EXHIBIT 10.2

AGREEMENT OF SALE

THIS AGREEMENT OF SALE made this 25th day of September 2018 (the “Effective Date”), by and between Berry Contracting, L.P., a Texas limited partnership, dba Bay, Ltd. (“Buyer”), and Gulf Marine Fabricators, L.P., a limited partnership (“Seller”).

W I T N E S E T H:

Seller desires to sell to Buyer those certain tracts of land, as further described on Exhibit A attached hereto, together with (a) all buildings, fixtures and other improvements thereon (the “Buildings”), (b) any and all heating, cooling, water/sewer, electrical, fire and other systems ordinarily installed in commercial structures in the Buildings for the purpose of providing utility services, ventilation, or other amenities to the Buildings, (c) all parking and other exterior improvements upon the Property, (d) all strips, gores, and land adjacent to the Property (to the extent any may or may not be present), as well as all rights of way, easements, appurtenances, and air and subsurface rights, if any, used or connected with the beneficial use or enjoyment of the Property, and (e) all warranties and guaranties, licenses, approvals, or permits which relate to the ownership, maintenance or operation of the Property, if any and to the extent assignable, all right, title and interest of Seller in all mineral and development rights appurtenant to such Property, if any, and all water rights associated with such Property (collectively, the “Premises”). Seller also desires to sell to Buyer the equipment described on Exhibit B attached thereto (the “Equipment”).

Buyer desires to purchase the Premises and Equipment on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, the undersigned, with the intention to be legally bound hereby, and in consideration of the mutual promises herein, agree as follows:

1. Sale of Premises and Equipment. Seller agrees to sell and convey to Buyer, and Buyer agrees to purchase, the Premises and Equipment.

2. Purchase Price and Transaction Costs. The total consideration or purchase price (“Purchase Price”) for the sale and purchase of the Premises and Equipment shall be Twenty-Eight Million Dollars ($28,000,000.00), payable as follows:

(a) Five Hundred Thousand Dollars ($500,000.00) non-refundable deposit (the “Deposit”) payable by wire transfer on the Effective Date to Seller’s account set forth on Exhibit C, (as may be updated by Seller with written notice to Buyer, “Seller’s Account”).

(b) The balance of the Purchase Price by wire transfer to Seller’s Account.

(c) As separate consideration for Seller entering into this Agreement, Buyer has delivered to Seller the sum of One Hundred and no/100 Dollars ($100.00), which consideration shall be provided as of the Effective Date.

(d) At Settlement, Seller agrees to pay (i) the legal fees of the attorneys representing Seller, (ii) document recording fees for release of debt, liens or other encumbrances

arising by, through, or under Seller; (iii) one-half of the Title Company’s escrow or closing fee; (iv) the basic premium for the Owner’s Title Policy to be issued to Buyer upon Settlement. At Settlement, Buyer agrees to pay (i) the legal fees of the attorneys representing Buyer; (ii) the document recording fees for the Deed (as defined below); (iii) recording fees for any documents executed and recorded in connection with Buyer’s financing; (iv) premiums and fees for all endorsements to the Owner’s Title Policy or any mortgagee’s title policy required by Buyer’s lender; (v) one-half of the Title Company’s escrow or closing fee. Any other costs of closing or Settlement shall be apportioned in the manner of commercial real estate transactions in San Patricio County, Texas.

3. Condition of Property. Buyer accepts the Premises in “AS IS” condition as of the Effective Date, it being hereby expressly understood that Seller has made no representations or warranties with respect to the Premises except as are expressly set forth in this Agreement and in the Deed and other closing documents to be delivered by Seller at Settlement, and that by proceeding to Settlement Buyer acknowledges that it is satisfied therewith.

4. Title; Survey.

(a) Title to the Premises shall be free and clear of all liens, restrictions, easements and other encumbrances and title objections, except for the Permitted Title Exceptions (as hereinafter defined), and shall be insurable as such at ordinary rates by a reputable title insurance company selected by Seller.

(b) (i) Promptly after the execution and delivery of this Agreement, Seller shall order a preliminary title report and/or commitment for title insurance for the Property (“Title Report”) from Alamo Title Company, Attn: Dave Pitschmann, Tel: 713-993-2998; email: david.pitschmann@alamotitle.com, 1800 Bering Dr Ste 150, Houston, TX 77057-3738 (the “Title Company”), which Title Policy shall be in the amount of the Purchase Price and shall guarantee title to the Property to be vested in Buyer subject only to the Permitted Title Exceptions, together with copies of all instruments listed as Exceptions therein. Seller shall provide Buyer the Title Report within ten (10) days after the Effective Date. Within five (5) business days after the Effective Date, Seller shall deliver to Buyer its existing survey of the Property, if any (the “Existing Survey”). Buyer, at Buyer’ s expense, shall either cause an update of the Existing Survey to be made, or obtain a survey (the “Survey”) of the Property within thirty (30) days after the Effective Date. Upon approval by Buyer, Seller and the Title Company, any field notes prepared by the surveyor in connection with the Survey shall control any conflicts or inconsistencies with the legal description on Exhibit “A”, and shall be incorporated into this Agreement upon their completion and be used in the Deed to be delivered to Buyer at Settlement. (c) (i) Buyer may notify Seller of any objections Buyer may have with respect to the Exceptions (as hereinafter defined) on or before expiration of the Inspection Period (as defined below). “Exceptions” shall mean all liens, restrictions, reservations, outstanding mineral rights, leases, easements, rights-of-way, encroachments, encumbrances, title exceptions or defects and other matters affecting title to the Property which are disclosed in the Title Report or are shown on the Survey.

(ii) If Buyer does not so notify Seller of any objections to the Exceptions on or before expiration of the Inspection Period, then Buyer shall be deemed to have waived any objections to such Exceptions and such Exceptions shall also be deemed “Permitted Title

Exceptions,” for purposes of the sale of the Premises, and Buyer shall purchase the Premises subject to such Permitted Title Exceptions. Any liens or other items identified on Schedule C of the Title Reports for the Property, except for the lien for the year of closing for taxes and assessments which are not yet due and payable, shall automatically constitute objections.

(iii) For purposes of this Agreement, “Permitted Title Exceptions” shall mean and include the following:

(A) Ad valorem real estate taxes due for 2018 and subsequent years.

(B) All applicable zoning ordinances and governmental regulations.

(C) Any and all easements, conditions, restrictions, rights-of-way, survey exceptions, encroachments and other encumbrances listed as Exceptions on the Title Report or identified on the Survey that Buyer does not provide objection in accordance with Section 4(b)(ii) above.

(d) Seller shall have the obligation to use good faith efforts to cure such objections, but Seller shall not be obligated to bring suit or to incur costs or liability to cure same. Further, Seller shall cause all liens securing indebtedness of Seller on the Property arising by, through or under Seller, to be released on or prior to Settlement, except for the lien for the year of closing for taxes and assessments which are not yet due and payable, and Seller shall apply such portion of the Purchase Price as may be required to satisfy such liens should any remain unreleased at Settlement. If Seller has not, within three (3) days prior to Settlement, cured all Exceptions that are not Permitted Title Exceptions and which Buyer made objection pursuant to Section 4(b)(ii) above, other than those to be cured and/or satisfied at the Settlement, Buyer shall have the option of either taking such title as Seller can convey or of canceling this Agreement in which case the Deposit shall be returned to Buyer, and neither Buyer nor Seller shall have any further rights or obligations hereunder. If any revised Title Report or Survey or any amendments thereto disclose any exceptions or encumbrances in addition to those previously included on the Title Report or Survey, those additional items shall be deemed to be title objections.

5. Conditions to Settlement.

(a) Buyer’s obligation to complete Settlement under this Agreement is expressly conditioned upon the following, and Buyer shall have the further right, exercisable at any time and from time to time, to waive any one or more of such conditions without affecting any of Buyer’s other rights, conditions or obligations:

(i) all representations and warranties of Seller herein being true and correct at the time of Settlement; and

(ii) Seller having performed all of its covenants and obligations hereunder; and

(iii) the delivery of those items to be delivered by Seller at Settlement and during the Inspection Period as provided herein;

(iv) the expiration of the Inspection Period, without Buyer having terminated this Agreement;

(v) the Title Company shall have irrevocably committed to issue a Texas Owner’s Policy of title insurance in the amount of the Sales Price and in the form agreed upon pursuant to Section 4;

(vi) the City of Aransas Pass has provided consent to the assignment of the Industrial District Agreement (as defined below), as modified by the Settlement Agreement (as defined below) to Buyer, and any required consents to the assignment of any other permits, approvals or licenses held by Seller pertaining to the operation and maintenance of the Premises; and

(vii) The Port of Corpus Christi Authority of Nueces County, Texas has provided consent to the assignment of its Franchise Agreement with Seller to Buyer.

(b) If any of the conditions of Section 5(a) above are not satisfied in Buyer’s reasonable determination (and not waived by Buyer) prior to the Settlement Date, or such other time-period provided, as applicable, then Buyer shall have the option of (i) completing Settlement hereunder at the Purchase Price, or (ii) terminating this Agreement in which case this Agreement shall become null and void, and the Deposit shall be returned to Buyer, and neither Buyer nor Seller shall have any further rights or obligations hereunder.

