UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a party other than the Registrant ¨

Check the appropriate box:

|

| | |

| | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

ý | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Under Rule 14a-12 |

GULF ISLAND FABRICATION, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

ý | | No fee required. |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | | Title of each class of securities to which transaction applies: |

| | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | (5 | ) | | Total fee paid: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | (1 | ) | | Amount previously paid: |

| | (2 | ) | | Form, Schedule or Registration Statement No: |

| | (3 | ) | | Filing party: |

| | (4 | ) | | Date Filed: |

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE

SUITE 280

HOUSTON, TEXAS 77084

________________________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 18, 2016

________________________________________________________________

TO THE SHAREHOLDERS OF GULF ISLAND FABRICATION, INC.:

The annual meeting of shareholders of Gulf Island Fabrication, Inc. (the “Company”) will be held at 11:00 a.m., local time, on Wednesday, May 18, 2016, at the office of Gulf Island Shipyards, LLC located at 111 Bunge St., Hwy. 90 East, Jennings, LA, 70546, for the following purposes, more fully described in the accompanying proxy statement:

| |

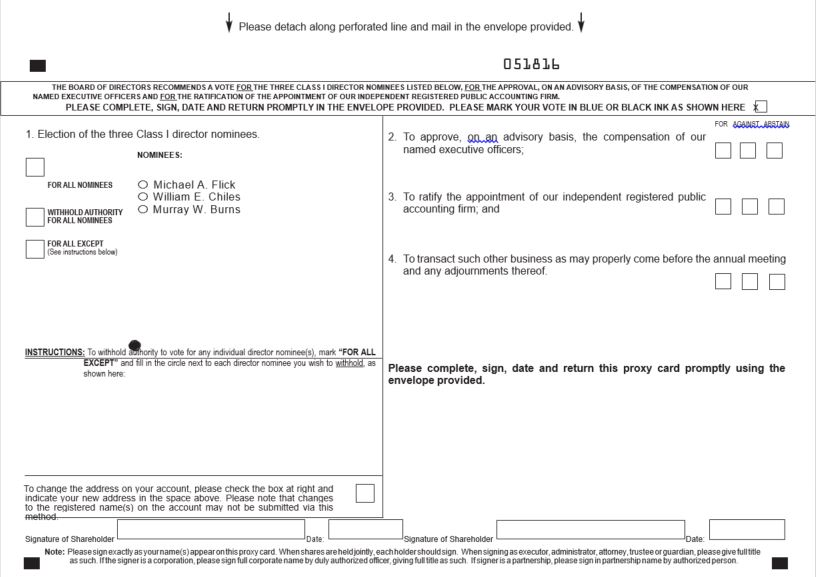

1. | To elect three Class I director nominees; |

| |

2. | To approve, on an advisory basis, the compensation of our named executive officers; |

| |

3. | To ratify the appointment of the Company’s independent registered public accounting firm; and |

| |

4. | To transact such other business as may properly come before the annual meeting and any adjournments thereof. |

The Board of Directors has fixed the close of business on April 4, 2016 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and all adjournments thereof.

Your vote is important regardless of the number of shares of the Company’s common stock you own. Whether or not you plan to attend the annual meeting, please complete, date and sign the enclosed proxy card and return it promptly in the enclosed stamped envelope. Furnishing the enclosed proxy will not prevent you from voting in person at the annual meeting should you wish to do so. To obtain directions to attend the annual meeting and vote in person, please contact Jeffrey M. Favret at (713) 714-6100.

|

|

By Order of the Board of Directors |

|

|

Jeffrey M. Favret |

Secretary |

Houston, Texas

April 6, 2016

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF THE PROXY MATERIALS FOR THE SHAREHOLDER

MEETING TO BE HELD ON MAY 18, 2016.

This proxy statement and the 2015 annual report are available at www.gulfisland.com/eproxy

GULF ISLAND FABRICATION, INC.

16225 PARK TEN PLACE, SUITE 280

HOUSTON, TEXAS 77084

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 18, 2016

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Q: Why am I receiving this proxy statement?

A: Our Board of Directors (our “Board”) is soliciting your proxy to vote at the 2016 annual meeting of shareholders and at any adjournment thereof because you owned shares of our common stock at the close of business on April 4, 2016, the record date for determining shareholders entitled to vote at the annual meeting. The proxy statement, along with a proxy card or a voting instruction card, and our 2015 annual report are being mailed to shareholders on or about April 14, 2016. We have also made these materials available to you on the internet. This proxy statement summarizes the information you need to know to vote at the annual meeting. You do not need to attend the annual meeting to vote your shares of our common stock.

Q: When and where will the annual meeting be held?

A: The annual meeting will be held at 11:00 a.m., local time, on Wednesday, May 18, 2016, at the office of Gulf Island Shipyards, LLC located at 111 Bunge St., HWY. 90 East, Jennings, LA, 70546.

Q: Who is soliciting my proxy?

A: Our Board, on behalf of Gulf Island Fabrication, Inc. (the "Company"), is soliciting your proxy to vote your shares of our common stock on all matters scheduled to come before the 2016 annual meeting of shareholders, whether or not you attend in person. By completing and returning the proxy card or voting instruction card, you are authorizing the proxy holder to vote your shares of our common stock at our annual meeting as you have instructed.

Q: On what matters will I be voting? How does the Board of Directors recommend that I cast my vote?

A: At the annual meeting, our shareholders will be asked to elect the three Class I director nominees named in this proxy statement, approve, on an advisory basis, the compensation of our named executive officers, ratify the appointment of our independent registered accounting firm, and consider any other matter that properly comes before the annual meeting.

Our Board unanimously recommends that you vote:

| |

• | FOR the election of the three Class I director nominees; |

| |

• | FOR the approval, on an advisory basis, of the compensation of our named executive officers (the “say-on-pay proposal”); and |

| |

• | FOR the ratification of the appointment of our independent registered public accounting firm. |

Q: How many votes may I cast?

A: You may cast one vote for every share of our common stock that you owned on April 4, 2016, the record date for the annual meeting.

Q: How many shares are eligible to be voted?

A: As of the record date, we had 14,630,686 shares of our common stock outstanding, each of which is entitled to one vote.

Q: How many shares must be present to hold the annual meeting?

A: Under Louisiana law and our By-laws, the presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the annual meeting. As of the record date, 7,315,344 shares constitute a majority of our outstanding stock entitled to vote at the annual meeting. The inspector of elections will determine whether a quorum is present at the annual meeting. If you are a beneficial owner (as defined below) of shares of our common stock and you do not instruct your broker, bank, or other nominee how to vote your shares on any of the proposals, your shares of our common stock will be counted as present at the annual meeting for purposes of determining whether a quorum exists. In addition, if you are a shareholder of record present at the annual meeting in person or by proxy, your shares of our common stock will be counted as present at the annual meeting for purposes of determining whether a quorum exists, whether or not you abstain from voting on any or all of the proposals.

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner?

A: If your shares of our common stock are registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC, you are considered, with respect to those shares, the “shareholder of record.” The proxy materials have been mailed to such shareholders of record by us.

If your shares of our common stock are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name.” The proxy materials have been forwarded to such beneficial owners by the organization that holds your shares of our common stock, which is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to instruct your broker, bank or other nominee how to vote your shares by completing and returning the voting instruction card included in their mailing or by following the voting instructions you received from your broker, bank or other nominee.

Q: What happens if I don’t vote for a proposal? What is discretionary voting? What is a broker non-vote?

