INVESTOR PRESENTATION November 2023 Exhibit 99.1

Cautionary Statements This presentation contains forward-looking statements in which the Company discusses its potential future performance, operations and projects. Forward-looking statements, within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, are all statements other than statements of historical facts, such as projections or expectations relating to operating results; timing of delivery of vessels related to the Active Retained Shipyard Contracts and subsequent wind down of the Company’s Shipyard Division operations; impacts of the resolution of the MPSV Litigation; diversification and entry into new end markets; improvement of risk profile; industry outlook; oil and gas prices; timing of investment decisions and new project awards; cash flows and cash balance; capital expenditures; liquidity; tax rates; and execution of strategic initiatives. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “to be,” “potential” and any similar expressions are intended to identify those assertions as forward-looking statements. The Company cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause its actual results to differ materially from those anticipated in the forward-looking statements include: supply chain disruptions (including global shipping and logistics challenges), inflationary pressures, economic slowdowns and recessions, natural disasters, public health crises (such as COVID-19), labor costs and geopolitical conflicts (such as the conflict in Ukraine and the Israel-Hamas conflict), and the related volatility in oil and gas prices and other factors impacting the global economy; cyclical nature of the oil and gas industry; its ability to resolve any material legal proceedings; competition; reliance on significant customers; competitive pricing and cost overruns on its projects; performance of subcontractors and dependence on suppliers; timing and its ability to secure and commence execution of new project awards, including fabrication projects for refining, petrochemical, LNG, industrial and sustainable energy end markets; its ability to maintain and further improve project execution; nature of its contract terms and customer adherence to such terms; suspension or termination of projects; changes in contract estimates; customer or subcontractor disputes; operating dangers, weather events and availability and limits on insurance coverage; operability and adequacy of its major equipment; recoveries of any insurance proceeds for previous damage at its Houma Facilities; its ability to raise additional capital; its ability to amend or obtain new debt financing or credit facilities on favorable terms; its ability to generate sufficient cash flow; its ability to obtain letters of credit or surety bonds and ability to meet any indemnification obligations thereunder; consolidation of its customers; financial ability and credit worthiness of its customers; adjustments to previously reported profits or losses under the percentage-of-completion method; its ability to employ a skilled workforce; loss of key personnel; utilization of facilities or closure or consolidation of facilities; failure of its safety assurance program; barriers to entry into new lines of business; weather impacts to operations; any future asset impairments; changes in trade policies of the U.S. and other countries; compliance with regulatory and environmental laws; lack of navigability of canals and rivers; systems and information technology interruption or failure and data security breaches; performance of partners in any future joint ventures and other strategic alliances; shareholder activism; focus on environmental, social and governance factors by institutional investors and regulators; and other factors described under “Risk Factors” in Part I, Item 1A of the Company’s annual report on Form 10-K for the year ended December 31, 2022, as updated by subsequent filings with the SEC. Additional factors or risks that the Company currently deems immaterial, that are not presently known to the Company or that arise in the future could also cause the Company’s actual results to differ materially from its expected results. Given these uncertainties, investors are cautioned that many of the assumptions upon which the Company’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, which it cannot control. Further, the Company may make changes to its business plans that could affect its results. The Company cautions investors that it undertakes no obligation to publicly update or revise any forward-looking statements, which speak only as of the date made, for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, and notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes. Non-GAAP Measures This presentation includes certain non-GAAP measures, including earnings before interest, taxes, depreciation and amortization ("EBITDA“), adjusted EBITDA, adjusted revenue, new project awards and backlog. The Company believes EBITDA is a useful supplemental measure as it reflects the Company's operating results excluding the non-cash impacts of depreciation and amortization. The Company believes adjusted EBITDA is a useful supplemental measure as it reflects the Company’s EBITDA adjusted to remove certain nonrecurring items (including the impact of insurance recoveries and costs associated with damage previously caused by Hurricane Ida and certain non-cash impairment charges) and the operating results of the Company’s Shipyard Segment (including the impact of certain nonrecurring items related to the resolution of the MPSV Litigation), which the Company intends to wind down by the fourth quarter 2023. The Company believes adjusted revenue is a useful supplemental measure as it reflects the Company’s revenue adjusted to remove revenue for the Company’s Shipyard Segment (including the impact of certain nonrecurring items related to the resolution of the MPSV Litigation), which the Company intends to wind down by the fourth quarter 2023. The Company believes new project awards and backlog are useful supplemental measures as they reflect work that we are obligated to perform under our current contracts. New project awards represents the expected revenue value of contract commitments received during a given period, including scope growth on existing commitments. Backlog represents the unrecognized revenue value of new project awards, and for the periods presented, was consistent with the value of remaining performance obligations for contracts as determined under GAAP. See slides 37-39 for reconciliations of the relevant amounts to the most comparable GAAP measures. Non-GAAP measures are not intended to be replacements or alternatives to GAAP measures, and interested parties are urged to consider these non-GAAP measures in addition to, and not in substitution for, measures prepared in accordance with GAAP. We may present or calculate non-GAAP measures differently from other companies. Cautionary Statements & Non-GAAP Measures

Company Overview

About Us Fabrication business strategically positioned in attractive end markets Growing Services business provides stable growth platform Significant progress on Strategic Transformation has positioned Gulf Island to pursue Profitable Growth ~$142 million of total revenue for 2022 ~$42 million cash balance at September 30, 2023 ~$64 million market capitalization at October 31, 2023 Gulf Island (GIFI) is a leading fabricator of complex steel structures and modules and services provider to the industrial and energy sectors. The Company is headquartered in The Woodlands, TX with its primary operating facilities in Houma, LA.

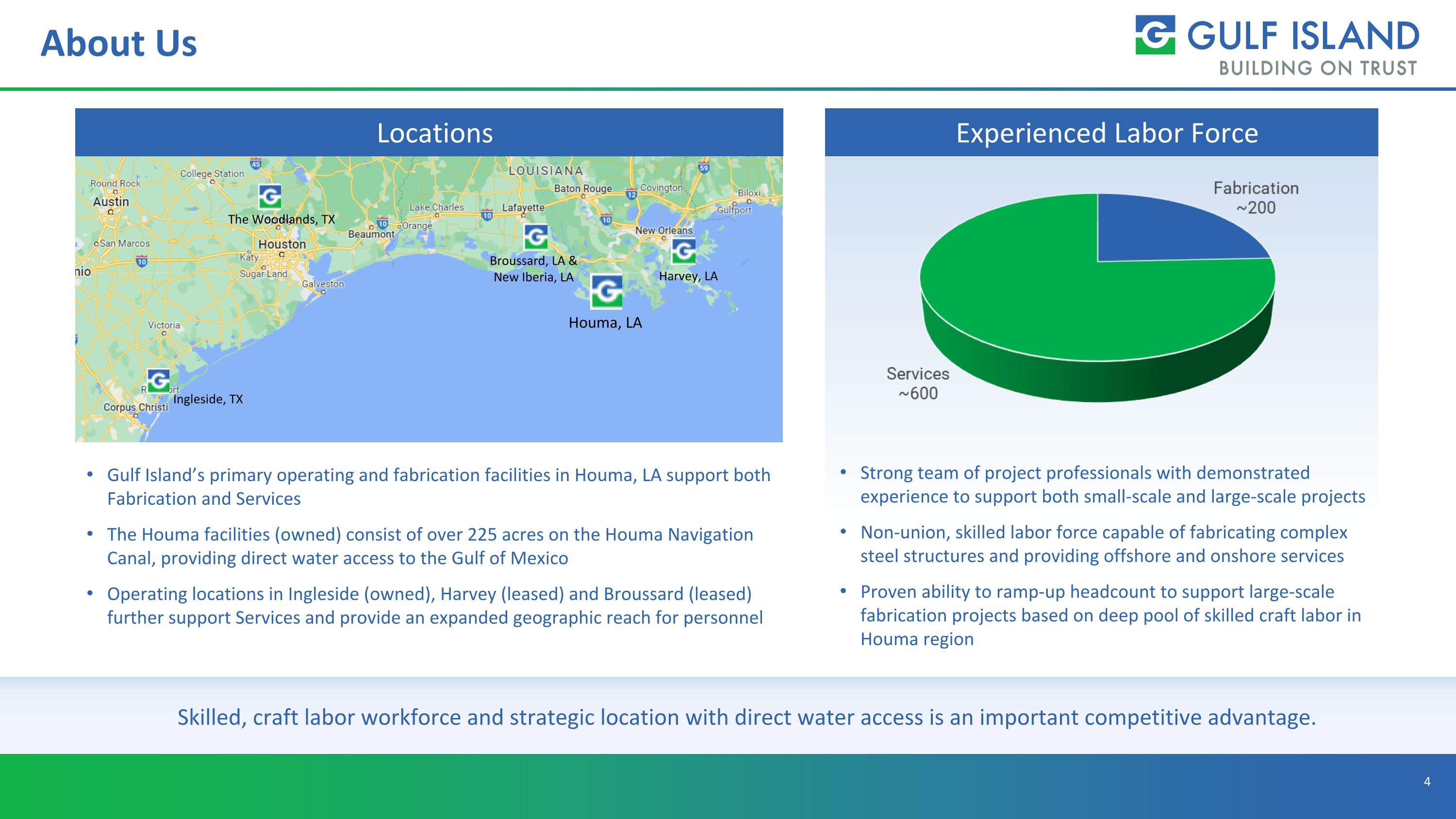

Houma, LA Broussard, LA & New Iberia, LA Harvey, LA Ingleside, TX About Us Experienced Labor Force Strong team of project professionals with demonstrated experience to support both small-scale and large-scale projects Non-union, skilled labor force capable of fabricating complex steel structures and providing offshore and onshore services Proven ability to ramp-up headcount to support large-scale fabrication projects based on deep pool of skilled craft labor in Houma region Gulf Island’s primary operating and fabrication facilities in Houma, LA support both Fabrication and Services The Houma facilities (owned) consist of over 225 acres on the Houma Navigation Canal, providing direct water access to the Gulf of Mexico Operating locations in Ingleside (owned), Harvey (leased) and Broussard (leased) further support Services and provide an expanded geographic reach for personnel Skilled, craft labor workforce and strategic location with direct water access is an important competitive advantage. Locations The Woodlands, TX

Segment Overview Operates Through Two Operating Segments FABRICATION Revenue Mix Current mix reflects strength of Services business and low volume of large-scale fabrication revenue. Anticipate relative mix to be more evenly split if large-scale fabrication projects are in backlog. SERVICES Fabrication business will benefit from near-term project activity in LNG, while opportunities in energy transition present attractive long-term growth potential. Growth of Services business accelerated by DSS Acquisition in 4Q21, which doubled Services headcount and increased its service offerings. Expanded Services platform provides benefit of stable, predictable results while also driving pull-through Fabrication work. Renewables Oil & Gas LNG Infrastructure Legacy Services Business + DSS Acquisition Oil & Gas Industrial

