 9, 2019.

This proxy statement and the 2018 Annual Report are available at https://ir.gulfisland.com/proxy.

|

| |

Table of Contents | |

| Page |

Proxy Summary | 1 |

2019 Annual Meeting of Shareholders | 1 |

Agenda and Voting Recommendations | 2 |

Director Highlights | 2 |

2018 Performance Overview | 3 |

Compensation Highlights | 3 |

2018 Corporate Governance Highlights | 4 |

Communications with our Board and Shareholder Engagement | 5 |

Corporate Governance; Our Board of Directors and Its Committees | 6 |

Board Leadership Structure | 6 |

Board Independence | 6 |

Board Skills Matrix | 7 |

Board Diversity, Tenure and Refreshment | 8 |

Board’s Role in Risk Oversight | 8 |

Board Evaluation Process | 9 |

Board Committees | 10 |

Audit Committee | 10 |

Corporate Governance and Nominating Committee | 10 |

Compensation Committee; Compensation Committee Procedures | 11 |

Compensation Committee Interlocks and Insider Participation | 11 |

Commitment to Corporate Governance | 12 |

Communications with our Board and Shareholder Engagement | 12 |

Ethics and Business Conduct Related Policies | 13 |

Director and Executive Officer Stock Ownership Guidelines | 13 |

Anti-Hedging and Pledging Policies | 13 |

Consideration of Director Nominees | 13 |

Director Compensation | 14 |

Cash Compensation | 14 |

Equity-Based Compensation | 15 |

2018 Director Compensation | 15 |

PROPOSAL 1: ELECTION OF DIRECTORS | 16 |

Information about the Directors, Director Nominees and Executive Officers | 17 |

Executive Compensation | 21 |

Compensation Discussion and Analysis | 21 |

Compensation Committee Report | 30 |

Executive Compensation Tables | 30 |

PROPOSAL 2: ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 37 |

Audit Committee Report | 38 |

Appointment of the Company’s Independent Registered Public Accounting Firm; Financial Statement Review | 38 |

Internal Audit | 39 |

|

| |

Independent Registered Public Accounting Firm | 39 |

Fees and Related Disclosures for Accounting Services | 39 |

PROPOSAL 3: RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 40 |

PROPOSAL 4: APPROVAL OF AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED COMMON SHARES | 41 |

PROPOSAL 5: APPROVAL OF AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO REVISE THE SPECIAL MEETING THRESHOLD | 43 |

PROPOSAL 6: APPROVAL OF CERTAIN OTHER AMENDMENTS TO OUR ARTICLES OF INCORPORATION TO CONFORM TO NEW LOUISIANA CORPORATE LAW AND CURRENT CORPORATE GOVERNANCE PRACTICES | 45 |

Certain Transactions | 47 |

Stock Ownership | 48 |

Section 16(a) Beneficial Ownership Reporting Compliance | 49 |

Questions and Answers about the Annual Meeting and Voting | 50 |

Shareholder Proposals and Nominations for the 2020 Annual Meeting | 54 |

| |

| |

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE

SUITE 300

HOUSTON, TEXAS 77084

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2019

Proxy Summary

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before returning your proxy card. For more information regarding our 2018 financial and operational performance, please review our 2018 annual report to shareholders (our “2018 Annual Report”). The 2018 Annual Report, including financial statements, is first being mailed to shareholders together with this proxy statement and form of proxy card on or about March 29, 2019.

2019 Annual Meeting of Shareholders

Time and Date: 10:00 a.m., Central time, Thursday, May 9, 2019

Location: Gulf Island Fabrication, Inc.

16225 Park Ten Place, Suite 260

Houston, Texas, 77084

Record Date: March 21, 2019

| |

Voting: | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director position and one vote for each of the other proposals to be voted on at the annual meeting. |

Agenda and Voting Recommendations

The Gulf Island Board of Directors (the “Board”) is asking shareholders to vote on these matters:

|

| | | | | | |

Item | | Proposal | | Board Vote Recommendation | | Page |

1 | | Election of three director nominees | | FOR each nominee | | 16 |

2 | | Advisory vote to approve the compensation of our named executive officers | | FOR | | 37 |

3 | | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019 | | FOR | | 40 |

4 | | Approval of an amendment to our articles of incorporation to increase the number of authorized shares of our common stock to 30,000,000 | | FOR | | 41 |

5 | | Approval of an amendment to our articles of incorporation to revise the special meeting threshold | | FOR | | 43 |

6 | | Approval of certain other amendments to our articles of incorporation to conform to new Louisiana corporate law and current corporate governance practices | | FOR | | 45 |

Director Highlights (page 17)

We have included summary information about each director nominee and each other director of the Company whose term will continue after the 2019 annual meeting in the table below. See “Information about the Directors, Director Nominees and Executive Officers” for additional information regarding our director nominees and directors.

|

| | | | | | | | | | | | |

Name | | Class/ Term | | Age | | Director Since | | Principal Occupation | | Indep. | | Board Committees |

Robert M. Averick | | II (2020) | | 53 | | 2018 | | Portfolio Manager, Kokino LLC | | Yes | | • Compensation |

Murray W. Burns | | I (2019) | | 73 | | 2014 | | Consultant, MBurns Consulting | | Yes | | • Compensation • Corporate Governance & Nominating

|

William E. Chiles | | I (2019) | | 70 | | 2014 | | Managing Partner, Pelican Energy Partners | | Yes | | • Compensation* |

Gregory J. Cotter | | II (2020) | | 70 | | 1985 | | Wealth Management Consultant | | Yes | | • Audit* |

Michael A. Flick | | I (2019) | | 70 | | 2007 | | Retired Banking Executive | | Yes | | • Corporate Governance & Nominating* • Audit • Compensation |

Christopher M. Harding | | II (2020) | | 68 | | 2007 | | Private Investor | | Yes | | • Audit • Compensation |

Michael J. Keeffe *** | | III (2021) | | 67 | | 2014 | | Retired Senior Audit Partner, Deloitte & Touche LLP | | Yes | | • Audit |

John P. (Jack) Laborde ** | | II (2020) | | 69 | | 1997 | | President, Overboard Holdings, L.L.C. and All Aboard Development Corporation | | Yes | | • Audit • Compensation • Corporate Governance & Nominating |

Kirk J. Meche | | III (2021) | | 56 | | 2012 | | Chief Executive Officer of Gulf Island | | No | | |

Cheryl D. Richard | | III (2021) | | 63 | | 2018 | | Retired Executive, Conoco Philips | | Yes | | • Corporate Governance & Nominating |

________________

2018 Performance Overview (page 21)

As more fully discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended December 31, 2018, we incurred operating losses of $19.7 million for 2018, primarily due to:

| |

• | Under-Recovery of Overhead Costs. The under-recovery of overhead costs for our Fabrication, and to a lesser extent, Shipyard Divisions (including holding costs for our South Texas Properties sold during 2018); |

| |

• | Lower Margin Shipyard Backlog. The impact of lower margin backlog for our Shipyard Division related to previous project awards sold during a period of competitive pricing; and |

| |

• | Fabrication and Shipyard Project Losses. Losses on certain projects within our Fabrication and Shipyard Divisions. |

