1.

Exhibit 10.2

AMENDMENT TO multiple indebtedness mortgage

BE IT KNOWN that on this 6th day of November, 2023;

BEFORE ME, THE UNDERSIGNED, a Notary Public, duly commissioned and qualified within the State of _____________ and the Parish/County of __________________, and in the presence of the undersigned competent witnesses;

PERSONALLY CAME AND APPEARED:

Gulf Island, L.L.C. (Tax ID# ***-**-XXXX), a Louisiana limited liability company domiciled in Terrebonne Parish, Louisiana, with its registered place of business and mailing address being 567 Thompson Road, Houma, LA 70363, represented herein by its undersigned duly authorized officer, authorized pursuant to the certified resolutions attached hereto; and

-and-

Gulf Island Services, L.L.C. f/k/a Dolphin Services, L.L.C. (Tax ID# ***-**-XXXX), a Louisiana limited liability company domiciled in Terrebonne Parish, Louisiana, with its registered place of business and mailing address being 400 Thompson Road, Houma, LA 70363, represented herein by its undersigned duly authorized officer, authorized pursuant to the certified resolutions attached hereto; (collectively, “Mortgagors”)

-and-

Zurich American Insurance Company and Fidelity & Deposit Company of Maryland (collectively, the “Sureties”)

who did declare as follows:

WHEREFORE, on April 19, 2021, Mortgagors granted a Multiple Indebtedness Mortgage in favor of the Sureties over the property described in Exhibit A of this Amendment to Multiple Indebtedness Mortgage (“Mortgaged Property”) and in the maximum amount of $50,000,000.00, which was filed in the Terrebonne Parish Public Records on April 21, 2021 under Instrument No. 1625076 (“MIM”);

NOW THEREFORE, for valid cause and for good and valuable consideration, the Parties have agreed to amend and modify the MIM as follows:

1. The Mortgagors and the Sureties hereby (i) amend, modify, and replace the definition of “Obligations” and (ii) add the definition of “Net Cash Proceeds” in alphabetical order, each as follows:

Net Cash Proceeds The term “Net Cash Proceeds” means the aggregate proceeds paid in cash or cash equivalents received by Mortgagor in connection with any sale or transfer of the Mortgaged Property, net of (a) direct costs incurred or estimated costs for which reserves are maintained, in connection therewith (including legal, accounting and investment banking fees and expenses, sales commissions and underwriting discounts), and (b) estimated taxes paid or payable (including sales, use or other transactional taxes and any net marginal increase in income taxes) as a result thereof.

Obligations. The term “Obligations” shall mean any and all obligations and liabilities of the Indemnitors and/or Mortgagor to Mortgagee, as expressed in the General Indemnity Agreements executed by any or all of the Indemnitors and Mortgagor in favor of Mortgagee with effective dates of October 15, 2007, June 21, 2010, December 15, 2015, and May 1, 2018 (“General Indemnity Agreements”); and/or any and all obligations and liabilities arising under or in connection with any surety bonds issued by Mortgagee that name any

Page 1

of the Indemnitors or Mortgagor as principal (“Surety Bonds”); and/or any and all obligations and liabilities arising under or in connection with that certain Secured Promissory Note dated November 6, 2023 executed by the Indemnitors (the “Note”); and/or any and all obligations and liabilities arising under or in connection with that certain Settlement Agreement dated November 6, 2023 executed by the Indemnitors and the Sureties.

2. The Mortgagors and the Sureties hereby amend, modify, and replace the section of the MIM styled “Negative Covenants Concerning the Mortgaged Property” with the following:

“Negative covenants concerning the mortgaged property. So long as this Mortgage remains in effect, Mortgagor shall not (a) sell or transfer the Mortgaged Property unless the Net Cash Proceeds from such sale or transfer are shared equally between Mortgagor and Mortgagee, provided, that Mortgagee’s portion of such Net Cash proceeds shall be applied to amounts owed and outstanding under the Note and shall in no event exceed any amounts outstanding under the Note; provided further, that the first $8,000,000 of Net Cash Proceeds from any such sale or transfer (i) shall be exempt from the sharing requirement in this clause (a), (ii) shall be retained in full by Mortgagor and (iii) shall not be required to pay down outstanding amounts under the Note so long as all of such retained amount is used to improve the Mortgaged Property, (b) abandon, permit others to abandon, commit waste of, or destroy the Mortgaged Property, except during required evacuations for weather events, pandemics or other similar occurrences, (c) other than any sale or transfer of Mortgaged Property permitted in clause (a) of this covenant, demolish and remove any building(s) on the Mortgaged Property with a book value in excess of $100,000, without Mortgagee’s consent, except if significantly damaged by fire or other casualty, and (d) do anything or permit anything to be done that may in any way materially impair Mortgagee’s rights under this Mortgage or Mortgagee’s rights in and to the Mortgaged Property.”

3. The Mortgagors and the Sureties hereby amend, modify, and replace the first sub-paragraph of the section of the MIM styled “Default” with the following:

“(1) the failure to make payment of or failure to fully perform the Obligations upon coming due and upon 60-day written demand provided by Mortgagee to Mortgagor,”

4. The Mortgagors and the Sureties hereby amend, modify, and replace the section of the MIM styled “Application of Proceeds” with the following:

“Application of Proceeds. Subject to the negative covenant herein governing the use of Net Cash Proceeds, Mortgagee may apply any proceeds derived or to be derived from the sale or other disposition of the Mortgaged Property first to the reimbursement of the expenses incurred by Mortgagee in connection therewith, including Mortgagee’s attorneys’ fees and costs; and then to the payment of any costs incurred by Mortgagee pursuant to this Mortgage; and then to the payment of the Obligations.”