Maintenance & Decommissioning Scaffolding Coatings Specialty Welding Enclosures Municipal & Civil Services Division Welding Fitting Rigging Equipment Operations Firewatch Traditional SafeDeck Blasting/Painting Insulation Fireproofing Ultra High Pressure Torquing/Tensioning Hydrotesting Weld Isolation Cold Cutting Spark Containment Pressurized Enclosures Firewatch Gulf Island’s Services Division provides maintenance, repair, construction, scaffolding, coatings, welding enclosures and other specialty services on offshore and inland platforms and structures and at industrial facilities. Contracts are generally structured as time & materials or cost-reimbursable. Pump Stations Levee Reinforcement Bulkheads Spud Barge Ops Other Public Works

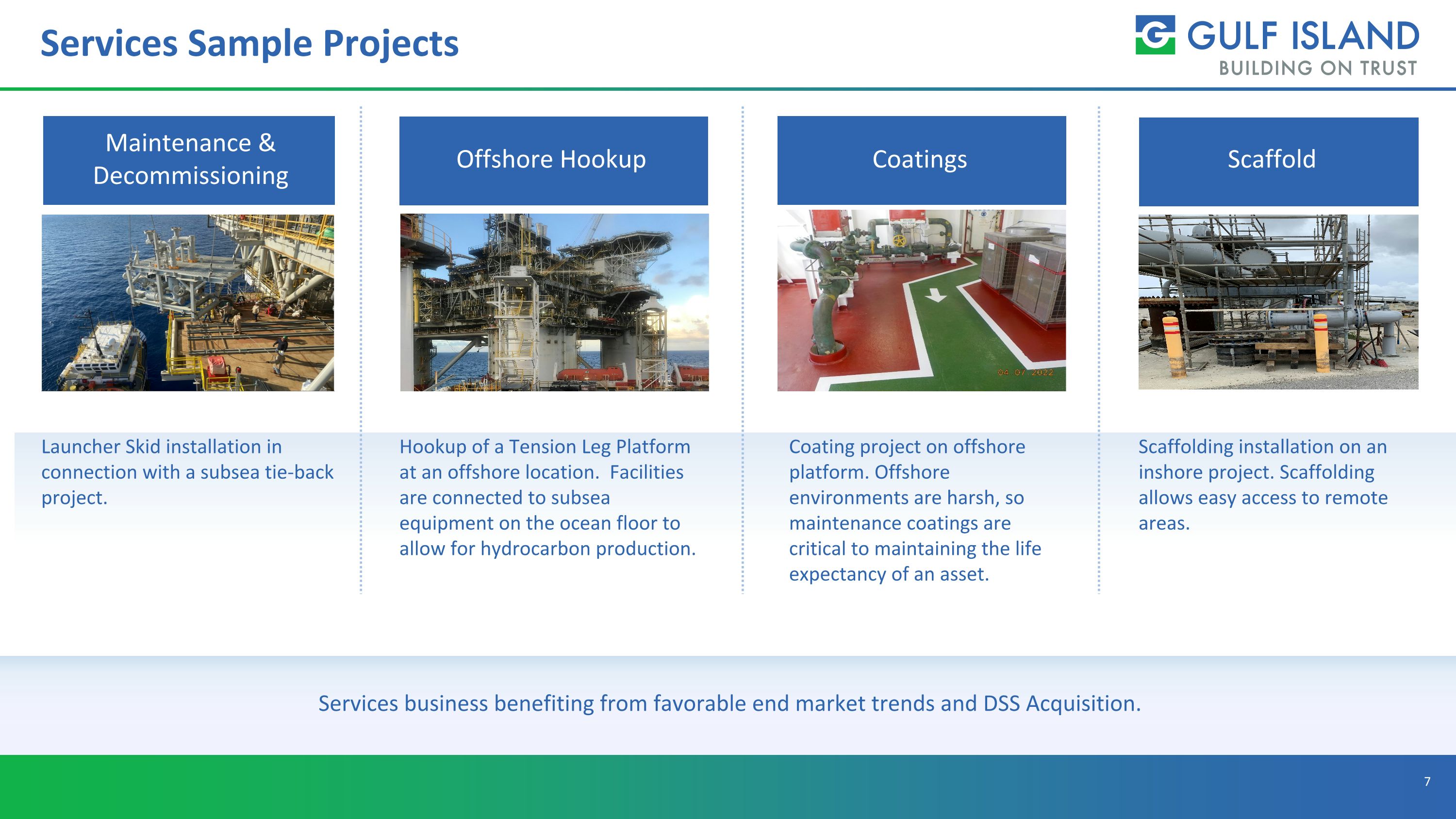

Launcher Skid installation in connection with a subsea tie-back project. Maintenance & Decommissioning Offshore Hookup Coatings Scaffold Hookup of a Tension Leg Platform at an offshore location. Facilities are connected to subsea equipment on the ocean floor to allow for hydrocarbon production. Coating project on offshore platform. Offshore environments are harsh, so maintenance coatings are critical to maintaining the life expectancy of an asset. Scaffolding installation on an inshore project. Scaffolding allows easy access to remote areas. Services Sample Projects Services business benefiting from favorable end market trends and DSS Acquisition.

Fabrication Division Offshore O&G Structures Offshore Wind Structures Rolled Goods, Docks & Terminals Subsea Structures Modules, Skids & Piping Systems Equipment Modules / Skids Process Modules / Skids Pipe Racks Pipe Spools Specialty Piping Jacket Foundations Decks Hulls Process Modules / Skids Sub-sea Tiebacks Piles / Monopiles Large OD Pipe Mooring Dolphins Dock Structures Walkways PLETS/PLEMS Inline Sleds Jumpers Suction Piles Manifolds Mudmats Jacket Foundations Electrical Substations Steel Components Support Structures Gulf Island’s Fabrication Division fabricates modules, skids and piping systems for onshore facilities; foundations and support structures for alternative energy developments; and offshore production platforms and associated structures. Contracts are generally structured as fixed-price or a hybrid of fixed-price, time & materials and cost-reimbursable.

Fabrication Sample Projects 2,900-ton Secondary Quench Exchanger (SQE) module and three 2,500-ton process modules for Ethane Cracker Facility. Ethane Cracker Modules Offshore Wind Turbine Foundations Mobile Launcher 2 Truss Components Subsea Structures Five 400-ton Jacket Foundations with Piles and five 360-ton Transition Pieces for Offshore Turbine Foundations. Multiple structural truss components for NASA’s Mobile Launcher 2 Project which will be used for the Artemis Space Program. Structures associated with a Gulf of Mexico subsea development consisting of Suction Piles, Sleepers, Mudmats, Jumpers and PLET pin piles. Small-scale fabrication business benefitting from strong trends in Gulf Coast region; bidding activity in the large-scale fabrication market is robust driven by favorable end market trends and limited industry capacity.

Corporate Sustainability A strong safety culture is a critical element of Gulf Island’s success, and the Company is committed to the safety and health of its employees and subcontractors. Gulf Island is committed to training the next generation of skilled craft professionals. The Company is also a vital part of the local community and is giving back and supporting good causes. Employees participate in a variety of community activities, including Junior Achievement, Relay for Life, and Hurricane relief. Gulf Island is focused on reducing its carbon footprint and protecting the environment within daily operations, with an emphasis on spill prevention, water and waste management, air emissions, and other natural resource conservation. Gulf Island is focused on promoting diversity and inclusion in the workplace. The Company’s commitment to diversity extends across all divisions and disciplines, starting with the Board of Directors, who adopted a policy of promoting diversity on the Board. Safety Community Environment Diversity Gulf Island works to build a sustainable and resilient Company for the employees and the communities in which it operates.

Safety Average Total Recordable Incident Rate of 0.54 since 2019 One Lost Time Incident since 2019 (7.8 million hours worked)

Supporting the Community Training Future Craft Professionals Del Mar College – Funds received from Texas Workforce Commission to upskill and reskill craft employees Louisiana Workforce Commission – Internal training developed to upskill craft employees Philanthropy and Community Involvement Relay for Life in Terrebonne Parish Junior Achievement in Houston LA Bayou Toy Drive TFMC Houston Heart Walk South LA Veterans Outreach Acadian Elementary Fund Raiser Roux for a Reason Bo Cipra Foundation

BUSINESS TRANSFORMATION

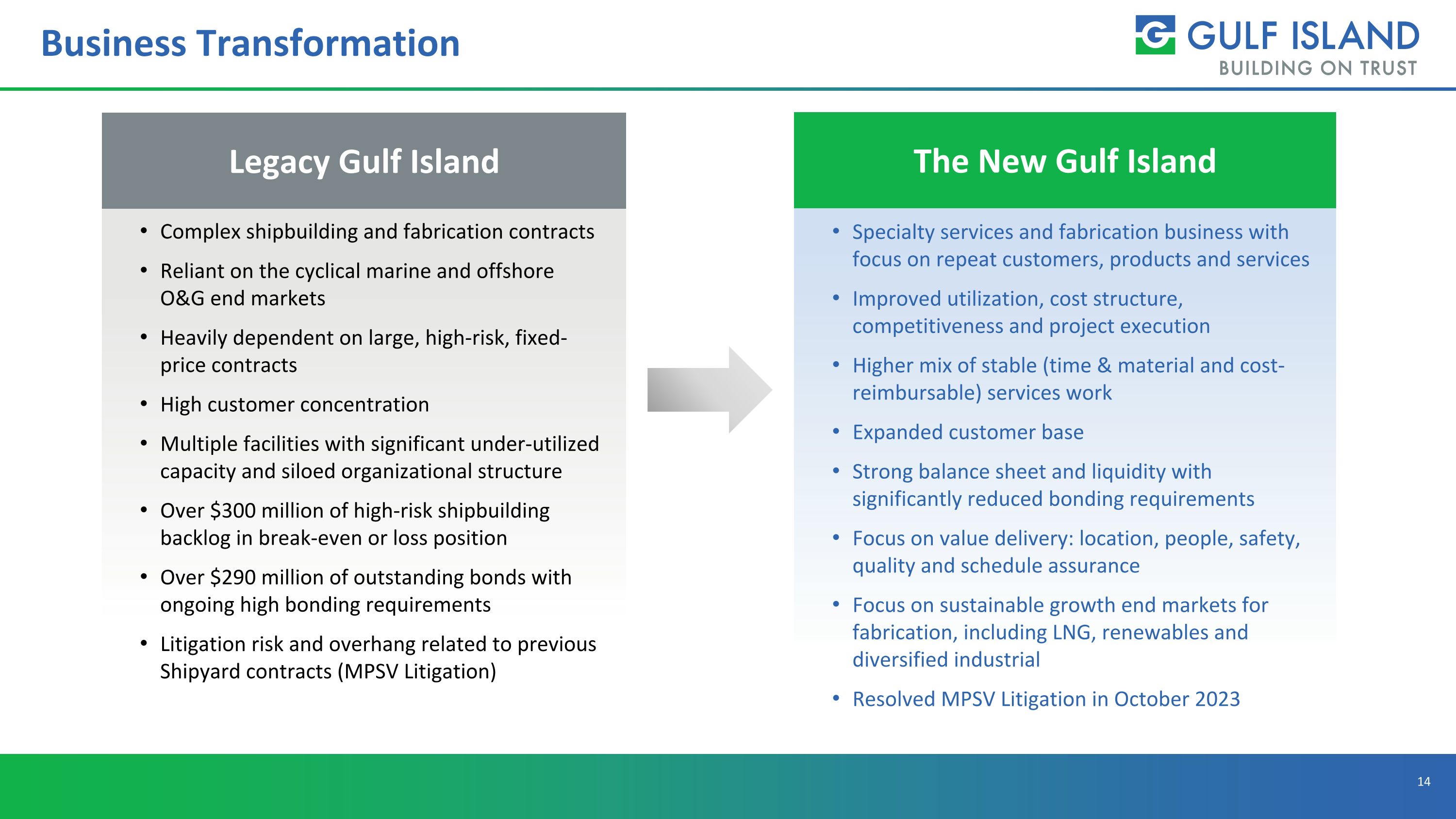

Business Transformation Complex shipbuilding and fabrication contracts Reliant on the cyclical marine and offshore O&G end markets Heavily dependent on large, high-risk, fixed-price contracts High customer concentration Multiple facilities with significant under-utilized capacity and siloed organizational structure Over $300 million of high-risk shipbuilding backlog in break-even or loss position Over $290 million of outstanding bonds with ongoing high bonding requirements Litigation risk and overhang related to previous Shipyard contracts (MPSV Litigation) Legacy Gulf Island The New Gulf Island Specialty services and fabrication business with focus on repeat customers, products and services Improved utilization, cost structure, competitiveness and project execution Higher mix of stable (time & material and cost-reimbursable) services work Expanded customer base Strong balance sheet and liquidity with significantly reduced bonding requirements Focus on value delivery: location, people, safety, quality and schedule assurance Focus on sustainable growth end markets for fabrication, including LNG, renewables and diversified industrial Resolved MPSV Litigation in October 2023