A: If you properly complete and return a proxy or voting instruction card, your shares will be voted as you specify.

Shareholders of Record

If you are a shareholder of record and you sign and return your proxy card without giving specific voting instructions on some or all of the proposals, then the proxy holders will vote your shares of our common stock in the manner recommended by our Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the annual meeting.

Beneficial Owners of the Shares Held in Street Name

If you are a beneficial owner of shares held in street name and do not provide specific voting instructions to the broker, bank or other nominee that holds your shares of our common stock, the organization that holds your shares of our common stock has discretion to vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, such organization will inform the inspector of elections that it does not have the authority to vote on this matter with respect to your shares of our common stock. This is generally referred to as a “broker non-vote.”

Q: Which proposals are considered “routine” and which are considered “non-routine”?

A: The proposal relating to the ratification of the appointment of our independent registered public accounting firm is the only routine matter being considered at the annual meeting. The proposal relating to the election of directors and the say-on-pay proposal are non-routine matters. A broker, bank or other nominee cannot vote without instruction on non-routine matters, in which case there would be broker non-votes on such proposals. Shares subject to broker non-votes will not be counted as votes for or against and will not be included in calculating the number of votes necessary for approval of such non-routine matters to be presented at

the annual meeting; however, such shares will be considered present at the annual meeting for purposes of determining the existence of a quorum.

Q: What vote is required to approve each item?

A: The election of directors will be decided by plurality vote, that is, the three nominees receiving the highest number of affirmative votes will be elected. The say-on-pay proposal and the ratification of the appointment of our independent registered public accounting firm will be decided by a majority of votes actually cast. All other matters properly brought before the annual meeting for a vote of shareholders will be decided by a majority of the votes actually cast.

Abstentions and broker non-votes will have no effect on the voting calculations for any of the proposals.

Q: How do I vote?

A: You may submit your proxy and/or voting instructions for your shares of our common stock by using any of the following methods:

| |

• | Proxy card or voting instruction card: Be sure to complete, sign and date your proxy card or voting instruction card and return it in the prepaid envelope provided. |

| |

• | By telephone or Internet: Shareholders of record cannot vote by telephone or Internet. The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank or other nominee. |

| |

• | In person at the annual meeting: All shareholders may vote in person at the annual meeting. You may also be represented by another person at the annual meeting by executing a proper proxy designating that person as your representative. If you are a beneficial owner of shares of our common stock, you must obtain a legal proxy from your broker, bank or other nominee and present it to the inspectors of election with your ballot when you vote at the annual meeting. |

Q: Can I revoke or change my voting instructions after I deliver my proxy?

A: Yes. Your proxy may be revoked or changed at any time before it is exercised by filing with our Secretary an instrument revoking it or a duly executed proxy bearing a later date, or by attending the annual meeting and voting in person. Your attendance alone at the annual meeting will not be enough to revoke your proxy.

Q: Who pays for soliciting proxies?

A: We pay all expenses incurred in connection with the solicitation of proxies for the annual meeting. We will also request banks, brokers, and other nominees holding shares of our common stock beneficially owned by others to send these proxy materials and 2015 annual report to, and obtain voting instructions from, the beneficial owners and will reimburse such shareholders of record for their reasonable expenses in so doing. Solicitation of proxies by mail may be supplemented by telephone, email and other electronic means, advertisements and personal solicitation by our directors, officers and employees. No additional compensation will be paid to directors, officers or employees for such solicitation efforts.

Q: Could other matters be decided at the annual meeting?

A: Our Board does not expect to bring any other matter before the annual meeting, and it is not aware of any other matter that may be considered at the annual meeting. In addition, the time has passed for any shareholder to properly bring a matter before the annual meeting. The enclosed proxy will, however, confer discretionary authority with respect to any other matter that may properly come before the annual meeting or any adjournment thereof. It is the intention of the person(s) named in the enclosed proxy to vote any shares of our common stock for which he has a proxy to vote at the annual meeting in accordance with his best judgment on any such matter.

Q: What happens if the annual meeting is postponed or adjourned?

A: Unless a new record date is fixed, your proxy will be valid and may be voted at the annual meeting, whether postponed or adjourned. You will still be able to change or revoke your proxy until your shares of our common stock are voted.

Q: I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

A: Some banks, brokers and other nominees are “householding” our proxy materials for their customers. This means that only one copy of our proxy materials may have been sent to multiple shareholders in your household. We will promptly deliver a

separate copy of any of these proxy materials and the 2015 annual report to you if you call us at (713) 714-6100 or write to us at: Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 280, Houston, Texas 77084.

If you would like to receive separate copies of our annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee or you may contact us at the above address and telephone number.

Our Board of Directors and Its Committees

Our Board currently consists of nine members. Our Board met seven times during 2015. Our Board has established three standing committees: the Corporate Governance and Nominating Committee, the Audit Committee, and the Compensation Committee. Each committee operates under a written charter adopted by our Board, and such charters are available on our website at www.gulfisland.com under Investors—Corporate Governance. The composition of each committee is reviewed annually by our Board of Directors. During 2015, each of our incumbent directors attended at least 75% of the aggregate of the total number of meetings of our Board and the total number of meetings held by all committees of our Board on which he served during the periods of his Board membership and committee service.

Board Leadership Structure

Jack Laborde serves as Chairman of our Board and Kirk Meche serves as President and Chief Executive Officer. Our Board determined that separation of these roles would maximize management’s efficiency by allowing the Chief Executive Officer to focus on our day-to-day business and the Chairman of our Board to lead the Board of Directors in its fundamental role of providing guidance to and oversight of management. While our By-laws and corporate governance guidelines do not require the Chairman of the Board and Chief Executive Officer positions to be separate, our Board believes that having separate positions is the appropriate leadership structure for the Company at this time. Our Board, however, periodically reviews the leadership structure and may make such changes in the future as it deems appropriate.

Our Board believes that the independent directors provided effective oversight of management. Moreover, in addition to feedback provided during the course of meetings of our Board, the independent directors are given the opportunity to meet in executive session after each regular meeting of our Board or more frequently, as needed. During 2015, Mr. J. Laborde served as Chairman for all of the executive sessions of independent directors and acted as the liaison between the independent directors and the Chief Executive Officer. Our three standing committees are composed entirely of independent directors, and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board or management.

Board’s Role in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic, environmental and regulatory risks, as well as risks associated with the impact of competition and weather conditions. Management is responsible for the day-to-day management of risks we face, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board conducts certain risk oversight activities through its committees, which oversee specific areas and provide reports to the full Board regarding such committee’s considerations and actions. The Audit Committee reviews and considers financial, accounting, internal controls and regulatory compliance risks, including those that could arise from our accounting and financial reporting processes. The Audit Committee also reviews and monitors risks through various reports presented by our internal auditors and our registered public accounting firm (external auditors). The Compensation Committee reviews and considers risks related to our compensation policies, including incentive plans, to determine whether those plans subject the Company to material risks. Senior management attends the quarterly meetings of our Board and is available to address any questions or concerns raised by our Board on risk management topics and any other matters.

Board Independence

Our Board determined that all of our directors who served during 2015 are “independent” as such term is defined in the NASDAQ Stock Market LLC (“NASDAQ”) listing standards, except for Mr. Meche. In making this determination, our Board evaluated responses to a questionnaire completed by each director regarding relationships and possible conflicts of interest between each director, the Company and management. In its review of director independence, our Board considered all commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the Company

or management. Kirk J. Meche, President and Chief Executive Officer during 2015, was not independent as defined by NASDAQ’s listing standards.