(c) Seller’s obligation to complete Settlement under this Agreement is expressly conditioned upon the following, and Seller shall have the further right, exercisable at any time and from time to time, to waive any one or more of such conditions without affecting any of Seller’s other rights, conditions or obligations:

(i) all representations and warranties of Buyer herein being true and correct at the time of Settlement; and

(ii) Buyer having performed all of its covenants and obligations hereunder;

(iii) the City of Aransas Pass has provided consent to the assignment of the Industrial District Agreement (as defined below), as modified by the Settlement Agreement (as defined below) to Buyer, and any required consents to the assignment of any other permits, approvals or licenses held by Seller pertaining to the operation and maintenance of the Premises;

(iv) The Port of Corpus Christi Authority of Nueces County, Texas has provided consent to the assignment of its Franchise Agreement with Seller to Buyer; and

(v) the delivery of those items to be delivered by Buyer at Settlement and during the Inspection Period as provided herein.

(c) Seller and Buyer each hereby agrees to cooperate reasonably with each other, in good faith, in connection with the pursuit of the satisfaction of all conditions to Settlement

hereunder and agrees to promptly execute all zoning approval applications and related documentation required to be signed by the owner of the Premises, as well as to attend municipal meetings and to testify thereat, if necessary.

6. Time and Place of Settlement. Subject to Section 5, closing or settlement hereunder (“Settlement”) shall be held at the offices of the Title Company, via document delivery, on the fifteenth (15th) day of November 2018 or such earlier date as mutually agreed upon by the parties or as extended pursuant to below (the “Settlement Date”); provided, however, Seller shall have reasonable access for not more than thirty (30) days following the Settlement Date to remove any personal property and equipment that is not included in the Equipment being transferred to Buyer from the Premises, at Seller’s sole cost and expense, and Seller covenants that it will repair any damage to the Property caused by such removal. The foregoing covenant is not subject to the remedy limitations contained in Section 14(b). Any personal property and equipment of Seller remaining on the Premises after such thirty (30) day period may be disposed of by Buyer in Buyer’s sole and absolute discretion, and Seller waives all rights or claims thereto.

7. Possession. Subject to the access and removal rights of Section 6 above, exclusive possession of the Property shall be given Buyer by delivery of the Deed at Settlement, at which time the Premises shall be entirely vacant.

8. Inspection Period.

(a) For a period of thirty (30) days after the Effective Date (the “Inspection Period”), Buyer shall have the right to conduct, at Buyer’s sole expense, whatever inspections, investigations, analyses and studies of the Property (collectively, “Inspections”) that Buyer may desire; provided that Buyer provides Seller at least twenty-four (24) hours advance notice prior to conducting any Inspections which requires access to the Property, and should any Inspections require any changes or alterations to the Property (e.g. soil boring, removing any portion of the Property, etc.), Buyer shall first obtain Seller’s prior written consent before conducting any such Inspections, which consent may be withheld in Seller’s sole discretion.

(b) Buyer hereby agrees to and does indemnify, defend, and hold Seller harmless from all liabilities, damages, claims, costs, or expenses whatsoever (including injury, death, or property damage) resulting from any Inspections conducted by or on behalf of Buyer. If Buyer’s Inspections reveal any matters that may require governmental reporting, Buyer hereby acknowledges and agrees that Seller shall solely handle any such reporting, to the extent Seller’s attorneys determine that such reporting is required by applicable law. Buyer further agrees to repair any damages to the Property caused by any Inspections performed on the Property by or on behalf of Seller and to return the Property to the condition existing prior to any Inspections. The provisions of this Section shall survive the Settlement Date or the termination or cancellation of this Agreement and shall not be subject to the remedy limitations set forth in Section 14.

(c) Within five (5) business days after the Effective Date, Seller shall deliver to Buyer, at Seller's sole cost and expense, copies of all of the following documents and information within the Seller's possession and to the extent readily available to Seller (collectively, the "Review Documents"): (a) all pleadings in connection with any actual or threatened lawsuits or claims

affecting any of the Property; (b) except for instruments recorded in the public records and listed as exceptions on the Title Report, any and all contracts or agreements which in any way bind the Property or bind Seller with respect to the Property and would be binding on Buyer after Settlement, including but not limited to (i) the sale, purchase, lease, or transfer of any interest in the Property, and (ii) the construction, development, management, repair or maintenance of improvements on the Property; (c) any and all permits, approvals, or pending applications for the same with any governmental entity or utility (whether public or private) which relate in any way to the development, ownership, use or operation of the Property, including but not limited to site plans, building permits, certificates of occupancy and subdivision plats; (d) any environmental or similar studies or reports relating to the Property; and (e) property tax bills or statements for the current (if any) and preceding two (2) years. All such Review Documents shall be delivered or made available without any representation or warranty as to the completeness or accuracy of the data or information contained therein, and all such Review Documents are furnished to Buyer solely as a courtesy, and Seller has neither verified the accuracy of any statements or other information therein contained, the method used to compile such information nor the qualifications of the persons preparing such information. The Review Documents are provided on an AS-IS-WHERE-IS BASIS, AND BUYER EXPRESSLY ACKNOWLEDGES THAT SELLER MAKES NO REPRESENTATION, EXPRESS OR IMPLIED, OR ARISING BY OPERATION OF LAW, INCLUDING, BUT IN NO WAY LIMITED TO, ANY WARRANTY OF CONDITION, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE AS TO THE REVIEW DOCUMENTS. Without Seller’s prior written consent, Buyer: (i) shall not divulge to any third party any of the Review Documents, except in connection with the evaluation of the acquisition of the Property; (ii) shall ensure that the Review Documents are disclosed only to such of Buyer’s officers, directors, employees, consultants, investors and lenders, as have actual need for the information in evaluating the Property and that prior to Settlement all such parties shall treat the Review Documents as confidential and proprietary to Seller; (iii) shall act diligently to prevent any further disclosure of the information; and (iv) shall, if the Settlement does not occur for any reason, promptly return to Seller (without keeping copies) all Review Documents. Seller’s obligations to deliver the Review Documents shall be deemed satisfied unless Buyer objects to what Seller provides within fifteen (15) days after the Effective Date.

Except as expressly represented by Seller herein, Purchaser will rely solely on its own investigation of the Property and not on any information provided by Seller, its agents, or its contractors. Seller will not be liable or bound in any way by any oral or written statements, representations or information about the Property or its operation furnished by any party purporting to act on Seller’s behalf.

(d) If after Buyer has completed its Inspections, Buyer determines that the Property is not suitable for Buyer, for any reason or for no reason, in Buyer’s sole and absolute discretion, Buyer may terminate this Agreement by notifying Seller of such termination before the expiration of the Inspection Period, whereupon both parties shall be released from all further obligations under this Agreement (except as otherwise provided herein).

9. Taxes – Apportionments; Excluded Tax Litigation.

(a) Real estate taxes and water and sewer rents, if any, shall be apportioned pro rata on a (calendar-fiscal) basis as of the date of Settlement. Ad valorem taxes for the year in which the Settlement occurs shall be prorated between Seller and Buyer as of the Settlement Date; provided, however, that Seller shall receive the full credit at the Settlement against Seller’s pro rata share of 2018 ad valorem taxes owed pursuant to that certain Settlement Agreement between Seller and the City of Aransas Pass, dated June 17, 2016 (the “Settlement Agreement”). If the amount of the ad valorem taxes for the year in which the Settlement Date occurs is not known on the Settlement Date, then the ad valorem taxes for the year in which the Settlement occurs shall be prorated initially on the basis of the ad valorem taxes for the previous year but that, when the amount of the ad valorem taxes for the year in which the Settlement occurs becomes known, such estimated proration shall be adjusted between the parties hereto (if necessary) so that such proration will be finally based upon the actual ad valorem taxes for the year in which the Settlement occurs. In the event that the Premises is taxed as part of a larger tract, taxes shall be allocated on a square footage basis. The provisions of this subparagraph shall survive the Settlement.

(b) Seller (i) is currently in discussions with the City of Aransas Pass regarding the overpayment of taxes on the Property pursuant to the terms of that certain Industrial District Agreement No. 8, effective as of January 1, 2016 (the “Industrial District Agreement”) for 2018 and all prior years, and (ii) has filed a civil action against San Patricio in the 36th Judicial District, County Docket # S-17-5706CV-A (collectively, the “Excluded Tax Proceedings”). Seller and Buyer acknowledge and agree all rights and claims regarding the overpayment of taxes on the Property for years prior to 2019 shall be retained by Seller and excluded from the sale of the Property, including such rights and claims asserted by Seller in the Excluded Tax Proceedings. Seller shall also have the exclusive right to continue the prosecution of the Excluded Tax Proceedings and any tax refund or other abatement application or proceeding after Settlement with respect to taxes applicable to 2018 on behalf of Seller and Buyer and due and payable in 2019 by Buyer; provided, however, that (i) Seller shall keep Buyer apprised of such proceedings and (ii) any settlement shall not reference or include any agreement relating to any taxes applicable to any tax years following taxes applicable to 2018, without obtaining the approval of Buyer to such settlement or compromise, such approval not to be unreasonably withheld, delayed or conditioned. With respect to taxes applicable to 2018 only, the amount of any refund, abatement or reduction actually obtained, less the actual, reasonable third party costs of obtaining the same (including reasonable attorney’s fees) (the “Tax Abatement Amount”), shall be apportioned between the parties based on their relative periods of ownership of the Property during the 2018 calendar year; and upon Seller receiving a cash refund, Seller shall provide to Buyer its pro rata share of the Tax Abatement Amount within fifteen (15) business days after receipt of such refund.