Despite these challenges and the ongoing impact of the downturn in the oil and gas industry, during 2018 we made significant progress in our efforts to strengthen our liquidity and strategically reposition the Company to participate in the fabrication of petrochemical and industrial facilities, pursue offshore wind opportunities, enter the EPC industry, and diversify our customer base within all our operating divisions. Key accomplishments during 2018 included:

| |

• | Sold South Texas Properties. Sold our Texas South Yard during the second quarter for net proceeds of $53.8 million and sold our Texas North Yard during the fourth quarter for net proceeds of $27.4 million, consistent with our strategy to monetize underutilized assets. |

| |

• | Improved Liquidity. Increased our cash and investments by approximately $70.0 million and extended the maturity date of our $40.0 million credit facility to mid-2020, consistent with our strategy to strengthen our liquidity. |

| |

• | Increased Backlog by 60%. Increased our backlog by approximately $134.0 million. Customer options, if exercised, would increase our backlog by an additional $534.0 million. Our increase in backlog was generated predominantly outside of the oil and gas sector, consistent with our strategy to diversify our customer base. |

| |

• | Completed Fabrication of Complex Modules. Completed the fabrication and timely delivery of four large modules for a new petrochemical facility in the U.S., consistent with our strategy to participate in the fabrication of petrochemical facilities. |

| |

• | Furthered our Offshore Wind Capabilities. Enhanced our offshore wind project management capabilities by leveraging our EPC Division and executed a cooperation agreement with a strategic partner for the pursuit and execution of offshore wind projects, consistent with our strategy to pursue offshore wind opportunities |

| |

• | Increased Profitability of Services Division. Increased the revenue and gross profit of our Services Division by approximately 35% and 172%, respectively, consistent with our strategy to improve and grow our profitable operations. |

| |

• | Grew Revenue and Reduced Overhead Costs. Increased our consolidated revenue by approximately $50.0 million, or approximately 29%, and reduced our overhead costs, consistent with our strategy to grow our business and improve the utilization of our facilities. |

As we continue to reposition the Company for growth and profitability, our focus remains on our liquidity and securing meaningful new project awards and backlog in the near-term and generating operating income and cash flows from operations in the longer-term.

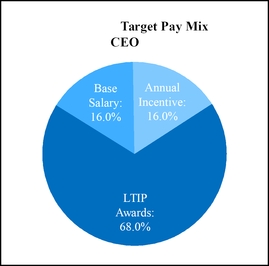

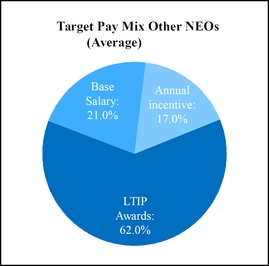

Compensation Highlights (pages 14 and 23)

| |

• | Incentive Programs Payout Based on Performance. Annual incentive awards for 2018 for our named executive officers (“NEOs”) were based on specific targets related to EBITDA, safety, and individual performance. Based on our 2018 performance, our NEOs earned annual cash payouts representing 21% of their target annual cash incentive awards. |

| |

• | Salary Reductions During 2018; No Salary Increases Since 2014. Given the economic environment of the oil and gas and marine industries and challenges faced by the Company, effective May 1, 2018, the Board approved a 5% reduction in base salaries of our NEOs. In addition, our Compensation Committee has not increased base salaries for our NEOs since 2014. |

| |

• | Director Fee Reductions. Effective May 1, 2018, the Board approved a 10% reduction in the annual fees paid to our directors. |

| |

• | Additional Rigor for Long-term Performance Awards: |

| |

◦ | Long-term performance awards granted in 2016, with a three-year performance period ending in 2018, would have resulted in a payout of 83% of target based on our total shareholder return (“TSR”) relative to a peer group. However, in light of the Company’s negative TSR results, the Compensation Committee and executive management agreed to reduce the payout of the 2016 long-term performance awards by 50%. |

| |

◦ | Beginning with the long-term performance awards granted during 2017, the Compensation Committee approved the addition of a negative TSR modifier, which will reduce the ultimate payout of the awards if our TSR for the applicable performance periods is negative. As noted above, although this modifier did not apply to the 2016 awards, the Compensation Committee and executive management agreed to a similar reduction in payout for the 2016 long-term performance awards based on our negative TSR results. |

| |

• | “Double Trigger” Equity and Performance-Based Cash Awards. Vesting of equity awards will only accelerate in connection with a change of control if, within one year upon such change of control event, a participant’s employment is terminated without cause or terminated by the participant for good reason. Similarly, in connection with a change of control, the long-term performance-based cash awards granted to our executive officers will only accelerate and be payable at the target level in connection with a change of control if, within one year upon such change of control event, a participant’s employment is terminated without cause or terminated by the participant for good reason. |

2018 Corporate Governance Highlights (page 12)

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens accountability of our Board and management and engenders public trust in the Company. Our Board reviews on an ongoing basis evolving corporate governance practices and investor preferences. In furtherance of our commitment to strong governance and in response to feedback from our shareholders, we recently took steps to improve our practices. These recent changes or recommended changes are discussed below, and together with our ongoing practices evidence our commitment to corporate governance. For detail regarding our ongoing corporate governance practices, see “Corporate Governance; Our Board and its Committees - Commitment to Corporate Governance”.

|

| | |

2018 Corporate Governance Highlights |

Majority Vote for Directors | | The Board approved a majority voting standard for election of directors in an uncontested election. |

Annual Board Evaluations | | Each of our directors completed an annual evaluation of the full Board for the purpose of improving Board and committee processes and effectiveness. |

Board Skills Assessment | | The Board conducts an annual assessment of director experience, qualifications, attributes and skills needed for the Board to effectively oversee the interests of the Company. During 2018, our Corporate Governance and Nominating Committee retained a third-party director search firm to assist in an evaluation of the experience, qualifications, attributes and skills of the members of the Board in addition to a director search process.

|

Board Refreshment | | We appointed two new directors to our Board and have committed to reduce the size of our Board from ten to eight directors by 2020. |

Board Diversity | | We adopted a formal board diversity policy, pursuant to which we strive to select director nominees with diverse backgrounds, experiences, skills and perspectives. In 2018, after a director search process, we appointed Ms. Richard as a Class III director. |

Shareholder Right to Call a Special Meetings | | Our shareholders holding a specific threshold percentage of votes may call a special meeting of shareholders. The Board approved a recommendation to the shareholders to amend and restate our articles of incorporation to, among other things, revise the threshold for shareholders to call a special meeting, which is included in Proposal No. 5 in this proxy statement to be voted on by our shareholders at this annual meeting.

|

Eliminate Supermajority Requirement | | The Board approved a recommendation to the shareholders to amend and restate our articles of incorporation to, among other things, eliminate the supermajority vote requirements to amend our by-laws and certain provisions of our articles of incorporation and to approve certain transactions, which is included in Proposal No. 6 in this proxy statement to be voted on by our shareholders at this annual meeting.

|

Increase Stock Ownership Requirements of Directors

| | In 2018, the Board approved an increase in the stock ownership guidelines for directors from 5,000 shares to 15,000 shares.

|

Communications with our Board and Shareholder Engagement (page 12)

We believe it is important for our shareholders and interested parties to provide input on our business, the industry, our corporate governance and executive compensation practices, or any other item of shareholder interest. Shareholders and interested parties may contact the Board as provided below:

|

| | | | | | |

By Letter | | By Telephone | | By Email | | In Person |

Gulf Island Fabrication, Inc. 16225 Park Ten Place Suite 300 Houston, TX 77084 | | Kirk Meche 713-714-6100 | | Kirk Meche kmeche@gifinc.com | | Annual Meetings 16225 Park Ten Place Suite 260 Houston, TX 77084 |

We welcome shareholder input to enable us to integrate insights from shareholders into Board discussions and decision-making processes. In response to discussions with certain of our shareholders, the Board implemented in 2018, or recommends to our shareholders at this annual meeting, certain changes to our governance structures, policies and practices highlighted above under “2018 Corporate Governance Highlights”.