Corporate Governance and Nominating Committee

During 2015, our Board authorized the formation of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee currently consists of the following three directors: Michael A. Flick (Chairman), John P. (Jack) Laborde and Murray W. Burns. Each of these directors is “independent” as such term is defined in the NASDAQ listing standards. The Corporate Governance and Nominating Committee met one time during 2015.

The Corporate Governance and Nominating Committee will regularly assess the appropriate size of our Board, and whether any vacancies on our Board are expected due to retirement or otherwise and whether such vacancies should be filled. In the event that any vacancies are anticipated, or otherwise arise, the Corporate Governance and Nominating Committee will consider various potential candidates for director who may come to the attention of our Board through current members of our Board, professional search firms, shareholders or other persons. Each candidate brought to the attention of our the Corporate Governance and Nominating Committee is considered on the basis of the criteria set forth below.

In evaluating the suitability of nominees for membership on our Board, the Corporate Governance and Nominating Committee considers many factors, including accounting and financial expertise, capital markets and banking experience, energy and energy service industry experience, environmental compliance and corporate responsibility expertise, senior corporate executive experience, industrial construction / fabrication management experience, legal and regulatory compliance expertise, marine industry experience and public company board experience. The Corporate Governance and Nominating Committee evaluates each individual in the context of our Board as a whole, with the objective of nominating persons for election to our Board who can best perpetuate the success of our business, be an effective director in conjunction with our full Board, and represent shareholder interests through the exercise of sound judgment.

Our Board has decided that nominations of directors and related matters will be voted upon by all of the independent directors while meeting in executive session. In this manner, should the proposed slate of directors be elected, all but one of the current directors will have been involved in the nominations process.

Audit Committee

The Audit Committee currently consists of the following five directors: Gregory J. Cotter (Chairman), John P. (Jack) Laborde, Michael A. Flick, Michael J. Keeffe and Christopher M Harding. Each of these directors is “independent” as such term is defined in the NASDAQ listing standards, and also satisfies the additional requirements applicable to an audit committee member under Rule 10A-3(b)(1) under the Securities and Exchange Act of 1934. Our Board has determined that Mr. Flick and Mr. Keeffe are “audit committee financial experts” as such term is defined within the applicable rules of the SEC.

The Audit Committee met five times during 2015. The Audit Committee’s primary function is to assist our Board in fulfilling its oversight responsibilities by monitoring (i) the continued development and performance of our system of financial reporting, accounting, auditing, disclosure controls and procedures and internal control over financial reporting and financial reporting practices, (ii) the operation and integrity of our financial reporting system, (iii) the performance and qualifications of our independent registered public accounting firm (external auditors) and internal auditors, (iv) the independence of our independent registered public accounting firm (external auditors), and (v) risk assessment with respect to the Company’s financial statements and related controls.

Compensation Committee

The Compensation Committee currently consists of the following five directors: Michael A. Flick (Chairman), John P. (Jack) Laborde, Jerry D. Dumas, William E. Chiles and Murray W. Burns. Each of these directors is “independent” as such term is defined in the NASDAQ listing standards, and also satisfies the additional requirements applicable to a compensation committee member under Rule 166-3 under the Securities and Exchange Act of 1934. The Compensation Committee met three times during 2015. The Compensation Committee (i) reviews, approves and recommends to our Board goals and objectives relating to the compensation of our executive officers and other key employees (including the specific relationship of corporate performance to such officers’ compensation), (ii) evaluates at least annually the performance of our executive officers and other key employees in light of these goals and objectives, (iii) recommends to our Board the compensation of our executive officers and other key employees based on such evaluations, (iv) grants awards under our incentive compensation plans and programs, (v) otherwise administers our incentive compensation plans and programs, (vi) recommends to our Board the compensation of our directors, and (vii) performs such other functions as may be prescribed by our Board.

The Compensation Committee seeks the input of our Chief Executive Officer in connection with performance evaluations and compensation decisions for our executive officers; however, our Chief Executive Officer is not present when the Compensation Committee meets to evaluate his performance nor when our Board determines his compensation. The terms of our stock incentive plans permit the Compensation Committee to delegate to appropriate personnel its authority to make awards to employees other than those subject to Section 16 of the Exchange Act. However, the Compensation Committee has not delegated this authority to any individual.

Consideration of Shareholder Recommended Director Nominees

As set forth in our Corporate Governance Guidelines, our Board will consider director candidates recommended by our shareholders on candidates for nomination for election to our Board. Any shareholder may suggest a nominee by sending the following information to our Board: (i) the proposing shareholder’s name, address and telephone number, (ii) the number of shares of our common stock beneficially owned by the proposing shareholder and the suggested nominee, (iii) the suggested nominee’s name, age, business and residential addresses and telephone number, (iv) a statement whether the suggested nominee knows that his or her name is being suggested by the proposing shareholder, and whether he or she has consented to being suggested and is willing to serve, (v) the suggested nominee’s résumé or other description of his or her background and experience, and (vi) the proposing shareholder’s reasons for suggesting that the individual be considered. The information should be sent to the Corporate Governance and Nominating Committee of our Board addressed as follows: Chair,am - Corporate Governance and Nominating Committee of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 280, Houston, Texas 77084.

Our Amended and Restated Articles of Incorporation also permit shareholders to directly nominate directors for election at an annual shareholder meeting. In general, to be timely, a shareholder’s notice must be received by our Secretary at our principal executive office no less than 45 days or more than 90 days prior to the shareholder meeting and the notice must be in writing and must include certain specified information about the nominee and the shareholder making the nomination.

Communications with our Board

Any shareholder may communicate with our Board (or with any individual director) by sending a letter by mail addressed to the Chairman of the Board of Directors of Gulf Island Fabrication, Inc., 16225 Park Ten Place, Suite 280, Houston, Texas, 77084. The Chairman of our Board will forward the shareholder’s communication directly to the appropriate director or directors.

Our Board has adopted a policy that recommends that all directors personally attend each annual and special meeting of our shareholders. At the last annual meeting of shareholders held on April 23, 2015, all nine of the members of our Board at the time were in attendance.

Ethics and Business Conduct Policies

We have adopted a Code of Ethics for our Chief Executive Officer and senior financial officers and a Code of Business Conduct and Ethics, which applies to all employees and directors, including our Chief Executive Officer and senior financial officers. These codes are posted on our website at www.gulfisland.com under Investors—Corporate Governance. Any substantive amendments to the Code of Ethics or any waivers granted under the Code of Ethics will be disclosed within four business days of such event on our website.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than 10% shareholders are required by the regulations of the SEC to furnish the Company with copies of all Section 16(a) reports they file. Based solely on our review of copies of such reports and written representations from our officers and directors that no other reports were required for those persons, we believe that all of our officers, directors and greater than 10% shareholders complied with the filing requirements applicable to such persons for the fiscal year ended December 31, 2015.

Compensation Committee Interlocks and Insider Participation

During 2015, none of Messrs. Michael A. Flick, John P. (Jack) Laborde, Jerry D. Dumas, Sr., William E. Chiles and Murray W. Burns, who comprised the Compensation Committee, were officers or employees of the Company or any of its subsidiaries or had any relationships requiring disclosure in this proxy statement under “Certain Transactions,” and none of our executive officers served as a member of the compensation committee of another entity or as a director of another entity, one of whose executive officers served on the Compensation Committee or our Board. No member of the Compensation Committee is a former officer of the Company.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Amended and Restated Articles of Incorporation provide for a Board of Directors consisting of three classes, with the number of directors to be set forth in our By-laws. Our By-laws allow for the number of directors constituting the entire Board of Directors to be a range of not less than three nor more than twelve, with the exact number of directors to be fixed by a duly adopted resolution of the Board of Directors. The size of our Board is currently set at nine directors. The term of office of the Class I directors will expire at this annual meeting, and, in accordance with the recommendations of the independent directors, our Board has nominated the three persons listed as the Class I director nominees in the table below for election to our Board for a term expiring in 2019.