10. Representations, Warranties and Covenants.

(a) Seller’s Authority. As a material inducement to cause Buyer to enter into this Agreement, Seller represents and warrants that this Agreement and all agreements, instruments and documents to be executed by Seller are duly authorized, executed and delivered by the Seller; that Seller is duly authorized and qualified to do all things required of it under this Agreement; and Seller has the capacity and authority to consummate the transactions herein provided and nothing

prohibits or restricts the right or ability of Seller to close the transactions contemplated hereunder and carry out the terms hereof.

(b) Buyer’s Authority. As a material inducement to cause Seller to enter into this Agreement, Buyer represents and warrants that this Agreement and all agreements, instruments and documents to be executed by Buyer are duly authorized, executed and delivered by the Buyer; that Buyer is duly authorized and qualified to do all things required of it under this Agreement; Buyer has the capacity and authority to consummate the transactions herein provided and nothing prohibits or restricts the right or ability of Buyer to close the transactions contemplated hereunder and carry out the terms hereof.

(c) Foreign Person. Seller represents and warrants that it is not a foreign person as defined in Section 1445(f)(3) of the Code.

(d) Access. From the Effective Date until Settlement, Seller shall afford Buyer and its representatives and consultants the continuing right to inspect the Property at all reasonable hours, subject to the provisions of Section 8 hereof (including without limitation providing Seller at least twenty-four (24) hours advance notice).

(e) Maintenance. From the Effective Date until Settlement, Seller shall (i) maintain the Property in accordance with sound and prudent practices, and not commit or permit to be committed any waste to the Property, (ii) not enter into any agreement or instrument, or amend any existing agreement or instrument, with regard to the Property or take any action which would constitute a lien or other encumbrance of the Property which would not be paid off and released at Settlement, or which would be binding on Buyer after the Settlement Date, or which would be outside the normal scope of maintaining the Property, all without the prior written consent of Buyer, (iii) afford Buyer and its representatives and consultants the continuing right to inspect and have access to the Review Documents; (iv) keep, maintain and repair the Property in the substantially the same manner Seller has done as of the Effective Date, and comply in all material respects with all laws and regulations affecting the Property, and maintain (and renew if necessary) all governmental licenses, permits and approvals held by Seller as of the Effective Date.

(f) Bills. Seller represents and warrants that all bills and other payments then due and owing from Seller with respect to work performed or materials provided for the Property will be paid or satisfied prior to or at Settlement.

(g) Actions and Proceedings. Except for the Excluded Tax Proceedings, Seller represents and warrants that there is no action, proceeding, suit or investigation pending or being prosecuted to which Seller is a party in any court or by or before any governmental entity affecting the Property, or the ownership, operation, use or condition of the Property and to Seller's Knowledge, no action, suit, proceeding or investigation is contemplated or threatened, including, but not limited to any pending, contemplated or threatened action, suit, proceeding or investigation relating to condemnation, eminent domain or offers of just compensation by or on behalf of any governmental or other entity having eminent domain power. “Seller’s Knowledge” shall mean the current actual knowledge of Kirk J. Meche, without any duty of inquiry or investigation by him.

(h) Conflict with Existing Agreements. Seller represents and warrants that neither the execution, delivery or performance of this Agreement nor compliance herewith conflicts or will conflict with or results or will result in a breach of or constitutes or will constitute a default under (a) the organizational or governing documents of Seller, (b) any law or any order, writ, injunction or decree of any court or governmental authority, or (c) any other contract or agreement to which Seller is a party; or results in the creation or imposition of any lien, charge or encumbrance upon its property pursuant to any such agreement or instrument.

(i) Parties in Possession. Seller represents and warrants that to Seller's Knowledge, there are no parties in possession of any portion of the Property as lessees, licensees, or tenants at sufferance.

(j) Seller Obligations. Seller represents and warrants that to Seller's Knowledge, all obligations of Seller arising from the ownership and operation of the Property, including, but not limited to, salaries, employee compensation, taxes, leasing commissions and the like, have been paid as they became due or will be paid at or prior to Settlement. Except for obligations for which provisions are made herein for assumption by Buyer, proration or other adjustment at Settlement, to Seller's Knowledge, there will be no obligations of Seller with respect to the Property outstanding as of Settlement which could give rise to a lien on the Property.

(k) Attachments; Assignments. Seller represents and warrants that to Seller's Knowledge, there are no attachments, executions, assignments for the benefit of creditors or voluntary or involuntary proceedings in bankruptcy or under any other debtor relief laws contemplated by or pending or threatened against Seller or the Property.

(l) Environmental. Seller represents and warrants that except as may be set forth in the Review Documents or otherwise disclosed to Buyer, to Seller’s Knowledge, Seller has not received written notice from any governmental authorities in the preceding three (3) years that the Property contains hazardous materials in violation of applicable laws, or has been used for the storage or disposal of any hazardous or toxic materials in violation of applicable laws.

(m) Title. The Property has not been assigned or conveyed to any party by Seller. Seller has the right to convey fee simple title to the Property pursuant to the terms of this Agreement. No person (other than Buyer pursuant to this Agreement) has a right to acquire any interest in the Property.

(n) Seller Insolvency Proceedings. Seller represents and warrants that Seller has not: (i) filed any voluntary or had involuntarily filed against it in any court or with any governmental body pursuant to any statute either of the United States or of any State, a petition in bankruptcy or insolvency or seeking to effect any plan or other arrangement with creditors, or seeking the appointment of a receiver; (ii) had a receiver, conservator or liquidating agent or similar person appointed for all or a substantial portion of its assets; (iii) suffered the attachment or other judicial seizure of all, or substantially all of its assets; (iv) given notice to any person or governmental body of insolvency; or (v) made an assignment for the benefit of its creditors or taken any other similar action for the protection or benefit of its creditors. Seller is not insolvent and will not be rendered insolvent by the performance of its obligations under this Agreement.

(o) Buyer Insolvency Proceedings. Buyer represents and warrants that Buyer has not: (i) filed any voluntary or had involuntarily filed against it in any court or with any governmental body pursuant to any statute either of the United States or of any State, a petition in bankruptcy or insolvency or seeking to effect any plan or other arrangement with creditors, or seeking the appointment of a receiver; (ii) had a receiver, conservator or liquidating agent or similar person appointed for all or a substantial portion of its assets; (iii) suffered the attachment or other judicial seizure of all, or substantially all of its assets; (iv) given notice to any person or governmental body of insolvency; or (v) made an assignment for the benefit of its creditors or taken any other similar action for the protection or benefit of its creditors. Buyer is not insolvent and will not be rendered insolvent by the performance of its obligations under this Agreement.

(p) Employees. Seller represents and warrants that there are no employees of Seller at the Property, for whom Buyer will be obligated for the payment of salaries or benefits unless Buyer elects to continue the employment of such employees.

(q) Operational Covenants. Seller shall not, without the prior written consent of Buyer, enter into any written or oral service contract with respect to the Property that will not be fully performed on or before Settlement, or that will not be cancelable by Buyer with thirty (30) days' notice without penalty, fee or liability on or after Settlement. Seller shall promptly advise Buyer of any litigation, arbitration, administrative hearing or legislation before any governmental body or agency in addition to the Excluded Tax Proceedings of which Seller becomes aware, concerning or affecting the Property, which is instituted or threatened after the Effective Date hereof. Seller shall maintain and keep in full force and effect the present fire, casualty and liability insurance maintained by Seller with regard to the Property. Seller shall not further encumber or allow the encumbrance of the title to the Property, or modify the terms or conditions of any existing encumbrances, which will not be released at Settlement without the prior written consent of Buyer.

(r) Material Changes. Seller shall promptly notify Buyer of any material change in any condition with respect to Seller or of any event or circumstance which makes any representation or warranty of Seller to Buyer under this Agreement incorrect and would materially adversely affect the use of the Property. Buyer shall promptly notify Seller of any material change in any condition with respect to Buyer or of any event or circumstance which makes any representation or warranty of Buyer to Seller under this Agreement incorrect and would materially adversely affect Buyer’s ability to perform Buyer’s obligations under this Agreement.

(s) Waiver or Termination. If either party discovers or is advised by the other in writing that any of such party’s warranties and representations are materially incorrect as of the Settlement, then party receiving such notice may either (i) waive objection and any claim thereto and close, without reduction of the Purchase Price; or (ii) terminate this Agreement and pursue its remedies in accordance with Section 14 hereof.

(t) Brokerage. At Settlement, Seller will pay the agreed upon brokerage commission to CBRE who shall pay NAI Partners per a separate agreement (collectively, the “Brokers”). Buyer and Seller each represents and warrants to the other that it has had no dealings, negotiations or consultations with respect to the Premises or this transaction with any broker or intermediary other than the Brokers. In the event that any broker or intermediary other than the

Brokers claim a fee or commission in connection with this Agreement based upon the acts of Buyer or Seller, that party will be responsible for and will indemnify and save the other harmless from and against all costs, damages, fees (including, without limitation, reasonable attorney’s fees), expenses, liabilities, and claims incurred or suffered by the other as a result thereof.