Corporate Governance; Our Board of Directors and Its Committees

Our Board currently consists of ten members. Our Board met seven times during 2018. Our Board has established three standing committees: the Corporate Governance and Nominating Committee, the Audit Committee and the Compensation Committee. Each committee operates under a written charter adopted by our Board, and such charters, together with our Corporate Governance Guidelines, are available on our corporate governance page at www.gulfisland.com under “Investors.” Printed versions of these materials are available, free of charge, to any shareholder who requests them from the Corporate Secretary. The composition of each committee is reviewed annually by our Board. During 2018, each of our incumbent directors attended at least 75% of the aggregate of the total number of meetings of our Board and the total number of meetings held by all committees of our Board on which he or she served during the periods of his or her Board membership and committee service.

Board Leadership Structure

John P. (“Jack”) Laborde serves as Chairman of our Board and Kirk J. Meche serves as President and Chief Executive Officer. Our Board determined that separation of these roles would maximize management’s efficiency by allowing the Chief Executive Officer to focus on our day-to-day business and the Chairman of our Board to lead the Board of Directors in its fundamental role of providing guidance to, and oversight of, management. Our Corporate Governance Guidelines require the Chairman of the Board and Chief Executive Officer positions to be separate. Our Board periodically reviews the Company’s leadership structure and may make changes in the future as it deems appropriate.

Our Board believes that our independent directors, with the leadership of our Chairman of the Board, provide effective oversight of management. Moreover, in addition to feedback provided during the course of meetings of our full Board, the non-management directors are given the opportunity to meet in executive session at each regular meeting of our Board or more frequently, as needed. During 2018, Mr. Laborde served as Chairman for all executive sessions of the independent directors and acted as the liaison between the independent directors and the Chief Executive Officer. Our three standing committees are composed entirely of independent directors and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board or management.

Board Independence

On the basis of information solicited from each director, and upon the advice and recommendation of the Corporate Governance and Nominating Committee, our Board annually determines the independence of each of our then-current directors in connection with the nomination process. Further, in connection with the appointment of any new director to the board during the year, our board of directors makes the same determination. Our board of directors has determined that each of our current directors (specifically Ms. Richard and Messrs. Averick, Burns, Chiles, Cotter, Flick, Harding, Keeffe and Laborde) has no material relationship with the Company and are independent as defined in the director independence standards of listing standards of The NASDAQ Stock Market LLC (“NASDAQ”), as currently in effect. In making this determination, our Corporate Governance and Nominating Committee, with assistance from the Company’s legal counsel, evaluated responses to a questionnaire completed annually by each director regarding relationships and possible conflicts of interest between each director, the Company and management, and made a recommendation to our Board. In its review of director independence, our Board considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and family relationships any director may have with the Company or management.

Board Skills Matrix

The following table notes the breadth and variety of business experience that each of our current directors brings to the Company and which enable the Board to provide insightful leadership to the Company to advance its strategies and deliver returns to shareholders.

|

| | | | |

Director Experience and Skills Matrix |

CEO or other Senior Executive Experience | | Experience in senior leadership positions provides our Board with practical insights in developing and implementing business strategies, maintaining effective operations and driving growth, so that we may achieve our strategic goals. | | 9 of 10 directors |

Industry Experience | | Industry expertise and experience in each of energy or energy service, marine and industrial construction and fabrication allows the Board to develop a deeper understanding of our key business, its operations and key performance indicators in a competitive environment. In addition, industry expertise and experience provides the Board with awareness and know-how to help the Company cultivate and sustain growth in its industries and helps to maintain compliance with industry-related regulations. | | 8 of 10 directors

|

Accounting & Financial Experience | | Experience as an accountant, auditor, financial expert or other relevant experience is critical to allowing the Board to oversee the preparation and audit of our financial statements and comply with various regulatory requirements and standards. | | 8 of 10 directors |

Other Public Company Board Experience | | Directors who serve or have served on the boards of other public companies understand the responsibilities of a public company and board and can provide insight on issues commonly faced by public companies gained from this experience. | | 7 of 10 directors |

Capital Markets & Banking Experience | | Experience overseeing investments and capital market transactions provides the Board with critical background, knowledge and skills that enhance the Company’s ability to raise capital to fund its operations and evaluate and implement capital allocation strategies. | | 5 of 10 directors |

Legal & Regulatory Compliance Experience | | Experience in the legal field or in regulated industries provides the Board with knowledge and insights in complying with government regulations and legal obligations, as well as identifying and mitigating legal and compliance risks. | | 7 of 10 directors |

Cybersecurity | | Cybersecurity risks are increasing for all industries, including the Company’s, and our Board members’ experience and expertise in this rapidly developing area are essential to mitigating cybersecurity risks and to the Company’s risk management, on the whole. | | 1 of 10 directors |

Human Capital Management | | Experience in human capital management, including employee development, diversity and equal employment opportunity initiatives, workplace health and safety, labor relations, workforce engagement and administration, and executive compensation, helps the Board and the Company recruit, retain and develop key talent, grow diversity of personnel at all levels throughout the Company and build strong relationships with our employees. | | 6 of 10 directors |

Risk Management & Oversight | | Experience overseeing complex risk management allows the Board to preemptively identify, assess and mitigate key risks and to design and implement risk management practices to protect shareholder return. | | 9 of 10 directors |

Corporate Strategy & Business Development | | Corporate strategy and business development experience enhances the Board’s ability to develop innovative solutions, including our business and strategic plans, and to drive growth in our competitive industry. | | 10 of 10 directors |

Corporate Governance & Ethics | | Directors with experience implementing governance structures and policies provide an understanding of best practices and key issues, enhancing our ability to maintain good governance and to execute new key governance initiatives. | | 10 of 10 directors |

Independence | | Directors who are “independent” under the rules of the SEC, listing exchanges and other entities allow the Board to provide unbiased oversight over the Company and to implement governance practices with integrity and transparency. | | 9 of 10 directors |

In connection with our commitment to strong governance practices that deliver value to our shareholders, during 2018, our Corporate Governance and Nominating Committee retained a third-party director search firm to assist in an evaluation of the experience, qualifications, attributes and skills of the members of the Board and conduct an extensive and careful search to identify board candidates with highly additive skills and relevant experience to guide the Company’s ongoing transformation and maximize Board effectiveness, while being mindful of the Board’s desire to increase Board diversity. On October 15, 2018, the Board appointed Ms. Richard to serve as a Class III director as a result of this process.