Proxies cannot be voted more than one time for each of the three director nominees named in this proxy statement. In the unanticipated event that any nominee is unavailable as a candidate for director, the persons named in the accompanying proxy will vote your shares of our common stock for a substitute candidate nominated by our Board.

Under our By-Laws, directors are elected by a plurality vote, with the three Class I director nominees who receive the most votes being elected.

Our Board recommends that shareholders vote FOR the election of the three Class I director nominees named in this proxy statement.

Information about the Directors, Director Nominees and Executive Officers

The following table sets forth, as of April 6, 2016, for each director nominee, each other director of the Company whose term will continue after the annual meeting, and each of our executive officers, the age, any positions with the Company, and principal occupations and employment during the past five years, any family relationships among such persons, and, if a director nominee or a director, each such person’s directorships in other public corporations during the past five years and the year that such person was first elected a director of the Company. We have also included information about each director and director nominee’s specific experience, qualifications, attributes, or skills that led the independent directors of our Board to conclude that such person should serve as one of our directors at the time we file this proxy statement, in light of our business and structure. All executive officers serve at the pleasure of our Board.

|

| | |

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

|

Nominees for Election as Class I Directors (term expires in 2019) |

| | |

Murray W. Burns, 70 | Project management, engineering, and business development consultant through MBurns Consulting since 2013. From 1980 to 2013, employed by Technip USA, Inc. and its affiliates in various executive capacities, including Vice President—Offshore Business Unit, Vice President—Topsides and Fixed Platforms, Vice President—Engineering Operations, Vice President—Engineering, President and COO (Technip Upstream Houston Inc.). From 1976 to 1980, Project Manager, Group Manager, Manager of Facilities and Supervising Engineer with Petro-Marine Engineering, Inc. Prior to 1976, worked in various engineering capacities at Shell Oil Company. Mr. Burns experience in the engineering and offshore fabrication industries provides valuable insight and makes him highly qualified to serve as a member of our Board and Compensation Committee. | 2014 |

| | |

William E. Chiles, 67 | Managing Partner of Pelican Energy Partners since 2014. From July 2004 to July 2014, Mr. Chiles served as President, CEO and a director of Bristow Group, Inc. Mr. Chiles retired as President and CEO of Bristow in July 2014, but continues to serve as a Senior Advisor and CEO Emeritus through July 2016. From 2003 to 2004, served as Executive Vice President and COO of Grey Wolf Inc., a publicly traded onshore oil & gas drilling company. From 2002 to 2003, served as Vice President of Business Development of ENSCO. In 1997 founded Chiles Offshore, Inc. ("Chiles II") and served as President and CEO until its merger with ENSCO International Incorporated (ENSCO) in 2002. In 1992, founded Southwestern Offshore Corporation and served as CEO and President until acquired by Cliffs Drilling Company (Cliffs) in 1996. From 1996 to 1997, served as Senior Vice President—Drilling Operations of Cliffs. In 1977, co-founded Chiles Offshore Inc. (formerly, Chiles Drilling Company, or "Chiles I") and served as President and CEO until its acquisition in 1994 by Noble Drilling. Prior to 1977, worked as VP—Domestic Operations at Western Oceanic, Inc. Mr. Chiles serves on the board of directors of Basic Energy Services. We believe Mr. Chiles is a valuable member of the Board and Compensation Committee because of his broad international experience and knowledge of the oil and gas industry and our customer base, as well as his executive experience with various publicly traded companies. | 2014 |

| | |

|

| | |

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

| | |

Michael A. Flick, 67 | Retired Banking Executive. Member of the Board of Directors, Audit Committee and Corporate Governance and Nominating Committee and former Chairman of the Compensation Committee of the Bristow Group, Inc. From 1970 to 1998 employed by First Commerce Corporation and First National Bank of Commerce, its wholly-owned subsidiary, in various executive capacities including Chief Credit Policy Officer, Chief Financial Officer and Chief Administrative Officer. Mr. Flick’s experience in the banking and financial services industries and his role as Chief Financial Officer provided him with the extensive knowledge of financial reporting, legal and audit compliance, and risk management making him highly qualified to serve as a member of the Audit Committee, the Chairman of the Compensation Committee, the Chairman of the Corporate Governance and Nominating Committee and a member of our Board. | 2007 |

|

Continuing Class II Directors (term expires in 2017) |

| | |

Gregory J. Cotter, 67 | Wealth Management Consultant since 2009. Employed by Huey Wilson Interest, Inc., a business management service company, and its affiliates in various executive capacities, including Director, President, Chief Operating Officer and Chief Financial Officer from 1989 through 2008. Director, President, and Chief Operating Officer of a publicly traded multi-bank holding company from 1986 to 1988. Senior Vice-President and Chief Financial Officer of H.J. Wilson Co. Inc., a publicly traded retailer, from 1977 to May 1985. Mr. Cotter’s extensive career in the banking and financial industries as well as his executive experience with various publicly traded companies provided him with a knowledge of financial reporting, accounting and controls as well as a knowledge of operations making him highly qualified to lead the Audit Committee as Chairman and serve as a member of our Board. | 1985 |

| | |

John P. (Jack) Laborde, 66 | Chairman of our Board since 2013. President of Overboard Holdings, L.L.C. (Overboard), a management company engaged in oil and gas exploration and development since January 2002. President since 1997 of All Aboard Development Corporation (All Aboard), an independent oil and gas exploration and production company. All Aboard is currently being managed by Overboard. President of AVOCA, LLC since 2014. AVOCA holds land and mineral rights in South Louisiana. Employed by the Company from 1992 until 1996 in various capacities, including International Marketing Manager. Prior to 1992, he worked as an engineer for Exxon Corporation and in various capacities for Ocean Drilling & Exploration Company and Murphy Oil Corporation. Son of Alden J. (Doc) Laborde, co-founder of the Company and former director.

Mr. Laborde’s knowledge of engineering, construction and oil and gas operations as well as his experience managing and overseeing the expansion of businesses makes him a valued member as Chairman of our Board, and as a member of the Compensation Committee, Audit Committee and Corporate Governance and Nominating Committee. | 1997 |

|

| | |

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

| | |

Christopher M. Harding, 64 | Private Investor. From 2012 to 2014, Vice President of Horton Wison Deepwater, a technology development company specializing in deepwater applications. From 2009 to 2012, Executive Vice President of GL Noble Denton, an offshore consultancy & marine warranty surveyor. President of the engineering division of Technip USA from 1999 to 2004. Founder and President of Genesis Oil & Gas Consultants, a privately-owned consulting and engineering firm serving both independent and international oil & gas companies from 1988 until acquisition by Technip in 1998.