Transformation Phases In 2020 Gulf Island outlined a transformational strategy intended to improve the Company’s liquidity and operational performance to position the Company to pursue stable, profitable growth. With the significant progress achieved on the phase one initiatives, Gulf Island has shifted to phase two of its strategic transformation. PHASE ONE: Improve Liquidity and Operational Performance PHASE TWO: Pursue Stable, Profitable Growth 1 2 Legacy Gulf Island The New Gulf Island

PHASE ONE – Improve Financial Strength and Operational Performance Combined Fabrication activities within one division Closed certain under-utilized facilities and consolidated operations Made strategic changes to key personnel and added functional expertise Sold Shipyard operating assets and long-term contracts (2Q21) Resolved MPSV Litigation (4Q23) & winding down remaining Shipyard Division operations (expected completion in 4Q23) Increased mix of T&M and cost-reimbursable contracts Improved project cash flow Applied disciplined approach to pursuing/bidding projects Increased rigor around post award project reviews with a focus on risk mitigation and accountability Initiated lessons learned program Reduce risk profile and strengthen liquidity Improve resource utilization and centralize key project resources Improve competitiveness and project execution 1

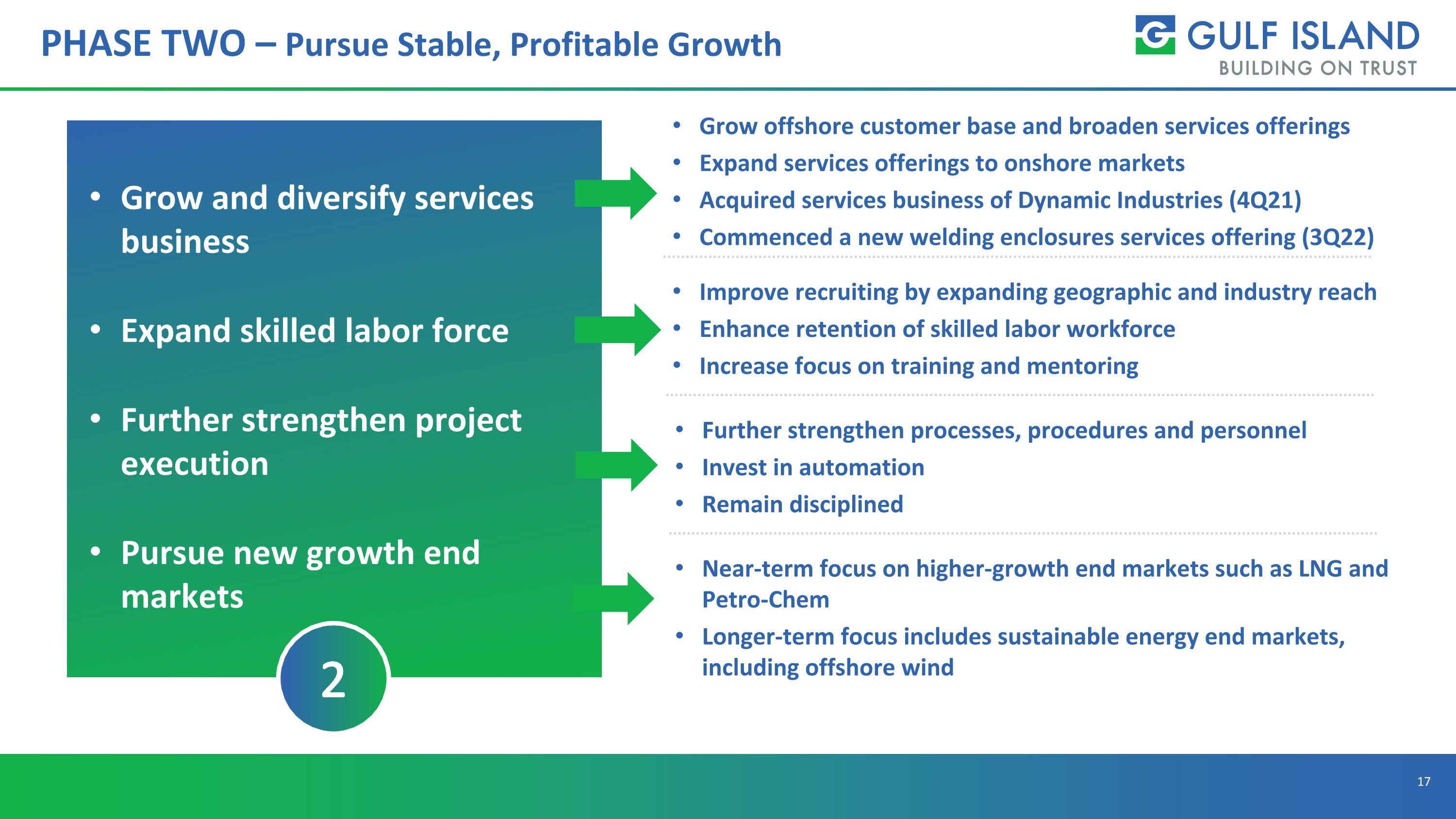

PHASE TWO – Pursue Stable, Profitable Growth Near-term focus on higher-growth end markets such as LNG and Petro-Chem Longer-term focus includes sustainable energy end markets, including offshore wind Grow offshore customer base and broaden services offerings Expand services offerings to onshore markets Acquired services business of Dynamic Industries (4Q21) Commenced a new welding enclosures services offering (3Q22) Further strengthen processes, procedures and personnel Invest in automation Remain disciplined Grow and diversify services business Expand skilled labor force Further strengthen project execution Pursue new growth end markets 2 Improve recruiting by expanding geographic and industry reach Enhance retention of skilled labor workforce Increase focus on training and mentoring

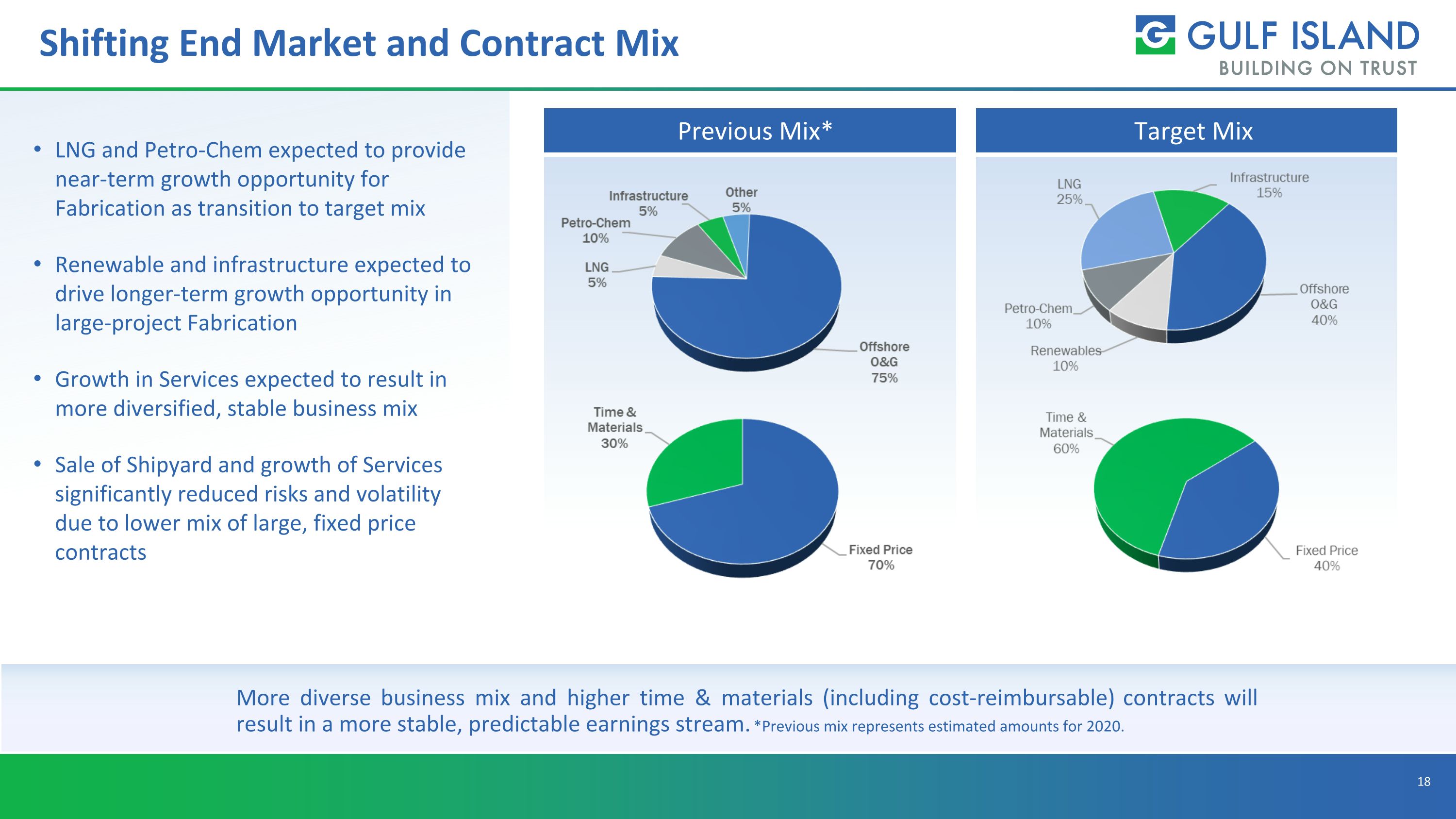

Previous Mix* Target Mix Shifting End Market and Contract Mix LNG and Petro-Chem expected to provide near-term growth opportunity for Fabrication as transition to target mix Renewable and infrastructure expected to drive longer-term growth opportunity in large-project Fabrication Growth in Services expected to result in more diversified, stable business mix Sale of Shipyard and growth of Services significantly reduced risks and volatility due to lower mix of large, fixed price contracts More diverse business mix and higher time & materials (including cost-reimbursable) contracts will result in a more stable, predictable earnings stream. *Previous mix represents estimated amounts for 2020.