Board Diversity, Tenure and Refreshment

We are committed to board diversity and board refreshment and we believe the Company’s policies and practices help to ensure a diversity of skills, experience, and tenure on the Board, promoting and supporting the Company’s long-term strategic goals. During 2018, the Board adopted a board diversity policy, appointed two new directors to the Board and has committed to reduce the size of the Board from ten to eight members following the 2020 annual meeting of shareholders.

Diversity Policy

On November 1, 2018, our Board adopted a formal Board Diversity Policy, which is available on our corporate governance page at www.gulfisland.com under “Investors.” The Board Diversity Policy is available in print to any shareholder who requests a copy. Pursuant to the policy, the Corporate Governance and Nominating Committee strives for inclusion of diverse groups, knowledge and viewpoints within the Board, considering various matters of diversity, including, but not limited to, gender, race, religion, sexual orientation and disability. The Corporate Governance and Nominating Committee seeks out highly qualified diverse candidates and evaluates each director nominee in the context of our Board composition as a whole, with the objective of nominating director candidates who can best perpetuate the success of our business, be effective directors in conjunction with our full Board and represent shareholder interests through the exercise of sound judgment. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, has committed to interviewing at least one candidate who would increase the gender, racial and/or ethnic diversity of the Board. To accomplish this, the Corporate Governance and Nominating Committee has sole authority to retain and terminate qualified independent external advisors, if it deems necessary, to conduct searches for candidates that help achieve the Board’s diversity objectives, and to approve such advisors’ fees and other retention terms.

Tenure and Refreshment

In 2018, we added two new directors to our Board. On October 15, 2018, Cheryl D. Richard was appointed to the Board to serve as a Class III director. On November 3, 2018, the Company appointed Robert M. Averick to the Board to serve as a Class II director, pursuant to the terms of the Cooperation Agreement (as defined in “Certain Transactions”). Further, under the terms of the Cooperation Agreement, immediately following the Company’s 2020 annual meeting of shareholders, the Company will reduce the size of the Board to no more than eight directors.

The appointments of Ms. Richard and Mr. Averick to our Board, coupled with our commitment to reduce the size of the Board following the Company’s 2020 annual meeting of shareholders, has increased diversity of gender and skills on our Board and will significantly decrease the average tenure of our directors.

Director Resignation Policy

The Board has adopted a director resignation policy. The policy requires that directors provide a written offer of resignation, which the Corporate Governance and Nominating Committee will consider and recommend to the Board whether to accept or reject, in the event that (1) an incumbent director nominee receives less than a majority of affirmative votes in an uncontested election; or (2) a director has a material change in his or her principal occupation, employment or business association or job responsibilities, including retirement, or receives an invitation to join another company board where a potential conflict of interest may arise.

In addition, subject to our articles of incorporation and by-laws, employee directors will resign from the Board when they retire, resign or otherwise cease to be employed by the Company.

Finally, the Board believes that a director should offer his or her resignation if there is a substantial conflict of interest between the director and the Company or the Board and such conflict cannot be resolved to the satisfaction of the Board.

Board’s Role in Risk Oversight

The Board, as a whole, directly oversees our strategic and business risks, including, among other items, risks related to operations, financing, competition, capital investments, reputation and cybersecurity, through regular interactions with our management and, from time-to-time, input from independent advisors. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. There are several ways our Board performs this function, including (i) receiving management updates on our business operations and financial results and discussing risks related to the business at

each regular board meeting, (ii) receiving reports on all significant committee activities at each regular board meeting and (iii) evaluating the risks inherent in significant transactions as applicable.

Our Board believes that full and open communication between management and our Board is essential to effective risk oversight. Management is available to address any questions or concerns raised by our Board on risk management or any other matters, and any member of management may be requested to attend any meeting of the Board or of a committee, upon request of any non-management director. Our Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company’s business opportunities and challenges and monitors the development and management of risks that impact our strategic goals.

The Board conducts certain risk oversight activities through its committees, which oversee specific areas and provide reports to the full Board regarding such committee’s considerations and actions. The Audit Committee reviews and considers financial, accounting, internal controls and regulatory compliance risks, including those that could arise from our accounting and financial reporting processes. The Audit Committee also reviews and monitors risks through various reports presented by our internal auditors and our independent registered public accounting firm (external auditors). The Compensation Committee reviews and considers risks related to our compensation policies, including incentive plans, to determine whether those plans subject the Company to material risks. The Corporate Governance and Nominating Committee assists our board in fulfilling its oversight responsibilities with respect to the management of risks associated with our Board leadership structure and corporate governance matters.

In carrying out its risk oversight responsibilities, the Board is active in overseeing management’s actions to refocus our business strategy and enhance our financial position. To ensure informed and effective oversight during a period of weak market conditions, in December 2018, the Board organized and attended a strategic planning retreat to discuss our strategic initiatives and to participate in the development of our strategic plan. The Board will continue to receive regular updates regarding management’s execution of the Company’s strategic initiatives. The Board will also continue to monitor the Company’s performance against its near-term and long-term strategic plans, including reviewing actual and forecast operating results on a regular basis to evaluate the status and success of management in the execution of the plans.

Board Evaluation Process

The Corporate Governance and Nominating Committee is responsible for overseeing the annual performance evaluation of the board. Annually, each director completes an evaluation of the full Board which is intended to provide each director with an opportunity to evaluate performance for the purpose of improving Board and committee processes and effectiveness. The detailed evaluation questionnaire seeks quantitative ratings and subjective comments in key areas of Board practice, and asks each director to evaluate how well the Board and its committees operate and to make suggestions for improvements. The Corporate Governance and Nominating Committee reviews the results and the assessment of Board performance is presented to the full Board. As needed the Corporate Governance and Nominating Committee recommends any areas of improvement for the Board to consider implementing.

Board Committees

The following table notes our committee structure and membership during 2018 (X - Member; C - Chairperson; FE - Financial Expert):

|

| | | | | | |

Director(1) | | Corporate Governance and Nominating Committee | | Audit Committee | | Compensation Committee |

John P. (“Jack”) Laborde | | X | | X | | X |

Robert M. Averick(2) | | | | | | X |

Murray W. Burns | | X | | | | X |

William E. Chiles | | | | | | C |

Gregory J. Cotter | | | | C | | |

Michael A. Flick | | C | | X | | X |

Christopher M. Harding | | | | X | | |

Michael J. Keeffe | | | | FE | | |

Cheryl D. Richard | | X | | | | |

_______________

| |

(1) | As a non-independent director, Mr. Meche does not serve as a member of any committee of the Board, all of which are composed entirely of independent directors. |

| |

(2) | Mr. Averick was appointed to the Compensation Committee in November 2018 pursuant to the Cooperation Agreement. |

Our Board annually reviews and approves committee assignments at the annual Board meeting that immediately follows the annual shareholders meeting.