11. Documents to be Delivered at Settlement. At Settlement, Seller and/or Buyer will deliver to the other and/or the Title Company as applicable the following, executed, acknowledged and in recordable form, as appropriate:

(a) a Special Warranty Deed in the form of Exhibit D attached hereto (the “Deed”), that conveys to Buyer the Property;

(b) a No Warranty Bill of Sale in the form of Exhibit E attached hereto (the “Bill of Sale”), that conveys to Buyer the Equipment;

(c) assignment and assumption instruments assigning to Buyer the Industrial District Agreement (as modified by the Settlement Agreement), any certificate of occupancy, other permits, approvals or licenses held by Seller pertaining to the operation and maintenance of the Premises to the extent such can be assigned, and the other property interests described in the definition of the “Property” on page 1 hereof;

(d) evidence reasonably satisfactory to the Title Company that Seller and Buyer and persons acting on behalf of Seller and Buyer are fully authorized and have the capacity to consummate the transaction contemplated by this Agreement;

(e) a certificate of Seller in a form acceptable to the Title Company stating that Seller is a U.S. taxpayer and is not a foreign entity or person in accordance with applicable law and the regulations of the Internal Revenue Code of 1986, as amended;

(f) certificates evidencing the payment of ad valorem taxes on the Premises for all years prior to the year in which the Settlement occurs furnished by the Title Company;

(g) such evidence, documents, affidavits and indemnifications executed and/or delivered by Seller as may be reasonably required by the Title Company and in form acceptable to Seller as a precondition to the issuance of the Owner’s Title Policy relating to: (i) mechanics’ or materialmen’s liens; (ii) parties in possession; (iii) the status and capacity of Seller and the authority of the person or persons who are executing the various documents on behalf of Seller in connection with the sale of the Property; or (iv) any other matter reasonably required to enable the Title Company to issue the Title Policy and endorsements thereto;

(h) such evidence, documents, affidavits and indemnifications executed and/or delivered by Buyer as may be reasonably required by the Title Company and in form acceptable to Buyer as a precondition to the issuance of the Title Policy including documents evidencing the status and capacity of Buyer and the authority of the person or persons who are executing the various documents on behalf of Buyer in connection with the sale of the Property, or any other matter

reasonably required to enable the Title Company to issue the Title Policy and endorsements thereto; and

(i) such other documents as may be reasonably required by the Title Company to effectuate this Agreement.

At Settlement, Buyer shall deliver the balance of the Purchase Price and such other documents as may reasonably be required to effectuate this Agreement. At Settlement, Seller and Buyer shall deliver resolutions authorizing such party’s execution, delivery and performance of this Agreement and the other documents contemplated for this transaction. At Settlement, the amount of prorations and adjustments shall be determined or estimated to the extent practicable, and monetary adjustment shall be made between Seller and Buyer. As the amounts of the respective items become finally ascertained, further adjustment shall be promptly made between the parties in cash, provided however, no reconciliation, re-proration, or adjustment may be made more than one (1) year following the Settlement Date except with respect to the Excluded Tax Proceedings.

12. Casualty. All risk of loss with respect to the Property shall be with Seller until Settlement. If on or before the Settlement Date all or any part of the Premises is destroyed or damaged by fire, casualty or any other cause (“Casualty”), Seller shall promptly notify Buyer thereof. If the cost to repair the damage (as reasonably estimated by an architect or general contractor mutually-approved by Buyer and Seller) exceeds five percent (5%) of the Purchase Price, Seller or Buyer shall have the right to terminate this Agreement. Should either party terminate this Agreement pursuant to the foregoing, the Deposit shall be returned to Buyer, whereupon both parties shall be released from all further obligations under this Agreement (except as otherwise provided herein). If neither party elects to terminate this Agreement pursuant to its right contained in this Section 12, Buyer shall be bound to purchase the Premises without reduction in the Purchase Price, and Seller shall either (a) cause the repairs to the portions of the Premises that are damaged or destroyed to be made within a commercially reasonable time following the applicable Casualty event, or (b) pay to Buyer at Settlement the estimated costs to repair or remedy the damage to the Premises (as determined by the architect or general contractor selected by Buyer and Seller as set forth above) and Seller shall retain the right to all applicable insurance proceeds payable in connection with such Casualty.

13. Eminent Domain.

(a) In the event Seller receives any notice of any condemnation proceedings, or other proceedings in the nature of eminent domain, it will forthwith send a copy of such notice to Buyer. If all or any fee simple title to the Property is taken by eminent domain and the use of the Premises shall be materially affected as a result thereof, Buyer may, upon written notice to Seller, elect to cancel this Agreement, and in such event the Deposit shall be returned to Buyer and neither party shall have any further liability or obligation hereunder.

(b) If all or any portion of the Premises has been or is hereafter taken or condemned and this Agreement is not cancelled, Buyer shall have the right to negotiate, settle, or litigate the condemnation award related to the Premises. The proceeds of any such award collected prior to Settlement shall be paid or credited to Buyer at Settlement, and Seller shall, at Settlement,

credit or assign to Buyer all of Seller’s right, title and interest in and to any awards in condemnation, or damages of any kind, to which Seller may have become entitled or may thereafter be entitled by reason of any exercise of the power of eminent domain with respect to or for the taking of the Premises or any portion thereof.

14. Default.

(a) In the event Buyer fails to consummate the Settlement in accordance with the terms of this Agreement, then Seller, as Seller’s sole remedy, may cancel this Agreement by written notice delivered to Buyer and the Title Company, Seller shall retain the Deposit, and whereupon both parties shall be released from all further obligations under this Agreement (except as otherwise provided herein). The retention of the Deposit as a result of Buyer’s default hereunder is in the nature of liquidated damages (and not as a penalty). It is stipulated that the actual amount of any such damages would be difficult if not impossible to determine because of the uncertainties of the real estate market and fluctuating property values and differences of opinion with reference to such matters and that the Deposit is a reasonable estimate by the parties hereto of the damages which Seller will incur in the event of a default hereunder by Buyer.

(b) Should Seller fail to perform any of Seller’s obligations under this Agreement at or prior to Settlement then Buyer shall have the right to either (i) terminate this Agreement, whereupon the Deposit shall be returned to Buyer and Buyer shall be entitled to recover from Seller Buyer’s actual out-of-pocket expenses incurred in connection with this transaction up to a maximum aggregate amount of Fifty Thousand and no/100 Dollars ($50,000.00), and thereafter neither Seller nor Buyer shall have any further rights or obligations hereunder except as expressly survive the termination of this Agreement; or (ii) proceed with any other rights or remedies available to Buyer, whether legal and/or equitable, including the remedy of specific performance of this Agreement. Buyer shall provide written notice to Seller of any pre-Settlement breach of any of Seller's warranties or representations or pre-Settlement breach of any of Seller's covenants of which Buyer acquires knowledge, through any means, at any time after the Settlement Date, and Buyer may bring an action at law for damages as a consequence thereof, which must be commenced, if at all, prior to the expiration of two (2) years and one (1) day following the Settlement Date. Notwithstanding anything herein to the contrary, Buyer shall not be entitled to make a claim against Seller after the Settlement Date for a violation of Seller’s representations, warranties, and covenants unless the amount of damages to Buyer equals or exceeds Two Hundred and Fifty Thousand and no/100 Dollars ($250,000.00) (but for such claim exceeding $250,000.00, such initial $250,000.00 shall be included in such claim) in the aggregate of all such claims.

15. Survival of Warranties. The representations, warranties, and covenants made under this Agreement shall survive for two (2) years and one (1) day after the Settlement Date, except for any additional time is required solely with respect to the re-subdivision obligations under Section 4(e).

16. Assignment. Buyer shall have the right to assign this Agreement but shall remain liable hereunder regardless of any such assignment, and Seller agrees to convey the Premises to any nominee or assignee of Buyer.

17. Notices. All notices required or permitted to be given hereunder shall be in writing and sent by certified mail, return receipt requested, or by a nationally recognized overnight delivery service, such as Federal Express, or by telecopy or electronic mail, addressed to the intended recipient as follows:

If to Buyer Berry Contracting, L.P., dba Bay, Ltd.

Attn: Chuck Vanaman, Vice President

1414 Valero Way

Corpus Christi, Texas 78409

Tel: 361-693-2100

Fax: 361-693-2822

with a copy to Jeb Brown

Attorney at Law

3100 Edloe Street Suite 220

Houston, TX 77027

Tel: 713-439-1988

Fax: 832-460-3263

If to Seller Gulf Marine Fabricators, L.P.

16225 Park Ten Place, Suite 280

Houston, TX 77084

Attn: Kirk Meche, President/CEO

Tel: 713-714-6100

Fax: 713-714-6130

with a copy to Jones Walker LLP

201 St. Charles Avenue

P.O. Box 673

New Orleans, LA 70170

Attn: Chris Capitelli

Tel: 504-582-8454

Fax: 504-589-8454

or to such other person or address as the party to be charged with such notice may designate by notice given in the aforesaid manner. Notice may be given by counsel.

18. Parties Bound. This Agreement shall be binding upon the parties hereto and their respective heirs, administrators, executors, successors, and assigns.

19. Captions. The captions contained herein are not a part of this Agreement. They are only for the convenience of the parties and do not in any way modify, amplify, or give full notice of any of the terms, covenants or conditions of this Agreement.

20. Number and Gender. For purpose of this Agreement, the masculine shall be deemed to include the feminine and the neuter, and the singular shall be deemed to include the plural, and the plural the singular, as the context may require.

21. No Recording. Neither this Agreement nor any document referring to this Agreement shall be recorded by Buyer, or by anyone acting on its behalf, in any public office. At Seller’s option, any such recording shall be a default by Buyer hereunder.

22. Entire Agreement - Amendment. This Agreement (including the Exhibits attached hereto) contains the entire agreement between Seller and Buyer with respect to the Premises; there are no other terms, covenants, obligations or representations, oral or written, of any kind whatsoever related to the subject matter of this transaction. This Agreement may be amended only by a written instrument executed by the party against whom the amendment is being enforced.

23. Governing Law. The substantive laws of the State of Texas will govern the validity, construction and enforcement of this Agreement. Venue for any action arising under or in connection with this Agreement shall be in the state and federal courts in Harris County, Texas.