Mr. Harding’s experience in the engineering & construction industries, and in international operations makes him highly qualified to serve on our Board and as a member of the Audit Committee. | 2007 |

|

Continuing Class III Directors (term expires in 2018) |

| | |

Jerry D. Dumas, Sr., 80 | Private investor. Chairman of the Board, President and Chief Executive Officer from 1998 to 2009 and non-executive Chairman of the Board from 2009 to 2010 of Flotek Industries. Vice President of Corporate and Executive Services of Merrill Lynch from 1988 to 1998. Served in various capacities, including Group Division President of Hughes Tool Company (now Baker Hughes Incorporated), a position responsible for the offshore division and the drilling fluids and chemical group, from 1968 to 1985. Mr. Dumas’s extensive career in the financial and oil and gas industries as well as his experience managing a publicly traded company provides him with knowledge of risk management, finance and operations and makes him a valued member of our Board and the Compensation Committee. | 2011 |

| | |

Kirk J. Meche, 53 | Chief Executive Officer of the Company since 2013. President of the Company since 2009 and Chief Operating Officer from 2009 to 2012. Executive Vice President—Operations of the Company from 2001 to 2009. President and Chief Executive Officer of Gulf Marine Fabricators, L.P., a wholly-owned fabrication subsidiary of the Company, from February 2006 to October 2006. President and Chief Executive Officer of Gulf Island, L.L.C., a wholly-owned fabrication subsidiary of the Company, from 2001 until 2006. President and Chief Executive Officer of Southport, Inc., a wholly-owned fabrication subsidiary of the Company, from 1999 to 2001. Project Manager of the Company from 1996 to 1999. Held various engineering positions for J. Ray McDermott and McDermott, Inc. from 1985 to 1996. Mr. Meche’s experience in the energy and marine construction industries, in particular his over 20 years of experience in various leadership roles with the Company and over 30 years in the industry, provides him with knowledge of managing operations and overseeing the expansion of business making him highly qualified to serve as a member of our Board. | 2012 |

|

| | |

| | |

Name and Age | Positions with the Company, Principal Occupations, Directorships in Other Public Companies, and Family Relationships | Director Since |

| | |

Michael J. Keeffe, 64 | Prior to his retirement in 2011, Mr. Keeffe was a Senior Audit Partner with Deloitte & Touche LLP. He has 35 years of public accounting experience at Deloitte & Touche directing financial statement audits of public companies, principally in the oil field service and engineering and construction industries, most with significant international operations. He also served as a risk management and quality assurance partner in the firm’s consultation network. He is a Retired Certified Public Accountant and holds a Bachelor of Arts and a Masters of Business Administration from Tulane University. Mr. Keeffe's extensive accounting and financial expertise, particularly in our industry and related industries makes him highly qualified to serve as a member and financial expert of the Audit Committee and a member of our Board. | 2014 |

|

Current Executive Officers not Serving as Directors |

| | |

Jeffrey Favret, 54 | Chief Financial Officer and Treasurer since May 2013; Secretary since May 2014; Executive Vice President since February 2015. Mr. Favret has worked with companies in oil and gas exploration and production, vessel construction, offshore drilling construction and offshore vessel/marine transportation industries, among others. Mr. Favret previously served as Director of Finance, Energy Infrastructure Segment, of FMC Technologies, Inc., a leading global provider of technology solutions for the energy industry, from May 2012 to May 2013. Mr. Favret also served as the Chief Accounting Officer for Trico Marine Services, Inc., a provider of marine support vessel and subsea services to the offshore oil and gas industry, from April 2010 to May 2012. Prior to that, Mr. Favret served as Director (Partner) of the accounting firm Postlethwaite & Netterville, after serving in various roles at Ernst & Young in its Assurance and Advisory practice. | N/A |

| | |

Todd F. Ladd, 49 | Chief Operating Officer since February 2014; Executive Vice President since February 2015. Mr. Ladd previously served as Vice President and General Manager of the Company since July 2013. Mr. Ladd has over 28 years industry experience in the offshore fabrication sector. From 2001 to 2013, Mr. Ladd served as Senior Project Manager with Paloma Energy Consultants, an offshore construction project management firm. From 1996 to 2001, Mr. Ladd served as Project Manager for Gulf Island LLC. Mr. Ladd also served as Production Engineer and Facility Engineer at McDermott Marine Construction from 1988 to 1996. | N/A |

Director Compensation

We use a combination of cash and equity-based incentive compensation to attract and retain qualified candidates to serve on our Board. In setting director compensation, we consider the significant amount of time directors dedicate in fulfilling their duties as directors, as well as the skill-level required by the Company to be an effective member of our Board. For 2015, the form and amount of director compensation was reviewed by our full Board, which includes Mr. Meche, our President and Chief Executive Officer. During 2015, the Board reaffirmed stock ownership guidelines and established an anti-hedging policy for all directors.

Cash Compensation

For service as a director during 2015, each non-employee director, except Messrs. Cotter, Keeffe, Laborde and Flick, received an annual fee of $54,000 for his services as a director. Mr. Cotter, as a director and Chairman of the Audit Committee, received an annual fee of $66,000 and Mr. Keefe, as a director and the Audit Committee Financial Expert for nine months during 2015, received an annual fee of $63,000. Mr. Flick, as a director, the Audit Committee Financial Expert for three months during 2015, Chairman of the Compensation Committee, and Chairman of the Corporate Governance and Nominating Committee for three months during 2015, received an annual fee of $72,000. Mr. J. Laborde received an annual fee of $120,000 for serving as a director

and Chairman of the Board. All directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of our Board and its committees.

Equity-Based Compensation

Each non-employee director also received equity-based compensation under our stock incentive plans, which were approved by our shareholders. On April 23, 2015, each of our non-employee directors was granted 2,000 restricted stock units ("RSUs"), which vested on October 23, 2015, six months after the date of grant. Upon vesting, each RSU entitled the non-employee director, at his sole option, to receive either (i) one share of our common stock or (ii) in lieu of a share of our common stock, up to fifty percent (50%) of the fair market value of the share of our common stock in cash. We expect to continue to make an annual grant of RSUs to our non-employee directors. Under our stock ownership guidelines, as of the end of fiscal 2018, directors are required to maintain a minimum of 5,000 shares.

The table below summarizes compensation paid in 2015 to each person serving as a director during 2015, with the exception of Mr. Meche. Mr. Meche did not receive any compensation as a director and his compensation as an executive of the Company is fully reflected in the 2015 Summary Compensation Table on page 19.

|

| | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash (1) | | Stock Awards (2) | | Total |

Murray W. Burns | | $ | 54,000 |

| | $ | 30,680 |

| | $ | 84,680 |

|

William E. Chiles | | 54,000 |

| | 30,680 |

| | 84,680 |

|

Gregory J. Cotter | | 66,000 |

| | 30,680 |

| | 96,680 |

|

Jerry D. Dumas, Sr. | | 54,000 |

| | 30,680 |

| | 84,680 |

|

Michael A. Flick | | 72,000 |

| | 30,680 |

| | 102,680 |

|

Christopher M. Harding | | 54,000 |

| | 30,680 |

| | 84,680 |

|

Michael J. Keeffe | | 63,000 |

| | 30,680 |

| | 93,680 |

|

John P. Laborde | | 120,000 |

| | 30,680 |

| | 150,680 |

|

______________________________

| |

(1) | Reflects fees earned by the directors during 2015 for their service on our Board and its committees, as applicable. |

| |

(2) | Reflect the aggregate grant date fair value of RSUs. RSUs are valued on the date of grant at the closing sale price per share of our common stock. On April 23, 2015, each of our non-employee directors was granted 2,000 RSUs, with a grant date fair value of $15.34 per RSU. |