Audit Committee

The Audit Committee currently consists of the following five directors: Gregory J. Cotter (Chairman), Michael J. Keeffe (Financial Expert), Michael A. Flick, Christopher M. Harding and John P. Laborde. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards specifically governing audit committee members, and satisfies the additional requirements applicable to an audit committee member under Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (the Exchange Act). Our Board has determined that Mr. Keeffe is an “audit committee financial expert” as such term is defined within the applicable rules of the Securities and Exchange Commission (the “SEC”). The Audit Committee met six times during 2018.

The Audit Committee’s primary function is to assist our Board in fulfilling its oversight responsibilities by monitoring (1) the quality and integrity of the accounting, auditing, disclosure controls and procedures, internal control over financial reporting and financial reporting practices of the Company, (2) the independent auditor’s qualifications and independence and (3) the performance of the Company’s independent auditors.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of the following four directors: Michael A. Flick (Chairman), Murray W. Burns, John P. Laborde and Cheryl D. Richard. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards. The Corporate Governance and Nominating Committee met seven times during 2018.

The Corporate Governance and Nominating Committee assists the Board in fulfilling its oversight responsibilities by (1) identifying, considering and recommending to the Board candidates to be nominated for election or reelection to the Board or as necessary to fill vacancies and newly-created directorships, (2) monitoring the composition of the Board and its committees and making recommendations to the Board on membership of the committees, (3) maintaining the Company’s Corporate Governance Guidelines and recommending to the Board any advisable changes, (4) evaluating the effectiveness of the Board and its committees, (5) addressing any related matters required by the federal securities laws or NASDAQ, and (6) overseeing the succession plan process for each of the Company’s executive officers and the Chairman of the Board.

Compensation Committee; Compensation Committee Procedures

The Compensation Committee currently consists of the following five directors: William E. Chiles (Chairman), Robert M. Averick, Murray W. Burns, Michael A. Flick and John P. Laborde. Our Board has determined that each of these directors is “independent” as such term is defined in the NASDAQ listing standards, including standards specifically governing compensation committee members, and satisfies the additional requirements applicable for a compensation committee member under Rule 10C-1(b)(1) under the Exchange Act. Our Board has determined that each of the directors is a “non-employee director” as defined under Rule16b-3 under the Exchange Act. The Compensation Committee met six times during 2018.

The Compensation Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibilities by: (1) discharging the responsibilities of the Board relating to the compensation of the Company’s officers and directors and (2) administering the Company’s cash-based and equity-based incentive compensation plans. The Compensation Committee has overall responsibility for approving, evaluating and recommending to the Board all compensation plans of the Company and to administer and interpret such plans.

The Compensation Committee seeks the input of our Chief Executive Officer in connection with performance evaluations and compensation decisions for our other executive officers; however, our Chief Executive Officer is not present when the Compensation Committee meets to evaluate his performance nor when our Board determines his compensation.

The terms of our stock incentive plans permit the Compensation Committee to delegate to appropriate personnel its authority to make awards to employees other than those subject to Section 16 of the Exchange Act. However, the Compensation Committee has not delegated this authority to date.

Compensation Committee Interlocks and Insider Participation

During 2018, none of Messrs. Chiles, Laborde, Averick, Flick and Burns, who comprised the Compensation Committee, were officers or employees of the Company or any of its subsidiaries or had any relationships requiring disclosure in this proxy statement as reportable transactions under “Certain Transactions,” and none of our executive officers served as a member of the compensation committee of another entity or as a director of another entity, one of whose executive officers served on the Compensation Committee or our Board. No member of the Compensation Committee is a former officer of the Company.

Commitment to Corporate Governance

We prioritize developing and maintaining a corporate governance framework that promotes the long-term interests of our shareholders, strengthens accountability of our Board and management and engenders public trust in the Company. As discussed in “2018 Corporate Governance Highlights”, in furtherance of our commitment to strong governance and in response to feedback from our shareholders, we recently took steps to improve our corporate governance practices, including a review of our articles of incorporation and by-laws in light of evolving provisions of Louisiana law, current corporate governance best practices, and the Company’s current circumstances. We will continue this commitment to act in the best interest of our shareholders by regularly reviewing and updating our corporate governance practices over time. Our dedication to good corporate governance is evidenced by the following:

|

| | |

Corporate Governance Highlights |

Majority Vote for Directors | | The Board approved a majority voting standard for election of directors in an uncontested election. |

Board Independence | | All of our non-employee director nominees are independent, and 9 out of 10 current directors are independent. |

Committee Independence | | Each of our board committees (audit, compensation and corporate governance and nominating) is 100% independent. |

Non-executive Chairman | | The roles of our Chairman and Chief Executive Officer are separate. |

Annual Board Evaluations | | Each of our directors completes an evaluation of the full Board each year for the purpose of improving Board and committee processes and effectiveness. |

Board Skills Assessment

| | The Board conducts an annual assessment of director experience, qualifications, attributes and skills needed for the Board to effectively oversee the interests of the Company. During 2018, our Corporate Governance and Nominating Committee retained a third-party director search firm to assist in an evaluation of the experience, qualifications, attributes and skills of the members of the Board in addition to a director search process.

|

Board Refreshment | | Last year, we appointed two new directors to our Board and have committed to reduce the size of our Board from ten to eight directors by 2020. |

Board Diversity | | In 2018, we adopted a formal board diversity policy, pursuant to which we strive to select director nominees with diverse backgrounds, experiences, skills and perspectives. In addition, in 2018, after a director search process, we appointed Ms. Richard as a Class III director. |

Shareholder Right to Call a Special Meetings | | Our shareholders holding a specific threshold percentage of votes may call a special meeting of shareholders. The Board approved a recommendation to the shareholders to amend and restate our articles of incorporation to, among other things, revise the threshold for shareholders to call a special meeting, which is included in Proposal No. 5 in this proxy statement to be voted on by our shareholders at this annual meeting.

|

Eliminate Supermajority Requirement | | The Board approved a recommendation to the shareholders to amend and restate our articles of incorporation to, among other things, eliminate the supermajority vote requirement to amend our by-laws and certain provisions of our articles of incorporation and to approve certain transactions, which is included in Proposal No. 6 in this proxy statement to be voted on by our shareholders at this annual meeting.

|

Stock Ownership Guidelines | | Our directors and executives are required to hold certain numbers of shares of our common stock and are prohibited from hedging or pledging the Company’s stock, subject to a limited exception for pledging. In 2018, our Board approved an increase the stock ownership guidelines for directors from 5,000 shares to 15,000 shares. |

No Shareholder Rights Plan | | We have not implemented a shareholder rights plan, or “poison pill.” |

Executive Sessions | | Our independent directors regularly meet in executive session without management present. |

Governance Policies | | We have adopted robust corporate governance guidelines and code of business conduct and ethics. |

Communications with our Board and Shareholder Engagement

Our Board values communicating and engaging with our shareholders to understand their views on important business, corporate governance and executive compensation matters.

Any shareholder may communicate with our Board (or with any individual director) by sending a letter by mail addressed to the Chairman of the Board of Directors of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084 or by email to kmeche@gifinc.com. The Chairman of our Board will forward the shareholder’s communication directly to the appropriate director or directors.