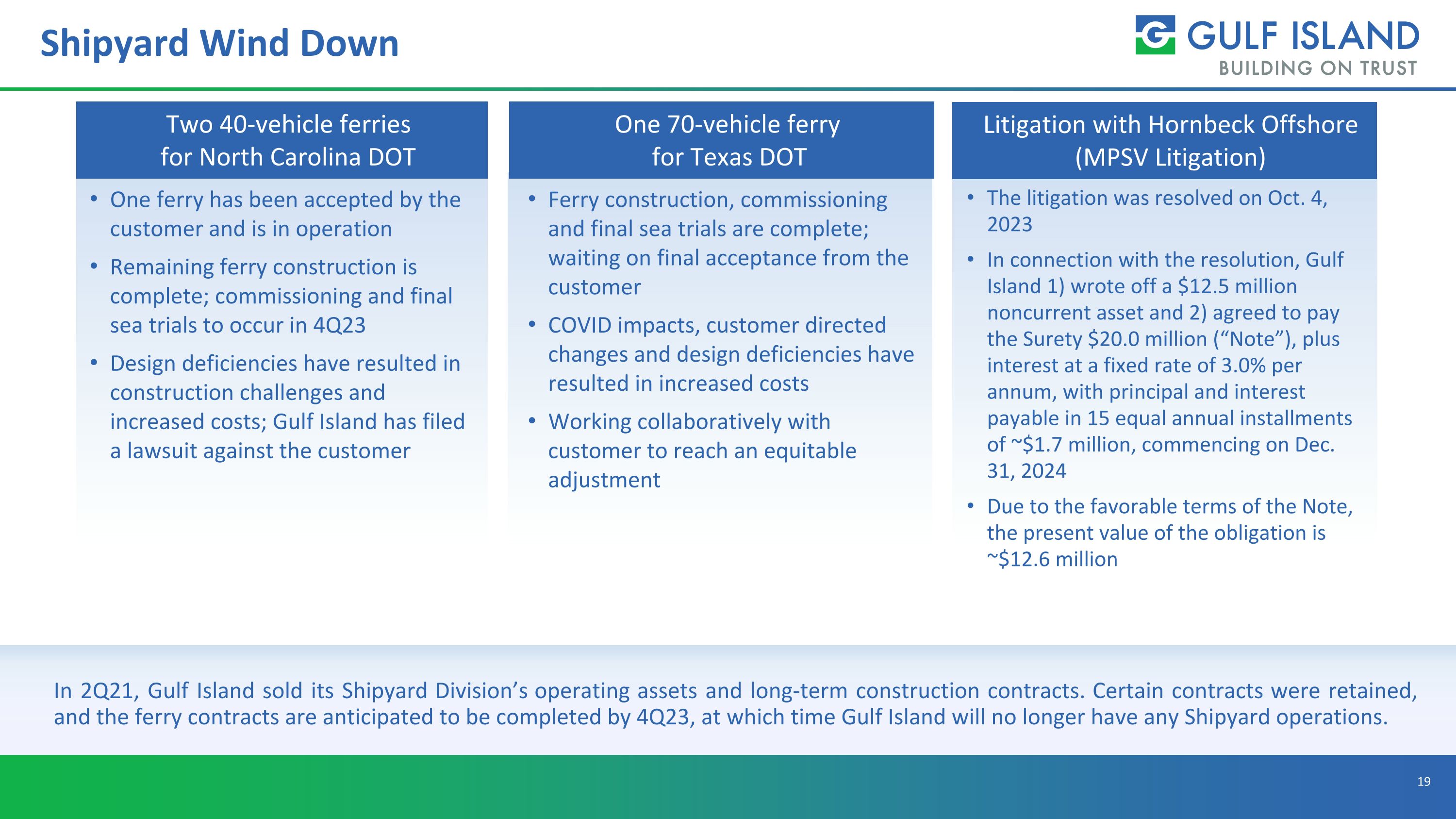

Litigation with Hornbeck Offshore (MPSV Litigation) One 70-vehicle ferry for Texas DOT Two 40-vehicle ferries for North Carolina DOT Shipyard Wind Down In 2Q21, Gulf Island sold its Shipyard Division’s operating assets and long-term construction contracts. Certain contracts were retained, and the ferry contracts are anticipated to be completed by 4Q23, at which time Gulf Island will no longer have any Shipyard operations. One ferry has been accepted by the customer and is in operation Remaining ferry construction is complete; commissioning and final sea trials to occur in 4Q23 Design deficiencies have resulted in construction challenges and increased costs; Gulf Island has filed a lawsuit against the customer Ferry construction, commissioning and final sea trials are complete; waiting on final acceptance from the customer COVID impacts, customer directed changes and design deficiencies have resulted in increased costs Working collaboratively with customer to reach an equitable adjustment The litigation was resolved on Oct. 4, 2023 In connection with the resolution, Gulf Island 1) wrote off a $12.5 million noncurrent asset and 2) agreed to pay the Surety $20.0 million (“Note”), plus interest at a fixed rate of 3.0% per annum, with principal and interest payable in 15 equal annual installments of ~$1.7 million, commencing on Dec. 31, 2024 Due to the favorable terms of the Note, the present value of the obligation is ~$12.6 million

Key Investment Highlights

Key Investment Highlights LNG and Petro-Chem offer strong near-term growth opportunity for Fabrication Renewables and offshore wind provide longer-term growth opportunity for Fabrication High energy prices and labor constraints driving favorable Services trends Baseload of stable craft labor and strategic location Long-standing customer relationships and reputation for quality and safety Attractive End Markets Financial stability Cash position offers flexibility to pursue strategic growth opportunities Management team with extensive and complementary industry experience Proven track record of successfully executing against strategic initiatives 1 Positioned for Growth 2 Strong Balance Sheet 4 Experienced Management Team 5 Improving Margin Profile 3 Growth in Services provides stable, profitable mix Improving Fabrication volumes will drive operating leverage

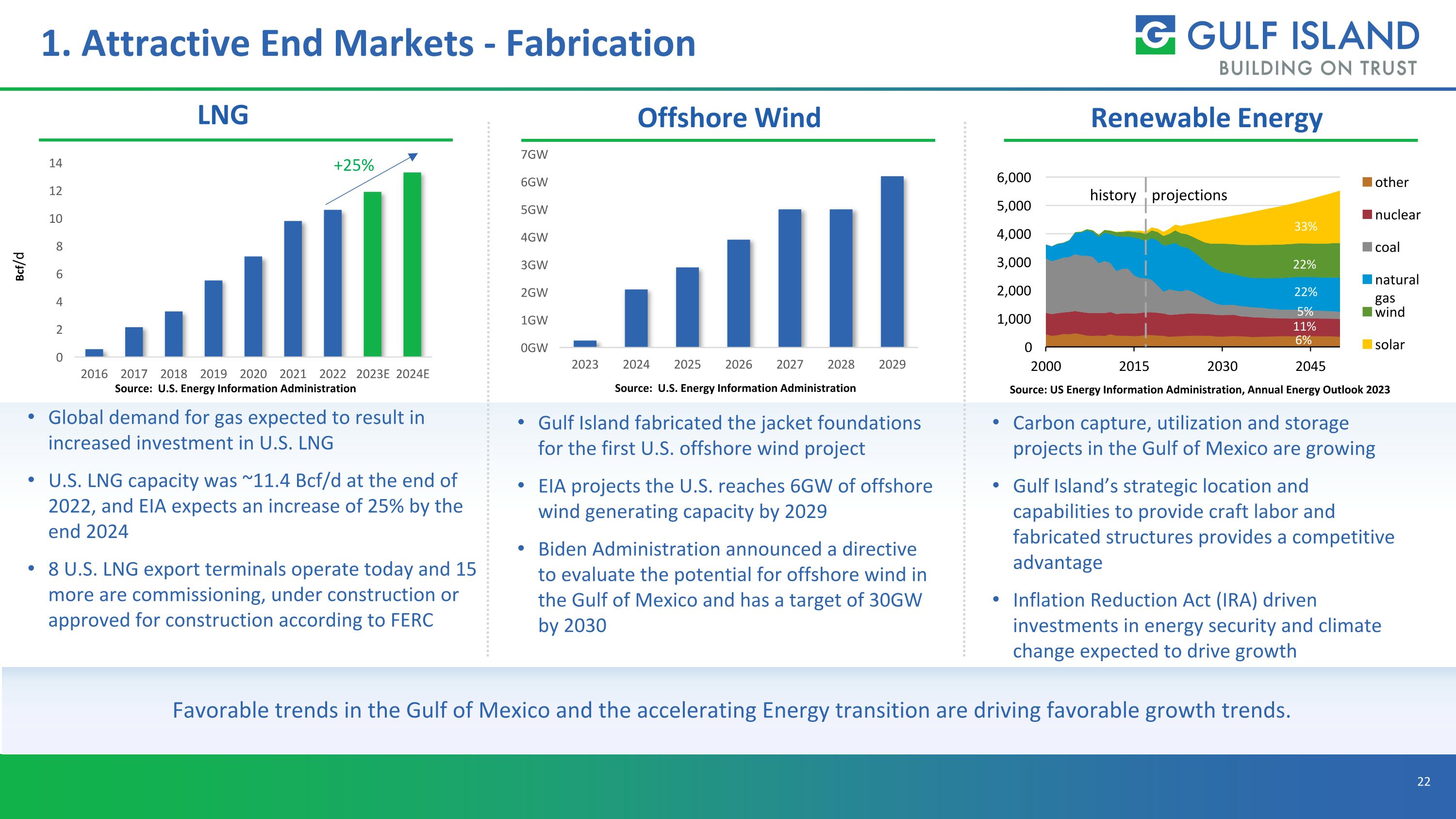

1. Attractive End Markets - Fabrication Offshore Wind Global demand for gas expected to result in increased investment in U.S. LNG U.S. LNG capacity was ~11.4 Bcf/d at the end of 2022, and EIA expects an increase of 25% by the end 2024 8 U.S. LNG export terminals operate today and 15 more are commissioning, under construction or approved for construction according to FERC Gulf Island fabricated the jacket foundations for the first U.S. offshore wind project EIA projects the U.S. reaches 6GW of offshore wind generating capacity by 2029 Biden Administration announced a directive to evaluate the potential for offshore wind in the Gulf of Mexico and has a target of 30GW by 2030 Carbon capture, utilization and storage projects in the Gulf of Mexico are growing Gulf Island’s strategic location and capabilities to provide craft labor and fabricated structures provides a competitive advantage Inflation Reduction Act (IRA) driven investments in energy security and climate change expected to drive growth LNG Renewable Energy Favorable trends in the Gulf of Mexico and the accelerating Energy transition are driving favorable growth trends. Source: U.S. Energy Information Administration Source: US Energy Information Administration, Annual Energy Outlook 2023 +25% Source: U.S. Energy Information Administration Bcf/d 33% 22% 5% 22% 11% 6% history projections 33% 22% 22% 11% 6% 5%

1. Attractive End Markets - Services Onshore Services High energy prices driving robust offshore O&G activity resulting in strong offshore services spending Offshore services demand benefitting from capital spending and maintenance that had been deferred in recent years Labor availability is limited resulting in favorable end market trends DSS Acquisition provides stronger onshore services opportunities Offshore professionals and services provide a platform for onshore services growth Increased customer base and suite of services provides opportunity to cross-sell services Partnering with engineering companies to provide turnkey solutions Offshore Services Other Services High energy prices and labor constraints creating unique opportunity for growing Services platform.