Stock Ownership

The following table sets forth, as of April 6, 2016, certain information regarding beneficial ownership of shares of our common stock by (i) each of our current directors and director nominees, (ii) each of our named executive officers, (iii) all of our director nominees and current directors and executive officers as a group, and (iv) each other shareholder known by us to be the beneficial owner of more than 5% of our outstanding common stock. Unless otherwise indicated, we believe that the shareholders listed below have sole investment and voting power with respect to their shares of our common stock based on filings with the SEC and/or information furnished to us by such shareholders.

|

| | | | | | | |

Name of Beneficial Owner | | Number of Shares Beneficially Owned(1) | | | | Shares Percentage of Outstanding Common Stock(2) |

Directors, Director Nominees and Named Executive Officers: | | | | | | |

Murray W. Burns | | 4,300 |

| | | | * |

William E. Chiles | | 4,000 |

| | | | * |

Gregory J. Cotter | | 9,000 |

| | | | * |

Jerry D. Dumas | | 5,055 |

| | | | * |

Jeffrey M. Favret | | 57,745 |

| | | | * |

Michael A. Flick | | 5,130 |

| | | | * |

Christopher M. Harding | | 6,000 |

| | | | * |

Michael J. Keeffe | | 3,000 |

| | | | * |

John P. Laborde (3) | | 14,849 |

| | | | * |

Todd F. Ladd | | 74,707 |

| | | | * |

Kirk J. Meche | | 160,745 |

| | | | * |

All director nominees and current directors and executive officers of the Company as a group (11 persons) (4) | | 344,531 |

| | | | * |

5% or Greater Shareholders: | | | | | | |

BlackRock, Inc. (5) | | 915,925 |

| | (6) | | 6.3% |

Dimensional Fund Advisors LP (7) | | 1,020,553 |

| | (8) | | 7.0% |

Heartland Advisors, Inc. (9) | | | | | | |

William J. Nasgovitz | | 954,455 |

| | (10) | | 6.5% |

Starboard Enterprises, L.L.C. (11) | | 884,700 |

| | (12) | | 6.0% |

T. Rowe Price Associates, Inc. (13) | | | | | | |

T. Rowe Price Small-Cap Stock Fund, Inc. | | 1,603,864 |

| | (14) | | 11.0% |

Royce & Associates, LLC (15) | | 858,925 |

| | (16) | | 5.9% |

___________________________________________

| |

1. | Includes unvested shares of restricted stock. |

| |

2. | Based on 14,630,686 shares of our common stock outstanding as of April 4, 2016. |

| |

3. | Mr. J. Laborde has sole voting and dispositive power with respect to 14,849 shares of our common stock. This amount does not include Mr. Laborde’ s indirect interest in the shares of our common stock held by Starboard Enterprises, L.L.C. (Starboard) and All Aboard Development Corporation (All Aboard) as a result of his ownership interest in those entities. See footnote 12. |

| |

4. | Includes our director nominees, current directors, and executive officers as of April 4, 2016. |

| |

5. | The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

| |

6. | Based on information contained in the Schedule 13G/A filed with the SEC on January 26, 2016 by BlackRock, Inc. |

| |

7. | The address of Dimensional Fund Advisors LP is Building One, 6300 Bee Cave Road, Austin, Texas, 78746. |

| |

8. | Based on information contained in the amended Schedule 13G filed with the SEC on February 9, 2016, all of the shares reported are owned by investment advisory clients of Dimensional Fund Advisory LP (Dimensional Fund). To Dimensional Fund’s knowledge, no such client has an interest relating to more than 5% of our outstanding common stock. As investment advisor, Dimensional Fund has (i) sole voting power with respect to 988,226 shares of our common stock and (ii) sole dispositive power with respect to 1,020,553 all of the shares reported. Dimensional Fund expressly disclaims beneficial ownership of these shares. |

| |

9. | The address of Heartland Advisors, Inc. (Heartland) and William J. Nasgovitz is 789 North Water Street, Milwaukee, Wisconsin 53202. |

| |

10. | Based on information contained in the amended Schedule 13G jointly filed with the SEC on February 5, 2016, all of the shares reported are owned by investment advisory clients of Heartland Advisors, Inc. To Heartland’s knowledge, no such client has an interest relating to more than 5% of our outstanding common stock. As investment advisor, the reporting persons have shared investment and dispositive power with respect to all of the shares reported. Heartland expressly disclaims beneficial ownership of these shares. |

| |

11. | The address of Starboard Enterprises, L.L.C. is 601 Poydras Street, Suite 1726, New Orleans, LA, 70130. |

| |

12. | Mr. Alden “Doc” Laborde was a founder of the Company. As such, he had a significant ownership stake in the Company prior to its initial public offering in 1997. As reported in the original Schedule 13D, on January 2, 2002, Mr. A. Laborde organized Starboard |

Enterprises, L.L.C. (Starboard) for purposes of establishing a private holding company for himself, his wife, and their five children in connection with his estate planning and in connection therewith he contributed 1,524,700 shares of Company common stock to Starboard, which was the substantial majority of his ownership interest in the Company. Also as reported in the original Schedule 13D, 600,000 of those shares were transferred from Starboard to The Almar Foundation (the “Foundation”) in 2005. Additionally, All Aboard Development Corporation (“All Aboard”), a privately-held independent oil and gas exploration and production company and another Laborde family company, beneficially owns 20,000 shares of Company common stock and the Foundation beneficially owns 100,000 shares of Company common stock. Each of Mr. A Laborde’s five children, including our Chairman of the Board, John P. Laborde, serves as a manager of Starboard (each, a “Manager”), a trustee of the Foundation and a director of All Aboard. On June 6, 2014, Mr. A. Laborde died and was survived by the Managers. Mr. A. Laborde’s estate (the “Estate”) now holds 14,650 shares of Company common stock which were owned by Mr. A. Laborde at his death, and the Managers are the co-executors of the Estate. In addition, the Estate holds a 33.93% interest in Starboard and a 49.95% equity interest in Overboard Holdings, L.L.C. (“Overboard”), the parent company of All Aboard. With respect to Starboard, each of the Managers directly owns a 0.2% interest and the remaining 65.07% interest is owned by various trusts of which the Managers are either both principal and income beneficiaries or are only income beneficiaries with their children as the principal beneficiaries. With respect to Overboard, the remaining 50.05% equity interest is owned 0.1% by Mr. John P. Laborde and 49.95% by various trusts of which the Managers are either both principal and income beneficiaries or are only income beneficiaries with their children as the principal beneficiaries.

| |

13. | The address of T. Rowe Price Associates, Inc. and T. Rowe Price Small-Cap Stock Fund, Inc. is 100 E. Pratt Street, Baltimore, Maryland, 21202. |

| |

14. | Based on information contained in the amended Schedule 13G jointly filed with the SEC on February 16, 2016 all of the shares reported by T. Rowe Price Associates, Inc. (Price Associates) are owned by investment advisory clients of and such clients have the right to receive dividends from and proceeds from the sale of the shares of our common stock. With respect to the shares reported to be owned by T. Rowe Price Small-Cap Stock Fund, Inc. (T. Rowe Price Fund), a registered investment company sponsored by Price Associates to which it also serves as investment advisor, only State Street Bank and Trust Company, as custodian for T. Rowe Price Fund, has the right to receive dividends paid with respect to, and proceeds from the sale of, such shares. To Price Associates’ knowledge, no other advisory client has an interest relating to more than 5% of our outstanding common stock. As investment advisor, Price Associates has (i) sole voting power with respect to 207,784 shares of common stock and (ii) sole dispositive power with respect to all of the reported shares, and T. Rowe Price Small-Cap Stock Fund has sole voting power over 713,000 shares. |

| |

15. | The address of Royce & Associates, LLC is 745 Fifth Avenue, New York, NY 10151. |

| |

16. | Based on information contained in the amended Schedule 13G filed with the SEC on January 13, 2016. |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