Our Board has adopted a policy that recommends that all directors personally attend all meetings of our shareholders. At the last annual meeting of shareholders held on April 25, 2018, all members of our Board were in attendance, except for Cheryl D. Richard and Robert M. Averick, who were not appointed to the Board until October 15, 2018 and November 3, 2018, respectively.

Ethics and Business Conduct Related Policies

The Company maintains a Code of Ethics (our “Code of Ethics”) for our Chief Executive Officer and senior financial officers and a Code of Business Conduct and Ethics, which applies to all employees and directors, including our Chief Executive Officer and senior financial officers. These codes are posted on our corporate governance page at www.gulfisland.com under “Investors.” These policies are available in print to any shareholder who requests a copy. Any substantive amendments to the Code of Ethics will be disclosed within four business days of such event on our website and will remain on our website for at least 12 months.

Director and Executive Officer Stock Ownership Guidelines

Our Corporate Governance Guidelines contain director and executive officer stock ownership guidelines that generally require (i) directors to hold at least 15,000 shares of the Company’s stock, including any unvested restricted stock or restricted stock units for the duration of their remaining tenure as a director of the Company, by the later of April 24, 2021 or five years from becoming a director; and (ii) executive officers to hold stock, including any unvested restricted stock or restricted stock units granted to them, in an amount equal to 2.0 times base salary in the case of the chief executive officer and 1.25 times base salary in the case of all other executive officers by the later of April 30, 2021 or five years from becoming subject to such guidelines.

Anti-Hedging and Pledging Policies

Pursuant to our Corporate Governance Guidelines, directors and executive officers are specifically prohibited from holding any Company stock in a margin account or engaging in any transaction that would have the effect of hedging the economic risk of ownership of their Company stock. Furthermore, directors and executive officers may not borrow against any account in which Company stock is held or pledge Company stock as collateral for a loan or for any other purpose, except that such insiders may pledge Company stock as collateral for a loan (not including margin debt) if:

| |

• | such shares are not pledged as collateral for a margin loan; |

| |

• | such executive or director establishes that he or she has the financial capacity to repay the loan without resorting to the pledged securities; |

| |

• | such executive or director notifies the Corporate Secretary prior to the execution of documents evidencing the proposed pledge; and |

| |

• | such shares pledged will not be considered as owned for purposes of the stock ownership guidelines applicable to the executive or the director. |

Finally, any pledging of or trading in Company stock by directors and executive officers is subject to the additional restrictions set forth in our Insider Trading Policy, which is posted on our corporate governance page at www.gulfisland.com under “Investors” and available in print to any shareholder who requests a copy.

Consideration of Director Nominees

The Corporate Governance and Nominating Committee will regularly assess the appropriate size of our Board, as well as whether any vacancies on our Board are expected due to retirement or otherwise and whether such vacancies should be filled. In the event that any vacancies are anticipated or otherwise arise, the Corporate Governance and Nominating Committee will consider various potential candidates for director who may come to the attention of our Board through current members of our Board, professional search firms or shareholders. Alternatively, the Corporate Governance and Nominating Committee may recommend that the Board reduce its size. Each candidate brought to the attention of the Corporate Governance and Nominating Committee, regardless of who recommended such candidate, is evaluated in the same manner.

The identification and evaluation of qualified directors is a complex and subjective process that requires consideration of many intangible factors and will be significantly influenced by the particular needs of the Board from time to time. The Corporate Governance and Nominating Committee believes that each potential director nominee should be evaluated based on his or her individual merits, taking into account the Company’s needs and the composition of the Board at the time. As a result, the Corporate Governance and Nominating Committee has not set specific, minimum qualifications that directors must meet in order for the Corporate Governance and Nominating Committee to recommend them to the Board, other than being under the age of 78 at the time of his or her election.

In evaluating nominees for membership on our Board, the Corporate Governance and Nominating Committee considers the board membership criteria set forth in our diversity policy and in our Corporate Governance Guidelines. To that end, the Corporate Governance and Nominating Committee, when expanding the size of the Board or filling a vacancy on the Board, has committed to interviewing at least one candidate who would increase the gender, racial and/or ethnic diversity of the Board.

Consistent with these policies, the Corporate Governance and Nominating Committee consistently seeks directors with integrity and proven business judgment, management ability and a diverse mix of backgrounds and experiences to build a capable, responsive, balanced and effective Board. In reviewing the qualifications of potential director nominees, the Corporate Governance and Nominating Committee considers many factors, including accounting and financial expertise, capital markets and banking experience, cybersecurity and technology expertise, energy and energy service industry experience and expertise, environmental compliance and corporate responsibility expertise, senior corporate executive experience, human resources and compensation management experience, industrial construction and fabrication management experience, legal and regulatory compliance expertise, marine industry experience, shipbuilding industry experience and other public company board experience.

Upon the recommendations of the Corporate Governance and Nominating Committee, nominations of directors and related matters are voted upon by the independent directors while meeting in executive session without management present. Since Mr. Meche is a member of management and a non-independent director, he is not involved in the nominations process.

As set forth in our Corporate Governance Guidelines, our Corporate Governance and Nominating Committee will consider director candidates recommended by our shareholders for nomination for election to our Board. Any shareholder may suggest a nominee by sending the following information to our Board: (i) the proposing shareholder’s name, address and telephone number, (ii) the number of shares of our common stock beneficially owned by the proposing shareholder and the suggested nominee, (iii) the suggested nominee’s name, age, business and residential addresses and telephone number, (iv) a statement that the suggested nominee knows that his or her name is being suggested by the proposing shareholder, and that he or she has consented to being suggested and is willing to serve, (v) the suggested nominee’s resume or other description of his or her background and experience and (vi) the proposing shareholder’s reasons for suggesting that the individual be considered. The information should be sent to the Corporate Governance and Nominating Committee of our Board addressed as follows: Chairman - Corporate Governance and Nominating Committee of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 300, Houston, Texas, 77084.

In addition, we have advance notice procedures that permit a shareholder to present shareholder nominees at our annual shareholder meetings. For additional information regarding our advance notice procedures, see “Shareholder Proposals and Nominations for the 2020 Annual Meeting.”

Director Compensation

We use a combination of cash and equity-based incentive compensation to attract and retain qualified candidates to serve on our Board. In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required by the Company to be an effective member of our Board. For 2018, the form and amount of director compensation was reviewed by the Compensation Committee and approved by our full Board, which includes Mr. Meche, our President and Chief Executive Officer.

Cash Compensation

In early 2017, following a review of director compensation by Aon Hewitt, the Compensation Committee’s independent consultant, the Board of Directors unanimously approved our non-employee director compensation program, consisting of the following cash components: (i) an annual fee paid to our Chairman of the Board of $140,000, (ii) an annual fee paid to each other non-employee director of $66,000, (iii) an additional annual fee of $12,000 paid to each of the chairs of the Audit Committee, the Corporate Governance and Nominating Committee, and the Compensation Committee, and (iv) an additional annual fee of $12,000 paid to the Audit Committee Financial Expert. This program remained in effect until May 2018. Effective May 1, 2018, considering the economic environment of the oil and gas and marine industries and challenges faced by the Company, the Board approved a

10% reduction in the directors’ annual retainers, decreasing the Chairman’s annual fee to $126,000 and the other directors’ annual fee to $59,400. The additional fees paid to our committee chairs and the Audit Committee financial expert remained the same. Directors do not receive additional fees for attending meetings of our Board and its committees; however, all directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of our Board and its committees. The table below summarizes total compensation paid to our directors.