24. Construction. The parties acknowledge that each party and each party’s counsel have reviewed and revised this Agreement and that the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party will not be employed in the interpretation of this Agreement or any Exhibits or amendments hereto.

25. Cooperation. After Settlement, Seller will assist Buyer in an orderly transfer of the Premises. Seller will, on the request of Buyer, provide such information with respect to the Premises as might be reasonably requested by Buyer and is in Seller’s possession.

26. Effective Date; Multiple Counterparts. This Agreement may be executed in counterparts, each of which shall be binding against the party whose signature appears thereon. All such counterparts, together, shall consist of one and the same document. For purposes of the foregoing, facsimile signatures shall have the same force and effect as original signatures.

27. Severability. If any provision of this Agreement or the application thereof shall, for any reason be invalid or unenforceable, the remainder of this Agreement shall not be affected thereby, but rather shall be enforced to the greatest extent permitted by law. This Agreement shall not be construed more strictly against one party than against the other merely by virtue of the fact that it may have been prepared primarily by counsel for one of the parties, it being recognized that both Buyer and Seller have contributed substantially and materially to the preparation of this Agreement.

28. No Partnership. Nothing herein is intended to, shall, or shall be deemed to, create a joint venture or partnership of any kind between the parties hereto, or any relationship other than that of a seller and purchaser of the Property.

29. Time. Time is of the essence of this Agreement. If the date or deadline for performance of any obligation or delivery of any notice shall fall on a weekend or holiday, performance thereof shall be extended to the next business day.

30. Waiver. The excuse or waiver of the performance by a Party of any obligation of the other Party under this Agreement shall only be effective if evidenced by a written statement signed by the Party so excusing or waiving. No delay in exercising any right or remedy shall constitute a waiver thereof, and no waiver by Seller or Buyer of the breach of any covenant of this Agreement shall be construed as a waiver of any preceding or succeeding breach of the same or any other covenant or condition of this Agreement.

31. Attorney’s Fees. In the event of a judicial or administrative proceeding or action by one party against the other party with respect to the interpretation or enforcement of this Agreement, the prevailing party shall be entitled to recover reasonable costs and expenses including, without limitation, reasonable attorneys’ fees and expenses, whether at the investigative, pretrial, trial or appellate level, but in any event such amounts shall be subject to the limitation on recovery of out-of-pocket expense set forth in Sections 14(a) and (b). The prevailing party shall be determined by the court based upon an assessment of which party’s major arguments or position prevailed.

32. No Personal Liability. Buyer and Seller agree that no directors, officers, employees, partners or agents of Seller or Buyer shall have any personal liability hereunder, and that each of Buyer and Seller shall not seek to assert any claim or enforce any rights against such directors, officers, employees, partners or agents in their individual capacities.

IN WITNESS WHEREOF, the parties hereto, intending to be legally bound hereby, have caused this Agreement to be signed and effective as of the Effective Date.

BUYER:

Berry Contracting, L.P., a

Texas limited partnership,

dba Bay, Ltd.

By:_/s/ A.L. Berry

Name: A.L. Berry

Title: Vice President

SELLER:

GULF MARINE FABRICATORS, L.P.

By: Gulf Marine Fabricators General Partner, L.L.C., a Texas

limited liability company

By: /s/ Kirk J. Meche

Name: Kirk J. Meche

Title: President and C.E.O.