Introduction

This section of the proxy describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during the last fiscal year to our chief executive officer, our chief financial officer, and our chief operating officer (our “named executive officers”), our only executive officers during 2015. Our fiscal 2015 named executive officers are:

| |

• | Kirk J. Meche, President and Chief Executive Officer; |

| |

• | Jeffrey M. Favret, Executive Vice President, Chief Financial Officer, Treasurer, and Secretary; |

| |

• | Todd F. Ladd, Executive Vice President and Chief Operating Officer. |

In this Compensation Discussion and Analysis, we first provide an Executive Summary of our actions and highlights from 2015. We next explain the principles that guide our Compensation Committee’s (the “Committee”) executive compensation decisions and recommendations and the process we follow when setting executive compensation. Finally, we discuss each component of executive compensation, including the actual results yielded for each named executive officer in fiscal 2015. You should read this section of the proxy statement in conjunction with the advisory vote that we are conducting on the compensation of our named executive officers (see Proposal 2), as it contains information that is relevant to your voting decision.

2015 Company Performance

As more fully discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the years ended December 31, 2015 and 2014, the Company recorded net income (loss) of $(25.4) million and $15.3 million on revenue of $306.1 million and $506.6 million for the years ended December 31,

2015 and 2014, respectively. Decreases in year-over-year results are primarily a result of loss provisions on certain projects and the downturn in the oil & gas industry.

During the year ended December 31, 2015, we incurred contract losses of $24.5 million related to a decrease in the contract price due to final weight re-measurements and our inability to recover certain costs on disputed change orders for a large deepwater project. In addition, we accrued contract losses of approximately $9.4 million resulting from increases in our projected unit labor rates of our fabrication facilities. Our increases in unit labor rates were driven by our inability to absorb fixed costs due to decreases in expected oil and gas fabrication activity.

The current industry downturn, resulting from crude oil price volatility, has created significant uncertainty in global equity prices and overall market fundamentals within the energy industry. This uncertainty is the result of several factors including a global supply/demand imbalance for oil and an oversupply of natural gas in the United States; robust non-OPEC supply growth led by expanding unconventional production in the United States; weakening growth in emerging markets; and the decision by OPEC to maintain its current production ceiling. We anticipate that crude oil prices will increase in the future, as continued growth in demand and a slowing in supply growth should bring global markets into balance; however, the timing of any such increase is unknown.

The downturn in the energy sector presents challenges in the near term, especially as it relates to Gulf of Mexico activity. The further reductions in capital spending by our customers in the global oil and gas industry, relative to the already reduced spending levels in the prior year for offshore exploration and production in particular, introduces additional uncertainty to short- and long-term demand in offshore oil and gas project activity. The result of these actions have had an adverse effect on our overall backlog levels and has created challenges with respect to our ability to operate our fabrication facilities at desired utilization levels.

We are responding to decreases in capital spending by our customers by reducing our own capital spending, adjusting our overall cost structure, and adjusting the level of our workforce commensurate with expected near-term work in our facilities. Our recent acquisition of LEEVAC provides us with assets and operations that are complementary to our existing marine fabrication business while at the same time allowing us to diversify our marine product offering away from traditional upstream oil & gas fabrication and add significant additional backlog at an attractive value.

We believe that our strong balance sheet, levels of cash, and access to capital provides us with the strength to persevere through the current down cycle.

Pay Philosophy

The Compensation Committee is responsible for designing, implementing, and administering a compensation program for executive officers that ensures appropriate linkage among pay, Company performance, and results for shareholders, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. The Compensation Committee seeks to increase shareholder value by rewarding performance with cost-effective compensation and ensuring that we attract and retain the best executive talent available. While our executive officer compensation program is simple in design, we believe it serves the Company well by providing a mix of annual cash compensation, including base salary and performance based annual incentive awards, with long-term awards.

2015 Compensation Program Highlights

| |

• | Annual Incentive Program Payout Based on Performance. Our named executive officers annual incentive awards for 2015 were based on specific targeted metrics related to our level of pre-tax earnings, operating margins, safety metrics, and individual performance. Based on our safety results for 2015, our named executive officers received annual cash payouts equal to 50% of their target annual cash incentive awards. |

| |

• | Long-Term Incentive Programs Now Incorporates Performance Awards. Executive officer annual incentive awards are based on specific targeted metrics. The Compensation Committee introduced performance share units to the long-term incentive mix in 2015 to better align pay opportunities with Company performance, shareholder interests, and emerging best practices. |

| |

• | No Salary Increases for 2015. Given the economic environment of the oil and gas industry, the Compensation Committee elected not to increase base salaries for our named executive officers in 2015. |

| |

• | “Double Trigger” Equity Awards. Beginning with the equity awards made under our long-term incentive program in 2015, in connection with a change of control, vesting of the awards will only accelerate upon the recipient’s actual or constructive termination of employment within one year following a the change of control. |

| |

• | All of our named executive officers are at-will employees. The Compensation Committee does not believe employment agreements provide any appreciable retentive or motivational value. Except for limited benefits available to certain executives in connection with a termination due to a change of control, we do not provide severance or retirement benefits to our executive officers other than those provided to all of our employees generally. |

Strong Historical Support of Say-on-Pay

At our 2015 annual meeting, we held a non-binding shareholder advisory vote on executive compensation (“say-on-pay”). Similar to results in the previous year, our shareholders approved our fiscal 2014 executive compensation, with more than 98% of voting shareholders casting their vote in favor of the say-on-pay resolution, excluding abstentions and broker non-votes which are not considered votes cast. The Compensation Committee considered the results of the 2015 say-on-pay vote relating to fiscal 2014 executive compensation as affirmation of shareholder approval of our executive compensation program.

Nevertheless, the Compensation Committee continues to monitor our executive compensation program in the context of current and emerging market practice, and the latest thinking on sound corporate governance. For example, effective for 2016, the company adopted share ownership guidelines and an anti-hedging policy to further align our executive compensation program with emerging “best practice.”

Compensation Decision-Making Process

The Compensation Committee engaged Aon Hewitt in 2015 as its independent compensation consultant to review compensation practices and policies. Consistent with our Compensation Committee’s policy, Aon Hewitt does not provide, and has not provided, any services to the Company’s management. As required by SEC rules, the Compensation Committee has assessed the independence of Aon Hewitt and concluded that Aon Hewitt’s work did not raise any conflicts of interest. A representative of Aon Hewitt attends meetings of our Compensation Committee when requested by the Compensation Committee chairman and communicates with our Committee chairman between meetings; however, our Compensation Committee makes all recommendations regarding the compensation of our executive officers to the Board of Directors for its approval. Aon Hewitt provides various executive compensation services to our Committee, including advising our Compensation Committee on our annual and long-term incentive programs, selection of an appropriate peer group, evolving industry practices and providing market information and analysis regarding the competitiveness of our program design.

Although we have not formally benchmarked our compensation to the compensation paid by our peers and competitors, the Compensation Committee uses peer compensation data prepared by Aon Hewitt to evaluate whether the executive compensation levels, including base salary and annual and long-term incentive targets, are in line with our energy and marine construction industry peers.