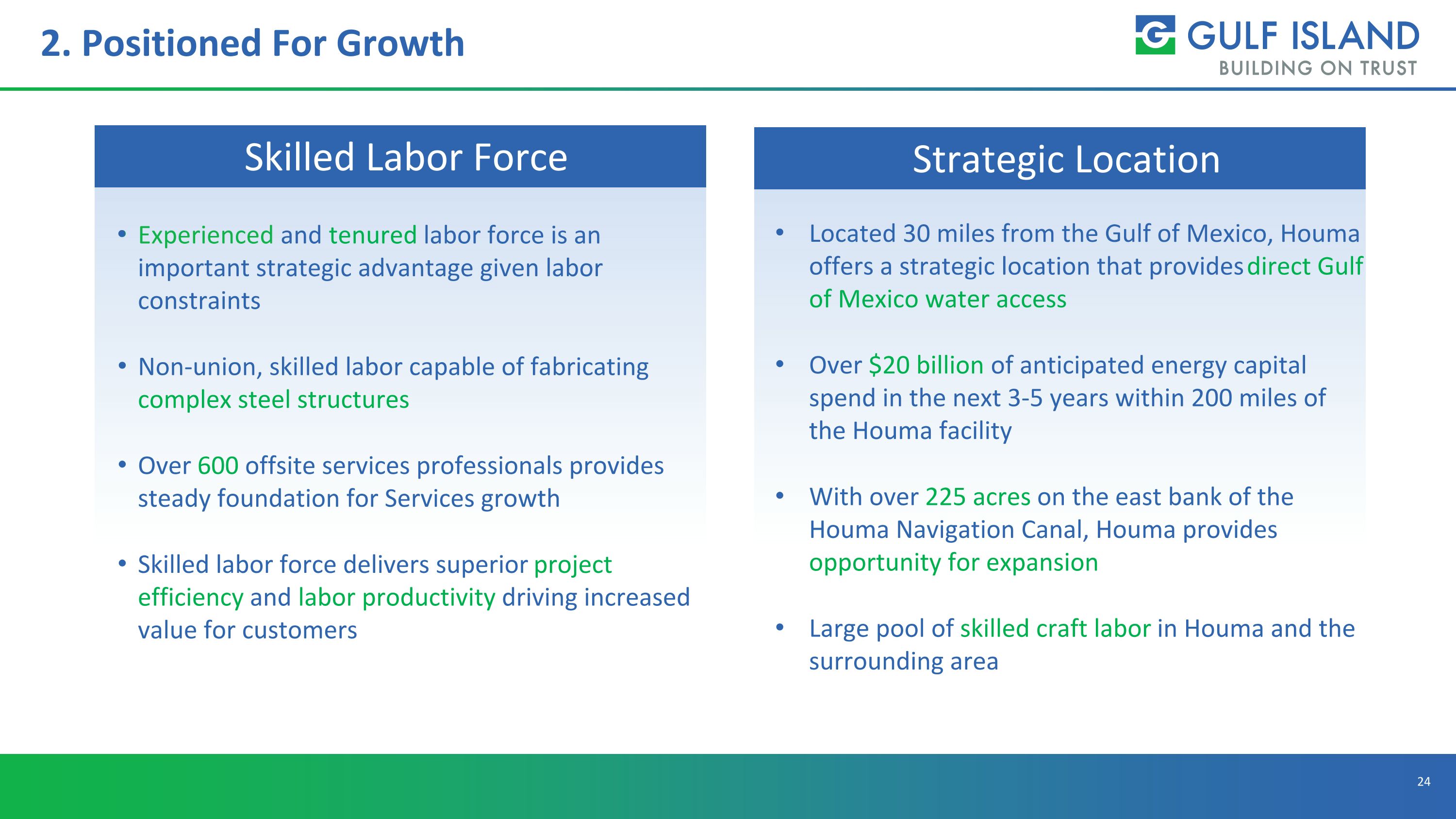

Strategic Location Skilled Labor Force Experienced and tenured labor force is an important strategic advantage given labor constraints Non-union, skilled labor capable of fabricating complex steel structures Over 600 offsite services professionals provides steady foundation for Services growth Skilled labor force delivers superior project efficiency and labor productivity driving increased value for customers Located 30 miles from the Gulf of Mexico, Houma offers a strategic location that provides direct Gulf of Mexico water access Over $20 billion of anticipated energy capital spend in the next 3-5 years within 200 miles of the Houma facility With over 225 acres on the east bank of the Houma Navigation Canal, Houma provides opportunity for expansion Large pool of skilled craft labor in Houma and the surrounding area 2. Positioned For Growth

2. Positioned For Growth Strong execution drives customer loyalty High quality, diversified customer base DSS Acquisition expanded customer base providing cross-sell opportunities Services platform provides opportunity for pull-though fabrication work Many clients embracing sustainability, providing new opportunities for growth Deep industry relationships and history of quality execution. Loyal Customer Base

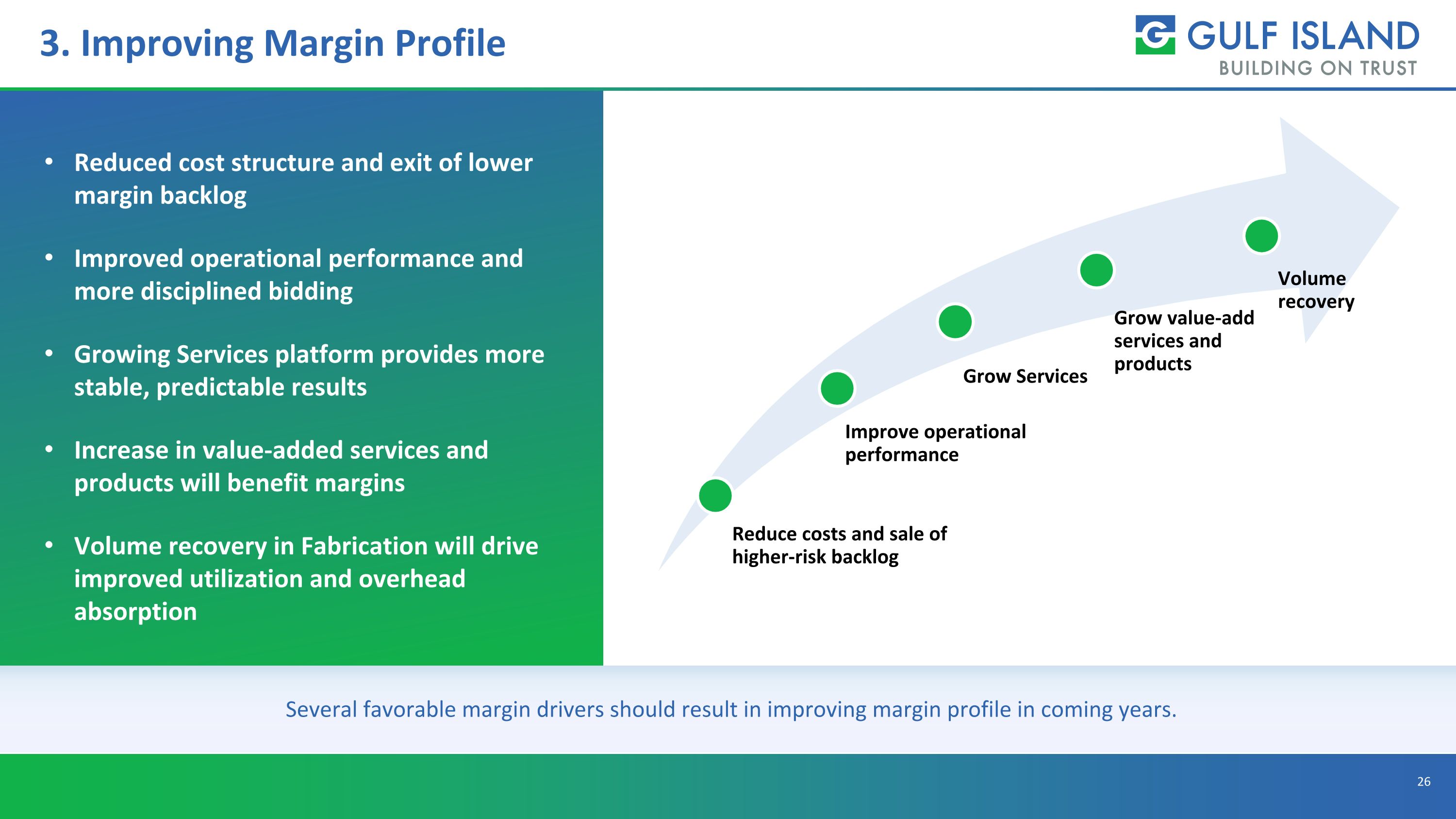

3. Improving Margin Profile Reduced cost structure and exit of lower margin backlog Improved operational performance and more disciplined bidding Growing Services platform provides more stable, predictable results Increase in value-added services and products will benefit margins Volume recovery in Fabrication will drive improved utilization and overhead absorption Grow Services Improve operational performance Reduce costs and sale of higher-risk backlog Grow value-add services and products Volume recovery Several favorable margin drivers should result in improving margin profile in coming years.

4. Strong Balance Sheet Surety requirements reduced; debt is long-term with favorable terms Shipyard Transaction improved liquidity and significantly reduced ongoing bonding and letters of credit requirements of the business. The MPSV Litigation settlement resulted in long-term debt of $20.0 million with favorable terms (3.0% fixed rate and 15 year pay back period), resulting in debt with a present value of ~$12.6 million. Liquidity and cash position allows Gulf Island to pursue growth Shipyard Transaction allowed Gulf Island to divest break-even or loss contracts that represented 90% of backlog. Monetized certain under-utilized assets, reduced costs and focused on strong project cash flow management. Cash balance of ~$42 million at Sept. 30, 2023 Exited higher-risk, long-term construction contracts Ended 3Q23 with a cash balance of $41.8 million; expect to end 2023 with a cash balance of ~$45 million. Net working capital position at Sept. 30, 2023 (excluding cash) of $17.5 million and ownership of Houma facility provide additional balance sheet support. The Shipyard Transaction, the sale of under-utilized assets, and improved profitability provide a solid balance sheet that will support Gulf Island’s strategic growth objectives.