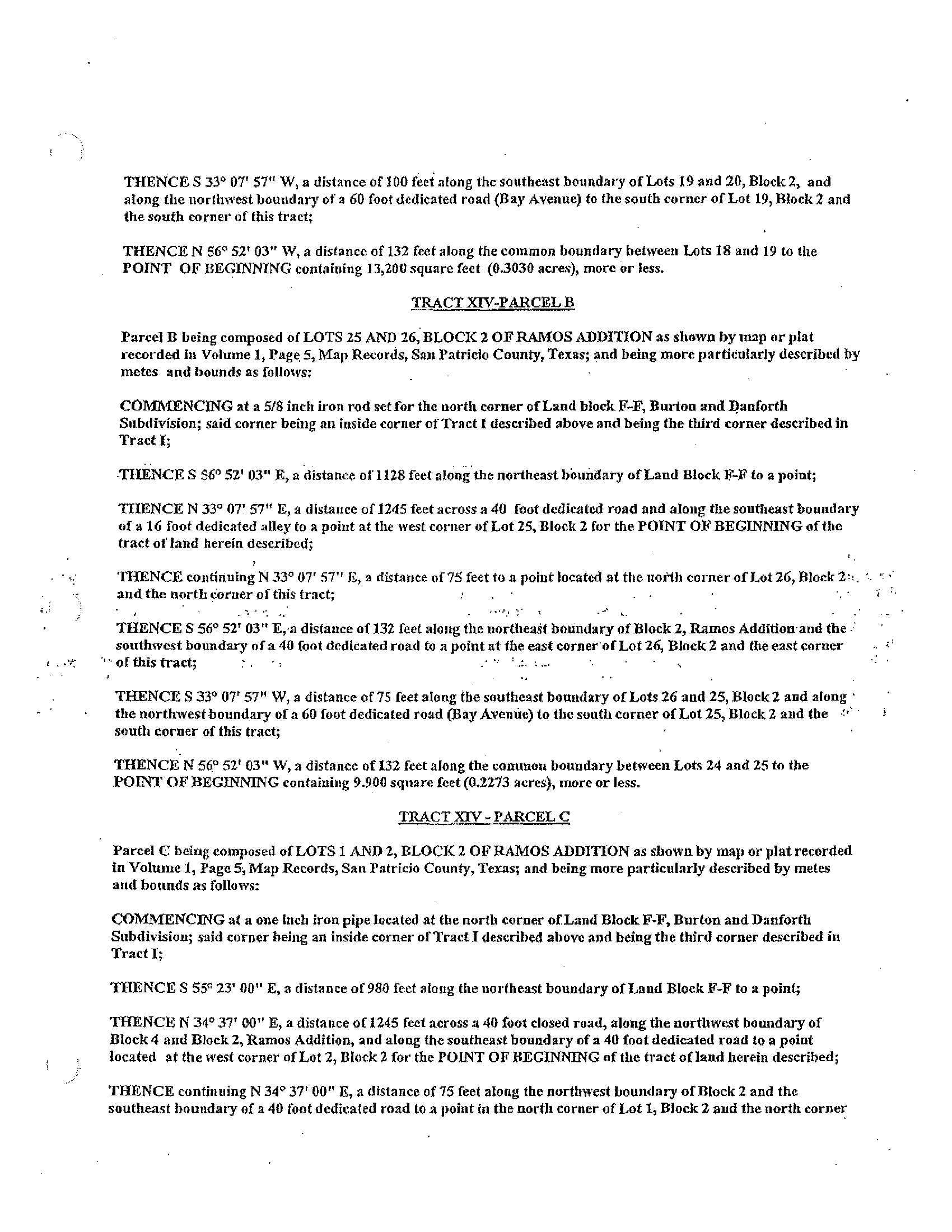

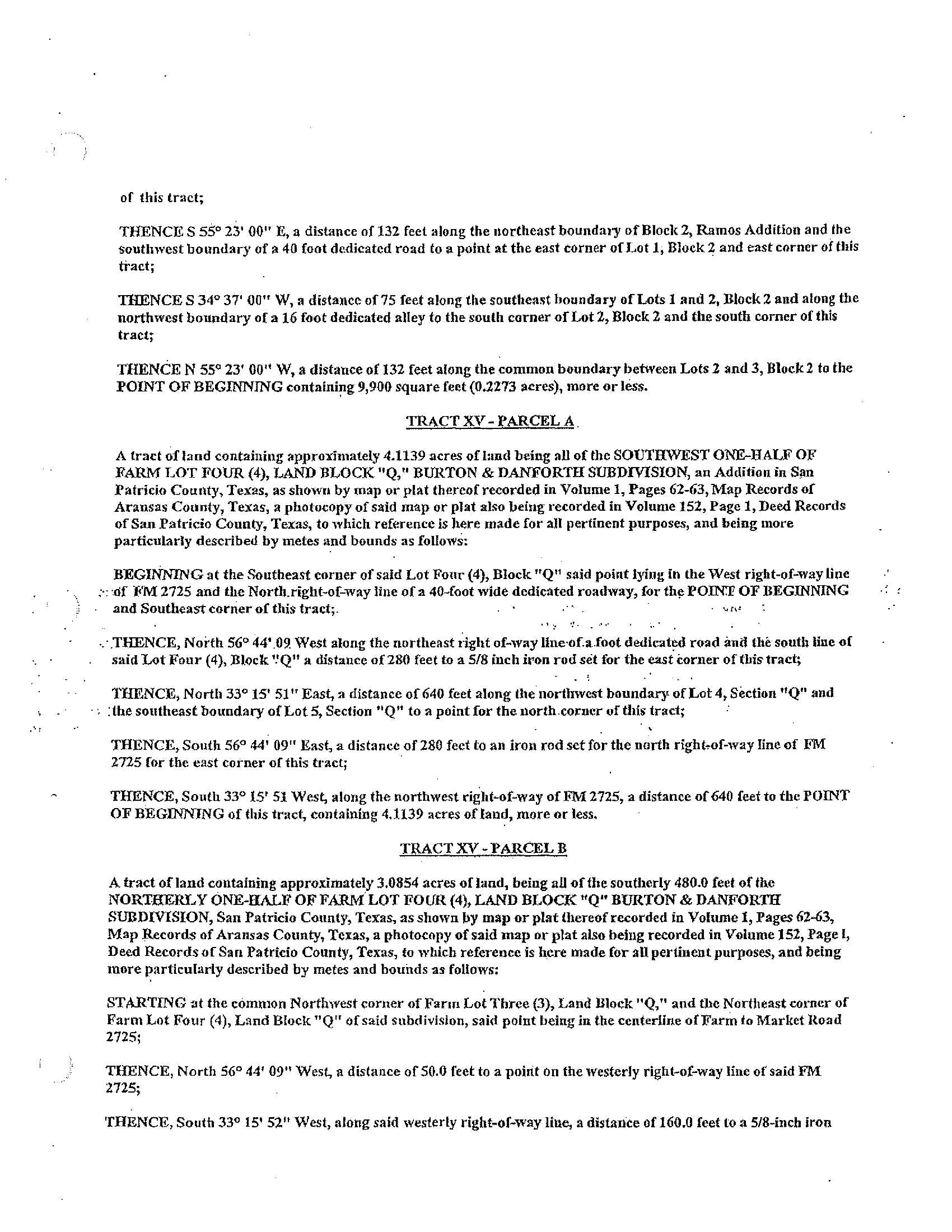

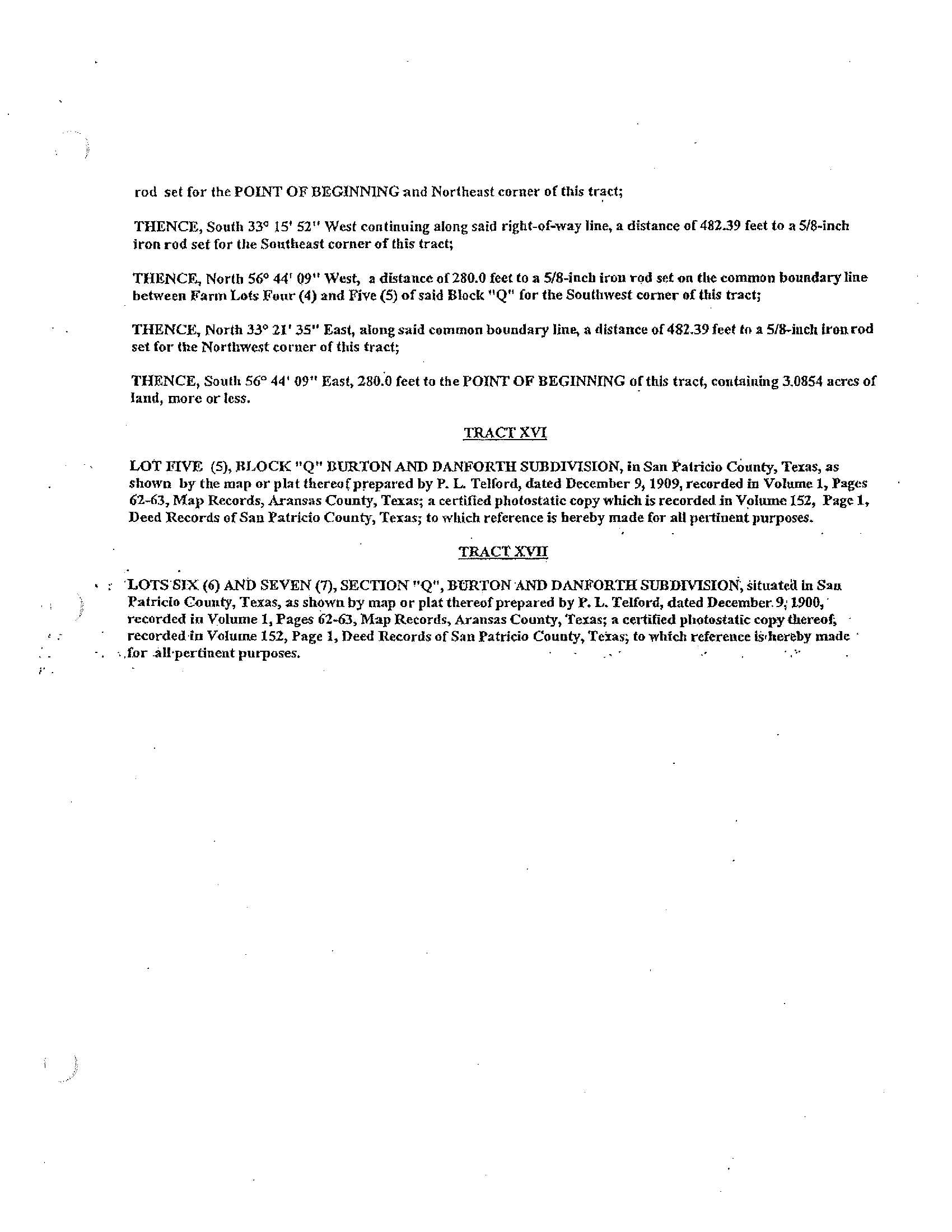

EXHIBIT A

Legal Description

See Attached.