Equity-Based Compensation

Each non-employee director also receives equity-based compensation under our stock incentive plans. Following Aon Hewitt’s review in early 2017, the Board of Directors unanimously approved an annual equity-based award to each of our non-employee directors with a grant date value of $75,000; provided, however, that in 2018, in light of industry conditions and the challenges faced by the Company, our Board approved a $10 floor price, which means that the per share value used to determine the number of shares subject to the award may not be less than $10 (capping the number of shares that may be subject to the award at 7,500).

Accordingly, on April 25, 2018, each of our then-current non-employee directors was granted 7,426 restricted stock units (“RSUs”), which vested on October 25, 2018, six months after the date of grant. Upon vesting, each RSU entitled the non-employee director to receive one share of our common stock, although each director, at his or her sole option, could elect to receive cash in lieu of shares of common stock for up to 50% of the vested award. Upon joining our Board in October and November 2018, respectively, each of Ms. Richard and Mr. Averick received a pro-rata equity-based award valued at approximately $18,750, representing 25% of the annual award value, which vest six months after the date of grant. Further, in accordance with the terms of the Cooperation Agreement, Mr. Averick will not receive any shares of common stock as compensation for his service as a director; therefore, his RSU award will be paid entirely in cash upon vesting. We expect to continue to make an annual grant of RSUs to our non-employee directors. As noted above, under our stock ownership guidelines, directors are required to own at least 15,000 shares of our common stock, no later than April 24, 2021 or five years after becoming a director, whichever is later.

2018 Director Compensation

The table below summarizes compensation earned for 2018 for each non-employee director serving as a director during 2018. Mr. Meche did not receive any compensation as a director, and his compensation as an executive of the Company is fully reflected in the 2018 Summary Compensation Table on page 30.

|

| | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash(1) | | Value of Stock Awards(2) | | Total |

Robert M. Averick | | $ | 14,850 |

| | $ | 16,500 |

| | $ | 31,350 |

|

Murray W. Burns | | 61,050 |

| | 75,000 |

| | 136,050 |

|

William E. Chiles | | 73,050 |

| | 75,000 |

| | 148,050 |

|

Gregory J. Cotter | | 73,050 |

| | 75,000 |

| | 148,050 |

|

Michael A. Flick | | 73,050 |

| | 75,000 |

| | 148,050 |

|

Christopher M. Harding | | 61,050 |

| | 75,000 |

| | 136,050 |

|

Michael J. Keeffe | | 73,050 |

| | 75,000 |

| | 148,050 |

|

John P. Laborde | | 129,500 |

| | 75,000 |

| | 204,500 |

|

Cheryl D. Richard | | 17,325 |

| | 17,344 |

| | 34,669 |

|

_______________

| |

(1) | Reflects fees earned by the directors during 2018 for their service on our Board and its committees, as applicable. |

| |

(2) | Reflects the aggregate grant date fair value of RSUs. RSUs are valued on the date of grant at the closing sale price per share of our common stock. On April 25, 2018, each of our then-current non-employee directors was granted 7,426 RSUs, with a grant date fair value of $10.10 per RSU. Upon her election to the Board on October 15, 2018, Ms. Richard was granted 1,875 RSUs with a grant date fair value of $9.25 per RSU, and upon his election to the Board on November 3, 2018, Mr. Averick was granted 1,875 RSUs with a grant date fair value of $8.80 per RSU. The number of shares granted for both of these grants were determined using the $10.00 floor price referenced above. As of December 31, 2018, each of Ms. Richard and Mr. Averick had 1,875 outstanding unvested RSUs, and no other directors had any unvested RSUs. |

PROPOSAL 1: ELECTION OF DIRECTORS

Our articles of incorporation provide for a Board of Directors consisting of three classes, with the number of directors to be set forth in our by-laws. Our by-laws allow for the number of directors constituting the entire Board of Directors to be a range of not less than three nor more than 12, with the exact number of directors to be fixed by a duly adopted resolution of the Board of Directors. The size of our Board is currently set at ten directors. The term of office of the Class I Directors will expire at the 2019 annual meeting and, in accordance with the recommendations of the Corporate Governance and Nominating Committee and the approval of the independent directors, our Board has nominated Murray W. Burns, William E. Chiles, and Michael A. Flick, the three persons listed as Class I director nominees in the table below, for election to our Board for a term expiring in 2022. Messrs. Burns, Chiles and Flick have each consented to being named as a nominee in this proxy statement and to serve as directors if elected.

Proxies cannot be voted more than one time for each of the three director nominees named in this proxy statement. In the unanticipated event that any nominee is unable to serve or for good cause will not serve as a candidate for director, the persons named in the accompanying proxy will vote your shares of our common stock for a substitute candidate nominated by our Board, unless otherwise directed.

Directors are elected by the affirmative vote of a majority of the votes cast with respect to each director (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee), except in the event of a contested election, in which case directors are elected by the affirmative vote of a plurality of the votes cast (meaning the three director nominees who receive the highest number of votes “for” their election are elected). A contested election occurs when the number of nominees for director exceeds the number of directors to be elected.

In the event an incumbent director nominee does not receive a majority of the votes cast in an uncontested election, such director must tender his resignation to the Corporate Governance and Nominating Committee which will consider the director’s offer of resignation and recommend to the Board whether to accept or reject the resignation, or whether other action should be taken. For additional information regarding the vote required and treatment of abstentions and broker non-votes, see “Questions and Answers about the Annual Meeting and Voting.”

Our Board unanimously recommends that you vote “FOR” the election of each of the three Class I director nominees named in this proxy statement.

Information about the Directors, Director Nominees and Executive Officers

The following table sets forth, as of March 21, 2019, for each director nominee, each other director of the Company whose term will continue after the annual meeting, and each of our executive officers, the age, any positions with the Company, principal occupations and employment during the past five years, any family relationships among such persons and, if a director nominee or a director, each such person’s directorships in other public corporations during the past five years and the year that such person was first elected a director of the Company. We have also included information about each director and director nominee’s specific experience, qualifications, attributes, or skills that led the Corporate Governance and Nominating Committee to recommend, and the independent directors of our Board to approve, that such person should serve as one of our directors at the time we file this proxy statement, in light of our business and board structure. All executive officers serve at the pleasure of our Board. Each Class I director nominee has consented to being named as a nominee in this proxy statement and to serve as a director if elected.

|

| | |

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

|

Nominees for Election as Continuing Class I Directors (term expires in 2022) |

| | |

Murray W. Burns, 73 | Mr. Burns has worked as a project management, engineering and business development consultant through MBurns Consulting since 2013. From 1980 to 2013, Mr. Burns was employed in various executive capacities by Technip USA, Inc. and its affiliates (“Technip”), which provide subsea, onshore/offshore and surface project management, construction and engineering. At Technip, his roles included: Vice President-Offshore Business Unit, Vice President-Topsides and Fixed Platforms, Vice President-Engineering Operations, Vice President-Engineering, President and COO (Technip Upstream Houston Inc.). From 1976 to 1980, Mr. Burns served as Project Manager, Group Manager, Manager of Facilities and Supervising Engineer with Petro-Marine Engineering, Inc., an engineering consulting firm specializing in services to the offshore petroleum and marine industries. Prior to 1976, Mr. Burns worked in various engineering capacities at Shell Oil Company, an oil and gas producer, marketer and manufacturer.