This data included a comparison of named executive officer compensation against similar positions in companies with comparable revenues to the Company from published oil and gas industry surveys. In addition, the Committee also reviewed comparisons of named executive officer compensation against compensation levels published in the proxy statements of 15 peer companies listed below:

|

| |

McDermott International Inc. | Matrix Service Company |

Atwood Oceanics, Inc. | W&T Offshore Inc. |

Helix Energy Solutions Group, Inc. | Pioneer Energy Services Corp. |

Parker Drilling Co. | Hercules Offshore, Inc. |

TETRA Technologies, Inc. | Dril-Quip, Inc. |

Hornbeck Offshore Services, Inc. | Cal Dive International Inc |

Tesco Corporation | Orion Marine Group, Inc |

ENGlobal Corp | |

The Committee considered both sets of data, but generally relied on the peer company proxy data as the primary source for the Chief Executive Officer and Chief Financial Officer positions. Since not all peer companies have Chief Operating Officer positions, the Committee relied on the published survey data as the primary source for that position.

Our Chief Executive Officer attends the Compensation Committee’s meetings, assists in the Compensation Committee’s evaluation of Company and executive officer performance (other than himself), and recommends the specific elements and amounts of compensation to be paid to the other executive officers. Our Chief Executive Officer is not present or otherwise involved when the Compensation Committee reviews his performance and develops recommendations regarding his compensation.

The Compensation Committee typically meets following the end of each fiscal year to review the performance of the Company and its executives. This meeting is generally scheduled approximately one year in advance, and at this meeting, all compensation recommendations are made, including recommendations regarding adjustments to the annual base salaries of the executive officers, the adoption of a cash incentive program for the following fiscal year, and whether any equity awards will be made. The Compensation Committee has not delegated authority to any officer to grant equity awards. The Board of Directors typically makes compensation decisions based on the Compensation Committee’s recommendations at a separate meeting of the Board of Directors following the Compensation Committee meeting.

Components of Executive Compensation

Our executive officer compensation program for 2015 included salaries, annual cash incentive bonuses, and long-term incentive compensation. The Compensation Committee reviewed and quantified all components of our named executive officers’ compensation, including salary, non-equity and equity incentive plan compensation, the current value of outstanding equity awards, and the incremental cost to the Company of all perquisites and other benefits for 2015, and determined that such officers’ total compensation in the aggregate is reasonable and not excessive.

Salaries. The base salaries of each of our named executive officers for 2015 were as follows: Mr. Meche—$500,000, Mr. Favret—$340,000, Mr. Ladd—$350,000. Our philosophy is that base salaries, which provide fixed compensation, should meet the objective of attracting and retaining the executive officers needed to manage our business successfully. The actual salaries of our named executive officers are based on their individual levels of responsibility and the Compensation Committee’s general knowledge of the competitive compensation levels in the energy and marine construction industry. With respect to the relevant base salaries of our peer or survey groups referenced above, our executive base salaries are below the 25th percentile range of the comparative groups. While the Compensation Committee does not formally benchmark our executives’ compensation, its goal is to move our executives’ base salaries toward the median of comparison groups over time in order to help retain and attract key executives. However, given market conditions within the oil and gas industry, the Committee elected not to recommend increases to our named executive officers' base salaries for 2015 and the Board agreed. In addition, given the sustained downturn within the oil and gas industry, our named executive officers did not receive base salary increases for 2016.

Annual Cash Incentives. In early 2015, the Committee recommended and the Board approved the performance measures and targets applicable to the annual cash incentive program for 2015 for our named executive officers, which are described in the table below. The Compensation Committee believes that these metrics are appropriate measures on which to base our annual bonus because they are directly tied to management’s success in growing our business and will drive our executives in improving operational efficiencies. Each executive has a target annual incentive (expressed as a percent of base salary), with threshold equal to 50% of target, and maximum equal to 200% of target. If actual results fall between performance standards, awards are determined by using straight-line interpolation. Notwithstanding the Company's performance, the Committee retains the right to reduce or eliminate the payments prior to payout. The table below summarizes the determination of annual cash incentives paid for 2015 performance to all of our named executive officers:

Performance Measures, Weights, Standards, and Payout Opportunities

|

| | | | | | | |

Performance Measure | Weighting | Threshold Performance | Target Performance | Maximum Performance | | Actual Performance | Payout |

Pre-Tax Earnings | 30% | 75% of Budget | 100% of Budget | 125% of Budget | | -517% / Below Threshold | 0% of Target |

Gross Profit Margin | 30% | 6.5% | 8% | 10% | | -4.1% / Below Threshold | 0% of Target |

Lost Time Incident Rate | 12.5% | 0.75 | 0.67 | 0.62 | | 0.20 / Maximum | 25% of Target |

Total Recordable Time Incident Rate | 12.5% | 2.0 | 1.5 | 1.0 | | 0.95 / Maximum | 25% of Target |

Individual Performance | 15% | * | * | * | | * | 0% of Target* |

| | | | | | Total Earned: | 50% of Target |

__________________________________

* Notwithstanding the results of individual performance appraisals, the Compensation Committee determined that the individual performance element of the plan should not pay out, given the results on earnings and gross profit margin measures, and the decreased share price experienced by the Company.

The annual incentive awards received by our named executive officers as compared to their incentive target for 2015 were as follows:

|

| | | | | | | | | | | | | | | | |

Named Executive Officer | | Base Salary | | Target Annual Incentive (% of base salary) | | Target Annual Incentive | | Earned Incentive - see table above (% of target) | | Earned Incentive |

Mr. Meche | | $ | 500,000 |

| | 100.0% | | $ | 500,000 |

| | 50.0% | | $ | 250,000 |

|

Mr. Favret | | 340,000 |

| | 75.0% | | 255,000 |

| | 50.0% | | 127,500 |

|

Mr. Ladd | | 350,000 |

| | 80.0% | | 280,000 |

| | 50.0% | | 140,000 |

|

Long-Term Incentive Awards. Historically, the Compensation Committee utilized restricted stock as the sole equity-based incentive awarded to our executives. During 2015, the Committee worked with its compensation consultant to revise the program and incorporate more Performance elements. Under our new long-term incentive program, executive officers were awarded equity-based grants in the form of time-vested restricted stock units and performance shares. Performance shares granted in 2015 had a target grant date value of $1,000,000 for Mr. Meche, $400,000 for Mr. Favret, and $500,000 for Mr. Ladd.

| |

• | Restricted stock units vest 1/3 per year over three years. |

| |

• | Performance share unit awards have a two-year performance period and pay out in shares of common stock at between 0% and 150% of the target value following the end of the performance period based on our total stockholder return relative to a group of peer companies as follows |

|

| |

Relative TSR Performance | Payout (% of target award earned) * |

Threshold / <25th % | —% |

Threshold / 25th % | 50% |

Target / 50th % | 100% |

Maximum / 75th % or higher | 150% |

__________________________________

* Payouts for performance between performance standards shown above determined using straight-line interpolation.

The peer companies used to determine relative TSR performance for the 2015 grants are as follows: Helix Energy Solutions Group, Inc., McDermott International Inc., Oceaneering International, Inc., Subsea 7 SA, Technip SA, Tetra Technologies, Inc., and Cal Dive International, Inc.

Perquisites. We also provide very limited perquisites and personal benefits to certain of our named executive officers, consisting of automobile related expenses and benefits. However, the aggregate value of these benefits for our named executive officers did not exceed $10,000 for any executive during 2015.

Post-Employment Compensation