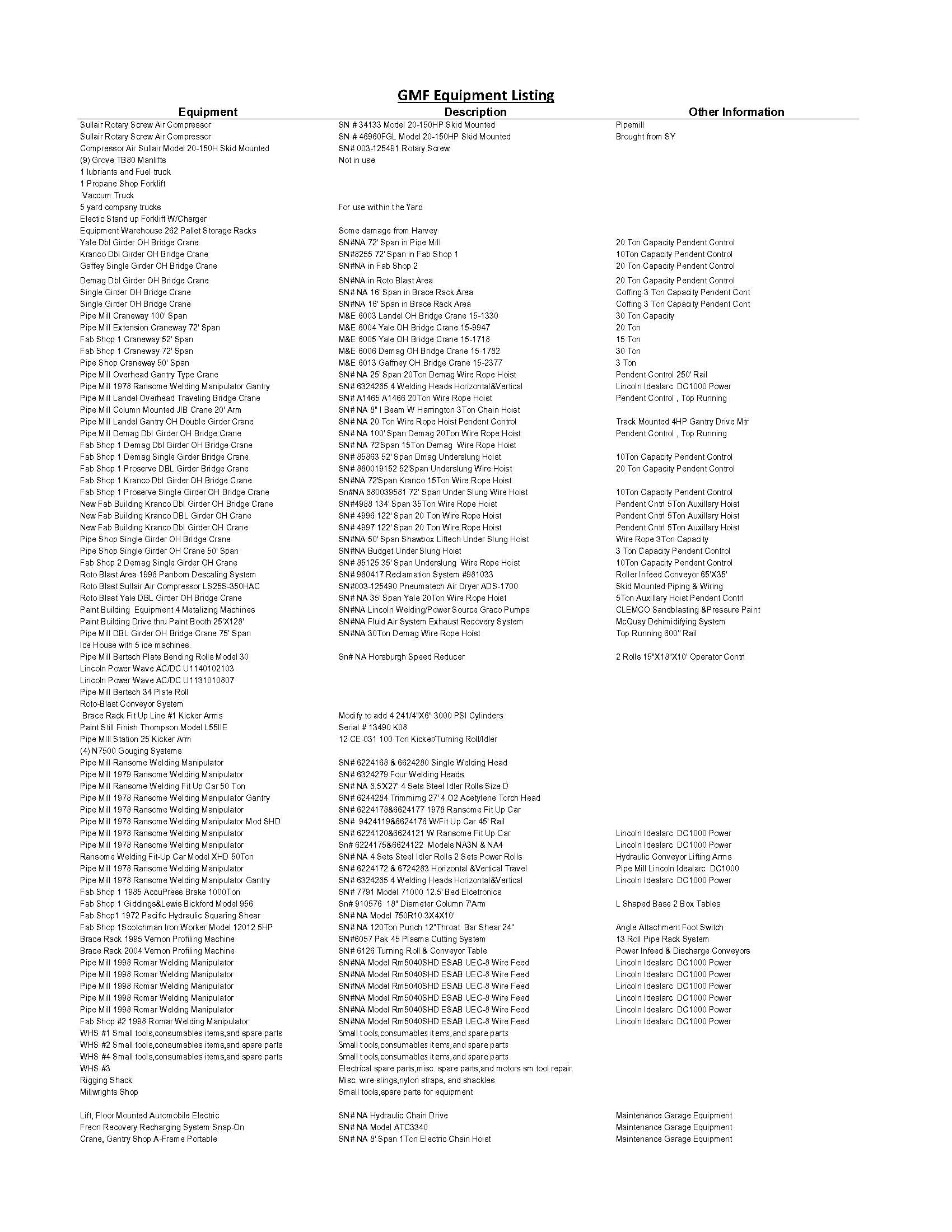

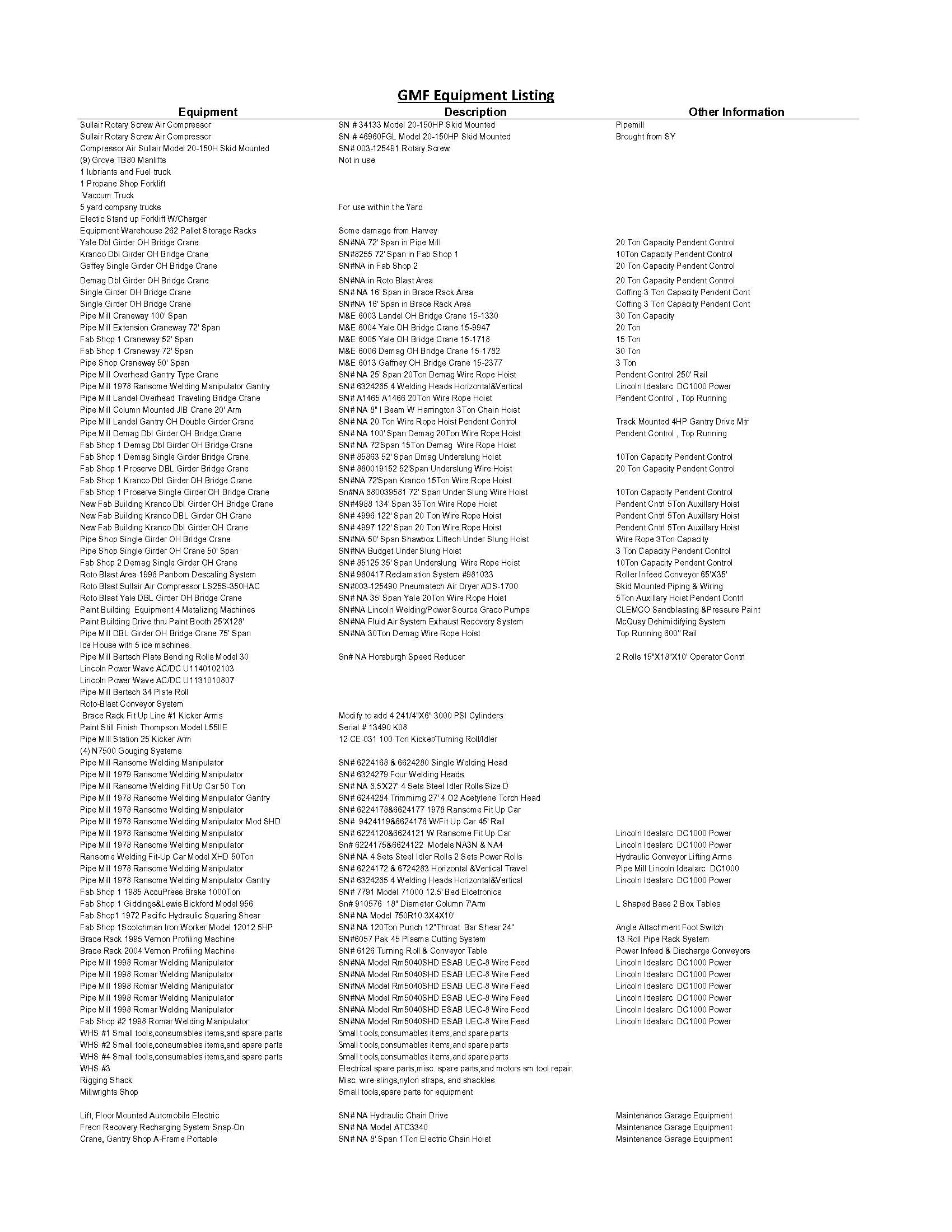

EXHIBIT B

Equipment List

See Attached.

EXHIBIT C

Seller Account Information

ACH INSTRUCTIONS:

Bank: Hancock Whitney National Bank

Routing #: 065400153

Account No.: 49811516

Account Name: Gulf Marine Fabricators, L.P.

Contact: Robert Wallis, Controller

Federal Tax ID: 20-4153734

Swift Code: WHITUS44

EXHIBIT D

Form of Deed

See Attached.

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OR ALL OF THE FOLLOWING INFORMATION FROM ANY INSTRUMENT THAT TRANSFERS AN INTEREST IN REAL PROPERTY BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER’S LICENSE NUMBER.

SPECIAL WARRANTY DEED

STATE OF TEXAS §

§ KNOW ALL MEN BY THESE PRESENTS:

COUNTY OF SAN PATRICIO §

THAT, Gulf Marine Fabricators, L.P., a Texas limited partnership (hereinafter referred to as “Grantor”), for the sum of Ten and No/100 ($10.00) Dollars and other good and valuable cash consideration in hand paid by Berry Contracting, L.P., a Texas limited partnership, dba Bay, Ltd. (hereinafter referred to as “Grantee”), whose mailing address is 5005 Riverway, Suite 440, Houston, Texas, 77056, the receipt and sufficiency of which are hereby acknowledged, has granted, sold and conveyed, and by these presents does grant, sell and convey, unto Grantee that certain tract or parcel of land, more particularly described on Exhibit “A” attached hereto and made a part hereof for all purposes together with all improvements thereon and all rights, privileges, and appurtenances pertaining to the land, including all right, title and interest of Grantor in and to any adjacent streets, alleys, strips, gores, easements, and air and subsurface rights, and rights-of-way (hereinafter referred to collectively as the “Property”).

This Special Warranty Deed and the conveyance hereinabove is made and accepted subject to those matters listed on Exhibit “B” attached hereto (collectively, the “Permitted Exceptions”). Ad valorem taxes for the current year have been prorated as of the date hereof based on current tax information and are hereby assumed by Grantee.

Grantee acknowledges that Grantee has independently and personally inspected the Property. The Property is hereby conveyed to and accepted by Grantee in its present condition, “AS IS, WITH ALL FAULTS, AND EXCEPT FOR THE SPECIAL WARRANTY OF TITLE CONTAINED HEREIN, AND AS SET FORTH IN THAT CERTAIN AGREEMENT OF SALE BETWEEN GRANTOR AND GRANTEE DATED _________, 2018, IS WITHOUT ANY WARRANTY WHATSOEVER, EXPRESS OR IMPLIED AS TO THE PHYSICAL CONDITION OF THE PROPERTY, SUITABILITY FOR ANY PARTICULAR PURPOSE, OR MERCHANTABILITY.” GRANTEE HEREBY EXPRESSLY WAIVES ANY AND ALL IMPLIED WARRANTIES UNDER TEXAS LAW.

WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, GRANTEE HEREBY EXPRESSLY ACKNOWLEDGES AND AGREES THAT, EXCEPT FOR THE SPECIAL WARRANTY OF TITLE CONTAINED HEREIN, AND AS SET FORTH IN THAT CERTAIN AGREEMENT OF SALE BETWEEN GRANTOR AND GRANTEE DATED _________, 2018, NEITHER GRANTOR, NOR ANY PARTY, WHOMSOEVER, ACTING OR PURPORTING TO ACT IN ANY CAPACITY WHATSOEVER ON BEHALF OF

GRANTOR, HAS MADE ANY REPRESENTATION, WARRANTY OR GUARANTY, AS TO: (A) THE PROPERTY BEING FREE FROM ANY DEFECTS OR VICES; (B) THE CONDITION OR STATE OF REPAIR OF THE PROPERTY (INCLUDING BUT NOT LIMITED TO THE ENVIRONMENTAL CONDITION OF THE PROPERTY); (C) ANY HAZARDOUS SUBSTANCES OR MATERIALS (WHICH INCLUDES ALL SUBSTANCES AND MATERIALS LISTED AS SUCH BY APPLICABLE LAW, ANY POLLUTANTS OR CONTAMINANTS, WHETHER HARMFUL OR NOT, MOLD, ASBESTOS AND NATURALLY-OCCURRING BUT HARMFUL SUBSTANCES (SUCH AS METHANE OR RADON) NOT HAVING BEEN RELEASED OR NOT EXISTING ON, IN, UNDER, ABOVE, UPON OR IN THE VICINITY OF THE PROPERTY; (D) THE QUALITY, NATURE, ADEQUACY AND PHYSICAL CONDITION OF THE PROPERTY, INCLUDING BUT NOT LIMITED TO, THE SOILS AND GEOLOGY; (E) THE EXISTENCE, QUALITY, NATURE, ADEQUACY AND PHYSICAL CONDITIONS OF ANY ELECTRICAL, MECHANICAL, PLUMBING, SEWAGE AND UTILITY SYSTEMS AND FACILITIES SERVING THE PROPERTY; (F) THE HABITABILITY OF THE PROPERTY; (G) THE MERCHANTABILITY OF TITLE TO THE PROPERTY, (H) THE FITNESS, SUITABILITY OR ADEQUACY OF THE PROPERTY FOR ITS ORDINARY USE OR ANY INTENDED USE OR PARTICULAR PURPOSE; (I) THE DEVELOPMENT POTENTIAL OF THE PROPERTY, (J) ANY ACCESS TO THE PROPERTY; (K) THE ZONING OR OTHER LEGAL STATUS OF THE PROPERTY; AND (L) THE PROPERTY’S COMPLIANCE WITH ANY APPLICABLE CODES, LAWS, REGULATIONS, STATUTES, ORDINANCES, COVENANTS, CONDITIONS, AND RESTRICTIONS OF ANY GOVERNMENTAL OR QUASI-GOVERNMENTAL ENTITY OR OF ANY OTHER PERSON OF ENTITY.

GRANTEE HEREBY RELEASES GRANTOR FROM ANY CLAIMS, DEMANDS, LIABILITIES, COSTS OR SUITS UNDER OR PURSUANT TO 42 U.S.C. § 9601, ET SEQ., 42 U.S.C. § 7401, ET SEQ., 42 U.S.C. § 6901, ET SEQ., 33 U.S.C. §1251, ET SEQ., AND 15 U.S.C. §2601 ET SEQ., TOGETHER WITH ANY AND ALL CLAIMS, DEMANDS, SUITS OR LITIGATION UNDER ANY OTHER APPLICABLE LAWS, STATUTES, RULES OR REGULATIONS AS THE SAME MAY FROM TIME TO TIME BE AMENDED, RELATING TO ANY CONTAMINATION ON, IN OR UNDER THE PROPERTY, AND ALL OTHER ENVIRONMENTAL OR HAZARDOUS SUBSTANCE LIABILITIES OF ANY KIND AND NATURE, WHATSOEVER, INCLUDING, WITHOUT LIMITATION, (A) ALL FORESEEABLE AND UNFORESEEABLE DAMAGES OF ANY KIND OR NATURE AND (B) THE COSTS OF ANY REQUIRED OR NECESSARY INVESTIGATION, STUDY, REPAIR, CLEAN-UP AND/OR DETOXIFICATION UNDER ANY LAW, STATUTE, RULE, REGULATION, ORDINANCE OR DECREE. GRANTEE HEREBY AGREES TO COMPLY WITH ALL SUCH LAWS, STATUTES, RULES, REGULATIONS, ORDINANCES OR DECREES IN SUCH MANNER THAT NO SUCH LIABILITY OR CLAIMS WILL BE ASSERTED AGAINST GRANTOR.