5. Experienced Management Team Senior leadership has average industry experience of ~26 years. Richard W. Heo PRESIDENT & CEO Joined Gulf Island in 2019 Previous Experience McDermott International, Inc. – Senior Vice President of North, Central and South America business unit Chicago Bridge & Iron N.V. (“CB&I”) – Executive Vice President of Fabrication Services business unit; President of Engineered Products business unit KBR, Inc. – Various senior leadership positions in the Technology business unit Westley S. Stockton EXECUTIVE VICE PRESIDENT & CFO Joined Gulf Island in 2018 Previous Experience CB&I – Senior Vice President & Chief Accounting Officer; Senior leadership positions within financial operations and M&A PricewaterhouseCoopers – Audit related roles Arthur Andersen – Audit related roles Jamie L. Morvant SR VICE PRESIDENT – Operations Joined Gulf Island in 2000 Matt R. Oubre SR VICE PRESIDENT – Commercial Joined Gulf Island in 2021 through DSS Acquisition (with Dynamic since 1998) Thomas M. Smouse VICE PRESIDENT & CHRO Joined Gulf Island in 2020

Financial Overview

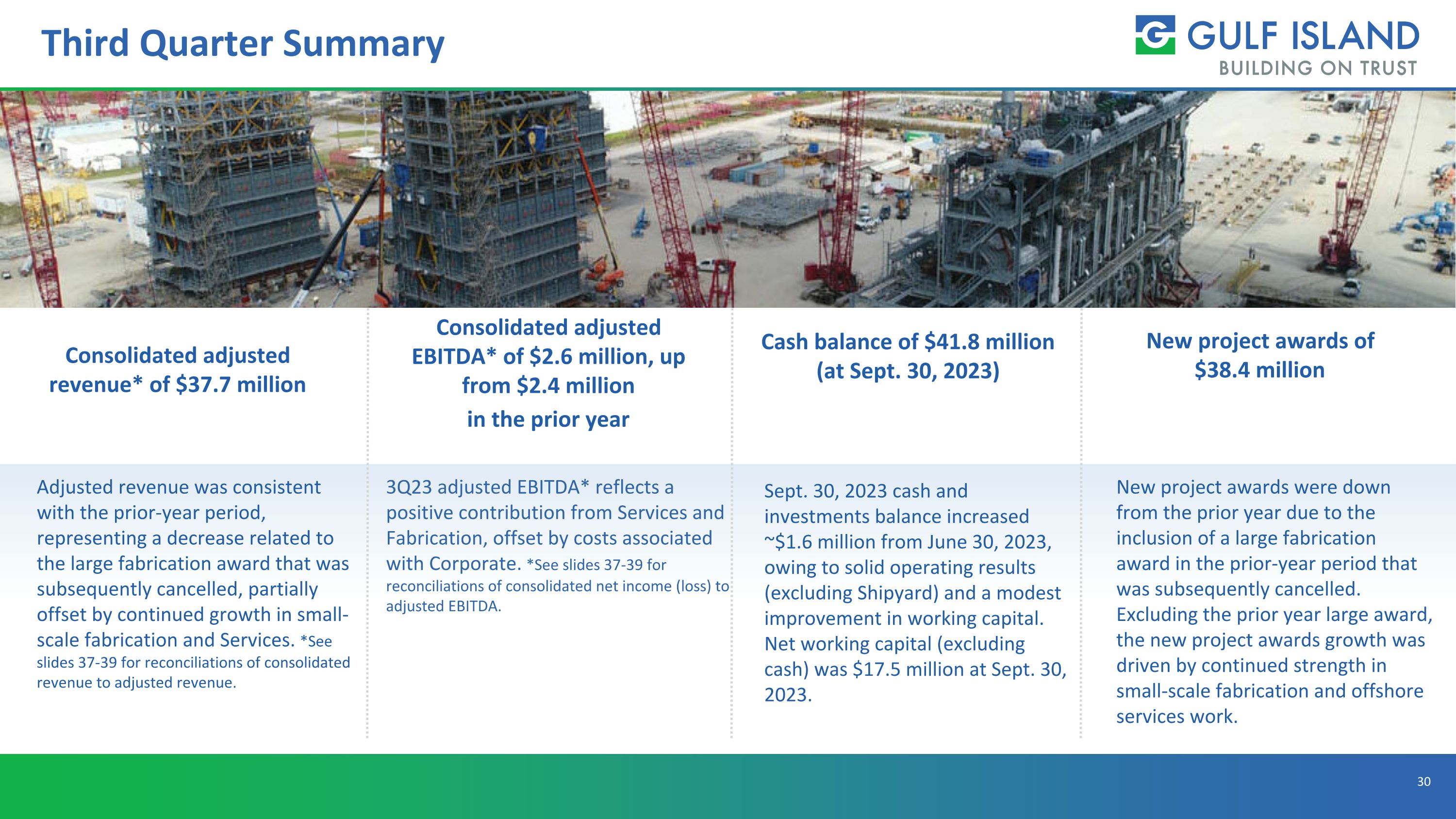

Third Quarter Summary Consolidated adjusted EBITDA* of $2.6 million, up from $2.4 million in the prior year 3Q23 adjusted EBITDA* reflects a positive contribution from Services and Fabrication, offset by costs associated with Corporate. *See slides 37-39 for reconciliations of consolidated net income (loss) to adjusted EBITDA. New project awards of $38.4 million Sept. 30, 2023 cash and investments balance increased ~$1.6 million from June 30, 2023, owing to solid operating results (excluding Shipyard) and a modest improvement in working capital. Net working capital (excluding cash) was $17.5 million at Sept. 30, 2023. Adjusted revenue was consistent with the prior-year period, representing a decrease related to the large fabrication award that was subsequently cancelled, partially offset by continued growth in small-scale fabrication and Services. *See slides 37-39 for reconciliations of consolidated revenue to adjusted revenue. Consolidated adjusted revenue* of $37.7 million Cash balance of $41.8 million (at Sept. 30, 2023) New project awards were down from the prior year due to the inclusion of a large fabrication award in the prior-year period that was subsequently cancelled. Excluding the prior year large award, the new project awards growth was driven by continued strength in small-scale fabrication and offshore services work.

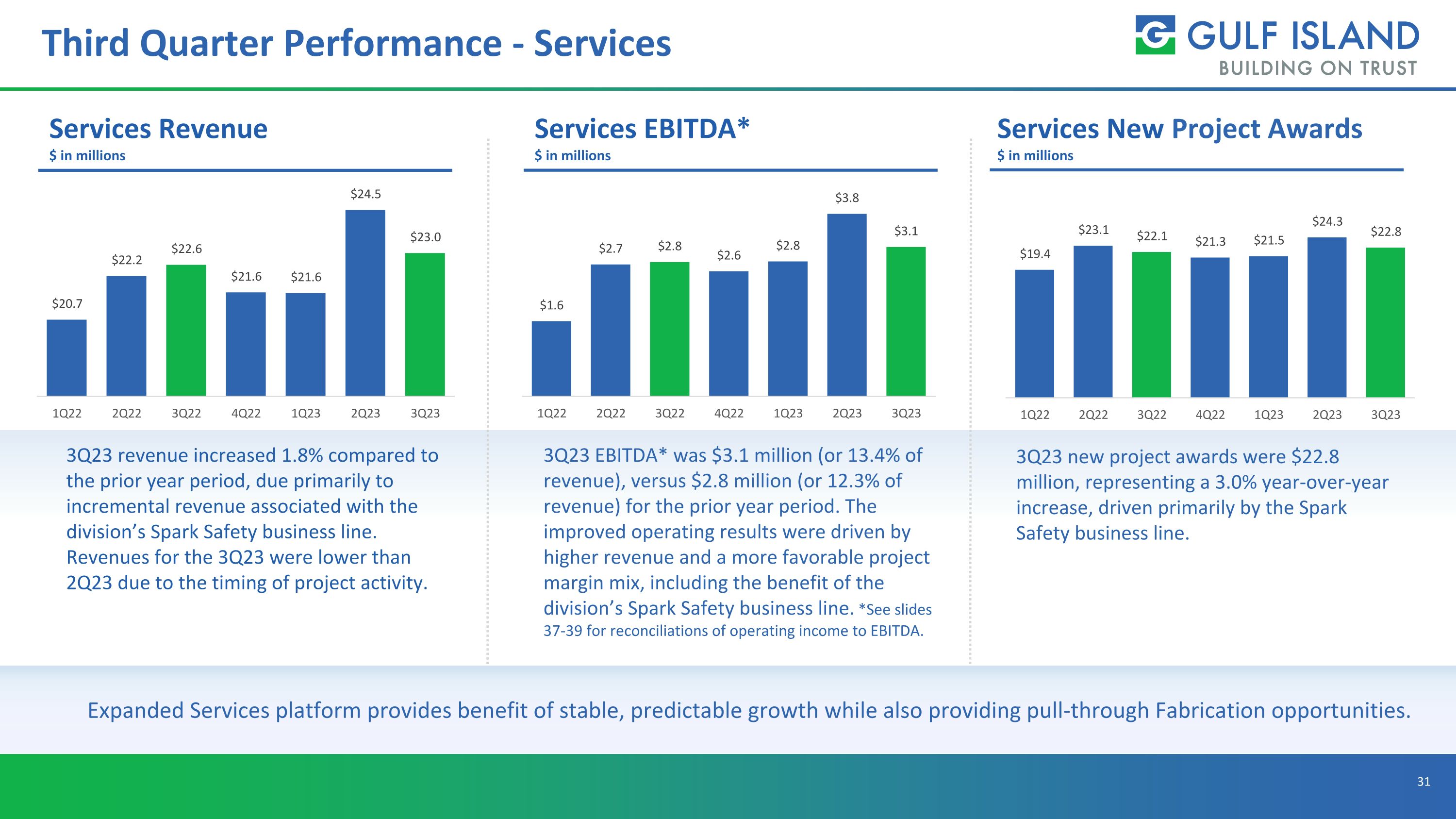

Third Quarter Performance - Services 3Q23 EBITDA* was $3.1 million (or 13.4% of revenue), versus $2.8 million (or 12.3% of revenue) for the prior year period. The improved operating results were driven by higher revenue and a more favorable project margin mix, including the benefit of the division’s Spark Safety business line. *See slides 37-39 for reconciliations of operating income to EBITDA. 3Q23 new project awards were $22.8 million, representing a 3.0% year-over-year increase, driven primarily by the Spark Safety business line. 3Q23 revenue increased 1.8% compared to the prior year period, due primarily to incremental revenue associated with the division’s Spark Safety business line. Revenues for the 3Q23 were lower than 2Q23 due to the timing of project activity. Services Revenue $ in millions Services EBITDA* $ in millions Services New Project Awards $ in millions Expanded Services platform provides benefit of stable, predictable growth while also providing pull-through Fabrication opportunities.