Mr. Burns’s experience and knowledge in engineering, fabrication, project execution and business development in the energy and offshore industries provide valuable insight and make him highly qualified to serve as a member of our Board, Compensation Committee and Corporate Governance and Nominating Committee.

| 2014 |

| | |

William E. Chiles, 70 | Mr. Chiles currently serves as Managing Partner of Pelican Energy Partners, a position he has held since 2014. Pelican Energy Partners is a private equity fund specializing in energy services and manufacturing investments. From July 2004 to July 2014, Mr. Chiles served as President, CEO and a director of the Bristow Group, Inc., a publicly traded global provider of offshore aviation services to the energy industry, and search & rescue services to the UK Maritime Coast Guard Agency. Mr. Chiles retired as President and CEO of Bristow in July 2014 but continued to serve as a Senior Advisor and as CEO Emeritus through July 2016. From 2003 to 2004, he served as Executive Vice President and COO of Grey Wolf Inc., a publicly traded onshore oil and gas drilling company. From 2002 to 2003, he served as Vice President of Business Development of ENSCO International. In 1997, Mr. Chiles founded Chiles Offshore, Inc. (“Chiles II”), a company that constructed and operating mobile offshore drilling rigs and served as President and CEO until its merger with ENSCO International Incorporated (“ENSCO”) in 2002. In 1992, he founded Southwestern Offshore Corporation, another offshore drilling operator, and served as CEO and President until its acquisition by Cliffs Drilling Company (“Cliffs”) in 1996. From 1996 to 1997, he served as Senior Vice President-Drilling Operations for Cliffs. In 1977, he co-founded Chiles Offshore Inc. (“Chiles I”), and served as President and CEO until 1992. Chiles I was acquired by Noble Drilling in 1994. Prior to 1977, he began his career working offshore in the North Sea for Western Oceanic, Inc., where he served as VP - Domestic Operations in Lafayette, Louisiana. Mr. Chiles served on the board of directors of Basic Energy Services, a publicly traded provider of wellsite services to oil and natural gas drilling and producing companies, from 2003 until December 2016.

Mr. Chiles’ broad international experience and knowledge of the oil and gas industry and our customer base, as well as his executive experience with various publicly traded companies, make him highly qualified to serve as a member of our Board and as Chairman of our Compensation Committee. | 2014 |

| | |

|

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

Nominee for Election as Continuing Class I Director (term expires in 2022) |

| | |

Michael A. Flick, 70 | Mr. Flick is a retired banking executive. From 1970 to 1998, Mr. Flick was employed by First Commerce Corporation, a bank holding company, and First National Bank of Commerce, its wholly-owned subsidiary, in various executive capacities including Chief Credit Policy Officer, Chief Financial Officer and Chief Administrative Officer. Mr. Flick formerly served as a member of the board of directors of the Bristow Group, Inc., a publicly traded global provider of industrial aviation services to the energy industry, and search & rescue services to the UK Maritime Coast Guard Agency, from 2006 to 2016, including as chairman of the compensation committee.

Mr. Flick’s experience in the banking and financial services industries and his role as a Chief Financial Officer and his public company board experience provide him with extensive knowledge of financial reporting, legal and audit compliance and risk management, making him highly qualified to serve as a member of our Board and the Audit Committee, the Compensation Committee, and the Chairman of the Corporate Governance and Nominating Committee.

| 2007 |

|

| | |

Continuing Class II Directors (term expires in 2020) |

| | |

Robert M. Averick, 53 | Mr. Averick has worked as a Portfolio Manager since 2012 at Kokino LLC, a private investment firm that provides investment management services to Piton Capital Partners LLC. Since 2016, Mr. Averick has served as a member of the Board of Directors of Amtech Systems, Inc., a publicly traded manufacturer of capital equipment. Mr. Averick formerly served as a member of the Board of Directors of Key Technology, Inc., a manufacturer of process automation systems for food processing and other industries, from 2016 until the company’s sale in 2018.

Mr. Averick has more than 18 years of experience as a small-capitalization, value-driven public equity portfolio manager. His experience in finance, strategic planning and consulting, as well as his public company board experience, provide him with valuable skills and expertise and make him highly qualified to serve as a member of our Board and Compensation Committee.

Mr. Averick was appointed to the Board pursuant to a Cooperation Agreement by and among the Company, Piton Capital Partners LLC and Kokino LLC dated November 2, 2018. Piton currently owns in excess of 9% of the outstanding shares of the Company. Pursuant to the terms of the agreement, the Board appointed Mr. Averick to the Compensation Committee effective November 3, 2018. | 2018 |

| | |

Gregory J. Cotter, 70 | Mr. Cotter has worked as a wealth management consultant since 2009. He was employed by Huey Wilson Interest, Inc., a business management service company, and its affiliates in various executive capacities, including Director, President, Chief Operating Officer and Chief Financial Officer from 1989 through 2008. Mr. Cotter served as Director, President, and Chief Operating Officer of a publicly traded multi-bank holding company from 1986 to 1988 and as Senior Vice-President and Chief Financial Officer of H.J. Wilson Co. Inc., a publicly traded retailer, from 1977 to May 1985.

Mr. Cotter’s extensive career in the banking and financial industries, as well as his public company executive and board experience, including as Chief Financial Officer, provide him with a knowledge of financial reporting, accounting and controls as well as a knowledge of operations and make him highly qualified to serve on our Board and as Chairman of our Audit Committee.

| 1985 |

| | |

| | |

| | |

|

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

Continuing Class II Directors (term expires in 2020) |

| | |

John P. (“Jack”) Laborde, 69 | Mr. Laborde has served as Chairman of our Board since 2013. Since 2002, he has served as President of Overboard Holdings, L.L.C. (“Overboard”), a management company engaged in oil and gas exploration and development, and since 1997, as President of All Aboard Development Corporation (“All Aboard”), an independent oil and gas exploration and production company. All Aboard is currently managed by Overboard. Mr. Laborde has also served as President of AVOCA, LLC (“AVOCA”) since 2014. AVOCA holds land and mineral rights in South Louisiana. Mr. Laborde was employed by the Company from 1992 until 1996 in various capacities, including International Marketing Manager. Prior to 1992, he worked as an engineer for Exxon Co. USA, an international oil and gas company, and in various capacities for Ocean Drilling & Exploration Company, an offshore drilling company, and Murphy Oil Corporation, an oil and gas exploration company.