5. The Mortgagors and the Sureties do not wish to amend or modify any other provision of the MIM, and instead intend that all other terms and conditions shall remain as written.

[Signature pageS and EXHIBITS FOLLOW.]

Page 2

Thus done and passed, on the day, month and year first written above, in the presence of the undersigned Notary Public and the undersigned competent witnesses, who hereunto sign their names with Mortgagor after reading of the whole.

MORTGAGOR:

GULF ISLAND, L.L.C., a Louisiana limited liability company

By: /s/ Richard W. Heo

Printed Name: Richard W. Heo

Its: President and Chief Executive Officer

GULF ISLAND SERVICES, L.L.C., a Louisiana limited liability company f/k/a Dolphin Services, L.L.C.

By: /s/ Richard W. Heo

Printed Name: Richard W. Heo

Its: President and Chief Executive Officer

WITNESSES:

By: __________________________________

Printed Name: _________________________

By: __________________________________

Printed Name: _________________________

WITNESS my hand and official seal.

Printed Name:

Notary Public in and for the said County/

Parish and State first stated above

Bar/Notary ID: _______________________

Commission Expiration: _______________

[SEAL]

Thus done and passed, on the day, month and year first written above, in the presence of the undersigned Notary Public and the undersigned competent witnesses, who hereunto sign their names with Mortgagor after reading of the whole.

MORTGAGEE:

Zurich American Insurance Company

By: /s/ Mark Wood

Printed Name: Mark Wood

Its: Vice President

Fidelity & Deposit Company of Maryland

By: /s/ Mark Wood

Printed Name: Mark Wood

Its: Vice President

WITNESSES:

By: __________________________________

Printed Name: _________________________

By: __________________________________

Printed Name: _________________________

WITNESS my hand and official seal.

Printed Name:

Notary Public in and for the said County/

Parish and State first stated above

Bar/Notary ID: _______________________

Commission Expiration: _______________

[SEAL]

{N4366820.6}

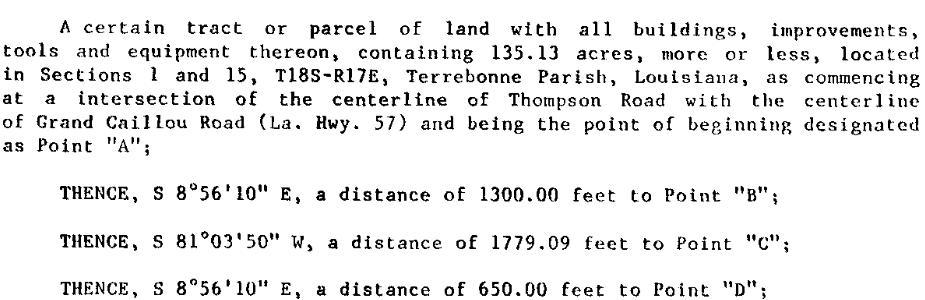

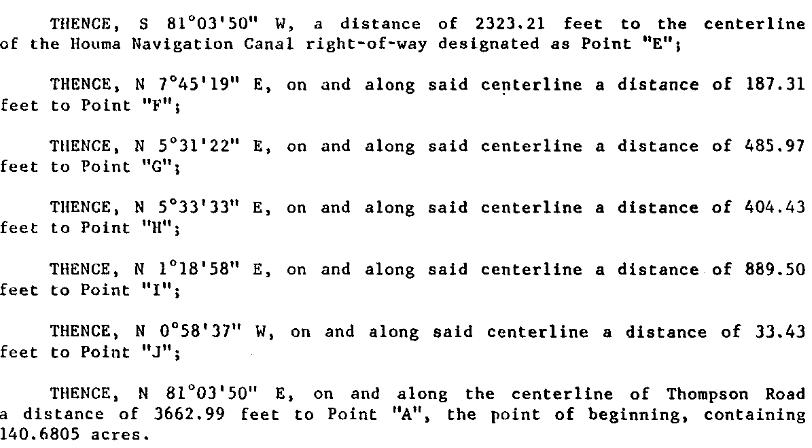

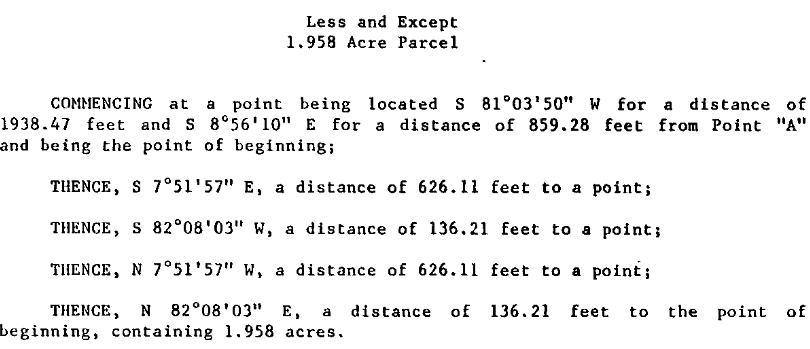

EXHIBIT A

Property Description

1. |

|

|

|

|

|

Schedule B

|

|

|

|

2. |

|

|

|

Schedule B

3. |

|

4. |

|

Schedule B

5. |

|

Schedule B

6. |

|

7. |

|

8. |

|

Schedule B

|

|

|

|

Schedule B