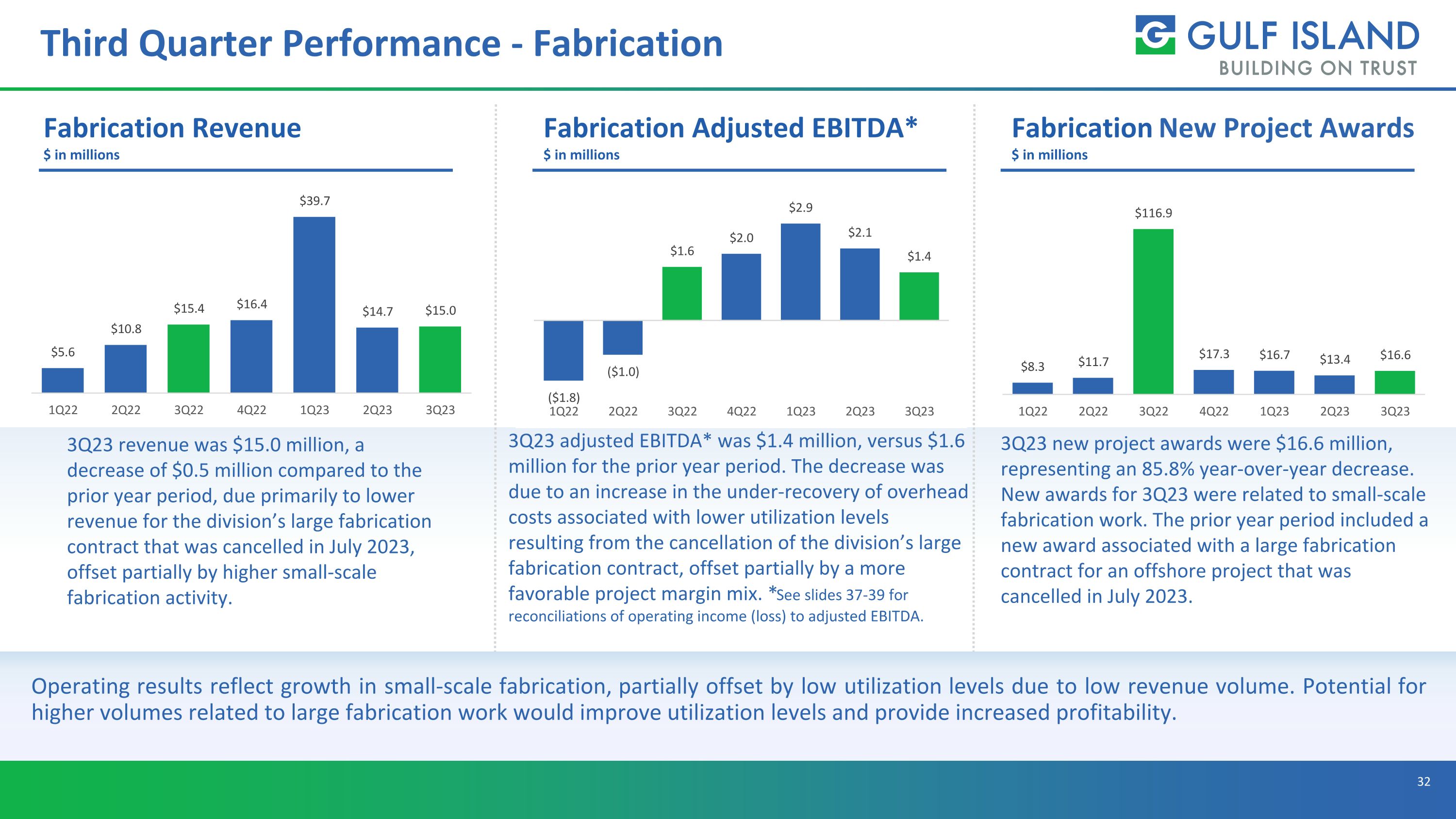

Third Quarter Performance - Fabrication 3Q23 adjusted EBITDA* was $1.4 million, versus $1.6 million for the prior year period. The decrease was due to an increase in the under-recovery of overhead costs associated with lower utilization levels resulting from the cancellation of the division’s large fabrication contract, offset partially by a more favorable project margin mix. *See slides 37-39 for reconciliations of operating income (loss) to adjusted EBITDA. 3Q23 new project awards were $16.6 million, representing an 85.8% year-over-year decrease. New awards for 3Q23 were related to small-scale fabrication work. The prior year period included a new award associated with a large fabrication contract for an offshore project that was cancelled in July 2023. 3Q23 revenue was $15.0 million, a decrease of $0.5 million compared to the prior year period, due primarily to lower revenue for the division’s large fabrication contract that was cancelled in July 2023, offset partially by higher small-scale fabrication activity. Fabrication Revenue $ in millions Fabrication Adjusted EBITDA* $ in millions Fabrication New Project Awards $ in millions Operating results reflect growth in small-scale fabrication, partially offset by low utilization levels due to low revenue volume. Potential for higher volumes related to large fabrication work would improve utilization levels and provide increased profitability.

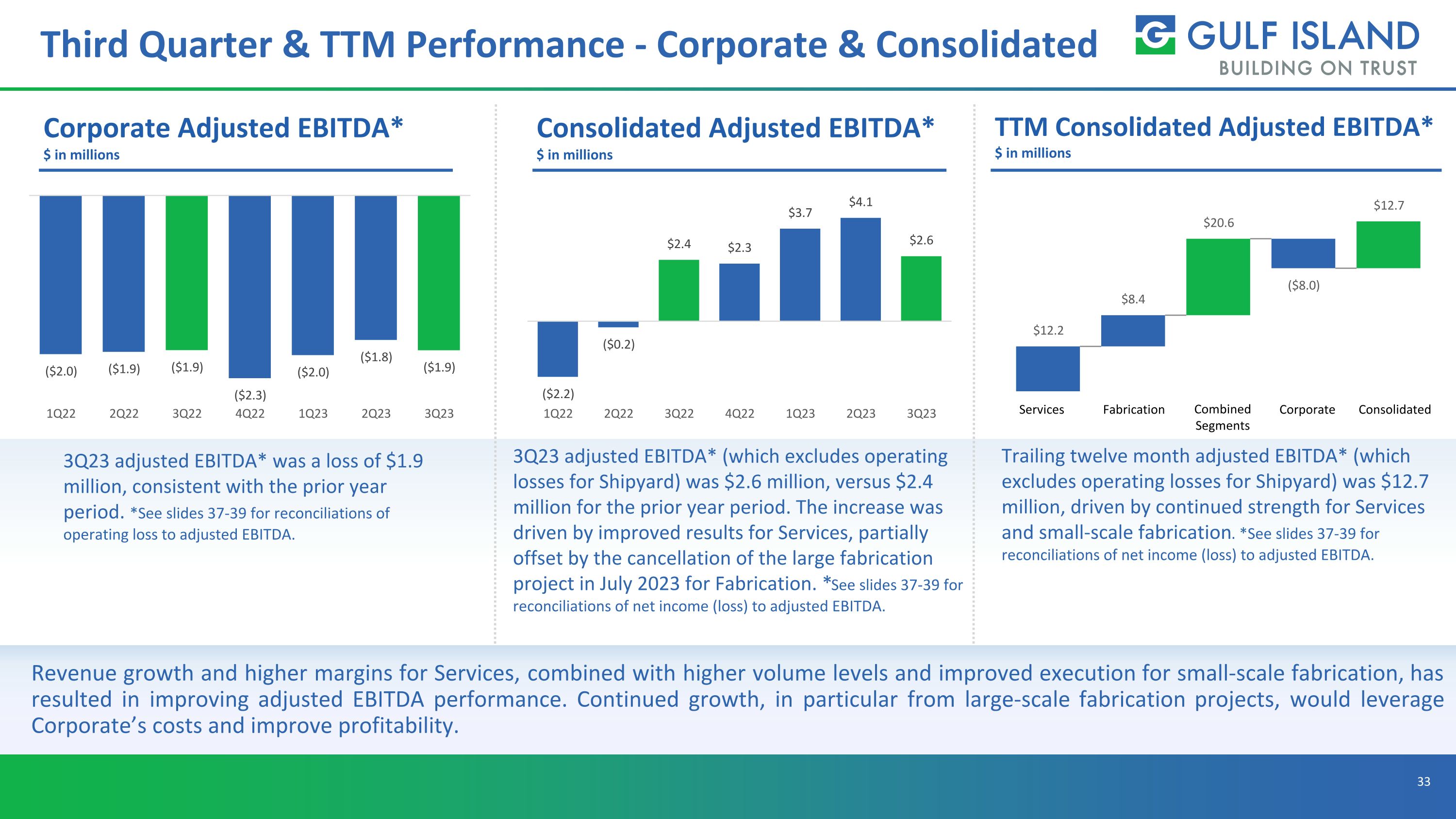

Third Quarter & TTM Performance - Corporate & Consolidated 3Q23 adjusted EBITDA* (which excludes operating losses for Shipyard) was $2.6 million, versus $2.4 million for the prior year period. The increase was driven by improved results for Services, partially offset by the cancellation of the large fabrication project in July 2023 for Fabrication. *See slides 37-39 for reconciliations of net income (loss) to adjusted EBITDA. Trailing twelve month adjusted EBITDA* (which excludes operating losses for Shipyard) was $12.7 million, driven by continued strength for Services and small-scale fabrication. *See slides 37-39 for reconciliations of net income (loss) to adjusted EBITDA. 3Q23 adjusted EBITDA* was a loss of $1.9 million, consistent with the prior year period. *See slides 37-39 for reconciliations of operating loss to adjusted EBITDA. Corporate Adjusted EBITDA* $ in millions Consolidated Adjusted EBITDA* $ in millions TTM Consolidated Adjusted EBITDA* $ in millions Revenue growth and higher margins for Services, combined with higher volume levels and improved execution for small-scale fabrication, has resulted in improving adjusted EBITDA performance. Continued growth, in particular from large-scale fabrication projects, would leverage Corporate’s costs and improve profitability. Services Fabrication Combined Segments Corporate Consolidated