TO HAVE AND TO HOLD the Property, together with all and singular the rights and appurtenances thereto in anywise belonging, unto Grantee and Grantee’s successors and assigns, and subject to the Permitted Exceptions, Grantor does hereby bind Grantor, and Grantor’s successors and assigns,

to Warrant and Forever Defend all and singular the Property unto Grantee and Grantee’s successors and assigns, against every person whomsoever lawfully claiming or to claim the same or any part thereof, by, through or under Grantor by not otherwise.

Grantee appears here and expressly agrees that it is acquiring the Property from Grantor under the terms and conditions set forth in this Special Warranty Deed.

[signature on the following page]

EXECUTED effective as of the ___ day of ___________, 2018.

GRANTOR: Gulf Marine Fabricators, L.P.,

a Texas limited partnership

By: Gulf Marine Fabricators General Partner, L.L.C.,

a Texas limited liability company

By:

Name: ______________________________

Title: _______________________________

STATE OF TEXAS §

§ KNOW ALL MEN BY THESE PRESENTS:

COUNTY OF _______________ §

This instrument was acknowledged before me on _________________, 2018 by _____________________________, the ______________ of Gulf Marine Fabricators General Partner, L.L.C., a Texas limited liability company, the general partner of Gulf Marine Fabricators, L.P., a Texas limited partnership.

__________________________________

Notary Public

My Commission Expires:

GRANTEE: BERRY CONTRACTING, L.P.,

a Texas limited partnership, dba Bay, Ltd.

By:

Name: _________________________________

Title: __________________________________

STATE OF TEXAS §

§ KNOW ALL MEN BY THESE PRESENTS:

COUNTY OF _______________ §

This instrument was acknowledged before me on ___________________, 2018 by _____________________________, the ______________ of Berry Contracting, L.P., a Texas limited partnership.

__________________________________

Notary Public

My Commission Expires:

EXHIBIT E

Form of Bill of Sale

See Attached.

BILL OF SALE

THIS BILL OF SALE (this “Bill of Sale”) is made and entered into as of September 26, 2018 (the “Effective Date’”) by Gulf Marine Fabricators, L.P., a Texas limited partnership (“Seller”), and Berry Contracting, L.P., a Texas limited partnership, dba Bay, Ltd. (“Buyer”).

RECITALS

WHEREAS, Seller and Buyer have agreed that Buyer will acquire from Seller the equipment (the “Equipment”) described on Exhibit A attached hereto and made a part hereof, pursuant to that Agreement of Sale dated as of September 26, 2018 (“Agreement of Sale”); and

WHEREAS, to consummate such transaction, Seller and Buyer have agreed to enter into this Bill of Sale on the terms and conditions set forth below.

NOW THEREFORE, in consideration of the mutual covenants and agreements set forth herein, Seller and Buyer, intending to be legally bound, hereby agree as follows:

Section (1) Transfer of Equipment. For and in consideration of TEN DOLLARS AND NO/100 ($10.00) and other good and valuable consideration stated in the Agreement of Sale, the receipt and sufficiency of which is hereby acknowledged, Seller hereby grants, sells, transfers, conveys, assigns and delivers unto Buyer, to have and to hold forever, all of Seller’s right, title and interest in and to the Equipment together with all distributor’s or manufacturer’s warranties and service contracts related to the Equipment. Buyer shall bear the risk of loss on the Equipment from the Effective Date.

Section 2. Disclaimer and Waiver of Warranties; Releases. BUYER TAKES THE EQUIPMENT “AS IS” AND “WHERE IS,” WITH ALL FAULTS, AND WITHOUT ANY WARRANTIES OR REPRESENTATIONS FROM SELLER WHATSOEVER, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES WITH RESPECT TO TITLE, CONDITION, OPERATION, DESIGN, MAINTENANCE, REPAIR OR USEFULNESS OF THE EQUIPMENT OR THAT THE EQUIPMENT IS FIT FOR ANY PARTICULAR PURPOSE OR ANY ORDINARY OR INTENDED USE. BUYER HEREBY ACKNOWLEDGES AND AGREES THAT IT HAS EXAMINED, INSPECTED AND EVALUATED THE EQUIPMENT AS OF THE EFFECTIVE DATE AND THAT IT IS RELYING SOLELY ON ITS OWN EXAMINATION, INSPECTION AND EVALUATION OF THE EQUIPMENT AND NOT UPON ANY WARRANTIES OR REPRSENTATIONS OF SELLER OR ANY OTHER PERSON OR ENTITY ACTING ON BEHALF OF SELLER. SELLER HEREBY EXPRESSLY DISCLAIMS, AND BUYER HEREBY WAIVES AND RELEASES SELLER FROM, ANY AND ALL IMPLIED WARRANTIES UNDER TEXAS LAW WITH RESPECT TO TITLE, CONDITION, OPERATION, DESIGN, MAINTENANCE, REPAIR OR USEFULNESS OF THE EQUIPMENT.

FURTHER TO THE FOREGOING, BUYER HEREBY FOREVER RELEASES AND DISCHARGES SELLER, ITS AFFILIATES AND THE OWNERS, MEMBERS, MANAGERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS AND

REPRESENTATIVES OF EACH OF THE FOREGOING (COLLECTIVELY, THE “SELLER PARTIES”), FROM ANY CLAIMS, DAMAGES, LOSSES, LIABILITIES, COSTS OR EXPENSES THAT BUYER MAY INCUR OR HAVE AGAINST SELLER OR ANY OF THE OTHER SELLER PARTIES, IN CONNECTION WITH, ARISING OUT OF, OR RELATED TO, DIRECTLY OR INDIRECTLY, THE USE, OWNERSHIP, MAINTENANCE, REPAIR, DISPOSAL, SCRAPPING, CONDITION, OR DESIGN OF THE EQUIPMENT, WHETHER IN CONTRACT OR TORT. BUYER HEREBY AGREES TO DEFEND, INDEMNIFY, AND HOLD HARMLESS SELLER AND THE OTHER SELLER PARTIES, FROM AND AGAINST, ANY AND ALL CLAIMS (INCLUDING ANY THIRD PARTY CLAIMS OR ANY CLAIMS FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF PROFIT OR LOSS OF BUSINESS OPPORTUNITY), DAMAGES, DEMANDS, LIABILITIES, LOSSES, COSTS OR EXPENSES (INCLUDING REASONABLE ATTORNEY’S FEES) OF ANY KIND OR NATURE WHATSOEVER, ACCRUING FROM AND AFTER THE DATE HEREOF, IN CONNECTION WITH, ARISING OUT OF, OR RELATED TO, DIRECTLY OR INDIRECTLY, (A) THE USE, OWNERSHIP, MAINTENANCE, REPAIR, DISPOSAL, SCRAPPING, CONDITION, OR DESIGN OF THE EQUIPMENT, (B) ANY PERSONAL INJURY (INCLUDING DEATH) TO OR DAMAGE TO PROPERTY OF BUYER OR ANY THIRD PARTY CAUSED BY OR INVOLVING THE EQUIPMENT, OR (C) ANY ENVIRONMENTAL POLLUTION OR CONTAMINATION OF ANY KIND OR NATURE WHATSOEVER, AS SPECIFIED UNDER ANY LAW, STATUTE, RULE OR REGULATION OF THE UNITED STATES OF AMERICA, ANY STATE, OR ANY POLITICAL SUBDIVISION THEREOF, RESULTING FROM ANY USE, DISPOSAL OR SCRAPPING OF THE EQUIPMENT.

Section 3. Further Assurances. Seller and Buyer each hereby agree to execute and deliver to each other such other instruments or documents and to do such other acts and things, as the other may reasonably request for the purpose of carrying out the intent and purposes of this Bill of Sale.

Section 4. Successors and Assigns. This Bill of Sale is binding upon, inures to the benefit of, and is enforceable by Seller and Buyer and their successors and assigns.

Section 5. Governing Law. This Bill of Sale shall be governed by the laws of the State of Texas.

Section 6. Counterparts. This Bill of Sale may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Any signatures delivered by a party by facsimile transmission or by e-mail transmission of an adobe file format document (also known as a PDF file) shall be deemed an original signature hereto.

IN WITNESS WHEREOF, the parties hereto have entered into this Bill of Sale effective as of the Effective Date.

SELLER:

Gulf Marine Fabricators, L.P., a Texas limited partnership

By: Gulf Marine Fabricators General Partner, L.L.C., a Texas limited liability company

By: /s/ Kirk J. Meche

Name: Kirk J. Meche

Title: President and C.E.O.

BUYER:

Berry Contracting, L.P., a Texas limited partnership, dba Bay, Ltd.,

By:_/s/ A.L. Berry

Name: A.L. Berry

Title: Vice President