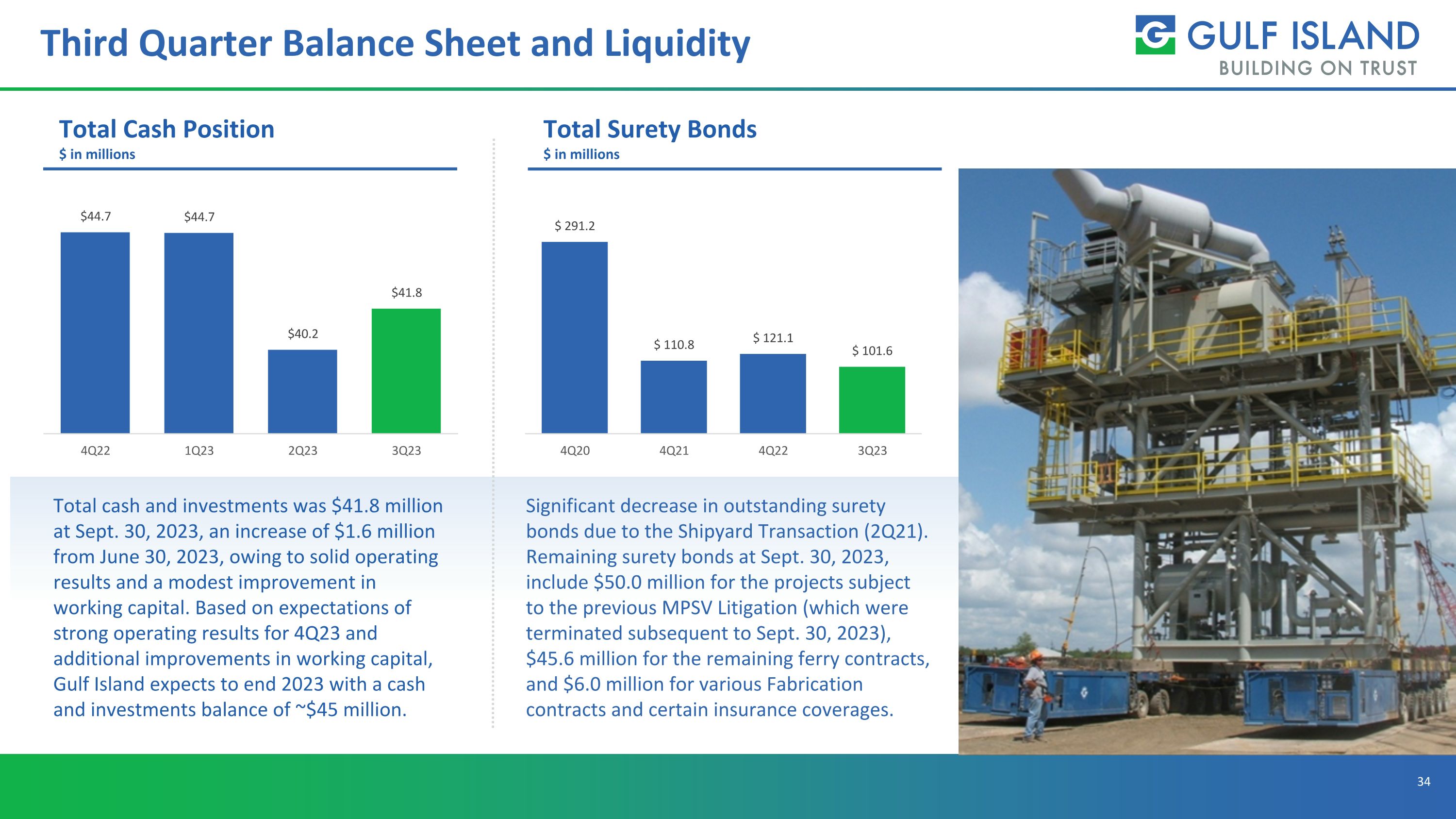

Third Quarter Balance Sheet and Liquidity Significant decrease in outstanding surety bonds due to the Shipyard Transaction (2Q21). Remaining surety bonds at Sept. 30, 2023, include $50.0 million for the projects subject to the previous MPSV Litigation (which were terminated subsequent to Sept. 30, 2023), $45.6 million for the remaining ferry contracts, and $6.0 million for various Fabrication contracts and certain insurance coverages. Total cash and investments was $41.8 million at Sept. 30, 2023, an increase of $1.6 million from June 30, 2023, owing to solid operating results and a modest improvement in working capital. Based on expectations of strong operating results for 4Q23 and additional improvements in working capital, Gulf Island expects to end 2023 with a cash and investments balance of ~$45 million. Total Cash Position $ in millions Total Surety Bonds $ in millions

Summary

Progress on business transformation has created a stronger, more predictable business positioned for profitable growth Shipyard Transaction and MPSV Litigation settlement significantly reduced risk profile and improved liquidity Fabrication segment benefits from people and process improvements and by improving end markets Growing Services business will provide improved visibility and result in a more stable and diversified business mix with higher margins Near term focus on LNG and Petro-Chem expected to drive near-term growth opportunity and sustainable energy expected to drive long-term opportunity Strong balance sheet positions the Company to pursue strategic growth strategy Summary Summary

Appendix

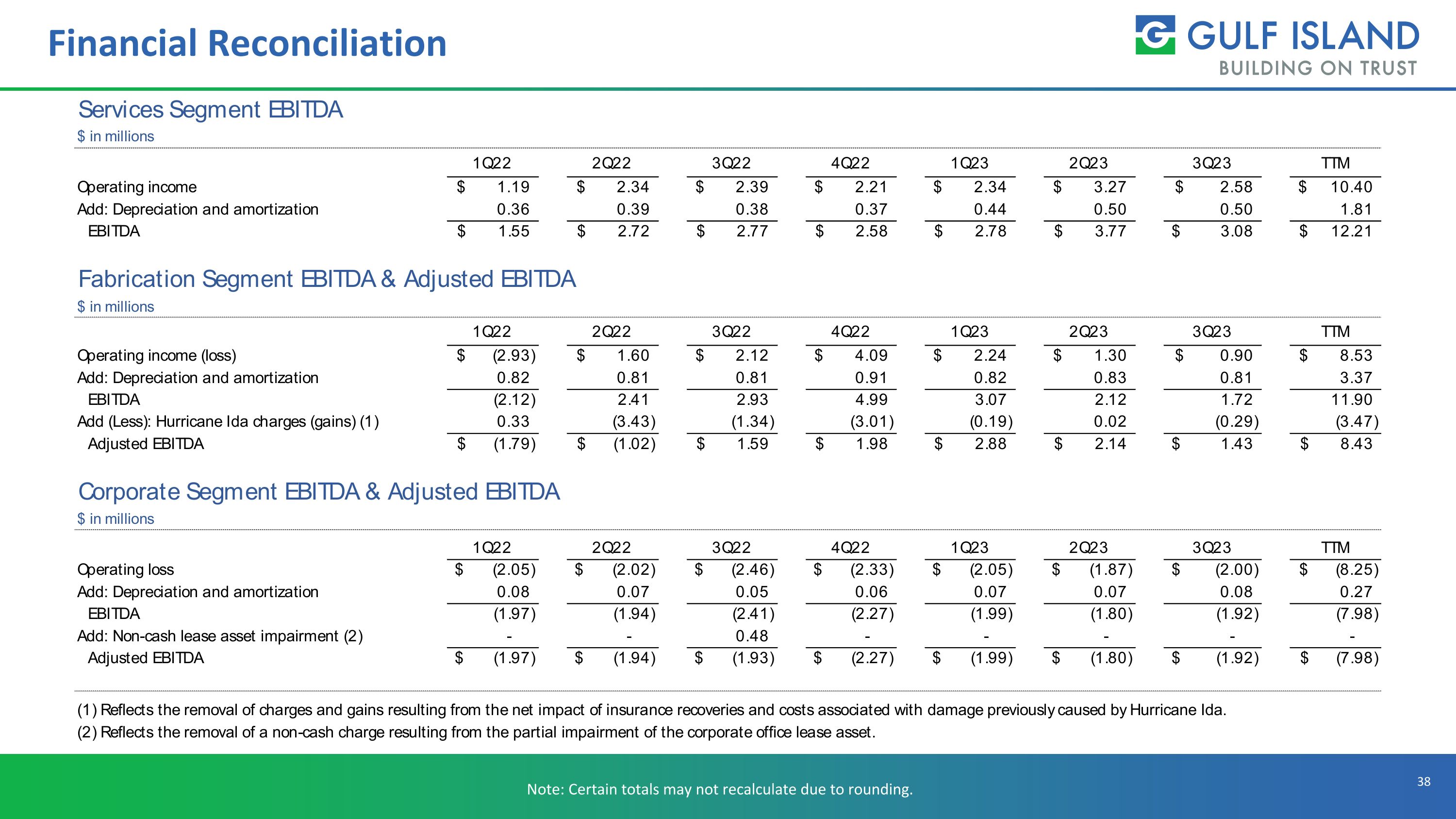

Financial Reconciliation Note: Certain totals may not recalculate due to rounding.

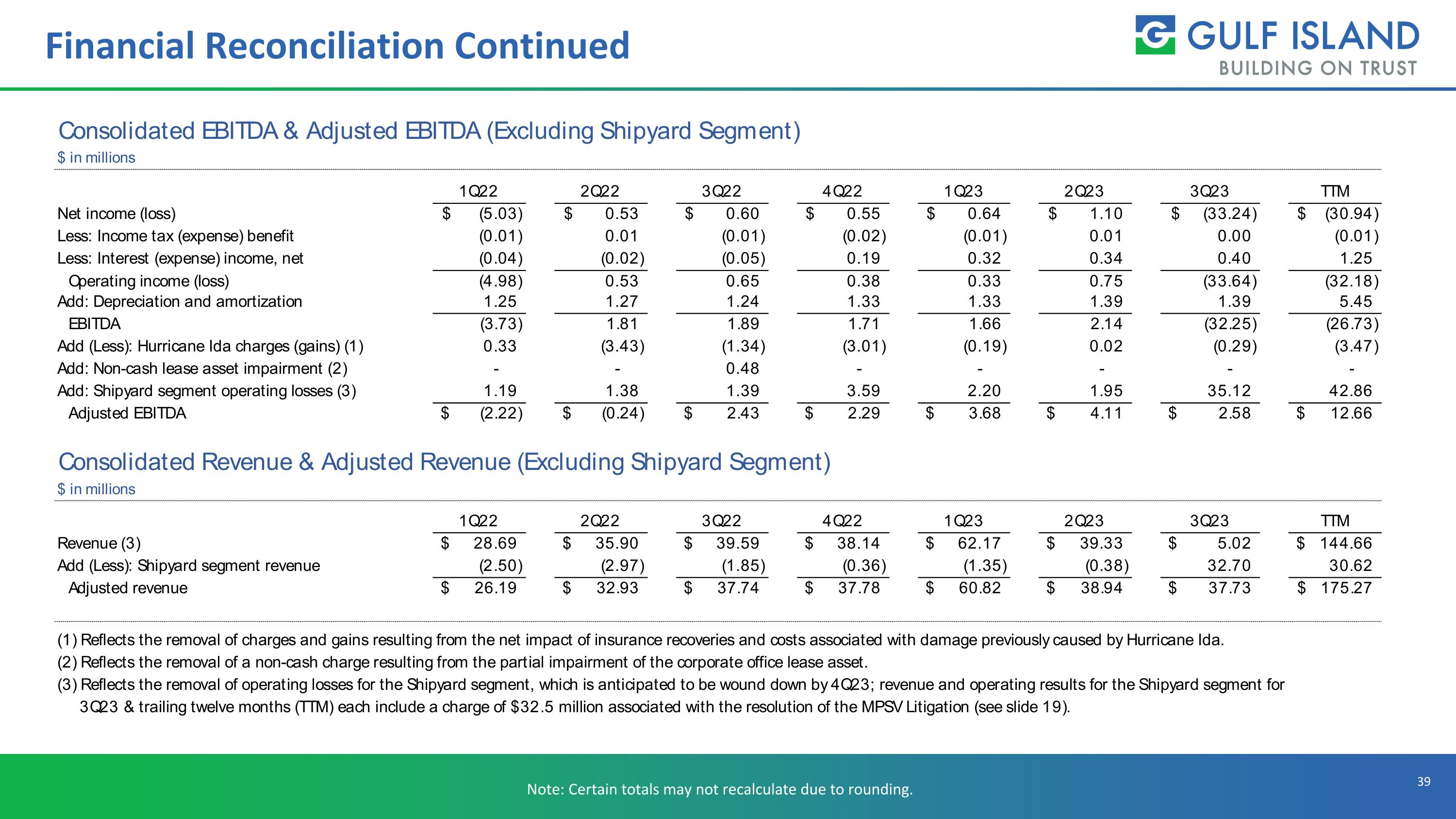

Financial Reconciliation Continued Note: Certain totals may not recalculate due to rounding.

Contact Information For questions or additional information please contact: Paul Bartolai, CFA 773.489.5692 paul.bartolai@val-adv.com